Best Type Of Life Insurance

Unveiling the Ideal Life Insurance: A Comprehensive Guide

Life insurance is an essential aspect of financial planning, providing a safety net for your loved ones and ensuring their future is secure. With numerous options available, choosing the best type of life insurance can be a daunting task. In this comprehensive guide, we delve into the world of life insurance, exploring the various types, their unique features, and how to make an informed decision tailored to your specific needs. Join us as we navigate the intricacies of life insurance, offering expert insights and real-world examples to help you make the right choice.

Understanding the Basics of Life Insurance

Life insurance is a contract between an individual (the policyholder) and an insurance company. The policyholder pays a premium, and in return, the insurance company promises to pay a sum of money (the death benefit) to the designated beneficiaries upon the policyholder's death. This death benefit can provide financial support to cover expenses such as funeral costs, outstanding debts, and ongoing living expenses for the family.

The primary purpose of life insurance is to offer peace of mind, knowing that your loved ones will be taken care of financially even if you are no longer present. It can also serve as a valuable tool for estate planning, business continuity, and even retirement planning in certain cases.

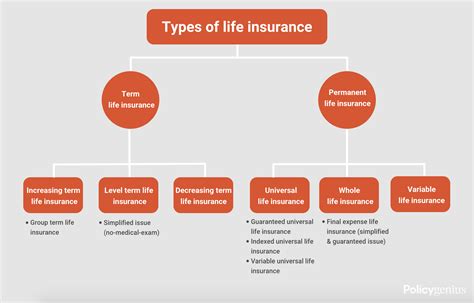

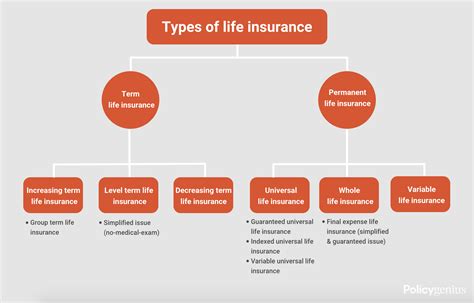

Types of Life Insurance: Exploring the Options

Term Life Insurance

Term life insurance is the most straightforward and cost-effective type of life insurance. It provides coverage for a specified period, typically ranging from 10 to 30 years. During this term, the policyholder pays regular premiums, and if they pass away within the term, their beneficiaries receive the death benefit. If the policyholder outlives the term, the coverage ends, and no benefits are paid out.

Key Features:

- Affordability: Term life insurance is known for its low cost, making it an excellent option for those on a budget.

- Flexibility: Policies can be tailored to your specific needs, with various term lengths available.

- Renewal: Most term policies offer the option to renew, allowing you to extend coverage if needed.

Term life insurance is ideal for covering temporary needs, such as providing for your family during your working years or paying off a mortgage. It's a popular choice for young families or those with significant financial obligations.

| Term Length | Premium Cost |

|---|---|

| 10 years | $200 - $300 annually |

| 20 years | $400 - $600 annually |

| 30 years | $600 - $900 annually |

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, provides coverage for the policyholder's entire life, as long as premiums are paid. This type of insurance includes a cash value component, which grows over time and can be accessed by the policyholder through loans or withdrawals.

Key Features:

- Lifetime Coverage: Whole life insurance ensures your beneficiaries receive the death benefit regardless of when you pass away.

- Cash Value: The policy builds cash value, which can be used for various financial needs, such as retirement planning or emergency funds.

- Fixed Premiums: Premiums remain level throughout the policy, providing stability and predictability.

Whole life insurance is an excellent choice for those seeking long-term financial protection and stability. It's often used for estate planning, providing a substantial death benefit and a source of tax-free income through the cash value.

| Policy Type | Average Annual Premium |

|---|---|

| Traditional Whole Life | $2,500 - $3,000 |

| Universal Life | $1,800 - $2,200 |

| Indexed Universal Life | $1,500 - $1,800 |

Universal Life Insurance

Universal life insurance is a flexible type of permanent life insurance that offers more control over premiums and death benefits. Policyholders can adjust their premiums and death benefits within certain limits, making it a customizable option.

Key Features:

- Flexibility: Universal life insurance allows for adjustments in premiums and death benefits, providing a customizable solution.

- Cash Value: Like whole life insurance, universal life policies build cash value, which can be used for various financial needs.

- Interest Earnings: The cash value component earns interest, providing an additional source of growth.

Universal life insurance is a popular choice for those seeking a balance between the stability of permanent life insurance and the flexibility to adjust their coverage as their needs evolve. It's an excellent option for those with changing financial circumstances.

| Policy Type | Average Annual Premium |

|---|---|

| Guaranteed Universal Life | $1,200 - $1,500 |

| Indexed Universal Life | $1,000 - $1,200 |

| Variable Universal Life | $800 - $1,000 |

Factors to Consider When Choosing Life Insurance

When deciding on the best type of life insurance, several factors come into play. These include your financial goals, your family's needs, your health, and your budget. Let's explore these factors in more detail.

Financial Goals and Family Needs

Consider your financial objectives and the needs of your loved ones. Do you want to provide for your family during your working years, or are you more concerned with long-term financial stability and estate planning? Term life insurance is ideal for covering short-term needs, while whole life and universal life insurance offer more comprehensive, long-term solutions.

Health and Lifestyle

Your health and lifestyle can impact the type of life insurance you qualify for and the cost of premiums. For example, if you have a pre-existing medical condition, you may find it more challenging to obtain whole life insurance, which typically requires a medical exam. In such cases, term life insurance may be a more accessible option.

Budget and Premiums

Your budget is a crucial factor when choosing life insurance. Term life insurance is generally more affordable, making it an excellent choice for those on a tight budget. Whole life and universal life insurance, while offering more comprehensive benefits, come with higher premium costs.

Real-World Examples and Case Studies

John's Term Life Insurance Journey

John, a 30-year-old single professional, recently purchased a term life insurance policy. He chose a 20-year term to cover his working years, providing enough time to pay off his mortgage and save for his retirement. With a budget-friendly premium of $450 annually, John felt confident that his loved ones would be taken care of financially if something were to happen to him during this critical period.

Sarah's Whole Life Insurance Story

Sarah, a 45-year-old married mother of two, opted for whole life insurance. With a stable career and a desire to provide long-term financial security for her family, Sarah chose a whole life policy with a $1 million death benefit. The policy's cash value component also allowed her to save for her children's education and retirement, offering a comprehensive financial solution.

Michael's Universal Life Insurance Experience

Michael, a 35-year-old entrepreneur, selected universal life insurance due to its flexibility. With a growing business and changing financial needs, Michael appreciated the ability to adjust his premiums and death benefits as his circumstances evolved. The policy's cash value also provided a source of funds for unexpected business expenses, making it a versatile choice for his unique situation.

Making an Informed Decision

Choosing the best type of life insurance involves careful consideration of your unique circumstances and needs. Whether you opt for the affordability of term life insurance, the stability of whole life insurance, or the flexibility of universal life insurance, it's essential to review your policy regularly and make adjustments as your life changes. Life insurance is a vital component of your financial plan, offering peace of mind and a secure future for your loved ones.

Frequently Asked Questions

Can I change my life insurance policy once it’s in place?

+

Yes, many life insurance policies offer the flexibility to make changes. You can often adjust your coverage, beneficiaries, and even convert from term to permanent life insurance if needed. It’s essential to review your policy regularly and consult with your insurance provider to ensure it aligns with your changing needs.

How much life insurance coverage do I need?

+

The amount of life insurance coverage you need depends on your individual circumstances. Factors to consider include your income, outstanding debts, future financial goals, and the number of dependents you have. It’s recommended to calculate your coverage needs based on these factors to ensure adequate protection.

What happens if I miss a premium payment for my life insurance policy?

+

Missing a premium payment can have different consequences depending on your policy type. For term life insurance, missing a payment may result in the policy lapsing, and you may need to reapply for coverage. Whole life and universal life policies often have a grace period, allowing you to make the missed payment within a certain timeframe to avoid policy cancellation.

Can I add additional coverage to my life insurance policy?

+

Yes, many life insurance policies allow you to increase your coverage amount or add additional riders to your policy. This can be especially useful if your financial obligations or family size increases over time. Consult with your insurance provider to understand your options and the potential costs involved.

How do I choose the right life insurance provider?

+

Choosing the right life insurance provider involves research and consideration. Look for reputable companies with a strong financial standing and positive customer reviews. Compare policies, premiums, and the range of options offered. Consider working with an independent insurance agent who can provide unbiased advice and help you find the best fit for your needs.