Cheap Insurance For Car Near Me

Finding affordable car insurance is a priority for many vehicle owners, and the good news is that with some research and understanding of the factors that influence premiums, it's possible to secure a great deal. This guide aims to provide an in-depth exploration of the strategies and considerations for obtaining cheap car insurance near you, with a focus on the unique circumstances and regulations of your locality.

Understanding Local Car Insurance Markets

The cost of car insurance can vary significantly depending on your geographical location. This is due to a range of factors, including the frequency of claims in your area, local driving conditions, and the overall cost of living. Understanding these local nuances is key to securing the best insurance deal.

For instance, urban areas often have higher insurance premiums due to increased traffic congestion, higher risk of accidents, and a greater likelihood of vehicle theft. In contrast, rural areas might offer more affordable insurance rates, but these savings could be offset by the higher cost of towing services or emergency response in remote locations.

Additionally, certain states or provinces have unique regulations that impact insurance costs. For example, some jurisdictions require insurers to offer discounts for certain safety features or provide specific coverage options. On the other hand, no-fault insurance laws, which are common in some regions, can sometimes lead to higher average premiums.

Local Driving Conditions and Premiums

The climate and terrain in your area can also influence insurance costs. For example, regions with harsh winters often experience a higher incidence of weather-related accidents, leading to increased insurance claims. Similarly, areas prone to natural disasters like hurricanes or floods may have higher insurance premiums to account for the greater risk.

By understanding these local factors, you can better negotiate with insurance providers and potentially secure cheaper rates. For instance, if you live in an area with a high rate of car theft, you might be able to negotiate a lower premium by installing an advanced anti-theft system in your vehicle.

The Role of Local Agents

Working with a local insurance agent can be beneficial when seeking affordable car insurance. These professionals have a deep understanding of the local market and can offer personalized advice based on your specific circumstances. They can help you identify discounts you may be eligible for, such as those for good driving records, loyalty, or certain professional affiliations.

Local agents can also guide you through the process of comparing quotes from multiple insurers, ensuring you understand the fine print and make an informed decision. They may have insights into local insurance trends and can advise on strategies to lower your premiums, such as increasing your deductible or adjusting your coverage limits.

Comparing Insurance Quotes

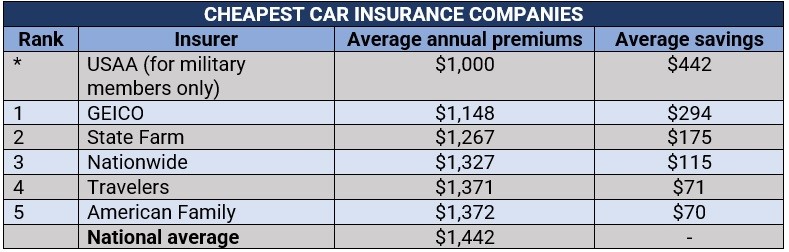

One of the most effective ways to secure cheap car insurance is by comparing quotes from multiple providers. This allows you to understand the range of prices and coverage options available in your area. Online quote comparison tools can be a great starting point, offering a quick and convenient way to view a variety of options.

However, it's important to remember that online quotes are often estimates and may not account for all the factors that influence your premium. For a more accurate quote, it's beneficial to discuss your specific circumstances with an insurance agent or broker.

Factors Influencing Car Insurance Quotes

Several factors influence the quotes you receive for car insurance. These include your age, gender, driving record, the make and model of your vehicle, and the level of coverage you choose. Understanding how these factors impact your premium can help you make more informed decisions when selecting an insurance policy.

For example, younger drivers often pay higher premiums due to their relative inexperience behind the wheel. However, some insurers offer discounts for young drivers who complete defensive driving courses or maintain good grades in school. Similarly, certain vehicle models may be more expensive to insure due to their repair costs or theft rates.

Using Discounts to Your Advantage

Insurance companies often offer a variety of discounts to attract customers and encourage loyalty. These discounts can significantly reduce your insurance premium. Some common discounts include:

- Safe Driver Discount: Insurers often reward drivers with clean records, so maintaining a good driving history can lead to significant savings.

- Multi-Policy Discount: Bundling your car insurance with other policies, such as home or life insurance, can result in discounts from some providers.

- Loyalty Discount: Staying with the same insurer for an extended period can lead to reduced premiums over time.

- Safety Features Discount: Vehicles equipped with advanced safety features like anti-lock brakes, air bags, or collision avoidance systems may be eligible for discounts.

- Low Mileage Discount: If you drive fewer miles annually, you may qualify for a reduced premium.

When comparing quotes, be sure to ask about all the potential discounts you may be eligible for. Some insurers may automatically apply certain discounts, while others may require you to request them.

Customizing Your Car Insurance Policy

Car insurance policies can be tailored to meet your specific needs and budget. By understanding the different coverage options and adjusting your policy accordingly, you can often reduce your insurance premium without sacrificing essential protection.

Adjusting Coverage Limits

Insurance policies typically offer a range of coverage limits, which refer to the maximum amount the insurer will pay out for a covered claim. Lowering your coverage limits can reduce your premium, but it’s important to ensure you still have adequate protection for your needs.

For example, if you have an older vehicle with a low resale value, you might consider reducing your comprehensive and collision coverage limits, as these types of coverage typically pay out based on the actual cash value of your vehicle. However, if you have a newer or more expensive vehicle, you may want to maintain higher coverage limits to ensure you're fully protected in the event of an accident.

Choosing the Right Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you can often reduce your insurance premium. However, it’s important to choose a deductible amount that you’re comfortable paying in the event of a claim.

For instance, if you're a cautious driver with a low risk of accidents, you might consider a higher deductible to take advantage of lower premiums. On the other hand, if you frequently drive in high-risk areas or have a history of accidents, a lower deductible may provide more financial protection when you need it.

Considering Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is a relatively new concept where your insurance premium is based on your actual driving behavior. This type of insurance uses telematics devices to track factors like how often you drive, how fast you drive, and when you drive.

While usage-based insurance may not be for everyone, it can be a great option for safe, low-mileage drivers. If you fall into this category, you could potentially save a significant amount on your insurance premium by opting for this type of coverage.

Maintaining a Low-Risk Profile

One of the most effective ways to keep your car insurance premiums low is by maintaining a low-risk profile as a driver. This involves both practicing safe driving habits and making smart decisions about your vehicle and insurance coverage.

Safe Driving Practices

Safe driving practices can help reduce your risk of accidents and, consequently, lower your insurance premiums. This includes obeying traffic laws, avoiding aggressive driving behaviors like speeding or tailgating, and practicing defensive driving techniques.

Additionally, it's important to keep your vehicle well-maintained. Regular maintenance can help prevent unexpected breakdowns and reduce the risk of accidents caused by mechanical failures. Simple practices like keeping your tires properly inflated and your brakes well-maintained can go a long way toward ensuring your safety on the road.

Vehicle Safety Features

Certain vehicle safety features can help reduce your insurance premiums. These features often include collision avoidance systems, lane departure warnings, and advanced braking systems. By choosing a vehicle equipped with these features, you can often qualify for insurance discounts.

Additionally, vehicles with good safety ratings often have lower insurance premiums. This is because these vehicles are designed to better protect their occupants in the event of an accident, which can reduce the severity of injuries and the cost of insurance claims.

Maintaining a Good Driving Record

A clean driving record is one of the best ways to keep your insurance premiums low. This means avoiding traffic violations and at-fault accidents. Even a single speeding ticket or minor accident can lead to increased insurance premiums, so it’s important to practice safe driving habits at all times.

If you do have a less-than-perfect driving record, it's worth noting that most violations and accidents will fall off your driving record after a certain period of time. This means your insurance premiums may decrease as these incidents become less recent.

The Future of Affordable Car Insurance

The car insurance industry is continually evolving, with new technologies and trends shaping the future of coverage and pricing. As a driver, understanding these trends can help you stay ahead of the curve and potentially save on your insurance premiums.

Telematics and Connected Car Technology

Telematics and connected car technology are expected to play an increasingly significant role in car insurance. These technologies allow insurers to gather more detailed data about driving behavior, which can be used to more accurately assess risk and set premiums.

For drivers, this means that safe driving habits may become even more rewarding, as insurers may offer even greater discounts for safe driving behavior tracked through connected car technology. However, it's important to consider privacy concerns when opting into these programs, as insurers may have access to a wide range of data about your driving habits.

Automated Vehicles and Insurance

The rise of autonomous vehicles is expected to have a significant impact on car insurance. As these vehicles become more prevalent, the nature of car accidents is likely to change, potentially leading to fewer and less severe accidents. This could result in lower insurance premiums for all drivers.

However, the introduction of autonomous vehicles also presents new risks and challenges for insurers. For instance, who is liable in the event of an accident involving an autonomous vehicle? As these questions are answered and regulations evolve, the insurance landscape is likely to change accordingly.

The Role of Data Analytics

Data analytics is already playing a significant role in the car insurance industry, allowing insurers to more accurately assess risk and set premiums. As data analytics capabilities continue to improve, insurers may be able to offer even more tailored insurance products and more accurately reward safe driving behavior.

For drivers, this means that the potential for savings through safe driving and other risk-mitigating behaviors is likely to increase. Additionally, as data analytics capabilities improve, it may become easier for insurers to identify and reward drivers who take proactive steps to reduce their risk, such as by installing advanced safety features in their vehicles.

Conclusion

Securing cheap car insurance near you is achievable with a combination of research, understanding of local markets, and smart decision-making. By comparing quotes, understanding the factors that influence premiums, and customizing your insurance policy to your needs, you can often find significant savings. Additionally, by maintaining a low-risk profile and staying informed about industry trends, you can position yourself to take advantage of new opportunities to save on your insurance premiums.

What are some common mistakes to avoid when seeking cheap car insurance?

+

Common mistakes include not comparing quotes from multiple insurers, failing to ask about all available discounts, and not reviewing your policy annually to ensure you’re still getting the best rate. Additionally, it’s important to avoid lapses in coverage, as this can lead to higher premiums when you re-insure.

How can I lower my car insurance premium if I have a poor driving record?

+

If you have a poor driving record, it’s important to demonstrate that you’re taking steps to improve your driving habits. This could include taking defensive driving courses, which may lead to a discount on your insurance premium. Additionally, consider increasing your deductible and adjusting your coverage limits to potentially lower your premium.

Are there any government programs that can help me reduce my car insurance costs?

+

Some states or provinces offer insurance programs or subsidies for certain drivers, such as low-income individuals or those who have completed approved driving courses. Check with your local government or insurance regulator to see if you’re eligible for any such programs.

What should I do if I’m having trouble affording my car insurance premium?

+

If you’re struggling to afford your car insurance premium, it’s important to discuss your situation with your insurer. They may be able to offer guidance on how to reduce your premium or suggest alternative coverage options that better fit your budget. Additionally, consider shopping around for quotes from other insurers to see if you can find a more affordable policy.