Cost Of Insurance

The world of insurance is a complex and often confusing landscape for many individuals and businesses. From health insurance to auto insurance, and from life insurance to property coverage, the myriad of options and associated costs can be overwhelming. This article aims to demystify the concept of the cost of insurance, providing a comprehensive understanding of the factors that influence these costs and offering practical insights for consumers to make informed decisions.

Understanding the Cost of Insurance

At its core, the cost of insurance, often referred to as the premium, is the price an individual or entity pays to an insurance company for a specific type of coverage. This premium is not a one-size-fits-all amount but is tailored to the unique needs and circumstances of the policyholder. Several critical factors come into play when determining the cost of insurance, each of which can significantly influence the final price.

Risk Assessment

One of the primary determinants of insurance premiums is the level of risk associated with the policyholder. Insurance companies meticulously evaluate potential risks to assess the likelihood of a claim being made. For instance, in the case of auto insurance, factors such as the driver’s age, driving record, and the type of vehicle being insured all play a role in determining the risk level. Similarly, health insurance premiums can be influenced by an individual’s medical history, age, and lifestyle choices.

To illustrate, consider the case of a young, urban professional who commutes to work in a densely populated city. This individual, due to the higher traffic volume and potential for accidents, may face higher auto insurance premiums compared to a rural resident with a clean driving record. Similarly, a person with a history of chronic illness may face higher health insurance premiums due to the increased likelihood of medical expenses.

Coverage Level and Deductibles

The extent of coverage desired by the policyholder is another critical factor in determining insurance costs. Comprehensive coverage, which provides a broader range of protections, often comes at a higher cost compared to more basic plans. For example, a homeowner may opt for additional coverage for natural disasters, such as floods or earthquakes, which can significantly increase the premium.

Deductibles, which represent the portion of a claim that the policyholder pays out of pocket before the insurance coverage kicks in, also play a pivotal role. Higher deductibles typically result in lower premiums, as the policyholder assumes a larger portion of the financial risk. Conversely, lower deductibles lead to higher premiums, as the insurance company bears more of the potential financial burden.

| Coverage Type | Premium |

|---|---|

| Basic Auto Insurance | $500 |

| Comprehensive Auto Insurance | $800 |

| Standard Health Insurance | $600 |

| Enhanced Health Insurance with Vision and Dental | $950 |

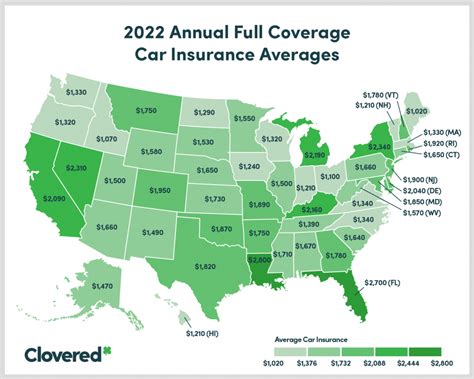

Location and Other Factors

The location where the insurance policy is in effect can also influence premiums. Areas with a higher incidence of natural disasters, crime, or accidents may see higher insurance costs. For instance, homeowners in areas prone to hurricanes or wildfires may face higher property insurance premiums.

Additionally, demographic factors such as population density and average income levels can impact insurance rates. Insurance companies also consider historical claim data for a specific area to assess the potential risk. Furthermore, personal factors like marital status and occupation can play a role, as certain occupations may be associated with higher risks.

Strategies to Manage Insurance Costs

Understanding the factors that influence insurance costs is the first step in managing these expenses effectively. Here are some practical strategies that consumers can employ to potentially reduce their insurance premiums.

Comparative Shopping

One of the most effective ways to find affordable insurance is to compare quotes from multiple providers. Insurance companies often have different risk assessment models and pricing structures, so shopping around can reveal significant variations in premiums for similar coverage. Online insurance comparison tools can be particularly useful for this purpose, allowing consumers to quickly and easily obtain quotes from various insurers.

For instance, a homeowner in a suburban area might find that one insurance company offers significantly lower premiums for a similar coverage package compared to others in the region. By taking the time to compare quotes, consumers can potentially save hundreds of dollars annually on their insurance expenses.

Bundling Policies

Many insurance companies offer discounts when policyholders bundle multiple types of insurance with them. This could include bundling auto and home insurance, or health and life insurance. By consolidating their insurance needs with a single provider, consumers can often negotiate more favorable rates and reduce their overall insurance costs.

For example, a family that insures their home, auto, and life with the same company may qualify for a multi-policy discount, resulting in savings on each of their insurance premiums. This strategy not only simplifies insurance management but also can lead to substantial cost savings over time.

Improving Risk Profile

Policyholders can also take proactive steps to improve their risk profile, which can lead to lower insurance premiums. In the case of auto insurance, this could involve taking defensive driving courses, which can result in discounts on premiums. Similarly, maintaining a clean driving record and avoiding accidents or traffic violations can lead to lower rates over time.

For health insurance, adopting a healthier lifestyle, such as quitting smoking or maintaining a healthy weight, can lead to lower premiums. Additionally, some health insurance providers offer incentives and discounts for participating in wellness programs or achieving certain health milestones. By actively working to reduce personal risk factors, individuals can often negotiate more favorable insurance rates.

The Future of Insurance Costs

As technology continues to advance and data becomes increasingly accessible, the insurance industry is likely to undergo significant transformations. The use of big data analytics and artificial intelligence (AI) is already influencing the way insurance companies assess risk and set premiums. These technologies allow insurers to analyze vast amounts of data to identify patterns and trends, enabling more accurate risk assessments and potentially more competitive pricing.

For example, AI-powered systems can analyze driver behavior through telematics devices, providing real-time data on driving habits. This data can be used to offer personalized insurance rates based on an individual's actual driving behavior, rather than generalized risk profiles. Similarly, in the health insurance sector, wearable devices and health tracking apps can provide insurers with insights into an individual's health status, potentially leading to more accurate risk assessments and personalized premium rates.

However, while technology offers opportunities for more precise risk assessment and potentially lower premiums, it also raises concerns about data privacy and the potential for algorithmic biases. As the insurance industry continues to evolve, striking a balance between leveraging technological advancements and protecting consumer rights will be crucial.

Conclusion

The cost of insurance is a complex equation that involves a multitude of factors, each of which can significantly influence the final premium. By understanding these factors and employing strategic approaches, consumers can navigate the insurance landscape more effectively and potentially reduce their insurance costs. As the insurance industry continues to evolve, staying informed about advancements and changes in the market will be key to making the most advantageous insurance decisions.

How often should I review my insurance policies to ensure I’m getting the best rates?

+It’s a good practice to review your insurance policies annually, especially when your circumstances change, such as getting married, buying a new home, or changing jobs. Regular reviews allow you to stay updated on the latest rates and coverage options, ensuring you’re not overpaying for your insurance needs.

Are there any government programs or initiatives that can help reduce insurance costs for specific demographics or situations?

+Yes, many governments offer programs to assist certain demographics with insurance costs. For instance, in the United States, Medicaid and Medicare provide health insurance coverage for low-income individuals and seniors, respectively. Similarly, there are often government-backed programs for specific types of insurance, such as flood insurance or crop insurance for farmers.

What are some common mistakes people make when trying to save on insurance costs that can actually backfire and lead to higher premiums or reduced coverage?

+One common mistake is opting for the lowest premium without fully understanding the coverage provided. This can lead to inadequate protection and higher out-of-pocket expenses in the event of a claim. Another mistake is neglecting to review policies regularly, which can result in missing out on discounts or not keeping up with changing risk factors.