Malpractice Insurance Carriers

Malpractice insurance, also known as professional liability insurance, is a vital component of the healthcare industry, providing protection to healthcare professionals against potential claims arising from their practice. With the complexity and high stakes involved in healthcare, understanding the landscape of malpractice insurance carriers is crucial for medical practitioners, hospitals, and healthcare facilities. This comprehensive guide delves into the world of malpractice insurance, exploring the leading carriers, their offerings, and the factors influencing their choices.

The Landscape of Malpractice Insurance Carriers

The market for malpractice insurance is diverse, featuring a range of carriers, each with its own unique features, specialties, and target markets. These carriers offer policies tailored to the specific needs of healthcare professionals, from individual physicians to large healthcare organizations.

Understanding Carrier Specialties

Malpractice insurance carriers often specialize in certain areas of healthcare, such as general practice, specialty medicine, or specific types of facilities like hospitals or clinics. For instance, Carrier A, a leading provider, focuses on offering comprehensive coverage for general practitioners, while Carrier B specializes in providing tailored policies for surgeons and their unique risks.

This specialization allows carriers to develop expertise in understanding the specific risks and legal considerations associated with different medical specialties. As a result, they can offer more targeted and effective coverage, often including additional benefits and resources to support healthcare professionals in managing risk.

The Importance of Financial Strength

When choosing a malpractice insurance carrier, financial strength is a critical consideration. Carriers with strong financial ratings, such as those rated by Standard & Poor’s or AM Best, are more likely to have the resources to pay out claims in the event of a large-scale litigation. This financial stability is essential to ensuring that healthcare professionals and facilities have the necessary protection when faced with potential malpractice claims.

| Carrier | Financial Rating | Specialization |

|---|---|---|

| Carrier A | AA+ (S&P) | General Practice |

| Carrier B | A++ (AM Best) | Surgical Specialties |

| Carrier C | A+ (S&P) | Hospital Systems |

Coverage Options and Policy Features

Malpractice insurance carriers offer a range of coverage options and policy features to meet the diverse needs of healthcare professionals. These can include:

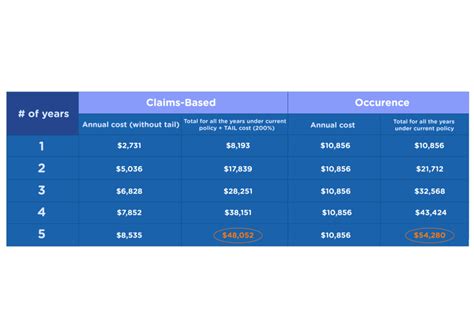

- Claims-Made vs. Occurrence Policies: Carriers may offer both types of policies, each with its own advantages and considerations. Claims-made policies cover claims made during the policy period, while occurrence policies cover incidents that occur during the policy period, regardless of when the claim is made.

- Policy Limits: Carriers provide different levels of coverage, with policy limits ranging from standard to high-capacity limits to accommodate the needs of various healthcare providers.

- Deductibles and Retentions: Some carriers offer policies with higher deductibles or retentions, which can reduce the overall cost of the policy but require the insured to bear a larger portion of the risk.

- Additional Benefits: Many carriers provide value-added benefits such as risk management resources, legal support, and access to specialized medical experts to help mitigate potential claims.

Influencing Factors in Carrier Selection

When choosing a malpractice insurance carrier, healthcare professionals and facilities consider a range of factors to ensure they select the most suitable provider. These factors can include:

Risk Profile and Specialization

Healthcare professionals and facilities must assess their own unique risk profiles and specialties. For example, a specialist surgeon may require more tailored coverage compared to a general practitioner. Understanding one’s specific risks is essential in selecting a carrier that can provide the right level of protection.

Cost and Budget Considerations

The cost of malpractice insurance is a significant factor, as premiums can vary widely based on factors such as specialty, location, and claim history. Healthcare providers and facilities must carefully consider their budget and find a balance between the cost of insurance and the level of coverage required.

Reputation and Trustworthiness

The reputation of a malpractice insurance carrier is crucial. Healthcare professionals and facilities seek carriers with a track record of fair and prompt claim handling, as well as a history of financial stability and reliability. Word-of-mouth recommendations and industry reputation can play a significant role in carrier selection.

Service and Support

The level of service and support provided by a malpractice insurance carrier is often a key differentiator. Carriers that offer comprehensive support, including risk management resources, legal guidance, and ongoing education, can be highly valued by healthcare professionals and facilities.

The Impact of Industry Trends

The malpractice insurance landscape is influenced by a variety of industry trends and developments. These trends can shape the offerings and strategies of carriers, as well as the needs and preferences of healthcare professionals and facilities.

Growing Complexity of Healthcare

The increasing complexity of healthcare, driven by advancements in medical technology and the rise of specialized treatments, has led to a corresponding increase in the complexity of malpractice claims. Carriers are adapting their policies and risk management strategies to address these evolving risks.

Regulatory and Legal Changes

Changes in healthcare regulations and malpractice laws can significantly impact the malpractice insurance market. Carriers must stay abreast of these changes to ensure their policies remain compliant and effective in protecting healthcare professionals and facilities.

The Role of Technology

Advancements in technology are transforming the way malpractice insurance is delivered and managed. Carriers are leveraging technology to enhance risk assessment, streamline claims processing, and provide more efficient and effective support to their policyholders.

The Future of Malpractice Insurance

Looking ahead, the malpractice insurance market is expected to continue evolving to meet the changing needs of the healthcare industry. Carriers will need to adapt their strategies and offerings to address emerging risks and changing regulatory environments.

Emerging Risks and Trends

The rise of telemedicine, the growing focus on patient safety and quality of care, and the increasing adoption of artificial intelligence and robotics in healthcare are just a few of the trends that will shape the future of malpractice insurance. Carriers will need to develop innovative solutions to address these emerging risks.

Collaboration and Partnerships

To stay ahead of the curve, malpractice insurance carriers may increasingly collaborate with other industry stakeholders, such as healthcare providers, medical associations, and technology companies. These partnerships can lead to the development of more effective risk management strategies and insurance solutions.

Focus on Prevention

While malpractice insurance is essential for managing potential claims, there is a growing emphasis on risk prevention. Carriers are investing in resources and programs to help healthcare professionals and facilities mitigate risks and prevent incidents that could lead to claims. This shift towards prevention reflects a broader industry trend towards a more proactive approach to patient safety.

Conclusion

The world of malpractice insurance is complex and ever-evolving, reflecting the dynamic nature of the healthcare industry. For healthcare professionals and facilities, understanding the landscape of malpractice insurance carriers and their offerings is crucial in making informed decisions about their protection. By considering factors such as specialization, financial strength, coverage options, and industry trends, healthcare providers can select the right carrier to meet their unique needs and ensure they are adequately protected against potential malpractice claims.

How often should healthcare professionals review their malpractice insurance coverage?

+Healthcare professionals should review their malpractice insurance coverage annually or whenever there are significant changes in their practice, such as a change in specialty, location, or employment status. Regular reviews ensure that their coverage remains adequate and aligned with their current needs.

What are some common exclusions in malpractice insurance policies?

+Common exclusions in malpractice insurance policies may include coverage for criminal acts, intentional harm, contractual liability, and certain types of business activities unrelated to the provision of healthcare services. It’s important to carefully review the policy exclusions to understand what is and isn’t covered.

How can healthcare facilities support their staff in managing malpractice risks?

+Healthcare facilities can support their staff by providing comprehensive risk management training, encouraging open communication about potential risks, and offering resources such as legal advice and peer support. By fostering a culture of risk awareness and mitigation, facilities can help reduce the likelihood of malpractice claims.