Cheapest California Health Insurance

Health insurance is an essential aspect of life, especially in a state like California, where medical costs can be significantly high. Finding the cheapest health insurance option that suits your needs can be a daunting task, but it is crucial for maintaining your financial well-being. In this comprehensive guide, we will delve into the world of California health insurance, exploring the various plans, their costs, and the factors that influence them.

Understanding California’s Health Insurance Market

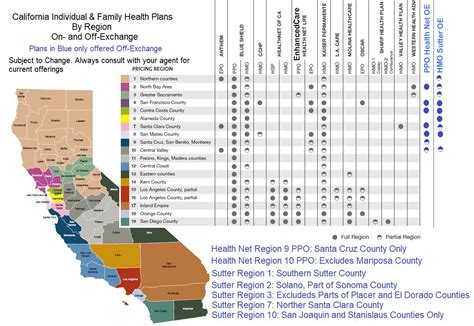

California boasts a diverse and competitive health insurance market, offering a wide range of plans to cater to its diverse population. The state has taken significant steps to ensure access to affordable healthcare, including the implementation of the Affordable Care Act (ACA) and the creation of the Covered California marketplace.

Covered California is an online marketplace that provides a user-friendly platform for individuals and families to compare and enroll in health insurance plans. It offers both individual and family plans, with a variety of options from different insurance providers. The marketplace also provides financial assistance to eligible residents, making healthcare more accessible.

Key Factors Influencing Insurance Costs

When it comes to health insurance, the cost is influenced by several factors. Understanding these factors can help you make informed decisions and find the most affordable plan for your needs:

- Age: Generally, younger individuals tend to have lower insurance premiums, as they are less likely to require extensive medical care. However, the cost difference between age groups can vary depending on the plan and provider.

- Location: The cost of insurance can vary significantly based on where you live in California. Urban areas often have higher costs due to increased healthcare expenses. It’s essential to consider your specific location when comparing plans.

- Tobacco Usage: Insurance providers may charge higher premiums for individuals who use tobacco products. This is because tobacco use is associated with an increased risk of various health issues, leading to higher healthcare costs.

- Plan Type: Different plan types offer varying levels of coverage and benefits. For instance, Health Maintenance Organizations (HMOs) typically have lower premiums but may have more limited provider networks. Preferred Provider Organizations (PPOs), on the other hand, offer more flexibility but come with higher costs.

- Coverage Level: The level of coverage you choose will impact the cost of your insurance. Higher coverage plans, such as Platinum or Gold, offer more extensive benefits but come with higher premiums. Lower coverage plans, like Bronze or Silver, have lower premiums but may have higher out-of-pocket expenses.

Exploring the Cheapest Health Insurance Options in California

Now, let’s dive into the specific plans and providers that offer some of the most affordable health insurance options in California. Keep in mind that the availability and pricing of these plans may vary depending on your location and other factors.

Low-Cost Plans on Covered California

Covered California, the state’s official health insurance marketplace, offers a range of low-cost plans designed to meet the needs of individuals and families with limited budgets. These plans typically have lower premiums but may have higher deductibles and out-of-pocket expenses.

For example, the Blue Shield of California Access+ Bronze Plan is one of the most affordable options available on Covered California. This plan offers essential health benefits at a low monthly cost, making it ideal for those on a tight budget. However, it's important to note that Bronze plans generally have higher deductibles and out-of-pocket maximums, so you may need to pay more if you require extensive medical care.

Another affordable option is the Health Net HMO Bronze 60 TX Plan, which provides comprehensive coverage at a competitive price. This plan has a slightly higher premium than the Blue Shield plan but offers a more extensive provider network and lower out-of-pocket costs for certain services.

| Plan Name | Monthly Premium (Individual) | Deductible | Out-of-Pocket Maximum |

|---|---|---|---|

| Blue Shield Access+ Bronze Plan | $220 - $350 | $6,500 | $8,000 |

| Health Net HMO Bronze 60 TX Plan | $250 - $380 | $6,400 | $6,850 |

It's worth mentioning that Covered California also provides financial assistance to eligible residents, further reducing the cost of insurance. This assistance is based on your household income and can significantly lower your monthly premiums.

Government-Funded Programs

For individuals and families with low incomes, government-funded programs can provide essential healthcare coverage at little to no cost. These programs are designed to ensure that vulnerable populations have access to necessary medical services.

Medi-Cal, California's Medicaid program, is a comprehensive healthcare program that offers free or low-cost coverage to eligible residents. To qualify for Medi-Cal, your household income must fall below a certain threshold, which varies based on family size. Medi-Cal provides a wide range of benefits, including doctor visits, hospital care, prescription drugs, and more.

Additionally, Medicare, the federal healthcare program for seniors and individuals with disabilities, is another option for those over the age of 65 or with specific medical conditions. Medicare has different parts, and some plans may have low or no premiums, making them an affordable choice for eligible individuals.

Employer-Provided Insurance

If you are employed, your workplace may offer health insurance as part of your benefits package. Employer-provided insurance plans are often more affordable than individual plans, as the employer typically contributes to the cost of coverage.

These plans can vary significantly in terms of coverage and cost, depending on the employer and the specific plan chosen. Some employers offer multiple plan options, allowing employees to choose the one that best suits their needs and budget.

It's important to review the details of your employer's health insurance plan carefully, as the coverage and benefits can vary. Factors such as the number of family members covered, the plan's network of providers, and any additional benefits (like dental or vision coverage) should all be considered when making your decision.

Tips for Finding the Best Deal

Finding the cheapest health insurance plan that meets your needs requires careful consideration and comparison. Here are some tips to help you navigate the process:

- Shop Around: Compare plans and providers to find the best deal. Use online tools and resources, such as Covered California’s website, to easily compare different options and their costs.

- Check Eligibility for Subsidies: If you’re purchasing insurance on your own, check if you’re eligible for subsidies or financial assistance. These can significantly reduce the cost of your insurance premiums.

- Evaluate Your Healthcare Needs: Consider your typical healthcare expenses and choose a plan that aligns with those needs. If you generally have minimal healthcare expenses, a plan with a higher deductible and lower premium might be a good fit.

- Consider Short-Term Plans: Short-term health insurance plans can be an affordable option if you’re between jobs or have a temporary gap in coverage. However, these plans often have limited benefits and may not cover pre-existing conditions.

- Use Discounts and Savings Programs: Many insurance providers offer discounts or savings programs for specific groups, such as veterans or members of certain organizations. Check if you’re eligible for any of these programs to further reduce your costs.

Conclusion: Making Informed Choices

Finding the cheapest health insurance in California involves a combination of understanding the market, comparing plans, and considering your individual needs and circumstances. Whether you’re seeking coverage through Covered California, government-funded programs, or employer-provided insurance, there are options available to meet your budget and healthcare requirements.

Remember, health insurance is a crucial investment in your well-being. While cost is an important factor, it's essential to choose a plan that provides adequate coverage for your specific healthcare needs. Take the time to review the details of each plan, consider your options carefully, and make an informed decision that ensures your peace of mind and financial stability.

How do I know if I’m eligible for financial assistance on Covered California?

+Eligibility for financial assistance on Covered California depends on your household income and family size. Generally, if your income is below 400% of the federal poverty level, you may qualify for subsidies to lower your monthly premiums. It’s recommended to use the Covered California website’s eligibility calculator to determine your specific eligibility.

Are there any disadvantages to short-term health insurance plans?

+Yes, short-term health insurance plans have some limitations. They often exclude coverage for pre-existing conditions and may have limited benefits, such as no coverage for preventive care or mental health services. Additionally, short-term plans can be more expensive in the long run if you have ongoing healthcare needs.

What should I consider when choosing an employer-provided health insurance plan?

+When selecting an employer-provided health insurance plan, consider factors such as the plan’s network of providers, the coverage limits, any additional benefits like dental or vision, and the cost-sharing structure (deductibles, copays, and coinsurance). It’s also important to understand the process for enrolling in the plan and any potential changes that may occur during your employment.