Car Insurance Quotes New Jersey

Welcome to the comprehensive guide on car insurance quotes in New Jersey, where we delve into the intricacies of the state's auto insurance market. New Jersey is known for its unique and complex insurance landscape, and understanding the nuances can be crucial for drivers seeking the best coverage and rates. In this article, we will explore the key factors that influence car insurance quotes in the Garden State, offering an in-depth analysis and expert insights to help you navigate this essential aspect of vehicle ownership.

Understanding the New Jersey Car Insurance Market

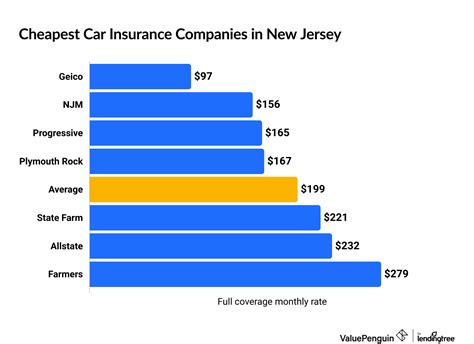

New Jersey’s car insurance market is characterized by a diverse range of providers, from major national insurers to local, specialized carriers. This variety can be a double-edged sword for consumers. On one hand, it provides ample options for coverage and pricing. On the other, it can make comparing policies and finding the best deal a daunting task. The state’s unique no-fault insurance system and various mandatory coverage requirements further add to the complexity.

The Impact of No-Fault Insurance

New Jersey operates under a no-fault auto insurance system, which means that drivers must first file claims with their own insurance provider, regardless of who is at fault in an accident. This system aims to streamline the claims process and reduce litigation. However, it also means that the cost of insurance can vary significantly based on an individual’s personal injury protection (PIP) coverage limits and other factors.

For instance, consider a hypothetical scenario where Driver A has a policy with $15,000 in PIP coverage, while Driver B has a policy with $250,000 in PIP coverage. In the event of an accident, Driver A's insurance costs may be lower due to the lower coverage limit, but they may face out-of-pocket expenses if their medical bills exceed $15,000. Driver B, on the other hand, has higher insurance costs due to the higher coverage limit, but they are protected from significant out-of-pocket expenses.

Mandatory Coverage Requirements

New Jersey mandates that all drivers carry a minimum amount of liability insurance to cover bodily injury and property damage in the event of an accident. The specific requirements are as follows:

- Bodily Injury Liability: $15,000 per person / $30,000 per accident

- Property Damage Liability: $5,000 per accident

These limits are considered relatively low compared to many other states, and many experts recommend purchasing higher limits to ensure adequate protection. Additionally, New Jersey requires drivers to carry uninsured/underinsured motorist coverage (UM/UIM) to protect against accidents with drivers who do not carry sufficient insurance.

| Coverage Type | Minimum Requirement |

|---|---|

| Bodily Injury Liability | $15,000 / $30,000 |

| Property Damage Liability | $5,000 |

| Uninsured/Underinsured Motorist Coverage | Typically equal to liability limits |

Factors Influencing Car Insurance Quotes in New Jersey

Several key factors play a role in determining car insurance quotes in New Jersey. Understanding these factors can help drivers make informed decisions about their coverage and potentially save money on their premiums.

Driver Profile and History

One of the most significant influences on insurance quotes is the driver’s profile and history. Insurance companies consider various aspects of a driver’s background when calculating premiums, including:

- Age and Gender: Younger drivers, particularly those under 25, often face higher insurance rates due to their relative lack of experience. Gender can also be a factor, with some insurers charging different rates based on statistical trends.

- Driving Record: A clean driving record with no accidents or violations can lead to lower insurance rates. Conversely, a history of accidents, especially those at fault, or traffic violations can significantly increase premiums.

- Credit Score: In New Jersey, insurers are allowed to use credit-based insurance scores when determining rates. A higher credit score can often lead to lower insurance premiums, as it is seen as an indicator of financial responsibility.

Vehicle Information

The type of vehicle being insured is another critical factor. Insurers consider the make, model, year, and other specifications of a vehicle when determining rates. For instance, sports cars and luxury vehicles are often more expensive to insure due to their higher repair costs and greater likelihood of theft.

Additionally, the usage of the vehicle can impact insurance rates. Those who use their vehicles primarily for commuting to work may pay different rates than those who use their cars for business purposes or long-distance travel. The number of miles driven annually can also be a factor, with higher mileage often resulting in higher premiums.

Coverage and Deductibles

The level of coverage chosen by the policyholder significantly affects insurance quotes. Higher coverage limits, especially for liability and collision coverage, will typically result in higher premiums. Conversely, opting for lower coverage limits can reduce costs but may leave the policyholder exposed to greater financial risk in the event of an accident.

Furthermore, the deductible chosen for collision and comprehensive coverage can impact premiums. A higher deductible (the amount the policyholder pays out of pocket before insurance coverage kicks in) can lead to lower premiums, while a lower deductible can increase costs.

Location and Usage

The geographic location of the vehicle and the policyholder can have a substantial impact on insurance rates. Areas with higher rates of accidents, thefts, or claims tend to have higher insurance premiums. For instance, urban areas like Newark or Jersey City often have higher rates than more rural areas of the state.

The usage of the vehicle, as mentioned earlier, is also a factor. Insurance companies may offer discounts for vehicles primarily used for pleasure rather than business or commuting. Additionally, the frequency of driving can impact rates, with those who drive less often potentially eligible for low-mileage discounts.

Tips for Obtaining the Best Car Insurance Quotes in New Jersey

Given the complexity of the New Jersey car insurance market, here are some expert tips to help you navigate the process and potentially save money on your insurance premiums:

Shop Around

New Jersey’s diverse insurance market means that rates can vary significantly between providers. It’s crucial to compare quotes from multiple insurers to find the best deal. Online quote comparison tools can be a valuable resource for this purpose.

Understand Your Coverage

Make sure you fully understand the coverage options available to you and the implications of each. Consider speaking with an insurance agent or broker who can provide guidance based on your specific needs and circumstances.

Consider Bundling Policies

If you have multiple insurance needs, such as auto, home, or life insurance, consider bundling your policies with the same insurer. Many companies offer discounts for customers who bundle multiple types of insurance, which can lead to significant savings.

Explore Discounts

Insurance companies often offer a variety of discounts to policyholders. These can include discounts for safe driving, good student status, low mileage, anti-theft devices, and more. Make sure to inquire about all available discounts when obtaining quotes.

Maintain a Clean Driving Record

A clean driving record is one of the most effective ways to keep insurance costs down. Avoid accidents and violations, and consider taking a defensive driving course, which can often lead to insurance discounts and improved driving skills.

Review Your Policy Regularly

Insurance needs can change over time, so it’s essential to review your policy annually to ensure it still meets your requirements. This is also a good opportunity to shop around for better rates or explore additional discounts.

Future Trends and Considerations

The New Jersey car insurance market is continually evolving, and several trends and considerations are worth noting for the future:

Telematics and Usage-Based Insurance

The use of telematics (technology that monitors vehicle usage and driver behavior) is becoming increasingly common in the insurance industry. Some insurers offer usage-based insurance programs that reward safe driving with lower premiums. While these programs are not yet widespread in New Jersey, they are expected to become more prevalent in the coming years.

Regulatory Changes

The New Jersey Department of Banking and Insurance regularly reviews and updates the state’s insurance regulations. Stay informed about any changes to insurance laws that could impact your coverage or premiums. For instance, recent discussions have centered around potentially raising the state’s minimum liability limits to provide greater protection for policyholders.

Increasing Claims Costs

The cost of auto insurance in New Jersey has been on the rise in recent years, largely due to increasing claims costs. Factors such as rising medical costs, an increase in severe weather events, and an aging vehicle fleet have all contributed to this trend. Keeping an eye on these costs and their potential impact on insurance rates is essential for policyholders.

Conclusion

Navigating the car insurance market in New Jersey can be challenging, but with a solid understanding of the factors that influence quotes and the tips provided in this guide, drivers can make informed decisions and potentially save money on their insurance premiums. Remember to regularly review your coverage, explore all available discounts, and stay informed about the evolving insurance landscape in the Garden State.

What is the average cost of car insurance in New Jersey?

+The average cost of car insurance in New Jersey can vary significantly based on numerous factors, including the driver’s profile, the vehicle being insured, and the level of coverage chosen. According to recent data, the average annual premium for a liability-only policy in New Jersey is around 500, while a full coverage policy with higher limits can cost upwards of 1,500.

Can I get car insurance without a license in New Jersey?

+Obtaining car insurance without a valid driver’s license in New Jersey can be challenging but not impossible. Some insurers may offer policies to individuals without licenses, but these are typically high-risk policies with very limited coverage and high premiums. It’s important to note that driving without a valid license is illegal and can lead to serious legal consequences.

Are there any low-cost insurance options for young drivers in New Jersey?

+Yes, there are several options available for young drivers in New Jersey to obtain more affordable insurance. These include taking a defensive driving course, which can lead to insurance discounts, and exploring policies specifically designed for young drivers, such as those offered by Metromile or Root Insurance, which use telematics to monitor driving behavior and offer discounted rates for safe driving.

What should I do if my insurance claim is denied in New Jersey?

+If your insurance claim is denied in New Jersey, it’s essential to first understand the reason for the denial. This information should be provided in writing by your insurer. If you believe the denial is unjustified, you can file an appeal with your insurance company, providing additional evidence or arguments to support your claim. If this doesn’t resolve the issue, you may need to seek legal advice or file a complaint with the New Jersey Department of Banking and Insurance.