Proof Of Health Insurance Tax Form

The Proof of Health Insurance Tax Form, also known as Form 1095-A, is a critical document for individuals and families in the United States who have enrolled in a qualified health plan through the Health Insurance Marketplace. This form plays a vital role in the healthcare system, serving as proof of health insurance coverage and impacting tax obligations. In this comprehensive guide, we will delve into the intricacies of the Proof of Health Insurance Tax Form, exploring its purpose, components, and its significance in the context of healthcare and taxation.

Understanding the Proof of Health Insurance Tax Form

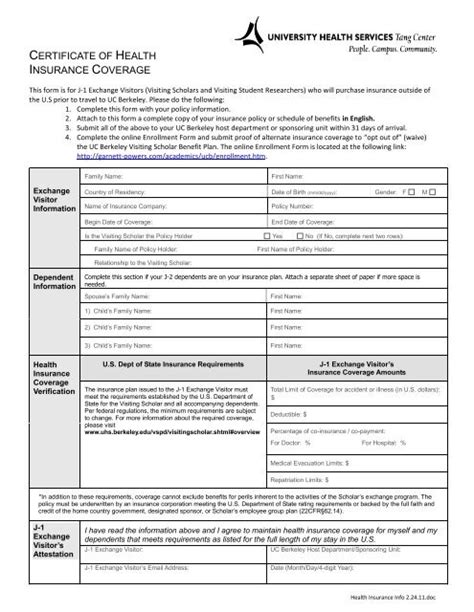

Form 1095-A is issued by health insurance providers to individuals who have obtained their health coverage through the Health Insurance Marketplace. It serves as an official record of the health insurance plan's details and the individual's enrollment status. The form is typically sent to enrollees in early to mid-February, following the conclusion of the open enrollment period.

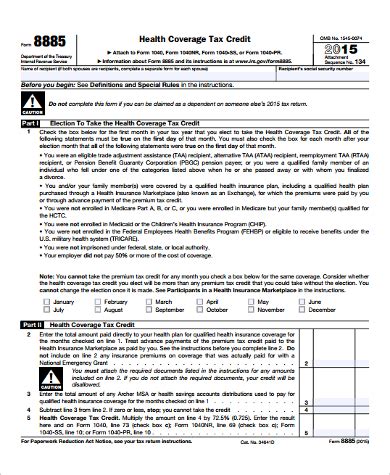

Key Components of Form 1095-A

The Proof of Health Insurance Tax Form consists of several crucial sections, each providing specific information about the enrollee's health insurance coverage.

-

Personal Information: This section includes the enrollee's name, address, and other identifying details. It ensures that the form is correctly associated with the individual's tax return.

-

Coverage Details: Here, the form outlines the specifics of the health insurance plan, such as the plan type, effective dates, and the names of any dependents covered under the plan.

-

Premium Amounts: Form 1095-A lists the monthly premiums paid by the enrollee and any applicable subsidies or tax credits received to offset these costs.

-

Coverage Period: This section indicates the duration for which the enrollee had health insurance coverage during the tax year.

-

Unique Identifier: Each form is assigned a unique identifier, which helps tax authorities match the form with the enrollee's tax return and ensures data integrity.

Importance of the Proof of Health Insurance Tax Form

The Proof of Health Insurance Tax Form holds significant importance for both healthcare and taxation purposes.

Healthcare Coverage Verification

Form 1095-A serves as a vital verification tool for healthcare providers and insurance companies. It confirms that an individual has met the Affordable Care Act (ACA) mandate to maintain minimum essential health insurance coverage or face a tax penalty. By presenting this form, individuals can demonstrate their compliance with the law and avoid potential penalties.

Tax Implications

The form's role extends beyond healthcare verification. It is a crucial document for tax purposes, particularly for individuals who receive premium tax credits to help offset the cost of their health insurance premiums. These tax credits are claimed on the enrollee's tax return, and Form 1095-A provides the necessary information to calculate and reconcile these credits accurately.

Reconciliation of Tax Credits

During the tax filing process, individuals who received premium tax credits must reconcile the amount of credits they received with the actual premium amounts paid. Form 1095-A contains the necessary data to facilitate this reconciliation. If the credits received exceed the actual premium costs, the enrollee may need to repay the excess amount as a tax liability. Conversely, if the credits were less than the premium costs, the enrollee may be eligible for an additional tax refund.

Using the Proof of Health Insurance Tax Form

Individuals who receive Form 1095-A should carefully review the information it contains to ensure its accuracy. Any discrepancies should be promptly addressed with the insurance provider. Here are some key steps to follow when using the form:

-

Verification: Verify that your personal information, coverage details, and premium amounts match your records. This step is crucial to ensure accuracy.

-

Tax Preparation: When preparing your tax return, use the information from Form 1095-A to accurately report your health insurance coverage and premium tax credits. This ensures compliance with tax regulations.

-

Reconciliation: Reconcile the premium tax credits you received with the actual premiums paid. This calculation is essential to determine any potential tax liabilities or refunds.

-

Storage: Keep Form 1095-A in a secure location along with other important tax documents. It may be needed for future reference or audits.

Future Implications

The Proof of Health Insurance Tax Form remains a critical component of the healthcare and taxation landscape in the United States. As healthcare policies evolve and tax regulations adapt, the form's role may continue to expand or shift. However, for the foreseeable future, it will remain a vital tool for individuals to navigate the complex interplay between healthcare coverage and tax obligations.

Frequently Asked Questions

What happens if I don’t receive Form 1095-A?

+If you do not receive Form 1095-A, it’s important to take action. Contact your health insurance provider to request a replacement form. They should be able to reissue the document to ensure you have the necessary proof of coverage for tax purposes.

Can I use Form 1095-A to claim tax deductions or credits?

+Form 1095-A primarily serves as proof of health insurance coverage and is not directly used for claiming tax deductions. However, it provides crucial information for calculating and claiming premium tax credits, which can reduce your tax liability.

What if the information on Form 1095-A is incorrect?

+If you notice any errors or discrepancies on Form 1095-A, contact your health insurance provider immediately. They can assist in rectifying the mistakes and issuing a corrected form, ensuring that your tax obligations are calculated accurately.

Do I need to keep Form 1095-A for future reference?

+Yes, it is highly recommended to retain Form 1095-A for at least three years. This ensures that you have the necessary documentation for future tax filings or audits. Storing it securely alongside other important tax documents is a prudent practice.