Cheap Best Car Insurance

Securing the best car insurance coverage at an affordable price is a priority for many vehicle owners. With the vast array of insurance providers and policies available, finding the right balance between cost and coverage can be challenging. This comprehensive guide aims to provide expert insights and practical tips to help you navigate the complex world of car insurance, ensuring you get the best value for your money.

Understanding Car Insurance

Car insurance is a contractual agreement between an individual and an insurance company, where the insurer agrees to compensate the policyholder for losses arising from accidents, theft, or other specified events in exchange for regular premium payments. The complexity of car insurance lies in the numerous factors that influence premiums and coverage, such as the make and model of the vehicle, the driver’s age and driving record, the location, and the type of coverage desired.

Types of Car Insurance

Car insurance policies typically fall into several categories, each offering different levels of coverage and premium costs. Understanding these types is crucial for making informed decisions about your insurance needs.

- Liability Coverage: This is the most basic form of car insurance, covering damages to other people’s property or injuries to other individuals in an accident for which you are at fault. It does not cover damage to your own vehicle.

- Collision Coverage: This type of insurance covers damage to your own vehicle, regardless of fault, in the event of a collision with another vehicle or object.

- Comprehensive Coverage: Comprehensive insurance provides protection for damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Personal Injury Protection (PIP) or Medical Payments Coverage: These policies cover medical expenses for the policyholder and passengers after an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient insurance.

Factors Influencing Car Insurance Premiums

The cost of car insurance varies significantly based on several factors. Understanding these factors can help you make more informed decisions and potentially negotiate better rates.

- Driver’s Age and Driving Record: Younger drivers, especially teenagers, often pay higher premiums due to their higher risk profile. Conversely, experienced drivers with clean driving records may enjoy more affordable rates.

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as its primary usage (commute, business, pleasure), can significantly impact your insurance rates. Sports cars and luxury vehicles, for instance, generally attract higher premiums.

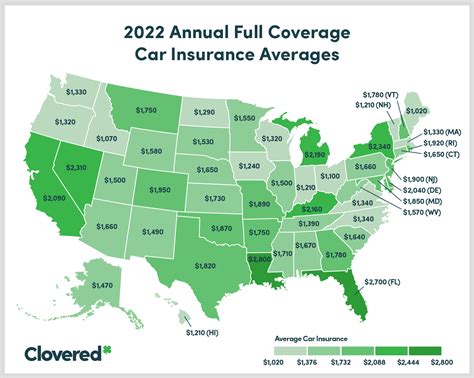

- Location: The area where you live and park your vehicle plays a crucial role. Areas with higher crime rates or a history of frequent accidents tend to have higher insurance costs.

- Coverage Level: The more comprehensive your coverage, the higher your premiums are likely to be. However, this may save you significant money in the long run if you’re involved in an accident.

- Discounts and Bundling: Many insurance companies offer discounts for various reasons, such as safe driving records, loyalty, or bundling multiple policies (e.g., home and auto insurance) with the same provider.

Tips for Finding Cheap Car Insurance

Securing affordable car insurance requires a combination of research, comparison, and understanding of your specific needs. Here are some strategies to help you find the best car insurance deal.

Shop Around and Compare

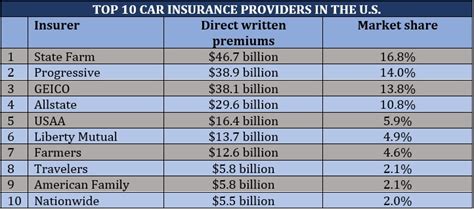

Don’t settle for the first insurance quote you receive. Take the time to shop around and compare quotes from multiple providers. Online insurance marketplaces can be a great starting point, allowing you to quickly get quotes from various insurers.

When comparing quotes, pay attention to the coverage details and any exclusions or limitations. Ensure that you’re comparing policies with similar coverage levels to get an accurate understanding of the best value.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, offers a more personalized premium based on your actual driving behavior. This type of insurance uses a device installed in your vehicle or an app on your smartphone to track factors like mileage, driving speed, and braking habits.

While this may not be suitable for everyone, it can be a great option for low-mileage drivers or those with a history of safe driving. By demonstrating safe driving practices, you may be able to secure lower premiums.

Explore Group Discounts

Many insurance companies offer group discounts to certain organizations or associations. These groups can include professional associations, alumni groups, or even large employers. If you’re a member of any such group, it’s worth checking if they have a partnership with an insurance provider that could save you money.

Opt for Higher Deductibles

Increasing your deductible (the amount you pay out-of-pocket before your insurance kicks in) can significantly lower your insurance premiums. This strategy is particularly effective if you’re a safe driver with a low risk of making a claim.

However, it’s important to choose a deductible amount that you’re comfortable paying if the need arises. Having a high deductible may not be beneficial if you’re likely to make frequent claims.

Maintain a Clean Driving Record

Your driving record is a significant factor in determining your insurance premiums. Maintaining a clean record by avoiding accidents and traffic violations can lead to substantial savings over time.

If you’ve had a less-than-perfect driving record in the past, consider taking defensive driving courses. Some insurance companies offer discounts for completing these courses, and they can also help improve your driving skills.

Evaluating Car Insurance Providers

Choosing the right car insurance provider is as important as selecting the right policy. Here are some key factors to consider when evaluating insurance companies.

Financial Stability

It’s crucial to choose an insurance company that is financially stable and has the resources to pay out claims. Look for companies with strong financial ratings from reputable agencies like AM Best, Moody’s, or Standard & Poor’s.

Customer Service and Claims Handling

The quality of customer service and claims handling can significantly impact your experience with an insurance provider. Read reviews and seek recommendations from friends and family to gauge the insurer’s reputation.

Consider factors like the ease of filing a claim, the speed of claim processing, and the overall satisfaction of customers with the insurer’s services.

Policy Features and Customization

Different insurance providers offer a range of policy features and customization options. Look for a provider that offers the coverage types and optional add-ons that align with your specific needs.

Some insurers, for instance, may specialize in providing coverage for classic cars or offer unique features like pet injury coverage or rental car reimbursement.

Discounts and Rewards Programs

Many insurance companies offer a variety of discounts and rewards programs to attract and retain customers. These can include safe driver discounts, loyalty rewards, or discounts for bundling multiple policies.

Explore the different discount options available and calculate the potential savings to determine which provider offers the best overall value.

The Future of Car Insurance

The car insurance industry is evolving rapidly, driven by technological advancements and changing consumer preferences. Here’s a glimpse into the future of car insurance.

Autonomous Vehicles and Insurance

The rise of autonomous vehicles is expected to revolutionize the car insurance industry. As these vehicles become more prevalent, the focus of insurance may shift from individual drivers to the technology and manufacturers themselves.

This could lead to new types of insurance policies that cover vehicle systems and their functionality, rather than individual driver behavior.

Telematics and Personalized Insurance

Telematics technology, which tracks and analyzes driving data, is already being used to offer personalized insurance rates. In the future, this technology is likely to become even more sophisticated, providing more accurate assessments of individual driving habits.

This could lead to even more customized insurance policies, where premiums are based on real-time driving data rather than historical records or estimates.

Data-Driven Risk Assessment

Insurance companies are increasingly leveraging data analytics to assess risk and price insurance policies. This trend is expected to continue, with more advanced algorithms and data sources being used to predict risks and set premiums.

This shift towards data-driven insurance could lead to more accurate pricing, benefiting both insurers and policyholders by ensuring premiums more closely reflect the actual risk posed.

Increased Focus on Prevention

As technology advances, there is a growing emphasis on preventing accidents and reducing risks on the road. This trend is likely to continue, with insurance companies offering incentives and discounts for drivers who adopt technologies and practices that promote safer driving.

For example, insurance providers may offer discounts for vehicles equipped with advanced driver-assistance systems (ADAS) or for drivers who complete online safety courses.

Conclusion

Finding the best car insurance at a cheap rate requires a combination of thorough research, understanding of your needs, and a strategic approach. By shopping around, comparing quotes, and considering factors like usage-based insurance and group discounts, you can secure a policy that offers both comprehensive coverage and affordable premiums.

As the car insurance industry evolves, staying informed about the latest trends and technologies can help you make even more informed decisions. Whether it’s embracing usage-based insurance or preparing for the rise of autonomous vehicles, being proactive can ensure you’re getting the best value for your insurance needs.

How much can I expect to pay for car insurance annually?

+The cost of car insurance varies widely based on individual factors such as driving record, vehicle type, location, and coverage level. On average, annual car insurance premiums range from 500 to 1,500, but they can be significantly higher or lower depending on your specific circumstances.

What factors can I control to lower my car insurance premiums?

+You can control several factors to lower your insurance premiums. These include maintaining a clean driving record, increasing your deductible, exploring group discounts, and opting for usage-based insurance if you’re a safe driver. Additionally, regularly reviewing and comparing insurance quotes can help you identify opportunities to save.

Are there any discounts available for car insurance?

+Yes, many insurance companies offer a variety of discounts. These can include safe driver discounts, loyalty rewards, discounts for bundling multiple policies, and group discounts. Some insurers also offer discounts for completing defensive driving courses or for vehicles equipped with advanced safety features.