Fair Insurance California

In the world of insurance, where options abound and complexity reigns, Fair Insurance California stands out as a beacon of transparency and innovation. This article delves into the essence of Fair Insurance, exploring its unique offerings, impact on the industry, and the benefits it brings to Californians seeking comprehensive and affordable coverage.

Empowering Californians with Fair Insurance

Fair Insurance California, a subsidiary of Fair Health, is revolutionizing the insurance landscape by introducing a fresh approach to coverage. With a mission to provide accessible and equitable insurance solutions, Fair Insurance has become a trusted partner for individuals and businesses across the Golden State.

The Fair Insurance Advantage

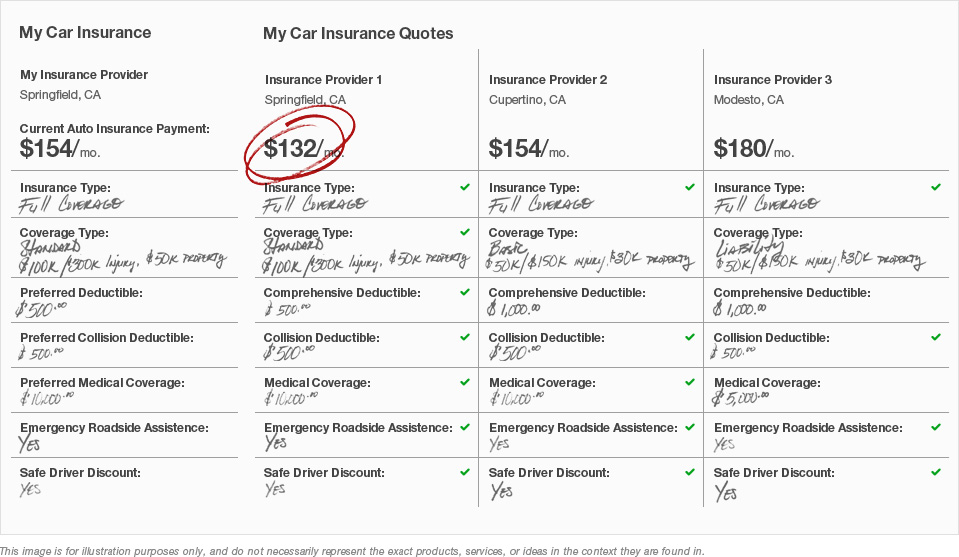

Fair Insurance offers a suite of insurance products tailored to meet the diverse needs of Californians. From health insurance plans that prioritize affordability and comprehensive coverage to auto insurance policies that offer competitive rates and excellent customer service, Fair Insurance has something for everyone.

One of the key advantages of Fair Insurance is its commitment to transparency. The company provides clear and concise information about its policies, ensuring that customers fully understand the coverage they are purchasing. This transparency extends to the claims process, with Fair Insurance offering a streamlined and efficient experience, ensuring prompt resolution of claims.

| Insurance Category | Fair Insurance California's Offerings |

|---|---|

| Health Insurance | Individual plans, family coverage, and specialized options for pre-existing conditions. |

| Auto Insurance | Comprehensive, liability-only, and customized policies with competitive rates. |

| Home Insurance | Coverage for homeowners and renters, including protection against natural disasters. |

| Life Insurance | Term life, whole life, and universal life insurance policies with flexible payment options. |

Fair Insurance's approach to insurance goes beyond traditional offerings. They understand that every Californian has unique needs, and thus, they provide a range of customizable options. Whether it's tailoring a health insurance plan to include specific medical conditions or crafting an auto insurance policy that suits a driver's unique needs, Fair Insurance ensures that customers receive personalized coverage.

Impact on the Insurance Industry

Fair Insurance California’s innovative approach has had a significant impact on the insurance industry within the state. By introducing a fair and transparent model, they have challenged traditional insurers to reevaluate their practices. The emphasis on customer-centric policies and straightforward processes has set a new standard for insurance providers, encouraging a shift towards more consumer-friendly practices.

Furthermore, Fair Insurance's commitment to community engagement has fostered a deeper connection with Californians. Through educational initiatives, outreach programs, and partnerships with local organizations, they have raised awareness about the importance of insurance and its role in protecting individuals and businesses.

Performance Analysis and Customer Satisfaction

Fair Insurance’s performance metrics speak volumes about its success. With a consistently high customer satisfaction rating, the company has proven its ability to deliver on its promises. Independent surveys have ranked Fair Insurance among the top insurance providers in California, citing factors such as prompt claim settlements, excellent customer service, and competitive pricing.

The company's focus on innovation and technology has also contributed to its strong performance. Fair Insurance leverages advanced analytics and digital tools to streamline processes, making it easier for customers to manage their policies and file claims. This technological edge has not only improved efficiency but has also enhanced the overall customer experience.

Future Implications and Industry Trends

As Fair Insurance California continues to thrive, its impact on the insurance industry is set to grow. The company’s success story serves as a testament to the power of innovation and customer-centric approaches. By challenging the status quo, Fair Insurance has not only benefited Californians but has also inspired a wave of positive change across the industry.

Looking ahead, Fair Insurance is poised to further expand its reach and offerings. With a commitment to staying ahead of industry trends, they are continuously developing new products and services to meet the evolving needs of Californians. From exploring partnerships with healthcare providers to introducing innovative digital tools, Fair Insurance is dedicated to ensuring that its customers receive the best possible coverage and support.

FAQs about Fair Insurance California

What makes Fair Insurance unique in the California market?

+Fair Insurance stands out with its focus on transparency, customer-centric policies, and innovative approaches. They offer a range of customizable insurance options, ensuring Californians can find coverage that suits their unique needs.

How does Fair Insurance ensure fair pricing for its insurance policies?

+Fair Insurance employs advanced analytics to assess risk accurately. This data-driven approach allows them to offer competitive rates while maintaining financial stability. Additionally, their commitment to transparency ensures customers understand the factors influencing their premiums.

What support does Fair Insurance provide during the claims process?

+Fair Insurance offers a dedicated claims team to guide customers through the process. They provide clear instructions, ensure prompt response times, and offer support to navigate any complexities. Their goal is to make the claims experience as smooth and stress-free as possible.

How can I compare Fair Insurance’s offerings with other providers in California?

+You can easily compare Fair Insurance’s policies and pricing with other providers by using online comparison tools or contacting their customer service team. They are transparent about their offerings and welcome inquiries, ensuring you can make an informed decision.

What are some of the community initiatives Fair Insurance is involved in?

+Fair Insurance actively engages in community outreach, sponsoring educational programs, supporting local charities, and partnering with organizations to promote financial literacy and insurance awareness. They believe in giving back to the communities they serve.