Best Life Insurance Without Medical Exam

When it comes to securing your loved ones' financial future, life insurance is an essential consideration. However, for some individuals, the traditional route of undergoing a medical exam can be daunting or even inaccessible. Fortunately, the insurance industry has evolved to offer life insurance policies without the need for a medical examination. In this comprehensive guide, we will explore the best options for life insurance without a medical exam, shedding light on the features, benefits, and considerations to help you make an informed decision.

Understanding No-Exam Life Insurance

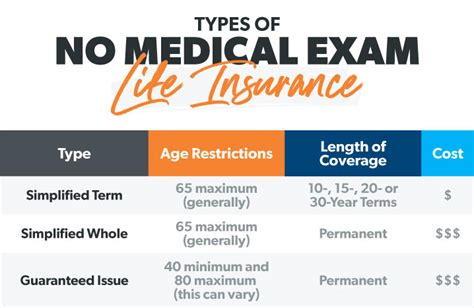

No-exam life insurance, also known as guaranteed issue life insurance or simplified issue life insurance, provides an alternative for individuals who may have health concerns, time constraints, or simply prefer a more convenient application process. These policies typically have a streamlined application procedure, eliminating the need for invasive medical tests or extensive paperwork.

Key Features and Advantages

The absence of a medical exam is the most notable feature of these policies. This means individuals with pre-existing health conditions or those who are averse to medical procedures can still obtain life insurance coverage. Additionally, the application process is often quicker, with some providers offering instant decisions. No-exam life insurance policies are also beneficial for individuals who require coverage urgently, such as those with dependent family members or substantial financial obligations.

| Feature | Description |

|---|---|

| No Medical Exam | Policies are issued without the need for a physical examination or medical test. |

| Simplified Application | The application process is straightforward and typically involves answering a few health-related questions. |

| Quick Turnaround | Some providers offer immediate coverage decisions, making the process efficient. |

| Flexible Coverage | Policies can be tailored to meet specific needs, offering various coverage amounts and terms. |

Top Providers for No-Exam Life Insurance

The market for no-exam life insurance is growing, with several reputable providers offering competitive policies. Here, we delve into some of the best options available, highlighting their unique features and benefits.

Provider 1: Aetna Life Insurance Company

Aetna is a well-established name in the insurance industry, known for its comprehensive coverage options. Their no-exam life insurance policy, Aetna Simplified Issue, offers a straightforward application process and flexible coverage limits. Here are some key features:

- Coverage Limits: Aetna offers coverage ranging from $5,000 to $25,000, providing adequate financial protection for many individuals and families.

- Simplified Application: The application requires basic personal information and a few health-related questions. No medical exam or blood tests are necessary.

- Accelerated Benefits: Some policies include an accelerated death benefit rider, which can provide access to a portion of the death benefit if the insured is diagnosed with a terminal illness.

- Renewal Option: Policyholders can renew their coverage annually, ensuring continuous protection.

Provider 2: Prudential Life Insurance

Prudential, a leading financial services provider, offers a no-exam life insurance policy known as Prudential Simplified Issue. This policy is designed to cater to a wide range of individuals, providing comprehensive coverage without the hassle of medical exams.

- Coverage Amounts: Prudential offers flexible coverage limits, ranging from $2,000 to $25,000, allowing individuals to choose an amount that suits their needs.

- Application Process: The application is simple and can be completed online or over the phone. It involves answering a few basic health questions, with no medical tests required.

- Term Length: Policyholders can choose from various term lengths, including 10, 20, and 30 years, providing long-term protection.

- Conversion Option: Prudential allows policyholders to convert their no-exam policy to a traditional term or permanent life insurance policy later, offering increased flexibility.

Provider 3: Mutual of Omaha

Mutual of Omaha is a trusted provider known for its comprehensive life insurance offerings. Their Mutual of Omaha Simplified Issue policy is designed to provide coverage without the need for a medical exam, making it an attractive option for many individuals.

- Coverage Options: Mutual of Omaha offers coverage amounts ranging from $2,000 to $25,000, ensuring a range of options to meet different financial needs.

- Instant Decision: The application process is quick and efficient, with some applicants receiving an immediate coverage decision.

- Level Premiums: Policyholders can enjoy level premiums for the duration of their term, providing budget-friendly protection.

- Renewal Guarantee: Mutual of Omaha guarantees the right to renew the policy annually, ensuring continued coverage without the need for additional health assessments.

Factors to Consider When Choosing No-Exam Life Insurance

While no-exam life insurance policies offer convenience and accessibility, it’s important to consider several factors to ensure you choose the best policy for your needs.

Coverage Amount and Term Length

Determine the amount of coverage you require to meet your financial obligations. Consider your family’s future needs, outstanding debts, and funeral expenses. Additionally, choose a term length that aligns with your goals. Shorter terms may be more affordable, while longer terms provide long-term protection.

Policy Riders and Benefits

Look for policies that offer additional riders or benefits. Accelerated death benefits, for instance, can provide access to a portion of the death benefit if the insured becomes terminally ill. Other riders may include waiver of premium or accidental death benefits.

Renewability and Convertibility

Check if the policy offers the option to renew or convert. Some policies allow for annual renewals, ensuring continuous coverage. Conversion options provide the flexibility to switch to a traditional life insurance policy in the future, which may offer more comprehensive benefits.

Company Reputation and Financial Strength

Research the provider’s reputation and financial stability. Choose a company with a solid track record and strong financial ratings to ensure they will be able to fulfill their obligations in the long term.

The Application Process

The application process for no-exam life insurance is designed to be simple and straightforward. Typically, you will need to provide basic personal information, such as your name, date of birth, and contact details. You may also be required to answer a few health-related questions, such as whether you have any pre-existing conditions or have engaged in high-risk activities.

Some providers may ask for additional information, such as your occupation or smoking status. It's important to provide accurate and truthful information during the application process to ensure the validity of your coverage.

Cost Considerations

No-exam life insurance policies may have higher premiums compared to traditional policies that require medical exams. This is because the insurance provider assumes a higher level of risk without the medical assessment. However, the convenience and accessibility of these policies often make them a worthwhile investment for many individuals.

It's essential to compare quotes from different providers to find the most competitive rates. Factors such as age, health status, and lifestyle choices can impact the premium, so it's beneficial to shop around and consider multiple options.

FAQs

Can anyone qualify for no-exam life insurance?

+

While no-exam life insurance policies are designed to be more inclusive, there may still be eligibility criteria. Most providers have age restrictions, and some may have specific health-related exclusions. It’s important to review the policy terms and conditions to understand the qualifications.

Are there any health conditions that may prevent me from getting coverage?

+

While no-exam policies are more lenient than traditional policies, there may be certain health conditions that could impact your eligibility. Some common exclusions include terminal illnesses, AIDS/HIV, and recent drug or alcohol abuse. It’s best to review the policy’s health exclusions to understand if your specific condition may be covered.

Can I increase my coverage amount after purchasing the policy?

+

Increasing your coverage amount after purchasing the policy may be possible, but it often requires a new application and underwriting process. Some providers offer the option to increase coverage during specific time frames, such as annual policy renewals or upon reaching certain milestones like a birthday or wedding anniversary.

No-exam life insurance policies offer a convenient and accessible solution for individuals seeking life insurance coverage without the need for medical exams. With a growing number of reputable providers offering competitive policies, finding the right coverage to protect your loved ones’ financial future has never been easier. Remember to carefully consider your needs, review policy terms, and compare options to make an informed decision.