Cheapest Renters Insurance Quotes

Renters insurance is a vital protection for those who live in rental properties, offering coverage for personal belongings and liability. It provides peace of mind and financial security in the event of unforeseen circumstances. In this article, we delve into the world of renters insurance, exploring its importance, how to find the cheapest quotes, and the key factors to consider when selecting a policy.

Understanding Renters Insurance and Its Benefits

Renters insurance is a form of property insurance that specifically caters to individuals residing in rented accommodations. It safeguards your personal property against a range of risks, including theft, fire, and natural disasters. Additionally, it provides liability coverage, which protects you from legal and medical expenses if someone is injured in your rental unit.

One of the primary advantages of renters insurance is its affordability. Compared to other insurance types, renters insurance policies tend to be more budget-friendly. This is because landlords typically carry insurance for the building structure, leaving the contents and personal liability coverage to the tenants.

Why Cheapest Quotes Matter

Finding the cheapest renters insurance quotes is essential for budget-conscious individuals. While price is a significant factor, it’s not the only consideration. It’s crucial to strike a balance between affordability and adequate coverage to ensure you’re adequately protected.

The good news is that there are numerous ways to secure affordable renters insurance quotes. By understanding the factors that influence premiums and exploring various options, you can make an informed decision that suits your needs and budget.

Key Factors Affecting Renters Insurance Quotes

Several factors come into play when determining the cost of renters insurance quotes. These factors can vary depending on your location, the insurance provider, and your specific circumstances. Let’s explore some of the key considerations:

Location and Risk Assessment

The geographical location of your rental property plays a significant role in determining insurance rates. Areas with a higher incidence of crimes, natural disasters, or a dense population may result in higher premiums. Insurance companies assess the risk associated with your location and adjust their rates accordingly.

Coverage Amount and Deductibles

The coverage amount you choose for your personal property will impact your insurance quote. Typically, higher coverage limits lead to higher premiums. Additionally, the deductible you select can also affect the cost. A higher deductible means you’ll pay less for the policy, but you’ll have to cover more out-of-pocket expenses in the event of a claim.

Type of Rental Property

The type of rental property you inhabit can influence your insurance rates. For instance, apartments in a multi-unit building may have lower premiums compared to standalone houses or condominiums. The reasoning behind this is that multi-unit buildings often have better security measures and shared amenities, reducing the risk of theft or damage.

Personal Liability and Additional Coverage

Renters insurance policies typically include personal liability coverage, which protects you if someone is injured in your rental unit or if you accidentally cause damage to someone else’s property. The level of liability coverage you choose can impact your insurance quote. Additionally, adding optional coverage, such as for valuable items or specific perils, can also affect the overall cost.

Discounts and Bundling Options

Insurance providers often offer discounts to attract customers. These discounts can be based on various factors, such as age, occupation, loyalty, or the presence of safety features in your rental unit. Additionally, bundling your renters insurance with other policies, like auto insurance, can lead to significant savings.

Tips for Finding the Cheapest Renters Insurance Quotes

Now that we’ve covered the key factors influencing renters insurance quotes, let’s explore some practical tips to help you secure the cheapest rates:

Compare Multiple Quotes

Obtaining multiple quotes from different insurance providers is crucial. Each company has its own rating system and considerations, so comparing quotes will give you a comprehensive view of the market. Online insurance marketplaces or comparison websites can be excellent tools for this purpose, allowing you to quickly assess various options.

Research and Understand Coverage Options

Before requesting quotes, take the time to understand the different coverage options available. Familiarize yourself with the basic components of a renters insurance policy, such as personal property coverage, liability coverage, and additional endorsements. This knowledge will help you make informed decisions and ensure you’re comparing apples to apples when evaluating quotes.

Consider Online Insurance Providers

Online insurance providers often offer more competitive rates due to their lower overhead costs. These companies specialize in providing insurance quotes and policies exclusively through digital channels, which can result in savings for consumers. However, ensure that the online provider you choose is reputable and licensed to operate in your state.

Bundle Policies for Discounts

If you have other insurance needs, such as auto or home insurance, consider bundling your policies with the same provider. Many insurance companies offer significant discounts when you combine multiple policies. This can be a cost-effective way to save money on your renters insurance and other insurance needs.

Increase Your Deductible

Opting for a higher deductible can lead to lower insurance premiums. While this means you’ll have to pay more out of pocket if you need to make a claim, it can be a strategic move if you’re confident that you won’t need to file a claim frequently. Assess your financial situation and comfort level with potential out-of-pocket expenses to determine the appropriate deductible amount.

Improve Your Credit Score

Insurance providers often consider your credit score when calculating your insurance premium. Maintaining a good credit score can positively impact your renters insurance quote. Work on improving your credit score by paying your bills on time, reducing outstanding debts, and regularly reviewing your credit report for any errors.

Negotiate with Your Current Provider

If you already have renters insurance, don’t hesitate to negotiate with your current provider. Contact your insurance company and inquire about any available discounts or special promotions. Let them know that you’re considering switching providers due to competitive rates. They may offer you a better deal to retain your business.

The Importance of Adequate Coverage

While finding the cheapest renters insurance quotes is important, it’s equally crucial to ensure that your coverage is adequate. Renters insurance is designed to provide financial protection and peace of mind, so it’s essential to have a policy that aligns with your needs.

When assessing coverage, consider the replacement cost of your personal belongings. Ensure that your policy covers the full value of your possessions, taking into account factors like inflation and the cost of living in your area. Additionally, review the liability limits to ensure they are sufficient to protect you from potential lawsuits.

It's also worth noting that standard renters insurance policies may have certain limitations or exclusions. For example, high-value items like jewelry, artwork, or electronics may require additional coverage or endorsements. Carefully review your policy to understand what is and isn't covered, and consider adding optional coverage if necessary.

Future of Renters Insurance: Digital Innovations

The renters insurance landscape is evolving, and digital innovations are playing a significant role in shaping the industry. Here are some trends to watch out for:

Digital Onboarding and Claims Process

Insurance companies are increasingly adopting digital technologies to streamline the onboarding and claims processes. From online applications and policy management to digital claims submission and real-time tracking, these innovations aim to provide a seamless and efficient experience for renters.

Personalized Coverage Options

With the advancement of data analytics and artificial intelligence, insurance providers can offer more personalized coverage options. By analyzing individual risk factors and behavior patterns, companies can tailor insurance policies to the specific needs of renters, potentially resulting in more affordable and customized quotes.

Telematics and Usage-Based Insurance

Telematics technology, which collects and analyzes data from sensors and devices, is being explored for renters insurance. This technology can provide insights into rental property usage, such as occupancy patterns and security measures. Usage-based insurance models may emerge, where premiums are based on actual usage and risk factors, offering renters more control over their insurance costs.

Integration with Smart Home Devices

The rise of smart home devices and the Internet of Things (IoT) presents opportunities for insurance providers to offer integrated coverage options. Renters with smart home devices may benefit from discounted insurance rates due to the enhanced security and monitoring capabilities these devices provide. Insurance companies are exploring partnerships with smart home manufacturers to create innovative insurance products.

Conclusion

Finding the cheapest renters insurance quotes is a balance between affordability and adequate coverage. By understanding the key factors that influence insurance rates and exploring the various options available, you can make an informed decision that suits your budget and provides the necessary protection. As the renters insurance market evolves with digital innovations, staying updated on the latest trends and advancements can help you navigate the insurance landscape effectively.

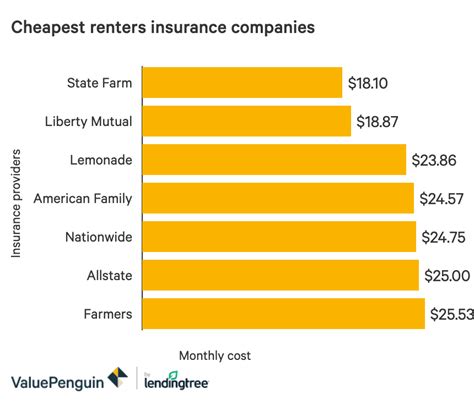

What is the average cost of renters insurance?

+The average cost of renters insurance varies depending on factors such as location, coverage limits, and deductibles. According to recent data, the national average for renters insurance is around 15 to 30 per month. However, it’s essential to note that rates can differ significantly based on individual circumstances.

How much coverage do I need for my personal belongings?

+The amount of coverage you need for your personal belongings depends on the value of your possessions. It’s recommended to conduct a home inventory to assess the replacement cost of your items. Most renters insurance policies offer coverage ranging from 10,000 to 50,000, but you can increase or decrease this limit based on your needs.

Are there any discounts available for renters insurance?

+Yes, insurance providers often offer discounts to attract customers. Common discounts include multi-policy discounts (bundling renters insurance with other policies), loyalty discounts for long-term customers, and safety discounts for having security features in your rental unit. It’s worth inquiring about these discounts when obtaining quotes.

What should I do if I’m unsure about the coverage I need?

+If you’re unsure about the coverage you need, it’s best to consult with an insurance professional. They can assess your specific circumstances, provide guidance on coverage options, and help you choose a policy that aligns with your needs. Don’t hesitate to reach out to insurance agents or customer service representatives for assistance.

Can I switch renters insurance providers if I find a better deal?

+Absolutely! Renters insurance is a competitive market, and you have the freedom to switch providers if you find a more affordable or suitable policy. Just ensure that you understand the terms and conditions of your current policy, including any cancellation fees or notice periods. Compare quotes and coverage thoroughly before making the switch.