Comparing Health Insurance

In today's fast-paced world, ensuring your health and well-being is of utmost importance. With a myriad of health insurance options available, making the right choice can be a daunting task. This comprehensive guide aims to simplify the process by offering an in-depth comparison of various health insurance plans, empowering you to make an informed decision that aligns with your unique needs and circumstances.

Understanding the Health Insurance Landscape

Health insurance is a vital financial tool that provides coverage for medical expenses, offering peace of mind and access to quality healthcare. The market is diverse, with a range of providers and plans catering to different demographics and requirements. From comprehensive coverage to specialized plans, understanding the landscape is the first step towards selecting the right insurance.

Key Factors to Consider

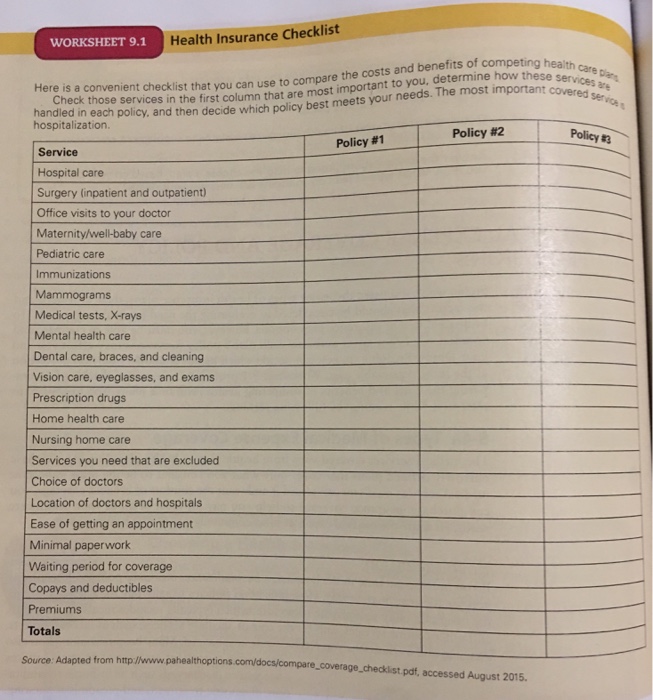

When comparing health insurance plans, several critical factors come into play. These include:

- Coverage Scope: The breadth of medical services covered, including routine check-ups, specialized treatments, and prescription medications.

- Premium Costs: The regular payments required to maintain the insurance policy, which can vary based on age, location, and plan type.

- Deductibles and Co-pays: The out-of-pocket expenses you incur before the insurance coverage kicks in, and the co-payment percentages for various services.

- Network Providers: The healthcare facilities and professionals affiliated with the insurance plan, offering discounted rates for members.

- Additional Benefits: Features like wellness programs, dental and vision coverage, and mental health services can add value to a plan.

Analyzing Leading Health Insurance Providers

To assist you in your search, let’s delve into an analysis of some of the leading health insurance providers in the market, comparing their offerings and highlighting unique features.

Provider A: Comprehensive Coverage with Personalized Benefits

Known for its extensive network and personalized approach, Provider A offers a range of plans catering to individuals, families, and employers. Here’s a closer look at their offerings:

- Individual Plans: With a focus on affordability, Provider A’s individual plans offer flexible coverage options, allowing you to choose the level of coverage that suits your needs. Their basic plan covers essential services, while their premium plan includes additional benefits like vision and dental coverage.

- Family Plans: Designed to cater to the unique needs of families, Provider A’s family plans offer comprehensive coverage with reduced out-of-pocket costs. They also provide specialized pediatric care and family wellness programs.

- Employer-Sponsored Plans: Partnering with businesses, Provider A offers competitive group insurance plans. These plans often include additional benefits like telemedicine services and discounted gym memberships, promoting overall employee wellness.

- Network Providers: Provider A boasts an extensive network of over 150,000 healthcare professionals and facilities nationwide, ensuring you have access to quality care wherever you are.

- Digital Tools: Provider A has invested in innovative digital platforms, offering online portals for easy claim submission and real-time updates on your coverage status.

Provider B: Focus on Innovation and Accessibility

With a reputation for embracing technological advancements, Provider B offers a unique approach to health insurance. Their plans are designed to be accessible and user-friendly, with a strong focus on digital integration.

- Virtual Healthcare Services: Provider B leads the way in virtual healthcare, offering telemedicine services that allow you to consult with medical professionals remotely. This not only saves time but also reduces costs associated with in-person visits.

- AI-Powered Personalization: Utilizing artificial intelligence, Provider B’s plans offer personalized coverage suggestions based on your health history and preferences. This ensures you receive a plan tailored to your unique needs.

- Transparent Pricing: Provider B prides itself on transparent pricing, with clear and concise explanations of costs. Their plans are designed to be affordable and offer a range of coverage options to suit different budgets.

- Mobile App Integration: Provider B’s mobile app allows you to manage your insurance policy on the go. From submitting claims to tracking your coverage, the app provides a seamless user experience.

- Wellness Incentives: To encourage healthy habits, Provider B offers wellness incentives like discounted gym memberships and rewards for achieving fitness goals.

Provider C: Tradition Meets Innovation

A long-standing provider in the industry, Provider C combines traditional insurance practices with innovative features to offer a comprehensive and reliable experience.

- Comprehensive Coverage: Provider C’s plans are known for their extensive coverage, including a wide range of medical services and prescription medications. Their focus is on ensuring you receive the care you need without financial strain.

- Network of Specialists: With a vast network of specialized healthcare providers, Provider C ensures you have access to experts in various fields. This is particularly beneficial for individuals with complex medical needs.

- Discounted Rates: Provider C negotiates discounted rates with their network providers, resulting in significant savings for policyholders. These savings are often passed on to members in the form of reduced out-of-pocket expenses.

- Member Support: Provider C offers dedicated support staff to assist members with insurance-related queries and claims. Their customer service is renowned for its efficiency and personalized approach.

- Online Resources: Provider C provides an extensive online knowledge base, offering educational resources and tools to help members understand their coverage and make informed healthcare decisions.

Comparative Analysis: Key Insights

As we delve deeper into the world of health insurance, it becomes evident that each provider offers unique advantages. Let’s summarize some key insights from our comparative analysis:

| Provider | Coverage Focus | Key Benefits |

|---|---|---|

| Provider A | Personalized Approach | Extensive network, digital tools, and family-centric plans |

| Provider B | Virtual Healthcare | AI-powered personalization, transparent pricing, and mobile app integration |

| Provider C | Comprehensive Coverage | Specialist network, discounted rates, and member support |

Navigating the Future of Health Insurance

The health insurance landscape is evolving, with providers continually innovating to meet the changing needs of consumers. As we look ahead, several trends and developments are shaping the future of health insurance.

Trends Shaping the Industry

- Telemedicine Integration: The rise of telemedicine is transforming the way healthcare is delivered. Expect to see more providers embracing virtual healthcare services, offering convenient and cost-effective solutions.

- AI and Data Analytics: Artificial intelligence and data analytics are being leveraged to personalize insurance plans and improve overall efficiency. Providers are utilizing these technologies to offer tailored coverage suggestions and enhance claim processing.

- Wellness Incentives: Encouraging healthy habits, wellness incentives are becoming a popular feature in health insurance plans. Expect to see more providers offering rewards and discounts for maintaining a healthy lifestyle.

- Digital Transformation: The digital revolution is reshaping the insurance industry. From online portals to mobile apps, providers are investing in technology to enhance the user experience and streamline processes.

Choosing the Right Plan for You

With a better understanding of the health insurance landscape and the latest trends, you’re equipped to make an informed decision. Consider your personal healthcare needs, budget, and preferences for digital integration. Assess the coverage scope, premium costs, and additional benefits offered by each provider to find the plan that aligns with your unique circumstances.

Remember, health insurance is a vital investment in your well-being. By comparing providers and plans, you can ensure you receive the coverage and support you deserve. Stay informed, and don't hesitate to seek professional advice if needed.

How do I determine my health insurance needs?

+Assessing your health insurance needs involves evaluating your current and potential future healthcare requirements. Consider factors like your age, health status, and any pre-existing conditions. Also, think about your preferred healthcare providers and the level of coverage you desire. Consulting with a healthcare professional or financial advisor can provide valuable guidance in determining the right level of coverage for your needs.

What are the key differences between PPO and HMO plans?

+PPO (Preferred Provider Organization) plans offer more flexibility, allowing you to visit healthcare providers both in and out of the insurance network, with varying levels of cost-sharing. HMO (Health Maintenance Organization) plans, on the other hand, require you to choose a primary care physician and typically have a more restricted network, with lower out-of-pocket costs but less flexibility.

How can I save on health insurance premiums?

+To save on premiums, consider enrolling in a high-deductible health plan (HDHP) paired with a health savings account (HSA). This combination allows you to save money tax-free for future medical expenses. Additionally, some providers offer discounts for early enrollment or for maintaining a healthy lifestyle. Comparing plans and shopping around can also help you find more affordable options.