Cheap Renters Insurance

Renters insurance is a crucial financial safeguard for individuals living in rental properties. While the cost of this insurance can vary significantly, it is possible to find affordable options that provide comprehensive coverage. In this article, we will explore the world of cheap renters insurance, discussing its benefits, the factors influencing its cost, and strategies to secure the best deals.

Understanding Renters Insurance

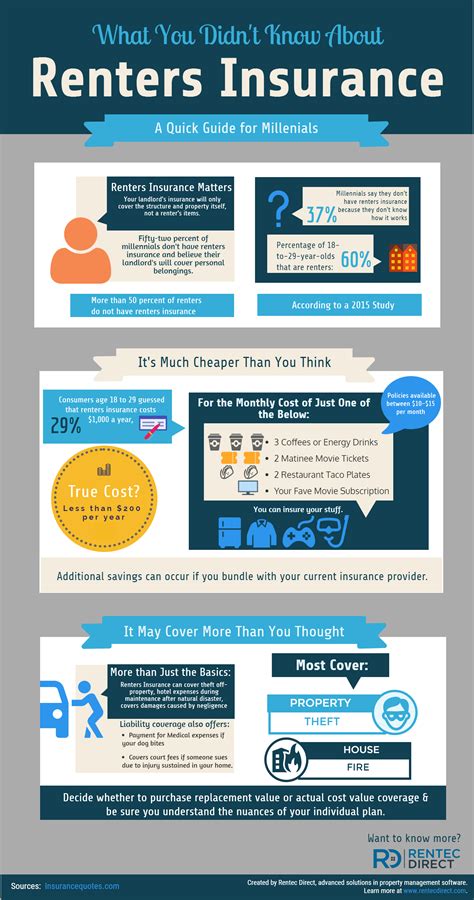

Renters insurance is a form of property insurance specifically designed for tenants. Unlike homeowners insurance, which covers the entire property and its structure, renters insurance primarily focuses on protecting the tenant’s personal belongings and providing liability coverage. It is an essential policy for renters as it offers financial protection against losses due to theft, damage, or accidents.

Renters insurance typically consists of three main components: personal property coverage, liability coverage, and additional living expenses. Personal property coverage reimburses the policyholder for the cost of replacing their belongings in the event of a covered loss. Liability coverage protects the renter from legal claims and lawsuits arising from accidents or injuries that occur on the rental property. Lastly, additional living expenses cover the costs incurred if the renter needs to temporarily relocate due to a covered loss.

Factors Influencing Renters Insurance Cost

The cost of renters insurance can vary based on several factors. Understanding these factors is crucial when seeking affordable coverage.

Location

The geographical location of the rental property plays a significant role in determining insurance rates. Areas with higher crime rates, natural disaster risks, or a history of frequent claims tend to have higher insurance premiums. It is advisable to research the specific risks associated with your rental area to anticipate potential costs.

| Location | Average Annual Premium |

|---|---|

| Urban Areas | $300 - $500 |

| Suburban Areas | $250 - $400 |

| Rural Areas | $200 - $350 |

Coverage Amount

The amount of coverage selected is a key factor in determining the cost of renters insurance. Policyholders can choose the coverage limit that best suits their needs and the value of their belongings. It is essential to assess the total value of your personal property and select a coverage amount that adequately protects your assets.

Deductibles

Deductibles are the amount the policyholder must pay out of pocket before the insurance company covers the rest. Opting for a higher deductible can result in lower premiums, as it reduces the insurer’s financial risk. However, it is important to strike a balance and choose a deductible that you can afford in the event of a claim.

Discounts and Bundles

Insurance companies often offer discounts and bundle packages to attract customers. These discounts can significantly reduce the cost of renters insurance. Some common discounts include:

- Multi-Policy Discounts: Combining renters insurance with other policies, such as auto insurance, can result in substantial savings.

- Loyalty Discounts: Insurance providers may offer reduced rates to long-term customers who have maintained their policies over an extended period.

- Safety Discounts: Renters who install security systems, smoke detectors, or take other safety measures may qualify for discounts.

- Bundle Discounts: Bundling renters insurance with other insurance products, like homeowners or life insurance, can lead to cost savings.

Tips for Finding Cheap Renters Insurance

While the cost of renters insurance can vary, there are several strategies you can employ to find affordable coverage.

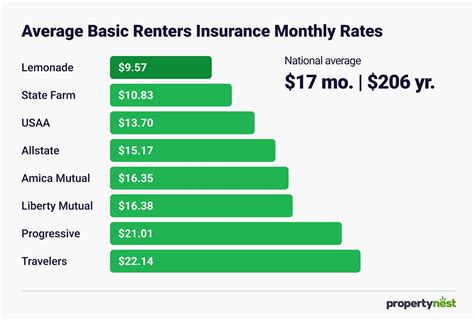

Shop Around and Compare Quotes

Obtaining multiple quotes from different insurance providers is essential to finding the best deal. Each insurer has its own rating system and factors that influence premiums. By comparing quotes, you can identify the most cost-effective option for your needs.

Understand Your Coverage Needs

Assessing your coverage needs accurately is crucial to avoid overpaying for unnecessary coverage. Consider the value of your personal belongings and choose a coverage limit that provides adequate protection without being excessive. Additionally, review the specific exclusions and limitations of each policy to ensure you are not paying for coverage you do not require.

Utilize Online Tools and Comparisons

Online insurance comparison websites and tools can simplify the process of finding cheap renters insurance. These platforms allow you to input your information once and receive multiple quotes from various insurers. This not only saves time but also provides a comprehensive overview of the available options.

Negotiate and Ask for Discounts

Don’t be afraid to negotiate with insurance providers. Many insurers are willing to offer discounts or customized rates to attract new customers. Contact your preferred insurer and inquire about available discounts, especially if you meet certain criteria, such as having a good credit score or a clean claims history.

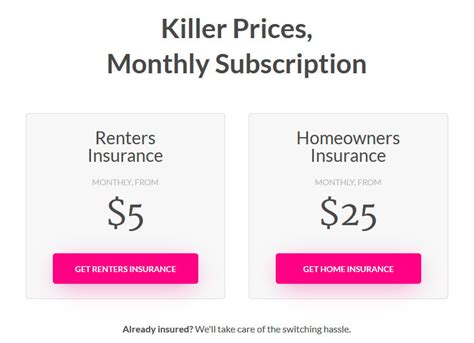

Bundle Policies

Bundling your insurance policies with the same provider can lead to significant savings. By combining renters insurance with other policies, such as auto or homeowners insurance, you may qualify for bundle discounts. This strategy not only simplifies your insurance management but also reduces your overall insurance costs.

Consider High Deductibles

Opting for a higher deductible can result in lower premiums. However, it is important to ensure that you can afford the deductible in the event of a claim. A higher deductible means you will have to pay more out of pocket, but it can significantly reduce your insurance costs in the long run.

Performance Analysis and Real-World Examples

To illustrate the potential savings of cheap renters insurance, let’s consider a real-world example. Jane, a recent college graduate, is renting an apartment in an urban area. She obtained quotes from three different insurance providers for renters insurance coverage.

| Insurance Provider | Annual Premium | Coverage Amount | Deductible |

|---|---|---|---|

| Provider A | $450 | $30,000 | $500 |

| Provider B | $380 | $25,000 | $1,000 |

| Provider C | $320 | $20,000 | $1,500 |

In this example, Provider C offers the most affordable annual premium, but it has a higher deductible and a lower coverage amount. Jane can decide based on her personal financial situation and the value of her belongings. If she is comfortable with a higher deductible and believes her belongings are adequately protected with a $20,000 coverage amount, Provider C's policy could be the best choice.

Future Implications and Industry Insights

The renters insurance market is evolving, and several trends are shaping the industry. One notable trend is the increasing adoption of digital technologies by insurance providers. Many insurers now offer online platforms and mobile apps, making it easier for renters to obtain quotes, manage their policies, and file claims.

Additionally, the rise of telematics and smart home technologies is influencing the renters insurance market. Telematics devices, which track driving behavior, are being used to offer personalized insurance rates for renters who own vehicles. Smart home devices, such as security cameras and smart locks, are also becoming more common in rental properties. Insurers are recognizing the benefits of these devices in reducing risks and are offering discounts to renters who utilize them.

FAQ

What is the average cost of renters insurance per month?

+

The average cost of renters insurance per month can vary depending on factors such as location, coverage amount, and deductibles. On average, renters insurance premiums range from 15 to 30 per month, with some providers offering even lower rates.

Can I customize my renters insurance coverage to fit my needs?

+

Yes, renters insurance policies can be customized to meet your specific needs. You can choose the coverage amount, select additional endorsements or riders for specific items, and adjust your deductibles to find the right balance between coverage and cost.

Are there any discounts available for renters insurance?

+

Absolutely! Insurance providers offer various discounts for renters insurance. Common discounts include multi-policy discounts (bundling renters insurance with other policies), loyalty discounts for long-term customers, safety discounts for installing security systems or smoke detectors, and bundle discounts when combining renters insurance with other insurance products.