Cheap Liability Car Insurance

Finding affordable liability car insurance is a crucial task for many drivers, especially those on a tight budget. With the rising cost of car insurance, it's essential to explore options that provide the necessary coverage without breaking the bank. This article aims to delve into the world of liability car insurance, offering a comprehensive guide to help you secure the best and most cost-effective coverage for your vehicle.

Understanding Liability Car Insurance

Liability car insurance is a fundamental component of any auto insurance policy. It protects you financially in the event that you are found at fault for an accident, covering the costs of damages or injuries sustained by others involved. This coverage is mandatory in most states and is often the minimum requirement for legally driving on the road. Understanding liability insurance and its intricacies is key to making informed decisions about your car insurance.

Liability coverage typically consists of two main components: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses, lost wages, and pain and suffering claims of the injured parties. Property damage liability, on the other hand, covers the cost of repairing or replacing damaged property, such as the other driver's vehicle or any other damaged assets.

When shopping for liability car insurance, it's important to strike a balance between adequate coverage and affordability. While it may be tempting to opt for the lowest premiums, it's crucial to ensure that your policy provides sufficient protection in case of an accident. Insufficient coverage can leave you vulnerable to significant out-of-pocket expenses and legal consequences.

Key Considerations for Affordable Liability Coverage

Securing cheap liability car insurance requires a strategic approach. Here are some key considerations to keep in mind when shopping for affordable coverage:

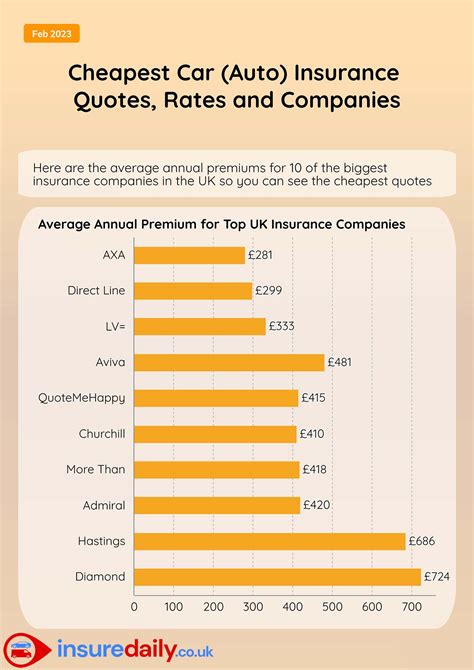

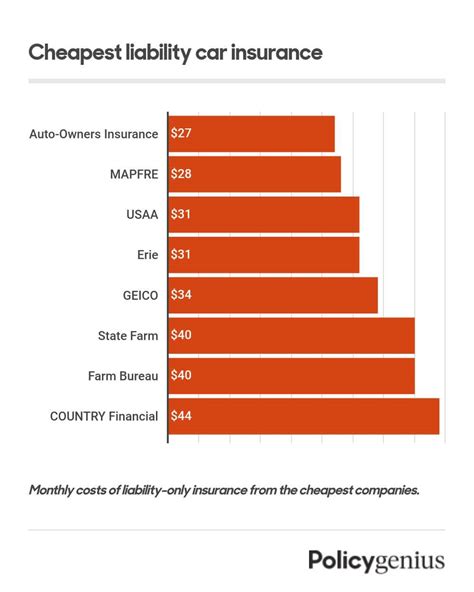

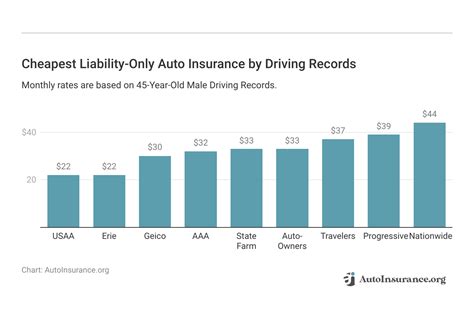

- Research Multiple Insurers: Compare quotes from various insurance providers to find the most competitive rates. Each insurer has its own methodology for calculating premiums, so getting multiple quotes can help you identify the most affordable options.

- Understand Coverage Limits: Familiarize yourself with the coverage limits offered by different policies. While higher limits provide more protection, they also come with higher premiums. Strike a balance between coverage and cost based on your specific needs and budget.

- Consider Deductibles: Opting for a higher deductible can reduce your premium costs. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. While it may require a larger upfront payment in the event of a claim, it can significantly lower your monthly premiums.

- Explore Discounts: Many insurers offer discounts for various reasons, such as good driving records, safety features in your vehicle, or bundling multiple insurance policies. Take advantage of these discounts to further reduce your premiums.

- Review Your Policy Regularly: Car insurance rates can fluctuate over time due to various factors, including changes in your personal circumstances, driving record, or the insurer's pricing structure. Regularly reviewing and updating your policy can help ensure you're getting the best value for your money.

Shopping for Cheap Liability Car Insurance

When embarking on the quest for cheap liability car insurance, it’s beneficial to have a structured approach. Here’s a step-by-step guide to help you navigate the process:

- Assess Your Needs: Before diving into insurance quotes, take the time to understand your specific insurance needs. Consider factors such as your driving history, the make and model of your vehicle, and any additional coverage requirements based on your state's regulations.

- Compare Quotes: Utilize online comparison tools or directly reach out to multiple insurance providers to obtain quotes. Provide accurate and detailed information about your vehicle, driving history, and desired coverage limits to ensure an accurate comparison.

- Evaluate Coverage and Premiums: Carefully review the coverage details and premiums offered by each insurer. Pay attention to the coverage limits, deductibles, and any additional perks or benefits included in the policy. Ensure that the coverage aligns with your needs and budget.

- Explore Discount Opportunities: Inquire about available discounts with each insurer. Common discounts include safe driver discounts, multi-policy discounts, and discounts for vehicle safety features. Applying for these discounts can significantly reduce your overall premiums.

- Read the Fine Print: Don't overlook the policy's fine print. Carefully read through the terms and conditions to understand any exclusions, limitations, or specific requirements. This ensures that you fully comprehend the scope of your coverage.

- Consider Bundling: If you have multiple insurance needs, such as homeowners or renters insurance, consider bundling your policies with the same insurer. Bundling often results in significant savings and simplifies the management of your insurance portfolio.

- Seek Expert Advice: Consult with insurance professionals or brokers who can provide personalized advice based on your circumstances. They can help you navigate the complexities of car insurance and guide you towards the most suitable and affordable coverage options.

| Insurers | Coverage Limits | Premium (Annual) |

|---|---|---|

| InsurCo | $50,000 Bodily Injury / $100,000 Property Damage | $450 |

| SecureAuto | $100,000 Bodily Injury / $300,000 Property Damage | $520 |

| SafeGuard | $25,000 Bodily Injury / $50,000 Property Damage | $380 |

Common Mistakes to Avoid

When navigating the world of liability car insurance, it’s important to steer clear of common pitfalls that can lead to costly consequences. Here are some mistakes to avoid when seeking cheap liability coverage:

- Underestimating Coverage Needs: Failing to assess your specific coverage needs can lead to inadequate protection. Ensure you understand the minimum liability requirements in your state and consider any additional coverage that aligns with your personal circumstances and potential risks.

- Neglecting to Shop Around: Relying on a single insurance quote can result in missing out on potentially better deals. Always compare quotes from multiple insurers to find the most competitive rates and coverage options that suit your needs.

- Overlooking Discounts: Many insurers offer a variety of discounts, such as safe driver discounts, multi-policy discounts, or discounts for vehicle safety features. Failing to inquire about and apply for these discounts can mean missing out on significant savings.

- Skipping Policy Reviews: Regularly reviewing your car insurance policy is essential to ensure it remains up-to-date and cost-effective. Changes in your personal circumstances, driving record, or the insurer's pricing structure can impact your premiums and coverage. Stay proactive and update your policy as needed.

- Ignoring Fine Print: Skipping over the policy's fine print can lead to misunderstandings and unexpected gaps in coverage. Always take the time to thoroughly read and understand the terms and conditions of your insurance policy.

Maximizing Savings and Benefits

While finding cheap liability car insurance is a priority, it’s equally important to maximize the benefits and savings associated with your policy. Here are some strategies to consider:

- Maintain a Clean Driving Record: A clean driving record is often rewarded with lower insurance premiums. Avoid traffic violations and accidents to keep your record clear and potentially qualify for safe driver discounts.

- Explore Usage-Based Insurance: Usage-based insurance programs, also known as pay-as-you-drive or telematics insurance, can offer significant savings. These programs use technology to monitor your driving behavior, rewarding safe driving habits with lower premiums.

- Consider Higher Deductibles: Opting for a higher deductible can reduce your monthly premiums. While it means paying more out of pocket in the event of a claim, it can be a cost-effective strategy if you're a safe driver and have a low risk of accidents.

- Review Coverage Regularly: Your insurance needs may change over time due to factors such as life changes, vehicle upgrades, or improvements in your driving record. Regularly reviewing your coverage ensures that you're not overpaying for unnecessary coverage or missing out on additional savings.

- Bundle Your Policies: If you have multiple insurance needs, such as homeowners or renters insurance, consider bundling your policies with the same insurer. Bundling often results in substantial savings and simplifies the management of your insurance portfolio.

The Future of Liability Car Insurance

The landscape of liability car insurance is constantly evolving, influenced by technological advancements, changing consumer behaviors, and evolving regulatory environments. Here’s a glimpse into the future of liability car insurance and its potential implications:

Technological Advancements

The integration of technology into the insurance industry is transforming the way liability car insurance is priced and delivered. Telematics and usage-based insurance programs are becoming increasingly popular, providing insurers with real-time data on driving behavior. This data-driven approach allows for more accurate risk assessment and pricing, potentially leading to more tailored and affordable insurance options.

Changing Consumer Behavior

The rise of ridesharing services and the growing popularity of electric vehicles are shaping the future of liability car insurance. As more individuals opt for ridesharing services or transition to electric vehicles, traditional car ownership patterns are shifting. Insurers are adapting their policies and coverage options to accommodate these changing behaviors, offering specialized coverage for ridesharing drivers and addressing the unique risks associated with electric vehicles.

Regulatory Changes

Regulatory environments play a significant role in shaping the liability car insurance market. Changes in state laws and regulations can impact the minimum liability requirements, influencing the coverage options and pricing structures offered by insurers. Staying informed about regulatory updates is crucial for consumers to ensure they remain compliant and have access to the most suitable insurance coverage.

The Rise of InsurTech

The emergence of InsurTech, or insurance technology startups, is disrupting the traditional insurance industry. These innovative companies leverage technology to offer more efficient, transparent, and personalized insurance experiences. InsurTech startups often focus on streamlining the insurance process, providing real-time quotes, and offering tailored coverage options. As InsurTech continues to evolve, it has the potential to drive competition and innovation in the liability car insurance market, ultimately benefiting consumers with more affordable and accessible coverage options.

Conclusion

Finding cheap liability car insurance is a balance between affordability and adequate coverage. By understanding your needs, comparing quotes, and exploring discounts, you can secure a policy that provides the necessary protection without straining your budget. As the liability car insurance landscape continues to evolve, staying informed and adapting to changing trends and technologies will ensure you remain protected and financially secure on the road.

What is the average cost of liability car insurance in the US?

+The average cost of liability car insurance in the US varies depending on factors such as location, driving history, and coverage limits. According to recent data, the average annual premium for liability coverage is around 500 to 1,500. However, it’s important to note that premiums can vary significantly based on individual circumstances.

How can I lower my liability car insurance premiums?

+There are several strategies to lower your liability car insurance premiums. Some effective approaches include maintaining a clean driving record, opting for higher deductibles, exploring usage-based insurance programs, and bundling your policies with the same insurer. Additionally, regularly reviewing and updating your policy can help you stay informed about potential savings opportunities.

What are the minimum liability coverage requirements in my state?

+Minimum liability coverage requirements vary by state. It’s crucial to understand the specific laws and regulations in your state to ensure you meet the necessary coverage limits. You can typically find this information on your state’s Department of Insurance website or by consulting with an insurance professional.