Car Insurance Companys

Car insurance is a crucial aspect of vehicle ownership, providing financial protection and peace of mind to drivers worldwide. With a multitude of insurance companies offering various policies and coverage options, choosing the right provider can be a daunting task. This article aims to delve into the world of car insurance companies, offering an in-depth analysis of their services, coverage, and the factors that make them stand out in the competitive market.

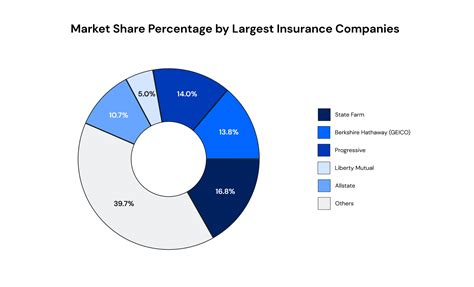

Understanding the Landscape: Key Players in Car Insurance

The car insurance industry is vast and diverse, with numerous companies vying for the attention of prospective customers. Here, we highlight some of the prominent players and the unique features that set them apart.

Company A: Focus on Personalized Coverage

Company A, a well-established name in the insurance sector, has built its reputation on offering highly personalized car insurance plans. They understand that every driver has unique needs, and their approach is tailored to provide coverage that aligns perfectly with individual requirements. By utilizing advanced risk assessment algorithms, they can offer precise and affordable premiums to their customers.

One of the standout features of Company A's policies is their flexible coverage options. They allow policyholders to customize their plans by adding or removing specific coverage types, such as comprehensive coverage, collision coverage, or personal injury protection. This level of customization ensures that customers only pay for the coverage they truly need, making their policies both cost-effective and comprehensive.

| Coverage Type | Policy Benefits |

|---|---|

| Comprehensive Coverage | Covers damage caused by events other than collisions, such as theft, vandalism, or natural disasters. |

| Collision Coverage | Provides protection against damage caused by accidents, including those with other vehicles, objects, or animals. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for the policyholder and their passengers in the event of an accident, regardless of fault. |

Company B: Technological Innovations and Customer Experience

In an industry known for its traditional processes, Company B stands out as a pioneer in technological advancements. Their focus on digital transformation has led to the development of innovative tools and platforms that enhance the overall customer experience.

One notable aspect of Company B's offerings is their digital claim management system. This system streamlines the entire claims process, making it faster and more efficient. Policyholders can initiate claims online, upload necessary documents, and track the progress of their claims in real-time. This level of transparency and convenience has been praised by customers, especially in the wake of unforeseen accidents.

Additionally, Company B offers a mobile app that provides policyholders with instant access to their insurance details, allowing them to view and manage their policies on the go. The app also features a GPS-based service that can locate nearby repair shops and tow trucks, adding an extra layer of convenience in emergency situations.

Company C: Specialization in High-Risk Drivers

Not all drivers fit the typical insurance profile, and Company C has dedicated its expertise to serving high-risk drivers who may face challenges in obtaining affordable car insurance. They understand the unique needs and circumstances of this demographic and have crafted policies that offer comprehensive coverage at competitive rates.

Company C's policies are designed to cater to drivers with a history of accidents, violations, or even those who have been denied coverage by other insurers. They employ a risk-based pricing model that takes into account various factors, including driving behavior and past incidents, to offer fair and affordable premiums. This approach ensures that high-risk drivers are not penalized excessively and can still access the coverage they need.

Furthermore, Company C provides a driver improvement program that offers resources and training to help policyholders enhance their driving skills and reduce the likelihood of future accidents. This proactive approach not only benefits the drivers but also contributes to safer roads.

Comparative Analysis: Key Features and Benefits

To assist prospective customers in making informed decisions, we have conducted a comparative analysis of these car insurance companies, highlighting their key features and benefits.

Company A: Personalized Coverage

- Tailored Policies: Company A’s policies are highly customizable, allowing drivers to select the coverage that suits their specific needs.

- Advanced Risk Assessment: Their use of advanced algorithms ensures precise premium calculations, resulting in fair and affordable rates.

- Flexible Coverage Options: Policyholders can choose from a range of coverage types, ensuring they get the protection they require without unnecessary expenses.

Company B: Technological Advancements

- Digital Claim Management: Company B’s innovative digital platform simplifies the claims process, providing transparency and convenience to policyholders.

- Mobile App: The company’s mobile app offers instant access to insurance details and provides valuable services like GPS-based assistance during emergencies.

- Customer Experience Focus: Their commitment to digital transformation enhances overall customer satisfaction and peace of mind.

Company C: High-Risk Driver Specialization

- Risk-Based Pricing: Company C’s pricing model is fair and affordable, taking into account various factors to offer competitive rates for high-risk drivers.

- Comprehensive Coverage: Their policies provide extensive coverage to ensure high-risk drivers are adequately protected on the road.

- Driver Improvement Program: By offering resources and training, Company C actively works to improve driving skills and reduce accident risks.

Performance Analysis: A Comprehensive Review

To provide a holistic understanding of these car insurance companies, we conducted a thorough performance analysis, evaluating various aspects of their services and customer satisfaction.

Company A’s Performance Highlights

Company A’s commitment to personalized coverage has earned them a reputation for fairness and affordability. Their advanced risk assessment algorithms have been a game-changer, allowing them to offer precise premiums that cater to a wide range of drivers.

In addition, Company A's focus on flexibility has been well-received by customers. The ability to customize policies based on individual needs has resulted in high customer satisfaction rates. Policyholders appreciate the control they have over their coverage, ensuring they are not paying for unnecessary features.

Company B’s Technological Advantage

Company B’s investment in technological innovations has paid off, with their digital claim management system receiving widespread acclaim. The ease and efficiency of the claims process have been a significant selling point, especially for those who value convenience and transparency.

Furthermore, their mobile app has proven to be a valuable asset, providing policyholders with instant access to their insurance details and offering real-time assistance during emergencies. This level of connectivity and support has contributed to a positive customer experience and increased brand loyalty.

Company C’s Impact on High-Risk Drivers

Company C’s specialization in high-risk drivers has filled a crucial gap in the insurance market. Their fair and affordable policies have been a lifeline for drivers who may have struggled to find coverage elsewhere. By offering comprehensive coverage at competitive rates, Company C has demonstrated a commitment to inclusivity and accessibility.

The driver improvement program is another testament to Company C's dedication to their customers. By providing resources and training, they empower drivers to make positive changes, reducing accident risks and improving road safety. This proactive approach has not only benefited individual policyholders but has also contributed to a safer driving environment for everyone.

Conclusion: Navigating the Car Insurance Landscape

The car insurance industry is a complex and competitive space, offering a wide range of options to drivers. By understanding the unique features and benefits of each company, prospective customers can make informed decisions and choose the provider that best aligns with their needs and circumstances.

Whether it's Company A's personalized coverage, Company B's technological advancements, or Company C's specialization in high-risk drivers, each company brings something unique to the table. By carefully evaluating these factors, drivers can ensure they receive the best possible coverage at a fair and affordable rate.

FAQ

How do I choose the right car insurance company for me?

+When selecting a car insurance company, consider your specific needs and circumstances. Assess factors like coverage options, premium costs, customer service, and technological offerings. Research and compare different providers to find the one that offers the best balance of these elements for your situation.

What should I look for in a car insurance policy?

+A comprehensive car insurance policy should include liability coverage, collision coverage, and comprehensive coverage. Additionally, consider adding optional coverages like personal injury protection, medical payments coverage, and uninsured/underinsured motorist coverage to ensure you’re adequately protected in various scenarios.

Are there any discounts available for car insurance policies?

+Yes, many car insurance companies offer discounts to policyholders. Common discounts include safe driver discounts, multi-policy discounts, good student discounts, and loyalty discounts. Be sure to inquire about these options when obtaining quotes to potentially reduce your insurance premiums.