Canada Trust Car Insurance

Canada Trust Car Insurance, now known as TD Car Insurance, is a prominent player in the Canadian insurance market. With a rich history and a commitment to innovation, TD Car Insurance has established itself as a trusted provider, offering comprehensive coverage and exceptional customer service to motorists across the nation.

This expert-reviewed guide will delve into the intricacies of TD Car Insurance, exploring its offerings, benefits, and unique features. By the end of this article, you'll have a comprehensive understanding of why TD Car Insurance is a preferred choice for many Canadian drivers.

A Legacy of Trust: The Evolution of TD Car Insurance

The story of TD Car Insurance begins with its predecessor, Canada Trust, a renowned financial institution that had a long-standing reputation for reliability and customer satisfaction. In the late 20th century, Canada Trust recognized the growing need for accessible and reliable car insurance, and thus, its insurance division was born.

Over the years, Canada Trust Car Insurance gained popularity for its competitive rates and personalized service. The company's focus on understanding the unique needs of its customers and providing tailored coverage plans set it apart from its competitors. This commitment to customer-centricity has been a cornerstone of its success.

In the early 2000s, Canada Trust underwent a strategic transition, becoming a part of the Toronto-Dominion Bank, one of Canada's largest financial institutions. This integration led to a rebranding, and the insurance division was renamed TD Car Insurance, signifying a new chapter in its history.

Key Milestones and Innovations

TD Car Insurance has been at the forefront of industry advancements, implementing several groundbreaking initiatives that have benefited its customers.

- In 2010, TD introduced a revolutionary online claims system, allowing policyholders to report and track their claims conveniently from their digital devices. This innovation streamlined the claims process and reduced the time and effort required by customers.

- The company has consistently invested in state-of-the-art risk assessment technologies, utilizing advanced analytics to offer accurate and fair premiums. This has resulted in more precise pricing and better value for its customers.

- TD Car Insurance was one of the first providers to offer comprehensive ride-sharing coverage, recognizing the changing landscape of transportation. This coverage ensures drivers who use ride-sharing apps are protected while on the clock, addressing a critical gap in traditional policies.

These milestones have not only enhanced the customer experience but have also positioned TD Car Insurance as an industry leader, committed to staying ahead of the curve.

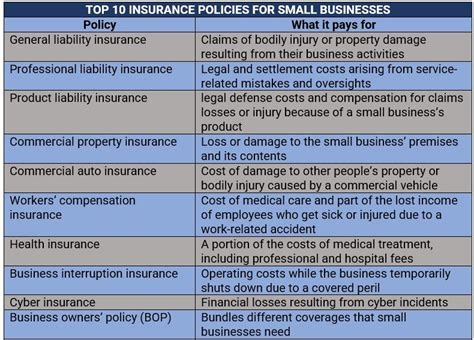

Coverage Options: Tailored Protection for Every Driver

TD Car Insurance understands that every driver has unique needs and circumstances. As such, they offer a diverse range of coverage options to ensure that their policies are adaptable and comprehensive.

Comprehensive and Collision Coverage

The foundation of any car insurance policy, comprehensive coverage and collision coverage are essential for protecting your vehicle from a wide range of potential damages. TD Car Insurance provides flexible options for these core coverages, allowing you to choose deductibles and limits that align with your budget and risk tolerance.

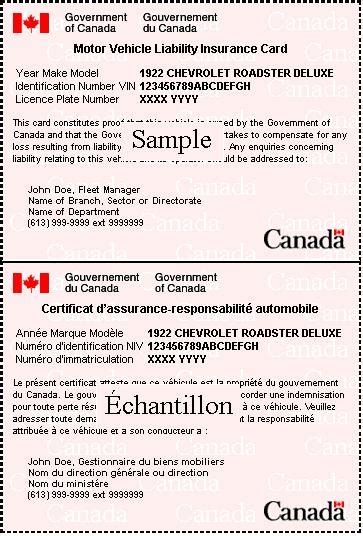

Liability Coverage

Protecting yourself and others on the road is a critical aspect of car insurance. TD's liability coverage ensures that you're financially protected in the event of an accident, covering bodily injury and property damage claims made against you.

Optional Add-Ons

To further enhance your policy, TD Car Insurance offers a suite of optional add-ons that can be tailored to your specific needs. These include:

- Roadside Assistance: This coverage provides emergency services such as towing, battery jump-starts, and flat tire changes, ensuring you're never stranded.

- Loan/Lease Payoff Coverage: In the event of a total loss, this coverage pays off the remaining balance on your auto loan or lease, providing financial relief.

- Rental Car Coverage: If your vehicle is being repaired after an accident, this coverage provides a rental car to keep you on the move.

- Accident Forgiveness: With this add-on, your rates won't increase after your first at-fault accident, offering peace of mind.

Claims Process: Seamless and Efficient

When it matters most, a seamless and efficient claims process is essential. TD Car Insurance has invested heavily in its claims handling, ensuring a smooth experience for policyholders.

Online and Mobile Claims Reporting

TD understands the convenience of digital tools, which is why they've made it easy to report claims online or via their mobile app. This allows you to initiate the claims process promptly, reducing the stress associated with accidents.

Dedicated Claims Adjusters

Each claim is assigned to a dedicated claims adjuster who will guide you through the process, answering your questions and ensuring a fair and timely resolution. Their expertise and personalized approach make the claims journey less daunting.

Advanced Claims Technology

TD leverages advanced technology to expedite the claims process. From digital photo estimating to real-time claims tracking, these tools ensure efficiency and transparency, keeping you informed every step of the way.

Customer Experience: A Focus on Service Excellence

TD Car Insurance places a strong emphasis on delivering exceptional customer service. Their commitment to this principle has earned them accolades and a loyal customer base.

24/7 Customer Support

Whether you have a question about your policy or need assistance with a claim, TD's customer support team is available around the clock. This ensures that you can get the help you need, whenever you need it.

Personalized Policy Management

TD offers a dedicated policy management portal where you can view and manage your policy details, make payments, and update your information. This level of control and transparency empowers you to take charge of your insurance needs.

Customer Rewards and Perks

As a token of appreciation, TD Car Insurance offers a range of customer rewards and perks. These include discounts for safe driving, loyalty bonuses, and access to exclusive offers and events. Such incentives not only save you money but also enhance your overall experience.

Performance and Reputation: A Trusted Choice

TD Car Insurance's performance and reputation in the market are testaments to its reliability and customer satisfaction.

Industry Recognition

TD has consistently been recognized as a leader in the insurance industry. It has earned top rankings in various independent surveys, including being named one of the "Best Auto Insurance Companies" by J.D. Power for multiple years in a row.

Financial Strength and Stability

With a strong financial backing from the Toronto-Dominion Bank, TD Car Insurance boasts an exceptional financial rating from leading agencies. This rating signifies the company's ability to meet its financial obligations, providing peace of mind to policyholders.

Customer Satisfaction

TD's commitment to customer satisfaction is evident in its high customer retention rates and positive feedback. Online reviews and testimonials highlight the company's professionalism, responsiveness, and fair pricing, making it a trusted choice for many Canadians.

Conclusion: Why Choose TD Car Insurance

TD Car Insurance stands out as a preferred choice for Canadian drivers due to its rich legacy, innovative spirit, and unwavering commitment to customer satisfaction. With a wide range of coverage options, a seamless claims process, and exceptional customer service, TD offers a comprehensive and reliable insurance experience.

As you navigate the world of car insurance, consider TD Car Insurance as your trusted partner, ensuring you're protected on the road ahead.

Frequently Asked Questions

What types of discounts does TD Car Insurance offer?

+TD Car Insurance offers a variety of discounts to help customers save on their premiums. These include multi-policy discounts (for bundling car insurance with other TD insurance products), good student discounts, mature driver discounts, and loyalty discounts for long-term customers.

<div class="faq-item">

<div class="faq-question">

<h3>How can I get a quote for TD Car Insurance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>You can easily get a quote for TD Car Insurance by visiting their official website and using their online quote tool. Alternatively, you can contact their customer service team or visit a TD Insurance location near you for assistance.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What is the process for filing a claim with TD Car Insurance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To file a claim with TD Car Insurance, you can report it online through their website or mobile app, call their 24/7 claims hotline, or visit a TD Insurance location. You'll need to provide details about the incident and any relevant documentation. A dedicated claims adjuster will guide you through the process.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Does TD Car Insurance offer any specialized coverage for specific vehicles or situations?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, TD Car Insurance offers specialized coverage options to cater to various needs. This includes coverage for classic cars, commercial vehicles, and motorcycles. They also provide unique coverages like pet injury coverage and identity theft protection.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How does TD Car Insurance determine premiums and rates?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>TD Car Insurance uses a combination of factors to determine premiums, including the make and model of your vehicle, your driving record, the coverage limits you choose, and your location. They also offer personalized rates based on your individual circumstances and driving behavior.</p>

</div>

</div>