Cheap Auto Insurance Quotes Near Me

Finding affordable auto insurance is a priority for many vehicle owners, and with a little research and understanding of the factors involved, it's possible to secure the best rates. This guide aims to provide an in-depth analysis of how to get cheap auto insurance quotes, covering everything from understanding insurance costs to exploring discounts and choosing the right coverage. By the end of this article, you'll have the knowledge and tools to navigate the insurance landscape and make informed decisions.

Understanding Auto Insurance Costs

Auto insurance costs can vary significantly based on a multitude of factors. These include your driving history, the type of vehicle you own, your location, and even your age and gender. Insurance companies use these factors to assess the level of risk associated with insuring a particular driver. Understanding these variables is the first step towards obtaining more affordable rates.

The Impact of Driving History

Your driving record plays a pivotal role in determining your insurance rates. A clean driving history, free from accidents and traffic violations, can lead to lower premiums. Conversely, a history of accidents or moving violations may result in higher insurance costs. Insurance companies consider these factors to assess the likelihood of future claims, and thus, the risk associated with insuring you.

| Driving History | Premium Impact |

|---|---|

| Clean Record | Lower Premiums |

| Accidents or Violations | Higher Premiums |

For instance, a driver with a history of speeding tickets and a recent at-fault accident is likely to face significantly higher insurance premiums compared to a driver with a clean record. This is because the former is considered a higher risk, and insurance companies will adjust their premiums accordingly.

Vehicle Type and Value

The type and value of your vehicle also influence your insurance rates. Generally, sports cars and luxury vehicles are more expensive to insure due to their higher repair costs and increased risk of theft. On the other hand, sedans and compact cars are often more affordable to insure. Additionally, the age and condition of your vehicle can impact insurance costs. Older vehicles, especially those no longer under warranty, may have lower insurance rates as they are less expensive to repair or replace.

Location and Demographic Factors

Your location and demographic factors can also affect your insurance rates. Areas with higher rates of accidents, theft, or vandalism may have higher insurance premiums. Similarly, demographic factors such as age and gender can influence rates. Younger drivers, particularly males, are often considered higher risk and may face higher insurance costs.

For example, a young male driver living in an urban area with high rates of theft and accidents may pay significantly more for insurance than an older female driver in a rural area with low accident rates.

Exploring Discounts and Savings

One of the most effective ways to reduce your auto insurance costs is by taking advantage of various discounts and savings opportunities offered by insurance providers. These discounts can significantly lower your premiums and make insurance more affordable.

Common Discounts Offered by Insurance Companies

Insurance companies offer a wide range of discounts to attract customers and reward safe driving behavior. Here are some of the most common discounts you can explore:

- Multi-Policy Discounts: If you have multiple insurance policies with the same provider, such as auto and home insurance, you may be eligible for a discount.

- Safe Driver Discounts: Insurance companies often reward drivers with clean records and no recent accidents or violations. These discounts can significantly reduce your premiums.

- Good Student Discounts: If you're a student, maintaining a certain GPA or honor roll status may qualify you for a discount on your auto insurance.

- Low Mileage Discounts: If you drive less than a certain number of miles per year, you may be eligible for a low mileage discount.

- Vehicle Safety Features Discounts: Having certain safety features in your vehicle, such as anti-lock brakes, air bags, or anti-theft devices, can result in lower insurance premiums.

- Loyalty Discounts: Staying with the same insurance provider for an extended period can earn you loyalty discounts.

Comparing Quotes from Different Providers

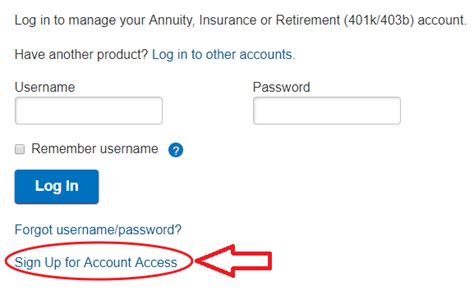

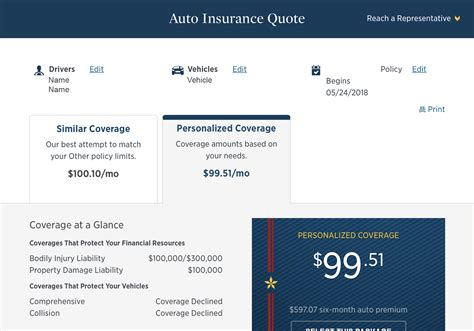

Shopping around and comparing quotes from multiple insurance providers is a crucial step in finding the best rates. Insurance companies use different criteria and algorithms to calculate premiums, so the rates they offer can vary significantly. By obtaining quotes from several providers, you can identify the most affordable option for your specific situation.

Consider using online comparison tools or insurance brokers to streamline the process. These resources can provide you with quotes from multiple providers, making it easier to compare and choose the best option. When comparing quotes, pay attention to the coverage details and any additional benefits or perks offered by each provider.

Understanding Deductibles and Their Impact

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your insurance premiums, as you’re taking on more financial responsibility in the event of a claim. However, it’s important to choose a deductible that you can comfortably afford in the event of an accident or other covered incident.

For example, if you typically drive safely and have a clean driving record, opting for a higher deductible could be a cost-effective strategy. However, if you're at higher risk of accidents or have a history of claims, a lower deductible might be more suitable to minimize your financial exposure.

Choosing the Right Coverage

While it’s important to find affordable insurance, it’s equally crucial to ensure you have the right coverage to protect yourself and your assets. Different types of auto insurance cover different risks, and understanding these differences is key to making informed decisions.

Liability Coverage

Liability coverage is a fundamental component of auto insurance. It covers the costs associated with damages you cause to others in an accident. This includes bodily injury and property damage. Most states have minimum liability requirements, but it’s generally recommended to carry higher limits to provide adequate protection in the event of a serious accident.

Collision and Comprehensive Coverage

Collision coverage pays for damages to your vehicle in the event of an accident, regardless of fault. Comprehensive coverage, on the other hand, covers damages caused by events other than collisions, such as theft, vandalism, or natural disasters. While these coverages are optional, they provide valuable protection for your vehicle and can be worth the additional cost.

Additional Coverages and Endorsements

Depending on your specific needs and situation, you may want to consider additional coverages or endorsements. These can include rental car coverage, gap insurance, or coverage for specific items or situations. For instance, if you frequently transport valuable equipment in your vehicle, you may want to consider additional coverage to protect these items.

Final Thoughts

Finding cheap auto insurance quotes near you is a process that involves understanding the factors that influence insurance costs, exploring discounts and savings opportunities, and choosing the right coverage. By doing your research, comparing quotes, and making informed decisions, you can secure affordable insurance that provides the protection you need.

Remember, the key to getting the best rates is to be a safe and responsible driver, shop around for quotes, and tailor your coverage to your specific needs. With the right approach, you can navigate the insurance landscape successfully and make the most of your auto insurance.

How often should I review my auto insurance policy and rates?

+It’s recommended to review your auto insurance policy and rates annually, or whenever you experience significant life changes such as moving to a new location, purchasing a new vehicle, or getting married. These events can impact your insurance needs and premiums.

Can I get auto insurance if I have a poor driving record?

+Yes, even with a poor driving record, you can still obtain auto insurance. However, you may face higher premiums and may need to explore specialized insurance providers that cater to high-risk drivers. It’s important to shop around and compare quotes to find the best rates.

Are there any online tools or apps that can help me save on auto insurance?

+Yes, there are several online tools and apps available that can help you compare auto insurance rates and identify potential savings. These resources often provide quotes from multiple providers, making it easier to find the best deal. Additionally, some apps offer features like mileage tracking, which can help you qualify for low-mileage discounts.