Car Insurance Compare Car

In the vast landscape of automotive ownership, one of the most crucial decisions you'll make is choosing the right car insurance. With countless providers, coverage options, and varying price points, finding the best car insurance can be a daunting task. This comprehensive guide aims to simplify the process, providing you with the tools and insights to make an informed decision. By understanding the key factors that influence car insurance costs and comparing providers, you can ensure you're getting the best value for your money.

Understanding the Fundamentals of Car Insurance

Car insurance is a vital financial safeguard for every driver. It provides coverage for a range of potential incidents, from minor fender-benders to major accidents, offering peace of mind and financial protection. However, with such a wide range of options, it’s essential to grasp the basics before diving into the comparison process.

Types of Car Insurance Coverage

Car insurance policies can be broadly categorized into three main types: liability, collision, and comprehensive. Liability coverage is the most basic and is required by law in most states. It covers the cost of damage or injury you cause to others while driving. Collision coverage, on the other hand, pays for repairs to your own vehicle if you’re involved in an accident, regardless of fault. Comprehensive coverage protects against non-collision incidents, such as theft, vandalism, or natural disasters.

| Coverage Type | Description |

|---|---|

| Liability | Covers damages to others |

| Collision | Covers repairs to your vehicle |

| Comprehensive | Protects against non-collision incidents |

Most drivers opt for a combination of these coverages to ensure they're adequately protected. However, the specific coverage types and limits can vary greatly between insurance providers.

Factors Influencing Car Insurance Costs

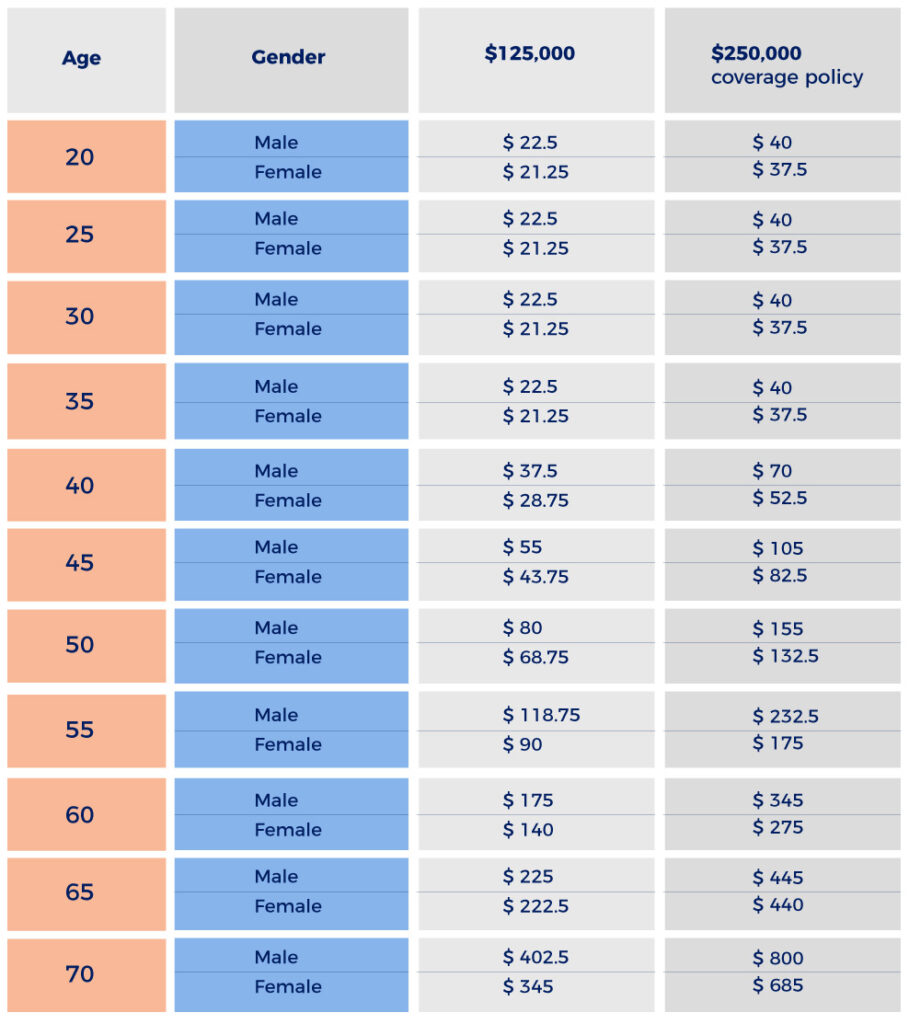

The cost of car insurance is influenced by a multitude of factors, each of which can significantly impact your premium. These factors include your age, gender, driving history, location, and the make and model of your vehicle. Additionally, the coverage types and limits you choose, as well as any optional add-ons, will affect the overall cost.

For instance, younger drivers and those with a history of accidents or violations may face higher premiums. Similarly, certain makes and models of vehicles, particularly sports cars or luxury vehicles, can attract higher insurance costs due to their perceived risk or expense to repair. Understanding how these factors influence your insurance costs is crucial when comparing providers and seeking the best deal.

Comparing Car Insurance Providers: A Step-by-Step Guide

Now that we’ve covered the fundamentals, let’s delve into the process of comparing car insurance providers. This step-by-step guide will ensure you’re equipped with the knowledge and tools to make an informed decision.

Step 1: Research and Understand Your Options

The first step in comparing car insurance is to thoroughly research the market. Start by identifying the major providers in your area. You can do this by checking online review platforms, consumer reports, and insurance comparison websites. These resources can provide valuable insights into the reputation and service quality of different providers.

As you research, make a note of the coverage options, discounts, and additional services offered by each provider. This will give you a clearer picture of the range of options available and help you identify the features that are most important to you.

Step 2: Get Multiple Quotes

Once you’ve identified a shortlist of potential providers, it’s time to get quotes. Most insurance companies offer online quote tools, which allow you to input your personal and vehicle information to receive an estimated premium. Ensure you’re providing consistent information to each provider to ensure an accurate comparison.

When getting quotes, pay attention to the coverage limits and any additional fees or charges. Some providers may offer a lower base premium but charge extra for certain services or add-ons. It's essential to understand the full cost of the policy, not just the headline figure.

Step 3: Analyze the Coverage Details

While the cost of the premium is a significant factor, it’s not the only consideration. You must also carefully analyze the coverage details to ensure you’re getting the protection you need. Compare the limits and exclusions for each type of coverage, as well as any optional add-ons that may be beneficial.

For example, some providers may offer more generous rental car coverage or roadside assistance services. Others may have unique add-ons, such as pet injury coverage or rideshare insurance, which could be valuable depending on your circumstances.

Step 4: Consider Customer Service and Claims Handling

In addition to the cost and coverage details, it’s crucial to consider the provider’s customer service and claims handling reputation. After all, the true value of your insurance policy will be evident when you need to make a claim.

Look for providers with a solid track record of prompt and fair claims handling. Check online reviews and consumer reports to gauge customer satisfaction levels. You may also want to consider the provider's availability and accessibility, especially if you prefer to communicate via phone, email, or online chat.

Step 5: Assess Financial Stability and Ratings

When choosing a car insurance provider, it’s essential to consider their financial stability and ratings. A financially stable company is more likely to be able to pay out claims in the event of an accident or other covered incident.

Check the provider's financial ratings from reputable agencies such as AM Best, Moody's, or Standard & Poor's. These ratings provide an independent assessment of the company's financial strength and ability to meet their obligations. Aim for providers with strong ratings, indicating a lower risk of financial instability.

Step 6: Evaluate Additional Services and Discounts

Many car insurance providers offer a range of additional services and discounts that can enhance your coverage or reduce your premium. These might include accident forgiveness, loyalty discounts, or discounts for safe driving, good grades, or certain vehicle safety features.

Evaluate the potential savings or benefits of these additional services and discounts. Some providers may offer more generous or unique offerings that could be a deciding factor in your choice.

Step 7: Compare Online Tools and Resources

In today’s digital age, many insurance providers offer online tools and resources to enhance the customer experience. These can include mobile apps for policy management, online claims reporting, or tools to track your driving behavior and earn discounts.

Consider the quality and usefulness of these digital offerings. They can provide added convenience and value, especially if you prefer to manage your insurance affairs online or want to take advantage of usage-based insurance programs.

Case Study: Comparing Car Insurance Providers in Action

To illustrate the process of comparing car insurance providers, let’s consider a hypothetical case study. Imagine you’re a 30-year-old driver with a clean driving record, residing in a suburban area. You own a 2018 Toyota Camry and are currently insured with Provider X, paying a premium of $1,200 annually.

You decide to explore your options and compare quotes from other providers. After researching and getting quotes, you narrow down your choices to three providers: Provider Y, Provider Z, and Provider A.

| Provider | Annual Premium | Coverage Details |

|---|---|---|

| Provider Y | $1,050 | Offers slightly lower coverage limits but includes rental car coverage and roadside assistance |

| Provider Z | $1,150 | Provides comprehensive coverage with generous limits and includes pet injury coverage |

| Provider A | $1,250 | Has excellent customer service ratings and offers accident forgiveness after 3 years of claim-free driving |

After analyzing the quotes and coverage details, you decide that Provider Z offers the best balance of coverage and cost. While Provider Y has a slightly lower premium, the lack of certain coverage limits and additional services makes Provider Z a more appealing choice.

Tips for Getting the Best Car Insurance Deal

To ensure you’re getting the best deal on your car insurance, here are some additional tips to consider:

- Bundle your policies: Many providers offer discounts when you bundle multiple policies, such as auto and home insurance.

- Raise your deductibles: Increasing your deductible can lower your premium, but ensure you can afford the higher out-of-pocket expense if needed.

- Take advantage of discounts: Explore all potential discounts, such as safe driver, good student, or loyalty discounts.

- Maintain a clean driving record: Avoid accidents and violations, as these can significantly increase your insurance costs.

- Shop around regularly: Car insurance rates can change over time, so it's beneficial to compare providers and quotes every year or two.

Future of Car Insurance: Trends and Innovations

The car insurance industry is continually evolving, with new technologies and trends shaping the future of coverage. Here are some key developments to watch for:

Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is gaining popularity. This type of insurance uses telematics devices or smartphone apps to track driving behavior, such as miles driven, time of day, and driving style. Premiums are then calculated based on individual driving habits, offering a more personalized and potentially cost-effective option.

Connected Car Technology

The rise of connected car technology is set to transform the insurance industry. With vehicles becoming increasingly connected and equipped with advanced sensors and data collection capabilities, insurers can gain more insights into driving behavior and vehicle performance. This data can be used to offer more precise and tailored insurance coverage, potentially reducing costs for safer drivers.

AI and Machine Learning

Artificial intelligence and machine learning are being utilized to improve various aspects of car insurance, from fraud detection to claims processing. These technologies can analyze vast amounts of data quickly and accurately, helping insurers make more informed decisions and improve efficiency.

Enhanced Personalization

The future of car insurance is moving towards greater personalization. Insurers are developing more sophisticated algorithms and risk assessment models to offer customized coverage and pricing based on individual driver profiles and risk factors. This shift towards personalized insurance could result in more equitable pricing and better protection for all drivers.

Conclusion: Making an Informed Decision

Choosing the right car insurance provider is a critical decision that can impact your financial well-being and peace of mind. By understanding the fundamentals of car insurance and following a systematic comparison process, you can ensure you’re getting the best value and protection for your needs.

Remember to research thoroughly, analyze quotes and coverage details, and consider factors such as customer service, financial stability, and additional services. With the right approach, you can find a car insurance provider that offers both competitive pricing and comprehensive coverage, giving you the confidence to hit the road with peace of mind.

What is the average cost of car insurance?

+The average cost of car insurance varies widely depending on numerous factors, including your location, age, gender, driving record, and the make and model of your vehicle. According to the Insurance Information Institute, the national average annual premium for car insurance was $1,674 in 2021. However, your personal premium could be significantly higher or lower based on your specific circumstances.

How often should I compare car insurance providers?

+It’s a good idea to compare car insurance providers at least once a year or whenever your policy renews. Insurance rates can change, and you may find better deals or more suitable coverage options by shopping around. Additionally, significant life changes, such as buying a new car or moving to a different location, can also prompt a review of your insurance needs.

Can I switch car insurance providers mid-policy?

+Yes, you can switch car insurance providers at any time. However, it’s important to ensure that your new policy is active before canceling your old one to avoid any gaps in coverage. When switching mid-policy, you may be entitled to a refund of the unused portion of your premium from your previous provider.