Calculate Life Insurance

Determining the right amount of life insurance coverage is a crucial financial decision that can provide peace of mind for both you and your loved ones. Life insurance serves as a safety net, ensuring that your family's financial well-being is protected in the event of your untimely passing. This article aims to guide you through the process of calculating life insurance, offering expert insights and real-world examples to help you make an informed decision.

Understanding Life Insurance

Life insurance is a contract between an individual (the policyholder) and an insurance company. In exchange for premium payments, the insurance company promises to pay a specified amount, known as the death benefit, to the policyholder’s beneficiaries upon their death. This financial protection can cover a wide range of needs, from paying off debts and funeral expenses to providing long-term financial support for dependents.

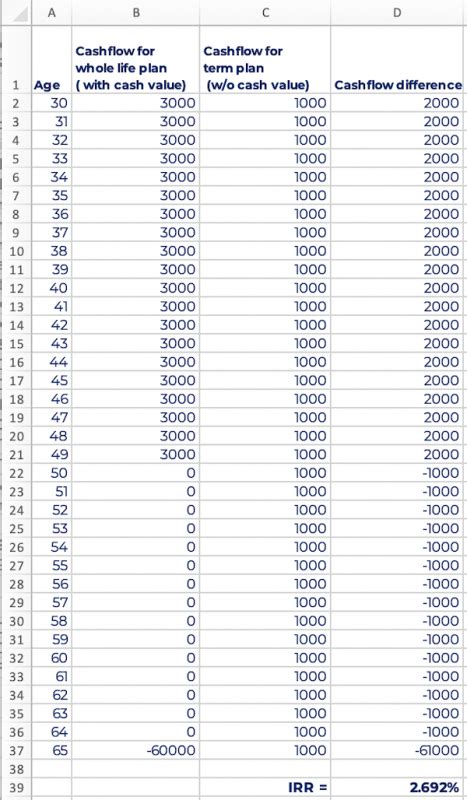

The two primary types of life insurance are term life insurance and permanent life insurance. Term life insurance offers coverage for a specified period, typically ranging from 10 to 30 years, while permanent life insurance, such as whole life or universal life, provides lifelong coverage and often includes a cash value component that can be accessed during the policyholder's lifetime.

Assessing Your Needs

Calculating the appropriate life insurance coverage involves a thorough assessment of your unique financial situation and goals. Here are some key factors to consider:

Financial Dependents

Start by evaluating who relies on your income. This could include a spouse, children, aging parents, or even business partners. Consider their current and future financial needs, such as day-to-day living expenses, education costs, and potential loss of income due to your absence.

For instance, imagine you're a single parent with two children. You'll need to ensure that your life insurance coverage is sufficient to cover their living expenses, education fees, and any other financial obligations you have, such as a mortgage or outstanding debts.

Debt and Obligations

Take stock of your existing debts and financial commitments. This includes mortgages, personal loans, credit card balances, and any other outstanding liabilities. Life insurance can be used to pay off these debts, ensuring your loved ones are not burdened with them.

Let's say you have a mortgage of $300,000 and other debts totaling $50,000. You'll want to ensure your life insurance coverage exceeds these amounts to provide financial relief to your family.

Funeral and Burial Costs

The average cost of a funeral and burial can be significant. Life insurance can cover these expenses, preventing your loved ones from having to make difficult financial decisions during an emotional time.

According to recent statistics, the average cost of a funeral in the United States is around $10,000. This is a crucial consideration when calculating your life insurance needs.

Income Replacement

Life insurance should also replace your income to maintain your family’s standard of living. Consider the number of years your dependents may rely on your income and calculate an appropriate death benefit to cover this period.

For example, if you're the primary breadwinner and your family relies on your income for the next 20 years, you'll need a life insurance policy that provides sufficient coverage during this timeframe.

Final Expenses and Legacy

Beyond immediate financial needs, life insurance can also be used to cover final expenses, such as estate settlement costs and potential inheritance taxes. Additionally, you may wish to leave a legacy for your loved ones through charitable donations or trust funds.

Incorporating these long-term goals into your life insurance plan ensures that your financial support extends beyond your lifetime.

Calculating Coverage

Now that you’ve assessed your needs, it’s time to determine the appropriate life insurance coverage. Here’s a step-by-step guide:

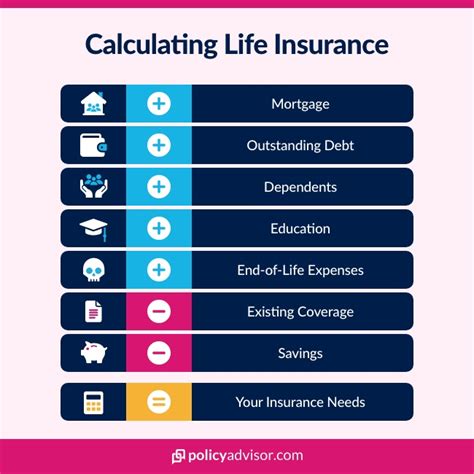

Step 1: Determine Total Needs

Add up all the financial needs and goals you identified in the previous section. This should include debt repayment, funeral costs, income replacement, and any other specific financial objectives.

For instance, if your total needs amount to $1,000,000, this becomes the starting point for your life insurance coverage calculation.

Step 2: Consider Existing Coverage

Take into account any life insurance coverage you already have through your employer or other policies. This will reduce the amount of additional coverage you need to purchase.

If you have a $50,000 life insurance policy through your employer, subtract this from your total needs to get a more accurate estimate of the additional coverage required.

Step 3: Factor in Inflation

Inflation can significantly impact the purchasing power of your life insurance benefits over time. To ensure your coverage remains adequate, consider the effects of inflation on your financial needs.

Let's say you expect an average inflation rate of 3% over the next 20 years. This means your financial needs will likely increase by approximately 70% during this period. Adjust your coverage amount accordingly to account for inflation.

Step 4: Evaluate Other Assets

Consider any other assets or savings you have that could be used to meet your financial needs. This might include investment accounts, savings, or the equity in your home.

For example, if you have $200,000 in savings and investments, you can reduce your life insurance coverage needs by this amount.

Step 5: Calculate Final Coverage Amount

By now, you should have a clear idea of your total financial needs, existing coverage, and potential inflation adjustments. Subtract your existing coverage and other assets from your total needs to arrive at the final coverage amount you require.

| Total Financial Needs | $1,000,000 |

|---|---|

| Existing Coverage | $50,000 |

| Inflation Adjustment | $300,000 |

| Other Assets | $200,000 |

| Final Coverage Amount | $1,050,000 |

In this example, the final coverage amount of $1,050,000 ensures that your financial needs are met and provides a safety net for your loved ones.

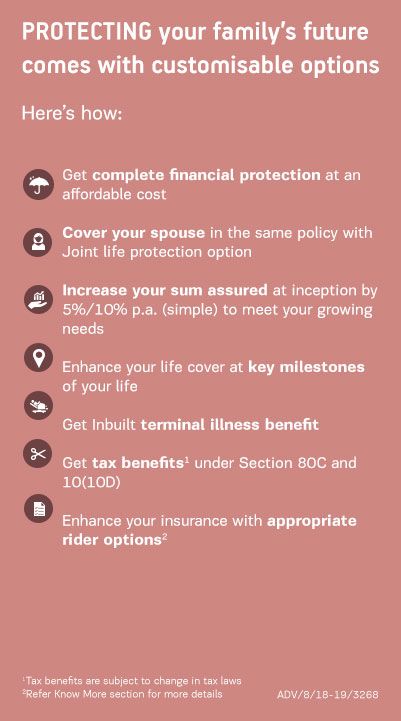

Selecting the Right Policy

Once you’ve determined your coverage needs, it’s time to choose the right life insurance policy. Consider the following factors:

Term Life Insurance

Term life insurance is often more affordable and offers flexibility. It’s ideal for covering short-term needs, such as paying off a mortgage or providing income replacement during specific periods.

For instance, if you're a young professional with a growing family, a 20-year term life insurance policy might be sufficient to cover your needs until your children become financially independent.

Permanent Life Insurance

Permanent life insurance, such as whole life or universal life, provides lifelong coverage and often includes a cash value component. This type of policy is suitable for long-term financial planning and can be used for wealth accumulation.

If you're looking for lifelong protection and want the option to access cash value, permanent life insurance may be the better choice.

Policy Riders

Consider adding policy riders to your life insurance plan. Riders can provide additional benefits, such as waiver of premium, accelerated death benefit for terminal illness, or coverage for specific health conditions.

For example, a waiver of premium rider ensures that your policy remains in force even if you become unable to work and pay premiums due to illness or injury.

Working with an Insurance Professional

Calculating life insurance coverage and selecting the right policy can be complex. Working with a qualified insurance professional can provide valuable guidance and ensure you make informed decisions.

An insurance agent or financial advisor can help you:

- Assess your unique financial situation and goals

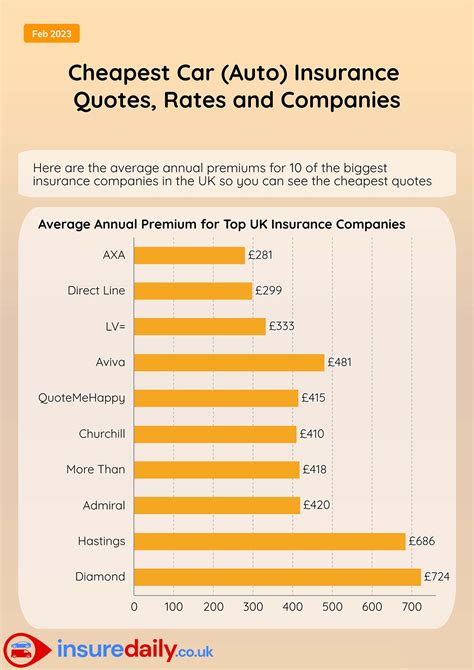

- Compare different life insurance policies and providers

- Navigate the application process and understand the fine print

- Review and adjust your coverage as your needs change over time

Remember, life insurance is a long-term commitment, and having expert guidance can make the process easier and more effective.

Conclusion

Calculating life insurance coverage is a crucial step in ensuring your loved ones’ financial security. By assessing your needs, considering existing coverage, and working with a qualified professional, you can make informed decisions and provide the peace of mind that comes with adequate life insurance protection.

Remember, life insurance is not a one-size-fits-all solution, and your needs may change over time. Regularly review and adjust your coverage to reflect your evolving financial situation and goals.

How much life insurance do I need if I’m single with no dependents?

+If you’re single with no financial dependents, you may still need life insurance to cover final expenses, pay off any outstanding debts, and provide a financial cushion for your loved ones. Consider your total financial obligations and aim for coverage that exceeds these amounts.

Can I increase my life insurance coverage in the future?

+Yes, you can often increase your life insurance coverage by purchasing additional policies or adding riders to your existing policy. However, this may require providing updated health information and potentially undergoing a new medical exam.

What if I have pre-existing health conditions?

+Pre-existing health conditions may impact your life insurance options and premiums. Some insurance companies specialize in high-risk policies, while others may require additional medical exams or charge higher rates. It’s important to be transparent about your health history during the application process.

Are there any tax benefits associated with life insurance?

+Yes, life insurance can offer tax advantages. The death benefit proceeds are typically tax-free, and the cash value growth in permanent life insurance policies may also be tax-deferred. Consult a tax professional for specific guidance on your situation.