Best Pet Cat Insurance

In today's pet-loving world, ensuring the well-being of our furry companions has become a top priority for many pet parents. With the rise of pet insurance plans, cat owners now have the opportunity to provide comprehensive care for their feline friends without breaking the bank. This comprehensive guide will delve into the world of pet cat insurance, exploring the best options available and offering valuable insights to help you make an informed decision.

Understanding the Need for Pet Cat Insurance

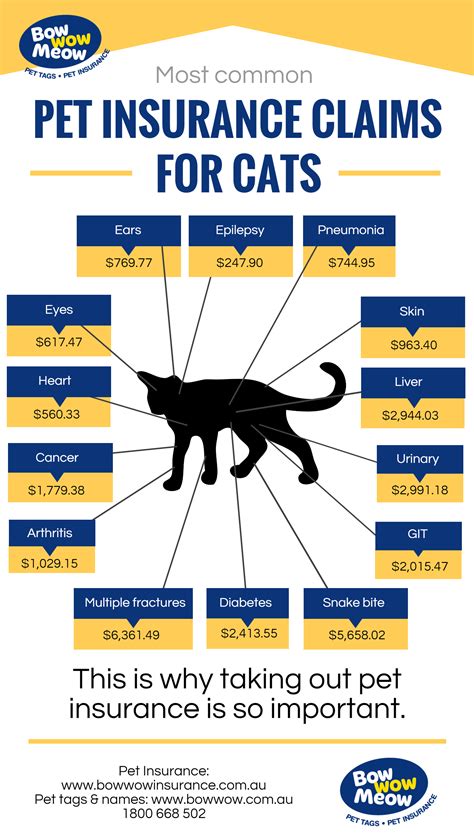

Cats, with their independent nature and curious personalities, can often find themselves in unexpected situations that may require veterinary attention. From accidental injuries to unexpected illnesses, the costs of veterinary care can quickly add up. This is where pet insurance steps in as a valuable safety net, offering financial support and peace of mind for pet owners.

The Top Pet Cat Insurance Providers

The pet insurance market is thriving, with numerous providers offering tailored plans for cats. Here’s a detailed look at some of the best pet cat insurance options:

1. Healthy Paws Pet Insurance

Healthy Paws has consistently been recognized as one of the top pet insurance providers in the industry. Their comprehensive plans cover a wide range of medical conditions, including accidents, illnesses, and even chronic conditions. With a simple reimbursement process and a user-friendly app, Healthy Paws makes it easy for pet parents to access their benefits.

| Plan Features | Healthy Paws |

|---|---|

| Reimbursement Percentage | Up to 90% |

| Annual Deductible Options | $0, $100, $250, $500, $750, $1000 |

| Annual Limit | Unlimited |

| Waiting Period | 14 days for injuries, 14 days for illnesses |

Key Benefits:

- Excellent coverage for both accidents and illnesses.

- Customizable plans to suit different budgets.

- Quick and efficient claims process.

- 24/7 access to veterinary helplines.

2. ASPCA Pet Insurance

ASPCA Pet Insurance, backed by the renowned ASPCA organization, offers a range of plans designed specifically for cats. Their policies provide coverage for accidents, illnesses, and even routine care. With a focus on preventive care, ASPCA Pet Insurance aims to keep your cat healthy and happy.

| Plan Features | ASPCA Pet Insurance |

|---|---|

| Reimbursement Percentage | 70%, 80%, or 90% |

| Annual Deductible Options | $100, $250, $500, $750, $1000 |

| Annual Limit | $10,000, $15,000, or Unlimited |

| Waiting Period | 14 days for accidents, 30 days for illnesses |

Key Benefits:

- Comprehensive coverage for various medical conditions.

- Optional routine care coverage for vaccinations and check-ups.

- Discounts for multiple pets insured.

- Access to a 24/7 pet helpline.

3. Embrace Pet Insurance

Embrace Pet Insurance stands out for its innovative approach to pet insurance. Their plans offer coverage for accidents, illnesses, and even alternative therapies like acupuncture and chiropractic care. Embrace also provides a unique Wellness Rewards program, encouraging pet owners to prioritize preventive care.

| Plan Features | Embrace Pet Insurance |

|---|---|

| Reimbursement Percentage | 70%, 80%, or 90% |

| Annual Deductible Options | $100, $250, $500, $750, $1000 |

| Annual Limit | $10,000, $15,000, or Unlimited |

| Waiting Period | 14 days for accidents, 14 days for illnesses |

Key Benefits:

- Inclusive coverage for alternative therapies.

- Wellness Rewards program for preventive care.

- Customizable plans with various add-ons.

- Access to a 24/7 pet poison control hotline.

4. PetPlan Pet Insurance

PetPlan is a trusted name in the pet insurance industry, offering lifetime coverage for cats. Their plans provide comprehensive coverage for accidents, illnesses, and even congenital conditions. With a focus on long-term care, PetPlan ensures that your cat's health is protected throughout their life.

| Plan Features | PetPlan Pet Insurance |

|---|---|

| Reimbursement Percentage | 80% |

| Annual Deductible Options | $250, $500, $750, $1000 |

| Annual Limit | Unlimited |

| Waiting Period | 14 days for accidents, 14 days for illnesses |

Key Benefits:

- Lifetime coverage ensures protection throughout your cat's life.

- Comprehensive coverage for congenital conditions.

- No upper age limit for enrollment.

- 24/7 access to veterinary advice.

Factors to Consider When Choosing Pet Cat Insurance

When selecting the best pet cat insurance, several factors come into play. Here are some key considerations:

1. Coverage Options

Evaluate the coverage provided by each insurance plan. Look for policies that offer comprehensive coverage for accidents, illnesses, and, if desired, routine care. Some plans may also include coverage for alternative therapies, which can be beneficial for holistic pet care.

2. Reimbursement and Deductibles

Understand the reimbursement percentages and deductible options available. Higher reimbursement percentages mean you’ll receive a larger portion of your expenses back, while lower deductibles can reduce your out-of-pocket costs.

3. Annual Limits and Lifetime Coverage

Consider the annual and lifetime limits offered by each plan. Some policies have unlimited annual limits, ensuring that your cat’s medical expenses are covered without restrictions. Lifetime coverage is also an important factor, as it guarantees protection for your cat’s entire life, regardless of age or pre-existing conditions.

4. Waiting Periods

Review the waiting periods for accidents and illnesses. Shorter waiting periods mean faster access to benefits, ensuring that your cat can receive timely care without delays.

5. Additional Benefits and Services

Look for insurance providers that offer additional benefits and services, such as 24⁄7 veterinary helplines, access to pet poison control hotlines, and discounts for multiple pets insured. These extras can provide valuable support and peace of mind.

Real-Life Case Studies

To illustrate the impact of pet cat insurance, let’s explore some real-life case studies:

Case Study 1: Accident Coverage

Meet Luna, a playful kitten who sustained an injury after jumping from a high surface. Luna’s owner, Sarah, had recently enrolled her in Healthy Paws Pet Insurance. The insurance covered the cost of Luna’s emergency vet visit, X-rays, and follow-up care, providing Sarah with financial relief during a stressful situation.

Case Study 2: Chronic Illness Management

Max, a senior cat, was diagnosed with chronic kidney disease. His owner, John, had enrolled Max in ASPCA Pet Insurance, which covered the cost of Max’s specialized diet, medications, and regular check-ups. The insurance plan allowed John to focus on Max’s treatment without worrying about the financial burden.

Case Study 3: Preventive Care Incentives

Emma, a responsible cat owner, chose Embrace Pet Insurance for its Wellness Rewards program. By keeping up with Emma’s annual vaccinations and check-ups, Emma was able to earn rewards that contributed to the cost of her routine care, making preventive care more affordable.

Conclusion: Securing Your Cat’s Future

Pet cat insurance is an invaluable tool for cat owners, offering financial protection and peace of mind. By choosing the right insurance plan, you can ensure that your feline companion receives the best possible care, no matter what life throws their way. With the right coverage, you can focus on enjoying the special bond you share with your cat, knowing that their health is protected.

Can I enroll my older cat in pet insurance?

+Yes, many pet insurance providers offer coverage for older cats. However, it’s important to note that some plans may have age restrictions or higher premiums for older pets. It’s best to research and compare options specifically tailored for senior cats.

What is the average cost of pet cat insurance?

+The cost of pet cat insurance can vary widely depending on factors such as your cat’s age, breed, location, and the coverage options you choose. On average, you can expect to pay anywhere from 20 to 50 per month for a basic plan, with premium plans costing upwards of $100 per month.

How do I file a claim with my pet insurance provider?

+Filing a claim with your pet insurance provider typically involves submitting a claim form along with supporting documentation, such as veterinary invoices and medical records. Most providers offer online claim submission, making the process convenient and efficient.

Are pre-existing conditions covered by pet insurance?

+Most pet insurance providers exclude coverage for pre-existing conditions, which are defined as any medical issues that your cat had prior to enrolling in the insurance plan. However, some providers offer waiting periods or specific coverage options for certain pre-existing conditions, so it’s important to review the policy terms carefully.

Can I switch pet insurance providers if I’m not satisfied with my current plan?

+Yes, you have the freedom to switch pet insurance providers if you find a plan that better suits your needs. However, keep in mind that pre-existing conditions may not be covered by the new provider, and you may need to serve additional waiting periods. It’s best to research and compare plans thoroughly before making a switch.