Florida Home Insurance Providers

Florida, known for its vibrant culture, diverse ecosystems, and year-round sunshine, is a popular destination for residents and tourists alike. However, the unique climate and environmental factors of the Sunshine State pose distinct challenges when it comes to safeguarding one's home and belongings. That's why choosing the right Florida home insurance provider is of paramount importance for every homeowner in the region.

In this comprehensive guide, we will delve into the intricacies of Florida home insurance, exploring the top providers, their coverage options, and the factors that influence policy choices. Whether you're a new homeowner or looking to switch providers, this article will equip you with the knowledge to make an informed decision tailored to your specific needs.

Understanding Florida’s Home Insurance Landscape

Florida’s home insurance market is unique, shaped by the state’s geographical and meteorological characteristics. With its coastal regions prone to hurricanes and tropical storms, and other areas facing risks like floods, wildfires, and sinkholes, the state demands specialized coverage. This is further compounded by the state’s high population growth and the aging infrastructure in certain areas.

As a result, Florida homeowners often face higher insurance premiums and more stringent policy terms compared to other states. Understanding these dynamics is crucial for making the right choices when selecting an insurance provider.

Top Florida Home Insurance Providers

The Florida home insurance market is diverse, offering a range of providers to cater to different needs and preferences. Here, we spotlight some of the leading insurance companies operating in the state, analyzing their coverage options, customer service, and overall reputation.

State Farm

State Farm is one of the largest insurance providers not only in Florida but across the United States. With a strong focus on customer service and a wide range of coverage options, State Farm has established itself as a trusted name in the industry.

State Farm offers comprehensive home insurance policies in Florida, covering a variety of risks including hurricane damage, fire, theft, and liability. They also provide additional coverage options such as water backup, identity restoration, and personal liability to further protect homeowners.

One of the standout features of State Farm's policies is their disaster response program. This program provides rapid response teams to assist homeowners in the event of a catastrophic event, ensuring prompt action to minimize damage and disruption. State Farm also offers a claims-free discount, rewarding policyholders who maintain a claims-free record over a certain period.

In terms of customer service, State Farm boasts a highly responsive and knowledgeable team. They provide 24/7 claims service, ensuring that homeowners can reach out for assistance at any time. Additionally, State Farm offers a convenient mobile app for policy management and claims reporting, making it easier for customers to stay on top of their insurance needs.

Allstate

Allstate is another leading insurance provider with a strong presence in Florida. Known for its innovative approach to insurance, Allstate offers a range of coverage options and services tailored to the unique needs of Florida homeowners.

Allstate's home insurance policies in Florida cover a comprehensive range of perils, including hurricane and windstorm damage, fire, theft, and liability. They also provide additional coverage options such as ordinance or law coverage, which can be crucial for older homes that may require specific building codes during reconstruction.

Allstate's Claim Satisfaction Guarantee is a notable feature of their policies. This guarantee ensures that if a policyholder is not satisfied with their claim settlement, Allstate will re-examine the claim and work to find a solution that meets the policyholder's needs. Allstate also offers a claim-free bonus, providing discounts to policyholders who maintain a claims-free record.

Allstate's customer service is highly regarded, with a dedicated team of local agents who understand the unique risks and challenges faced by Florida homeowners. They offer a 24/7 digital locker for policyholders to store important documents and a Good Hands® Advice Line for immediate assistance with non-emergency questions.

Progressive

Progressive is a well-known insurance provider that has expanded its services to offer comprehensive home insurance policies in Florida. With a focus on innovation and customer satisfaction, Progressive has quickly established itself as a reliable option for Florida homeowners.

Progressive's home insurance policies in Florida cover a wide range of perils, including hurricane and windstorm damage, fire, theft, and liability. They also provide additional coverage options such as equipment breakdown, identity theft, and credit card fraud protection.

One of Progressive's standout features is their HomeQuote Explorer® tool. This online tool allows prospective policyholders to explore different coverage options and receive an instant quote, making it easier to understand and compare policies. Progressive also offers a Multi-Policy Discount, providing savings to customers who bundle their home and auto insurance policies.

Progressive's customer service is highly accessible, with a 24/7 claims reporting service and a dedicated team of local agents who are knowledgeable about the unique risks faced by Florida homeowners. They also offer a convenient mobile app for policy management and claims reporting, ensuring that customers can easily stay on top of their insurance needs.

USAA

USAA is a leading insurance provider that offers a range of financial services specifically for military members, veterans, and their families. With a strong commitment to customer service and a focus on providing value, USAA has become a trusted name in the insurance industry.

USAA's home insurance policies in Florida cover a comprehensive range of perils, including hurricane and windstorm damage, fire, theft, and liability. They also provide additional coverage options such as replacement cost for personal property, ordinance or law coverage, and identity theft protection.

USAA's Military Discount is a significant benefit for its members. This discount provides savings on home insurance policies, recognizing the unique service and sacrifices made by military personnel. USAA also offers a Claims-Free Loyalty Bonus, rewarding members who maintain a claims-free record with additional savings.

USAA's customer service is highly regarded, with a dedicated team of specialists who understand the unique needs and challenges faced by military members and their families. They offer a 24/7 Claims Hotline and a Personalized Insurance Review service to ensure that members receive the coverage they need at a competitive price.

Chubb

Chubb is a leading provider of property and casualty insurance, known for its high-end coverage and specialized services. With a focus on delivering exceptional customer service and tailored coverage solutions, Chubb has become a trusted choice for many high-value homeowners in Florida.

Chubb's home insurance policies in Florida are designed to offer comprehensive coverage for a range of perils, including hurricane and windstorm damage, fire, theft, and liability. They also provide additional coverage options such as fine arts coverage, water backup, and personal liability for added protection.

One of Chubb's standout features is their Catastrophe Response Team. This team is dedicated to providing rapid response and assistance to policyholders in the event of a catastrophic event, ensuring that homeowners receive the support they need to quickly recover. Chubb also offers a Loss Prevention Service, which provides risk management advice and resources to help homeowners protect their property.

Chubb's customer service is highly personalized, with a dedicated team of professionals who understand the unique needs of high-value homeowners. They offer a 24/7 Claims Service and a Personal Concierge Service, providing assistance with a range of lifestyle and home-related services to enhance the overall customer experience.

Factors to Consider When Choosing a Florida Home Insurance Provider

When selecting a Florida home insurance provider, there are several key factors to consider. These factors will help you make an informed decision that aligns with your specific needs and preferences.

Coverage Options

The coverage options offered by an insurance provider are crucial, as they determine the extent of protection for your home and belongings. Look for providers that offer comprehensive coverage for a wide range of perils, including hurricane and windstorm damage, fire, theft, and liability. Additionally, consider additional coverage options that may be relevant to your specific situation, such as water backup, identity theft protection, or ordinance or law coverage.

Premiums and Deductibles

Premiums and deductibles are an essential consideration when choosing a home insurance provider. Premiums are the regular payments you make to maintain your insurance policy, while deductibles are the amount you must pay out of pocket before your insurance coverage kicks in. Compare the premiums and deductibles offered by different providers to find a balance that fits your budget and risk tolerance.

Discounts and Savings

Many insurance providers offer discounts and savings to their policyholders. These can include discounts for bundling home and auto insurance policies, claims-free records, or safety features in your home. Explore the various discounts and savings offered by different providers to see if you can reduce your insurance costs without compromising on coverage.

Customer Service and Claims Handling

The quality of customer service and claims handling can significantly impact your experience with an insurance provider. Look for providers with a strong reputation for responsive and knowledgeable customer service. Consider factors such as 24⁄7 claims reporting, convenient policy management tools, and a dedicated team of local agents who understand the unique risks and challenges faced by Florida homeowners.

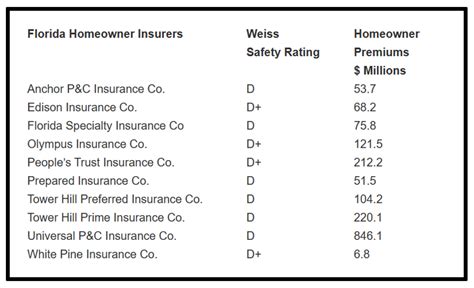

Financial Strength and Stability

The financial strength and stability of an insurance provider are important considerations. A financially strong provider is more likely to be able to pay out claims in the event of a catastrophic event. Look for providers with a solid financial rating from reputable agencies such as A.M. Best or Standard & Poor’s. This will give you confidence that your provider can meet its obligations even in challenging economic conditions.

FAQs

What are the typical coverage limits for Florida home insurance policies?

+

Florida home insurance policies typically offer coverage limits ranging from 100,000 to 500,000 or more, depending on the value of your home and the level of coverage you choose. It’s important to ensure that your coverage limits are sufficient to rebuild your home in the event of a total loss.

Are there any mandatory coverages required by law in Florida home insurance policies?

+

While Florida does not have specific mandatory coverages for home insurance, it’s important to ensure that your policy includes coverage for hurricane and windstorm damage, as these are significant risks in the state. Other common coverages include fire, theft, and liability protection.

How can I lower my Florida home insurance premiums?

+

There are several ways to lower your Florida home insurance premiums. These include increasing your deductible, bundling your home and auto insurance policies, installing safety features such as fire alarms and security systems, and maintaining a claims-free record. Shopping around and comparing quotes from different providers can also help you find the best rates.

What should I do if I need to file a claim with my Florida home insurance provider?

+

If you need to file a claim with your Florida home insurance provider, it’s important to contact them as soon as possible. Provide detailed information about the incident and any damage that has occurred. Take photos or videos of the damage and keep all receipts for any temporary repairs or expenses. Your insurance provider will guide you through the claims process and help you navigate any necessary steps.