Home Insurance Policies

Home insurance is an essential aspect of safeguarding one's most valuable asset—their home. With the diverse range of risks and hazards that homeowners face, from natural disasters to accidents and theft, comprehensive home insurance policies provide a crucial safety net. In this article, we delve into the intricate world of home insurance, exploring the various aspects that contribute to effective coverage and protection.

Understanding Home Insurance Policies

Home insurance, often referred to as homeowners insurance, is a contractual agreement between a homeowner and an insurance provider. This contract outlines the terms and conditions under which the insurance company agrees to financially protect the homeowner against potential losses and damages. It serves as a financial backup, offering peace of mind and ensuring that homeowners can recover from unexpected events without incurring significant financial burdens.

The importance of home insurance lies in its ability to provide coverage for a wide array of scenarios. From structural damages caused by natural disasters like hurricanes, floods, or earthquakes to personal liability claims resulting from accidents on the property, home insurance policies are designed to offer comprehensive protection. Additionally, they cover personal belongings, providing compensation for stolen or damaged items, and often include temporary living expenses if the home becomes uninhabitable due to an insured event.

Types of Home Insurance Policies

Home insurance policies come in various forms, each tailored to meet the specific needs and risks associated with different types of homes and locations. Understanding the different types of policies is crucial for homeowners to choose the most suitable coverage.

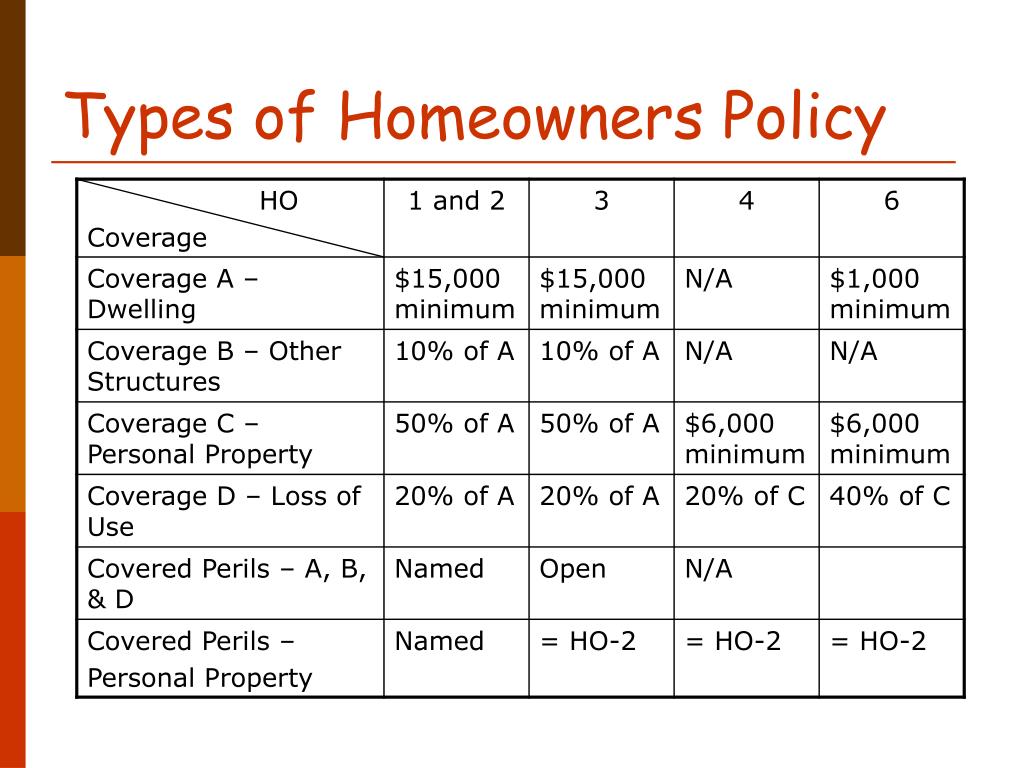

The most common types of home insurance policies include:

- HO-1 (Basic Form): This policy offers the most basic coverage, typically including protection against fire, lightning, windstorms, explosions, and more. However, it provides limited coverage and may not be sufficient for many homeowners.

- HO-2 (Broad Form): An upgrade from the basic form, the HO-2 policy provides more extensive coverage, including protection against damage caused by falling objects, weight of ice, snow, or sleet, and more. It also covers personal belongings against named perils.

- HO-3 (Special Form): The HO-3 policy is the most common and popular choice for homeowners. It offers broad coverage for the structure of the home and personal belongings against a wide range of perils, except those specifically excluded in the policy.

- HO-4 (Renter's Insurance): Designed for renters, this policy provides coverage for personal belongings and liability protection. It does not cover the structure of the building, as it is the landlord's responsibility.

- HO-5 (Premium Form): This policy offers the highest level of coverage, providing open-peril protection for both the structure and personal belongings. It is often recommended for high-value homes and valuable possessions.

Choosing the right policy type depends on various factors, including the location, value of the home, and the specific needs of the homeowner. It's essential to carefully review the coverage provided by each policy and consider additional endorsements or riders to customize the policy to individual requirements.

Key Components of Home Insurance Policies

Home insurance policies consist of several key components that collectively provide comprehensive coverage. Understanding these components is crucial for homeowners to ensure they have adequate protection.

Dwelling Coverage

Dwelling coverage is the core component of a home insurance policy. It provides financial protection for the physical structure of the home, including the main dwelling, attached structures like garages and porches, and even detached structures like sheds and guest houses, up to a specified limit.

Dwelling coverage typically covers damage caused by a wide range of perils, including fire, lightning, windstorms, hail, vandalism, and more. However, it's important to note that certain natural disasters, such as floods and earthquakes, often require separate policies or endorsements to be covered.

Personal Property Coverage

Personal property coverage, also known as contents coverage, protects the homeowner’s personal belongings inside the home. This includes furniture, clothing, electronics, and other valuable items. The coverage limit for personal property is usually a percentage of the dwelling coverage limit, and homeowners can choose to increase this limit if needed.

It's important to review the specific details of personal property coverage, as it may have limitations or exclusions. For instance, high-value items like jewelry, artwork, or collectibles may require separate endorsements or riders to be fully covered.

Liability Coverage

Liability coverage is a critical aspect of home insurance, providing protection against claims made by others for bodily injury or property damage that occurs on the insured property. This coverage helps homeowners defend against lawsuits and covers any resulting legal fees and settlements up to the policy limit.

Liability coverage is especially important for homeowners who host guests or have frequent visitors, as it can protect against accidents that occur on the property. It's advisable to choose a liability coverage limit that aligns with the homeowner's financial means and potential risks.

Additional Living Expenses

In the event that a homeowner’s home becomes uninhabitable due to a covered peril, additional living expenses (ALE) coverage steps in. This coverage provides financial assistance to cover the cost of temporary housing, meals, and other necessary expenses while the home is being repaired or rebuilt.

ALE coverage typically covers the additional expenses incurred above and beyond the homeowner's normal living expenses. It's important to review the policy's coverage limits and duration to ensure it aligns with the potential duration of repairs or reconstruction.

Factors Influencing Home Insurance Rates

Home insurance rates can vary significantly depending on various factors. Understanding these factors can help homeowners make informed decisions when choosing a policy and potentially negotiate better rates.

Location and Risk Factors

The location of the home plays a significant role in determining insurance rates. Areas prone to natural disasters, such as hurricanes, floods, or wildfires, generally have higher insurance premiums. Additionally, regions with high crime rates or a history of severe weather events may also result in higher rates.

Insurance companies assess the risk factors associated with a specific location and adjust premiums accordingly. Homeowners can mitigate some of these risks by taking preventive measures, such as installing security systems, implementing fire safety measures, or making structural improvements to the home.

Home Value and Replacement Cost

The value of the home, including its structure and contents, is a crucial factor in determining insurance rates. Higher-value homes typically require more extensive coverage, which can result in higher premiums. It’s essential for homeowners to accurately assess the replacement cost of their home and its contents to ensure adequate coverage.

Replacement cost refers to the amount it would cost to rebuild or replace the home and its contents in the event of a total loss. It's different from the market value of the home, which includes factors like location and real estate trends. Accurate replacement cost estimates are crucial for ensuring sufficient coverage and avoiding underinsurance.

Deductibles and Coverage Limits

Deductibles and coverage limits are key considerations when choosing a home insurance policy. Deductibles represent the amount the homeowner agrees to pay out of pocket before the insurance coverage kicks in. Higher deductibles can lead to lower premiums, as the homeowner assumes a larger portion of the risk.

Coverage limits, on the other hand, refer to the maximum amount the insurance company will pay for a covered loss. It's important to choose coverage limits that align with the potential risks and the value of the home and its contents. Insufficient coverage limits can leave homeowners financially vulnerable in the event of a major loss.

Tips for Maximizing Home Insurance Coverage

To ensure that homeowners have the most comprehensive and cost-effective home insurance coverage, here are some valuable tips to consider:

- Regularly Review and Update Policies: Homeowners should periodically review their insurance policies to ensure they still meet their needs. Life changes, such as renovations, additions, or significant purchases, may require adjustments to the policy.

- Bundle Policies for Discounts: Many insurance companies offer discounts when homeowners bundle their home and auto insurance policies together. This can result in significant savings.

- Consider Additional Endorsements: Homeowners should carefully review their policies and consider adding endorsements or riders to cover specific risks or high-value items. For instance, jewelry, artwork, or expensive electronics may require separate coverage.

- Implement Safety Measures: Taking preventive measures to reduce the risk of accidents or disasters can lead to lower insurance premiums. This includes installing smoke detectors, fire extinguishers, security systems, and making structural improvements to the home.

- Maintain Good Credit: Insurance companies often consider credit scores when determining premiums. Maintaining a good credit score can lead to more favorable rates.

Future Trends in Home Insurance

The home insurance industry is constantly evolving, driven by technological advancements and changing consumer needs. Here are some future trends that are likely to shape the landscape of home insurance:

- Smart Home Technology Integration: The increasing adoption of smart home technology, such as smart thermostats, security cameras, and leak detection systems, is expected to play a significant role in home insurance. Insurance companies may offer discounts or incentives for homeowners who implement these technologies, as they can help prevent or mitigate losses.

- Data-Driven Risk Assessment: With the advancements in data analytics and artificial intelligence, insurance companies are now able to more accurately assess risks and tailor policies to individual homeowners. This personalized approach can lead to more precise pricing and coverage options.

- Enhanced Claims Processing: Technological advancements are also transforming the claims process, making it more efficient and customer-friendly. Homeowners can expect faster and more streamlined claims handling, often with the help of digital tools and documentation.

- Parametric Insurance: Parametric insurance, which pays out based on specific parameters rather than actual losses, is gaining popularity. This type of insurance provides faster payouts and can be particularly beneficial for natural disasters, where traditional insurance claims may take longer to process.

- Climate Change Adaptation: As climate change continues to impact weather patterns and natural disasters, insurance companies are adapting their policies and risk assessments. This includes offering incentives for homeowners to adopt sustainable practices and make their homes more resilient to climate-related risks.

Conclusion

Home insurance is a vital component of financial protection for homeowners. By understanding the different types of policies, key components, and factors influencing rates, homeowners can make informed decisions to ensure they have adequate coverage. Regularly reviewing and updating policies, implementing safety measures, and staying informed about future trends can help homeowners maximize their coverage and peace of mind.

As the home insurance industry continues to evolve, homeowners can expect more personalized and innovative solutions. By staying engaged and proactive, homeowners can navigate the complexities of home insurance and secure the best possible protection for their valuable assets.

What is the difference between actual cash value and replacement cost coverage in home insurance policies?

+Actual cash value coverage reimburses the homeowner for the current market value of the damaged property, taking into account depreciation. On the other hand, replacement cost coverage provides reimbursement for the full cost of replacing the damaged property, without considering depreciation. Replacement cost coverage is generally more expensive but offers better protection.

Can home insurance policies cover damage caused by earthquakes or floods?

+Home insurance policies typically exclude coverage for damage caused by earthquakes and floods. However, homeowners can purchase separate policies or endorsements to cover these specific perils. It’s important to review the policy details and discuss options with an insurance agent to ensure adequate protection.

How often should homeowners review and update their home insurance policies?

+Homeowners should review their insurance policies annually or whenever there are significant changes to their home, such as renovations, additions, or major purchases. Regular reviews ensure that the policy still meets their needs and provides adequate coverage. It’s also a good opportunity to discuss any potential discounts or coverage adjustments with their insurance provider.