Car Insurance Companies State Farm

In the vast landscape of the insurance industry, State Farm stands as a prominent figure, offering a comprehensive range of services, including car insurance. With a rich history spanning decades, State Farm has become a trusted name for millions of policyholders across the United States. This article delves into the intricacies of State Farm's car insurance offerings, exploring its coverage options, customer experience, and unique features that set it apart from its competitors.

A Historical Overview: State Farm’s Journey

State Farm’s roots trace back to the early 20th century, a time when the concept of automobile insurance was still in its infancy. Founded in 1922 by George J. Mecherle, a former farmer and insurance salesman, the company initially focused on providing affordable insurance to farmers and their vehicles. Mecherle’s innovative idea of offering insurance directly to the public, rather than through agents, was a revolutionary concept at the time.

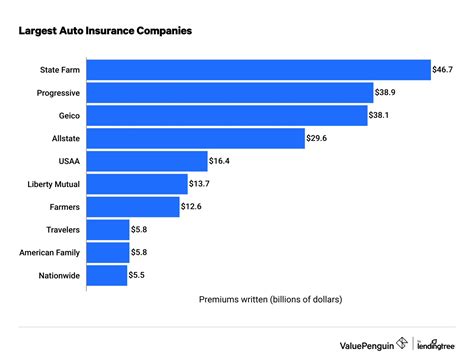

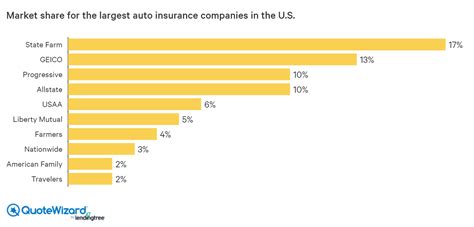

Over the years, State Farm expanded its reach, becoming a leading provider of auto, home, life, and health insurance. Its commitment to customer service and community involvement has been a cornerstone of its success. Today, State Farm boasts over 19,000 agents and a network of nearly 70,000 employees, making it one of the largest insurance providers in the United States.

State Farm Car Insurance: Coverage and Benefits

State Farm offers a diverse range of car insurance policies to cater to the unique needs of its customers. Here’s an overview of the key coverage options and benefits:

Comprehensive Coverage

State Farm’s comprehensive car insurance policy provides protection against a wide array of risks, including accidents, theft, vandalism, and natural disasters. It covers the cost of repairs or replacements, ensuring your vehicle is back on the road promptly. Additionally, comprehensive coverage includes medical payments, which can help cover healthcare expenses resulting from an accident.

Liability Coverage

Liability insurance is a vital component of any car insurance policy, and State Farm offers robust protection in this area. This coverage safeguards policyholders against claims arising from accidents they cause, including bodily injury and property damage. State Farm provides flexible limits, allowing customers to tailor their coverage to their specific needs and budget.

Uninsured/Underinsured Motorist Coverage

In the unfortunate event of an accident involving an uninsured or underinsured driver, State Farm’s uninsured/underinsured motorist coverage steps in to protect its policyholders. This coverage can help cover medical expenses, lost wages, and other damages resulting from such incidents.

Roadside Assistance

State Farm’s roadside assistance program provides peace of mind for drivers facing unexpected vehicle troubles. Policyholders can access services such as towing, battery jumps, flat tire changes, and even fuel delivery. This feature is particularly valuable for those who frequently travel long distances or reside in remote areas.

Discounts and Savings

State Farm is renowned for its commitment to offering competitive rates and various discounts. Policyholders can save on their premiums by taking advantage of discounts for safe driving, multiple policies, good grades (for young drivers), and vehicle safety features. State Farm also provides bundle discounts for customers who insure multiple vehicles or combine car insurance with other policies.

| Coverage Type | Benefits |

|---|---|

| Comprehensive | Protects against various risks, including accidents and natural disasters |

| Liability | Covers bodily injury and property damage claims arising from accidents |

| Uninsured/Underinsured Motorist | Provides coverage for accidents involving uninsured/underinsured drivers |

| Roadside Assistance | Offers towing, battery jumps, and other emergency services |

Customer Experience and Claims Process

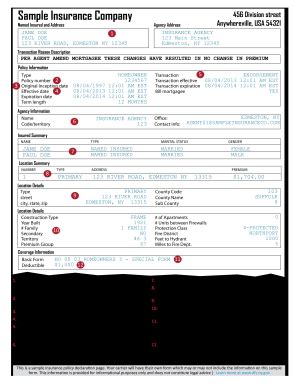

State Farm prides itself on delivering an exceptional customer experience, ensuring policyholders receive prompt and personalized service. The company’s extensive network of agents and dedicated claims professionals ensures efficient handling of claims. Policyholders can choose to file claims online, over the phone, or in person, providing flexibility and convenience.

State Farm's claims process is designed to be straightforward and transparent. The company offers a 24/7 claims reporting hotline, ensuring prompt assistance even during off-hours. Additionally, State Farm provides access to a network of trusted repair shops, ensuring high-quality repairs for damaged vehicles.

Unique Features and Innovations

State Farm continuously strives to innovate and enhance its car insurance offerings. Here are some notable features that set State Farm apart:

Drive Safe & Save®

State Farm’s Drive Safe & Save® program utilizes telematics technology to reward safe driving habits. Policyholders who opt into this program can receive discounts based on their driving behavior, including factors like smooth acceleration, consistent speed, and avoidance of harsh braking. This innovative approach encourages safer driving practices and can lead to significant savings on insurance premiums.

Digital Tools and Resources

State Farm has embraced digital technology to enhance the customer experience. Its mobile app offers policyholders easy access to their insurance information, including policy details, ID cards, and claims status. The app also provides tools for locating nearby repair shops and tracking claims progress. Additionally, State Farm’s website offers a wealth of resources, including educational articles and tools to help customers better understand their coverage.

Community Involvement

State Farm’s commitment to community involvement is a core aspect of its corporate culture. The company actively supports various initiatives and charities, including education, disaster relief, and youth programs. This dedication to giving back strengthens State Farm’s connection with its policyholders and local communities.

State Farm’s Impact and Future Outlook

State Farm’s influence extends beyond its insurance offerings. The company has played a pivotal role in shaping the insurance industry, setting standards for customer service and innovation. Its focus on community involvement and social responsibility has earned it a reputation as a trusted and responsible corporate citizen.

Looking ahead, State Farm is well-positioned to continue its success. With a strong brand presence, a dedicated workforce, and a commitment to innovation, the company is poised to adapt to the evolving needs of its customers and the insurance market. State Farm's ability to leverage technology and its customer-centric approach will likely remain key factors in its ongoing success.

How can I get a quote for State Farm car insurance?

+You can request a quote for State Farm car insurance by visiting their official website or contacting a local State Farm agent. The quote process typically involves providing details about your vehicle, driving history, and desired coverage options. State Farm’s agents can guide you through the process and help you customize your policy to meet your specific needs.

What factors influence State Farm’s car insurance rates?

+State Farm’s car insurance rates are influenced by various factors, including your age, driving record, the type and value of your vehicle, and the coverage options you choose. Other factors such as the location where you reside and the number of miles you drive annually can also impact your rates. It’s best to consult with a State Farm agent to understand how these factors apply to your specific situation.

Can I bundle my car insurance with other State Farm policies to save money?

+Yes, State Farm offers multi-policy discounts, allowing you to bundle your car insurance with other policies such as homeowners or renters insurance. By bundling your policies, you can often save a significant amount on your overall insurance premiums. Contact a State Farm agent to discuss your options and determine the best combination of policies for your needs.