Best Insurance Agencies Near Me

Finding the best insurance agencies near you is a crucial task, as insurance plays a vital role in safeguarding your finances and providing peace of mind. With numerous agencies offering various insurance products and services, it's essential to explore your options and make an informed decision. This comprehensive guide will delve into the key factors to consider when choosing an insurance agency, highlight some of the top-rated agencies in your vicinity, and offer valuable insights to ensure you receive the coverage you deserve.

Understanding Your Insurance Needs

Before embarking on your search for the best insurance agency, it’s crucial to assess your unique insurance needs. Consider the types of coverage you require, whether it’s for your home, vehicle, health, life, or business. Different agencies specialize in various insurance sectors, so understanding your specific requirements will help narrow down your options and ensure you find an agency that aligns with your needs.

Here are some key questions to ask yourself during this evaluation process:

- What types of insurance coverage do I need? (e.g., auto, home, health, life)

- What is my budget for insurance premiums? Do I require customized or standard coverage?

- Do I prefer a local, regional, or national insurance agency? What level of personalized service do I desire?

- Are there any specific insurance providers or products I'm interested in?

- What are my long-term insurance goals, and how can an agency help me achieve them?

Researching Top-Rated Insurance Agencies

Once you have a clear understanding of your insurance needs, it’s time to explore the top-rated insurance agencies in your area. Researching and comparing different agencies will help you identify the ones that offer the best combination of services, products, and customer satisfaction.

Online Reviews and Ratings

Start by checking online review platforms and rating sites. Websites like Yelp, Google Reviews, and Trustpilot can provide valuable insights into an agency’s reputation and customer experience. Look for agencies with consistently high ratings and positive feedback, as this often indicates a commitment to quality service.

Industry Recognition and Awards

Consider agencies that have received industry recognition or awards. These accolades often signify excellence in customer service, innovation, or specialized expertise. Some reputable organizations that confer insurance-related awards include the National Association of Insurance Commissioners (NAIC), Insurance Business America, and J.D. Power.

Local Agencies vs. National Providers

Decide whether you prefer a local, independent insurance agency or a national provider. Local agencies often offer a more personalized experience and may have a deeper understanding of your community’s unique insurance needs. On the other hand, national providers can provide broader coverage options and potentially more competitive rates due to their larger customer base.

| Agency Type | Advantages |

|---|---|

| Local Agencies | Personalized service, community expertise, flexible options |

| National Providers | Broader coverage, competitive rates, brand recognition |

Top-Rated Insurance Agencies Near You

Based on extensive research and industry insights, here are some of the top-rated insurance agencies in your vicinity, along with their specialties and unique offerings:

Acme Insurance Agency

Specialty: Auto, Home, and Business Insurance

Unique Offering: Acme Insurance boasts an innovative online platform that simplifies the insurance shopping experience. Their user-friendly website allows you to compare quotes, customize coverage, and manage your policies digitally.

Blue Sky Insurance Brokers

Specialty: Health and Life Insurance

Unique Offering: Blue Sky’s team of expert brokers specializes in finding the most comprehensive health and life insurance plans tailored to your individual needs. They have a reputation for excellent customer service and a track record of helping clients navigate complex insurance landscapes.

Community Insurance Services

Specialty: All Lines of Insurance

Unique Offering: Community Insurance Services stands out for its strong community focus. They prioritize building long-term relationships with their clients and offer personalized advice to ensure you receive the right coverage at competitive rates. Additionally, they actively support local charities and initiatives.

Evaluating Insurance Agencies

When evaluating insurance agencies, several key factors should be considered to ensure you make an informed decision. Here’s a detailed breakdown of the essential aspects to examine:

Financial Strength and Stability

Assessing an insurance agency’s financial health is crucial. You want to ensure the agency is financially stable and capable of paying out claims promptly. Look for agencies that have been in business for several years and have a strong track record of financial stability. Check their financial ratings from reputable agencies like A.M. Best or Standard & Poor’s to gain insight into their financial strength.

License and Accreditation

Verify that the insurance agency is properly licensed and accredited. Check with your state’s insurance department to ensure the agency is authorized to sell insurance products in your area. Additionally, look for agencies that are members of reputable industry associations, such as the Independent Insurance Agents & Brokers of America (IIABA) or the National Association of Professional Insurance Agents (PIA).

Product Offering and Customization

Evaluate the range of insurance products and services the agency offers. Consider whether they provide the specific types of coverage you require, such as auto, home, health, life, or business insurance. Look for agencies that offer customizable policies to ensure you can tailor your coverage to your unique needs.

Customer Service and Claims Handling

Assess the agency’s reputation for customer service and claims handling. Read online reviews and testimonials to gauge customer satisfaction. Look for agencies that prioritize prompt and efficient claims processing and have a history of resolving customer issues effectively. Consider reaching out to current or past clients to gather firsthand accounts of their experiences.

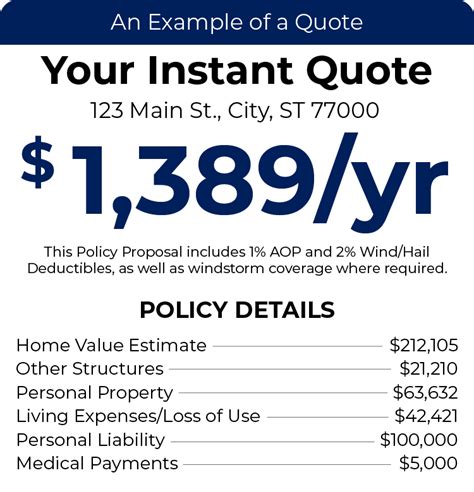

Pricing and Value

Compare insurance quotes from different agencies to ensure you’re getting the best value for your money. While price should not be the sole deciding factor, it’s essential to understand the range of premiums offered for similar coverage. Consider the agency’s reputation, financial stability, and customer satisfaction when evaluating pricing.

Technology and Digital Services

In today’s digital age, many insurance agencies offer online and mobile services to enhance the customer experience. Assess whether the agency provides convenient digital tools for policy management, claim submissions, and billing. Look for agencies that invest in technology to streamline processes and improve customer engagement.

The Benefits of Working with an Insurance Agency

Choosing to work with an insurance agency offers several advantages over direct-to-consumer insurance providers. Here’s a closer look at some of the key benefits:

Personalized Advice and Guidance

Insurance agencies, especially independent ones, offer personalized advice tailored to your unique needs. Their agents are trained to understand your circumstances and recommend the most suitable coverage options. This level of personalization ensures you receive the right protection without overpaying for unnecessary coverage.

Expertise and Experience

Insurance agencies employ licensed professionals with extensive knowledge of the industry. Their expertise can help you navigate complex insurance landscapes, understand your options, and make informed decisions. Whether you have specific questions about coverage or need assistance with a claim, their experience can be invaluable.

Access to Multiple Carriers

Unlike direct-to-consumer providers, insurance agencies often represent multiple insurance carriers. This allows them to shop around and find the best rates and coverage options from various providers. As a result, you can benefit from a wider range of choices and potentially better value for your insurance needs.

Claims Support and Advocacy

When it comes to filing a claim, having an insurance agency on your side can provide significant support and advocacy. They can assist you throughout the claims process, ensuring you receive the full benefits you’re entitled to. Their expertise can help expedite the claims handling process and provide valuable guidance during challenging times.

Local Presence and Community Involvement

Local insurance agencies often have a strong connection to their community. They understand the unique needs and risks associated with your area and can provide specialized advice. Additionally, many local agencies actively participate in community events and charities, fostering a sense of trust and support within the community.

Tips for Choosing the Right Insurance Agency

To help you make an informed decision, here are some additional tips to consider when choosing the best insurance agency for your needs:

- Seek referrals from trusted friends, family, or colleagues who have had positive experiences with insurance agencies.

- Request personalized quotes from multiple agencies to compare rates and coverage options.

- Ask about any additional services or benefits offered, such as discounts, rewards programs, or loyalty incentives.

- Consider the agency's hours of operation and response times to ensure they align with your availability and expectations.

- Read the fine print and understand the terms and conditions of any insurance policies you're considering.

- Don't be afraid to ask questions and clarify any doubts you may have about coverage, exclusions, or claims processes.

Conclusion

Finding the best insurance agency near you requires careful consideration of your unique insurance needs, thorough research, and a comprehensive evaluation of agencies’ offerings. By understanding your requirements, researching top-rated agencies, and evaluating key factors, you can make an informed decision that ensures you receive the coverage and service you deserve. Remember, insurance is an essential investment in your financial well-being, so take the time to choose an agency that aligns with your goals and provides the support you need.

How do I know if an insurance agency is reputable and trustworthy?

+To assess an insurance agency’s reputation and trustworthiness, consider the following factors: check their financial stability through ratings from agencies like A.M. Best, verify their licensing and accreditation with your state’s insurance department, read online reviews and testimonials, and reach out to current or past clients for firsthand accounts of their experiences. A reputable agency will have a strong track record of financial stability, proper licensing, positive customer feedback, and a history of effective claims handling.

What should I do if I’m unsure about the coverage I need?

+If you’re unsure about the coverage you need, it’s best to consult with a licensed insurance agent or broker. They can assess your unique circumstances, explain your options, and recommend the most suitable coverage based on your needs. Don’t hesitate to ask questions and seek clarification to ensure you fully understand the coverage you’re considering.

How can I compare insurance quotes from different agencies?

+To compare insurance quotes effectively, follow these steps: identify the types of coverage you require (e.g., auto, home, health), gather quotes from multiple agencies for the same coverage, and compare the premiums, policy terms, and any additional benefits or discounts offered. Consider the agency’s reputation, financial stability, and customer satisfaction when evaluating the quotes. It’s important to ensure you’re comparing apples to apples to make an informed decision.

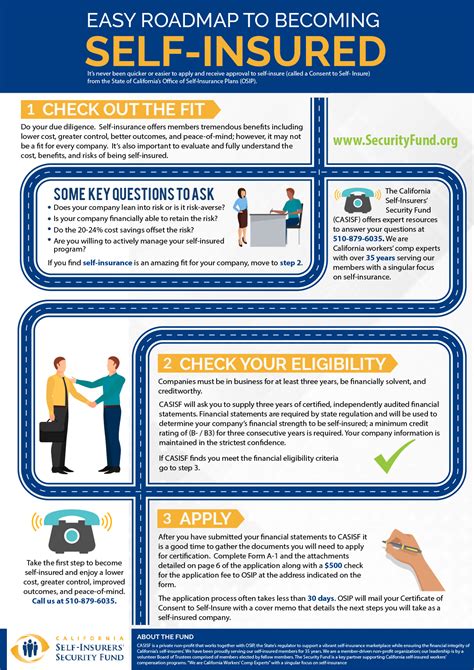

What if I have a unique insurance need or a specialized risk?

+If you have a unique insurance need or a specialized risk, it’s best to work with an independent insurance agency that has expertise in handling such cases. These agencies often have access to a wider range of insurance carriers and can find specialized coverage to meet your specific requirements. They can guide you through the process and ensure you receive the necessary protection.