Cheapest Full Coverage Motorcycle Insurance

Motorcycle enthusiasts know the thrill of the open road, but it's crucial to ensure that this thrilling experience is backed by adequate insurance coverage. Full coverage motorcycle insurance offers comprehensive protection, providing peace of mind for riders. However, finding the cheapest full coverage motorcycle insurance can be a challenging task, given the various factors that influence insurance rates. In this article, we delve into the world of motorcycle insurance, offering expert insights and practical tips to help riders secure the most affordable full coverage policies.

Understanding Full Coverage Motorcycle Insurance

Full coverage motorcycle insurance is a comprehensive policy that provides protection against a wide range of risks and potential damages. It typically includes liability coverage, which is mandatory in most states, and collision coverage and comprehensive coverage, which are optional but highly recommended. Let’s explore each of these components in more detail.

Liability Coverage

Liability coverage is the foundation of any motorcycle insurance policy. It protects riders against claims arising from bodily injury or property damage caused to others in an accident for which the insured rider is held responsible. This coverage is essential as it safeguards riders from potentially devastating financial consequences in the event of a serious accident.

| Liability Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages for injured parties. |

| Property Damage Liability | Pays for repairs or replacement of damaged property, including vehicles. |

Collision Coverage

Collision coverage is an optional add-on to motorcycle insurance policies. It provides protection for the insured motorcycle in the event of a collision, regardless of who is at fault. This coverage pays for repairs or replacement of the motorcycle, up to its actual cash value at the time of the accident.

Comprehensive Coverage

Comprehensive coverage is another optional component of full coverage motorcycle insurance. It protects against damages caused by events other than collisions, such as theft, vandalism, fire, natural disasters, or collisions with animals. Comprehensive coverage typically includes personal property coverage, which insures items carried on the motorcycle, like helmets or luggage.

Factors Influencing Motorcycle Insurance Rates

The cost of motorcycle insurance can vary significantly, influenced by a multitude of factors. Understanding these factors can help riders make informed decisions when shopping for insurance and potentially reduce their premiums.

Riding Experience and Record

Insurance companies consider a rider’s experience and driving record when calculating insurance rates. Generally, riders with more years of experience and a clean driving record can expect lower premiums. New riders or those with a history of accidents or traffic violations may face higher insurance costs.

Motorcycle Type and Usage

The type of motorcycle and how it is used also impact insurance rates. High-performance bikes, sportbikes, and motorcycles used for racing or off-road purposes often attract higher premiums due to their association with higher risk. Conversely, standard motorcycles used primarily for commuting or pleasure riding may be more affordable to insure.

Location and Usage Frequency

Where a rider lives and how often they use their motorcycle can affect insurance rates. Riders in areas with high crime rates or a history of severe weather events may pay more for comprehensive coverage. Additionally, frequent riders who use their motorcycles year-round may pay higher premiums compared to occasional riders.

Safety Features and Discounts

Motorcycles equipped with advanced safety features, such as anti-lock brakes (ABS) or advanced rider training certifications, may be eligible for insurance discounts. Some insurance companies offer discounts for riders who complete safety courses or have multiple motorcycles insured with the same provider. It’s worth exploring these options to potentially reduce insurance costs.

Tips for Finding the Cheapest Full Coverage Motorcycle Insurance

Navigating the world of motorcycle insurance to find the cheapest full coverage policy can be a complex task. Here are some expert tips to guide riders in their search for affordable insurance.

Shop Around and Compare Quotes

Insurance rates can vary significantly between providers. It’s crucial to shop around and obtain quotes from multiple insurance companies to find the best deal. Online comparison tools can be a convenient way to quickly gather quotes and compare rates.

Consider Bundle Discounts

Many insurance companies offer bundle discounts when riders insure multiple vehicles or combine motorcycle insurance with other policies, such as auto or home insurance. Exploring these options can lead to significant savings on insurance premiums.

Adjust Coverage Levels

Full coverage motorcycle insurance can be tailored to individual needs. Riders can adjust coverage levels and deductibles to find a balance between protection and affordability. It’s important to carefully assess personal risks and financial capabilities when making these decisions.

Explore Rider Discounts

Insurance companies often provide discounts for certain rider characteristics or behaviors. Riders should inquire about available discounts, such as those for good students, mature riders, or low-mileage riders. These discounts can make a significant difference in the overall cost of insurance.

Case Study: Affordable Full Coverage for a Sportbike Rider

To illustrate the process of finding affordable full coverage motorcycle insurance, let’s consider the case of John, a 30-year-old sportbike rider. John wants to ensure his new Kawasaki Ninja 650 is fully protected without breaking the bank.

Step 1: Research and Compare Providers

John starts by researching insurance providers in his state, focusing on those with a reputation for offering competitive rates for sportbike riders. He obtains quotes from three highly-rated companies, each offering a range of coverage options and discounts.

| Insurance Provider | Quote (Full Coverage) |

|---|---|

| Provider A | $1,200 annually |

| Provider B | $1,100 annually |

| Provider C | $1,050 annually |

Step 2: Explore Discounts and Adjust Coverage

John discovers that Provider C offers a 10% discount for mature riders (over 25 years old) and an additional 5% discount for completing a recognized safety course. He also finds that by increasing his deductible from 500 to 1,000, he can reduce his annual premium by $150.

Step 3: Finalize Coverage and Save

By taking advantage of the available discounts and adjusting his coverage, John is able to secure full coverage insurance for his sportbike with Provider C for $850 annually. This represents a significant saving compared to the original quotes, demonstrating the value of thorough research and customization.

Conclusion: The Importance of Affordable Full Coverage

Finding the cheapest full coverage motorcycle insurance is not just about saving money; it’s about ensuring that riders have the protection they need at a price they can afford. By understanding the factors that influence insurance rates and employing strategic approaches to shopping for insurance, riders can secure comprehensive coverage without breaking their budgets.

As the case study of John illustrates, with careful research, comparison, and utilization of available discounts, it is possible to find affordable full coverage motorcycle insurance. This allows riders like John to fully enjoy their passion for riding while being protected against the financial risks associated with motorcycle ownership.

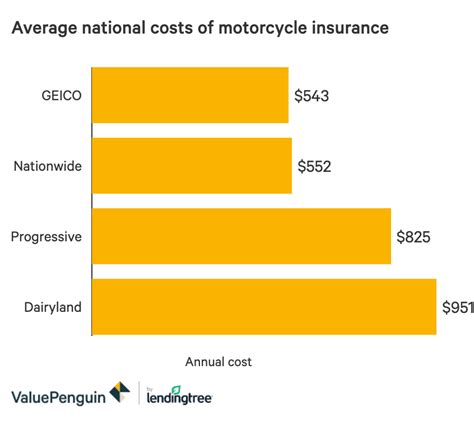

What is the average cost of full coverage motorcycle insurance?

+The average cost of full coverage motorcycle insurance varies depending on numerous factors, including the rider’s location, riding experience, and the type of motorcycle. On average, riders can expect to pay anywhere from 500 to 2,000 annually for full coverage insurance. However, it’s important to note that these figures are just estimates, and actual premiums can be higher or lower based on individual circumstances.

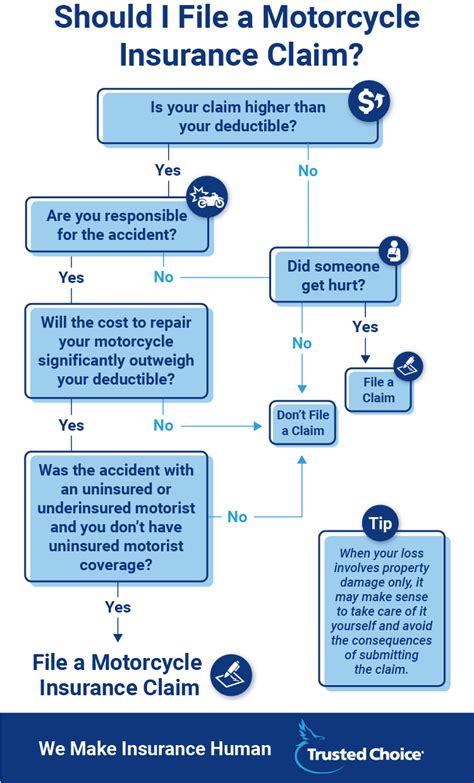

Are there any alternatives to full coverage insurance for motorcycles?

+Yes, riders have the option to choose liability-only coverage, which provides protection against bodily injury and property damage claims but does not cover damages to the insured motorcycle. This can be a more affordable alternative for riders who are willing to assume the financial risk of repairing or replacing their bike themselves in the event of an accident. However, it’s important to carefully consider one’s financial capabilities before opting for liability-only coverage.

How often should riders review and update their motorcycle insurance coverage?

+Riders should regularly review their insurance coverage, ideally at least once a year or whenever their circumstances change significantly. This includes changes in riding habits, the addition of new motorcycles to the policy, or any life events that may impact their insurance needs. Regularly reviewing coverage ensures that riders are adequately protected and that they are not paying for unnecessary coverage.