Best Life Term Insurance Companies

Life insurance is a crucial financial tool that provides security and peace of mind for individuals and their loved ones. With a wide range of life term insurance options available in the market, it can be challenging to identify the best companies that offer comprehensive coverage and excellent service. This article aims to explore the top life term insurance companies, highlighting their unique features, policies, and benefits, to assist you in making an informed decision.

Understanding Life Term Insurance

Life term insurance, also known as permanent life insurance, is a type of coverage that provides protection for the entire life of the policyholder. Unlike term life insurance, which offers coverage for a specific period, life term insurance remains in force until the insured passes away or reaches a certain age, typically 95-100 years. This type of insurance policy typically includes a cash value component, allowing policyholders to build savings alongside their protection.

The primary purpose of life term insurance is to provide financial support to beneficiaries in the event of the insured's death. This support can cover various expenses, including funeral costs, outstanding debts, daily living expenses, education costs for dependents, and even business succession planning. Additionally, life term insurance can serve as a valuable tool for estate planning and wealth transfer.

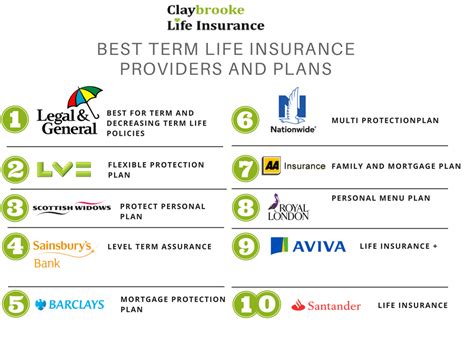

The Top Life Term Insurance Companies

When selecting the best life term insurance company, it is essential to consider factors such as financial strength, policy options, customer service, and overall reputation. Here, we delve into the top-performing life term insurance providers, analyzing their offerings and benefits.

Prudential Life Insurance

Prudential Life Insurance, a subsidiary of Prudential Financial, Inc., is a renowned player in the life insurance industry. With a rich history spanning over a century, Prudential has established itself as a trusted provider of life term insurance solutions. The company offers a comprehensive range of policies, including whole life, universal life, and variable universal life insurance, catering to diverse customer needs.

One of Prudential's standout features is its Prudential Term Essential policy, which provides affordable coverage for a specified period, typically up to age 95. This policy is ideal for individuals seeking temporary life insurance coverage to protect their loved ones during critical stages of life, such as raising a family or paying off a mortgage. Prudential's Term Essential policy offers flexibility, allowing policyholders to convert it to a permanent life insurance policy later.

Prudential's whole life insurance policies are designed to provide lifelong protection with a guaranteed death benefit. These policies also accumulate cash value over time, offering policyholders the opportunity to build savings alongside their insurance coverage. Prudential's whole life insurance plans are highly customizable, allowing customers to tailor their policies to their specific needs and preferences.

In addition to its comprehensive policy offerings, Prudential is known for its excellent customer service. The company provides dedicated agents who offer personalized advice and guidance, ensuring customers receive the right coverage for their unique situations. Prudential's online resources and tools further enhance the customer experience, providing easy access to policy information and claims assistance.

| Policy Type | Prudential Life Insurance |

|---|---|

| Term Life | Prudential Term Essential |

| Whole Life | Customizable Whole Life Plans |

| Universal Life | Flexible Premium Payment Options |

New York Life Insurance Company

New York Life Insurance Company, often referred to as New York Life, is one of the oldest and largest mutual life insurance companies in the United States. Founded in 1845, New York Life has a long-standing reputation for financial stability and innovative life insurance solutions.

New York Life offers a diverse range of life term insurance policies, including whole life, universal life, and term life insurance. The company's whole life insurance policies, known as "permanent protection plans," provide lifelong coverage with a guaranteed death benefit and the potential for cash value accumulation. These policies offer a solid foundation for long-term financial security and estate planning.

New York Life's universal life insurance policies provide policyholders with flexible premium payment options and the ability to adjust death benefits and coverage amounts as their needs evolve. This flexibility makes universal life insurance an attractive choice for individuals seeking customizable protection.

One of New York Life's standout features is its customized policy offerings. The company understands that every individual has unique financial goals and circumstances. As such, New York Life works closely with its clients to design tailored life term insurance plans that align with their specific needs, whether it's protecting loved ones, funding education, or supporting business ventures.

| Policy Type | New York Life Insurance Company |

|---|---|

| Whole Life | Permanent Protection Plans |

| Universal Life | Flexible Premium & Coverage Options |

| Term Life | Affordable Temporary Coverage |

MassMutual Life Insurance Company

MassMutual Life Insurance Company, or MassMutual, is a leading provider of life insurance and financial protection products. With a rich history dating back to 1851, MassMutual has established itself as a trusted name in the industry, known for its comprehensive life term insurance offerings and excellent customer service.

MassMutual's whole life insurance policies, known as "permanent protection plans," provide lifelong coverage with a guaranteed death benefit. These policies also offer the potential for cash value accumulation, allowing policyholders to build savings alongside their insurance coverage. MassMutual's whole life insurance plans are highly customizable, catering to the unique needs of individuals and families.

In addition to its whole life insurance offerings, MassMutual provides universal life insurance policies that offer flexible premium payment options and the ability to adjust coverage amounts as needed. This flexibility makes universal life insurance an attractive choice for individuals seeking customizable protection that can adapt to changing financial circumstances.

One of MassMutual's standout features is its innovative technology and digital tools. The company has embraced digital transformation, offering online policy management and claims processing. This digital approach enhances the customer experience, providing policyholders with easy access to their policy information and streamlined claims procedures.

| Policy Type | MassMutual Life Insurance Company |

|---|---|

| Whole Life | Permanent Protection Plans with Cash Value |

| Universal Life | Flexible Premium & Coverage Adjustments |

| Term Life | Affordable Temporary Coverage Options |

Factors to Consider When Choosing a Life Term Insurance Company

When selecting the best life term insurance company for your needs, it is essential to consider several key factors. These factors include financial strength, policy options, customer service, and overall reputation. Here’s a closer look at each of these considerations:

Financial Strength

The financial strength of a life term insurance company is a critical factor to evaluate. A financially stable company ensures that your policy will remain secure and that the company will be able to fulfill its obligations even in challenging economic times. Look for companies with strong financial ratings from reputable agencies such as A.M. Best, Moody’s, or Standard & Poor’s.

Policy Options

Consider the range of policy options offered by the insurance company. Evaluate whether the company provides the specific type of life term insurance coverage you require, whether it’s whole life, universal life, or term life insurance. Ensure that the policies align with your financial goals and provide the necessary protection for your loved ones.

Customer Service

Excellent customer service is essential when choosing a life term insurance company. Look for companies that provide dedicated agents or customer support representatives who can offer personalized advice and guidance. Consider the availability of online resources, policy management tools, and claims assistance to ensure a seamless and supportive customer experience.

Reputation

The reputation of a life term insurance company is a critical factor to consider. Research and evaluate the company’s track record, customer reviews, and industry recognition. A company with a strong reputation for ethical practices, customer satisfaction, and financial stability is more likely to provide reliable and trustworthy insurance coverage.

Frequently Asked Questions

What is the difference between life term insurance and term life insurance?

+

Life term insurance, also known as permanent life insurance, provides coverage for the entire life of the policyholder, typically until age 95-100. It includes a cash value component, allowing policyholders to build savings. Term life insurance, on the other hand, offers coverage for a specific period, typically 10-30 years, and does not include a cash value component.

How do I choose the right life term insurance policy for my needs?

+

Choosing the right life term insurance policy involves evaluating your financial goals and circumstances. Consider factors such as your income, debts, family responsibilities, and long-term financial goals. Consult with a financial advisor or insurance agent to determine the appropriate coverage amount and policy type that aligns with your needs.

Can I convert my term life insurance policy to a life term insurance policy?

+

Yes, many term life insurance policies offer a conversion option, allowing policyholders to convert their term policy to a permanent life insurance policy, typically a whole life or universal life policy. This conversion option is subject to specific conditions and may require additional medical underwriting.

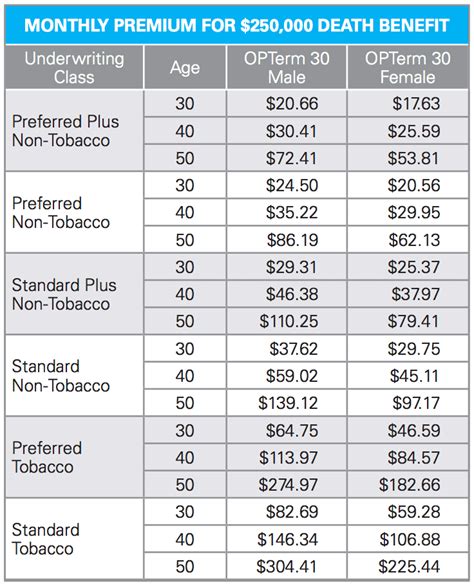

What factors determine the cost of life term insurance premiums?

+

The cost of life term insurance premiums is influenced by various factors, including the policyholder’s age, health status, occupation, and lifestyle habits. Additionally, the type of policy (whole life, universal life, or term life) and the coverage amount selected will impact the premium cost. It’s essential to compare quotes from different insurance companies to find the most competitive rates.

How can I maximize the benefits of my life term insurance policy?

+

To maximize the benefits of your life term insurance policy, consider the following strategies: regularly review and update your policy to ensure it aligns with your changing financial circumstances and goals; explore the policy’s optional riders or add-ons, such as accelerated death benefits or waiver of premium, to enhance your coverage; and utilize the policy’s cash value, if applicable, for financial planning and wealth accumulation.