Best Home Insurance Companies In California

In the sunny state of California, where dreams are made and the Golden Gate Bridge stands tall, homeownership is a common pursuit. As such, choosing the right home insurance company becomes a crucial decision to protect your biggest investment. With a vast array of options available, navigating the market can be daunting. This comprehensive guide will delve into the best home insurance companies operating in the Golden State, offering an insightful overview to assist you in making an informed choice.

The Golden Standard: Top-Rated Home Insurance Providers in California

California’s diverse landscape, from the Pacific Coast to the Sierra Nevada Mountains, presents a unique set of challenges for homeowners. Whether it’s the threat of wildfires, earthquakes, or the occasional heavy rainfall, the right insurance coverage is essential. Here, we unveil the cream of the crop in home insurance providers, tailored to meet the specific needs of California residents.

USAA: A Military-Focused Provider with Nationwide Reach

USAA stands out as a leading provider, primarily catering to military members, veterans, and their families. With an A++ rating from AM Best and an impressive J.D. Power rating, USAA offers comprehensive coverage at competitive rates. Their unique military-focused approach ensures that those who have served our country receive the best protection for their homes.

USAA’s coverage options include:

- Dwelling Coverage: Protects the structure of your home.

- Personal Property Coverage: Covers your belongings against theft, damage, or destruction.

- Liability Protection: Provides financial protection in case of lawsuits or accidents on your property.

- Additional Living Expenses: Covers temporary living expenses if your home becomes uninhabitable due to a covered event.

State Farm: A Reliable Choice with Customized Plans

State Farm is a well-known and trusted name in the insurance industry, offering a range of policies tailored to individual needs. With an A++ rating from AM Best, State Farm provides comprehensive home insurance coverage with a focus on customer satisfaction. Their personalized approach ensures that you receive a plan that suits your specific circumstances.

Key coverage options from State Farm include:

- Dwelling Protection: Covers the physical structure of your home against damages.

- Personal Property Coverage: Protects your belongings from theft, fire, or other covered perils.

- Liability Coverage: Provides financial protection if someone gets injured on your property.

- Additional Living Expenses: Covers temporary living costs if you need to evacuate your home due to a covered event.

Farmers Insurance: A Local Approach with National Strength

Farmers Insurance Group offers a unique blend of local knowledge and national strength. With an A rating from AM Best, Farmers provides a range of coverage options to meet the diverse needs of California homeowners. Their localized approach ensures that they understand the specific risks and challenges faced by residents in different parts of the state.

Farmers Insurance offers:

- Dwelling Coverage: Protects your home’s structure against damages caused by covered perils.

- Personal Property Coverage: Covers your belongings against theft, fire, or other specified events.

- Liability Protection: Provides financial coverage if someone gets injured on your property.

- Additional Coverages: Options like identity theft protection, earthquake coverage, and more can be added to your policy.

Mercury Insurance: Tailored Coverage for California Residents

Mercury Insurance is a California-based provider with a strong focus on offering tailored coverage to meet the unique needs of Golden State residents. With an A rating from AM Best, Mercury provides a range of coverage options designed to protect homeowners against the specific challenges faced in California.

Mercury’s home insurance coverage includes:

- Dwelling Coverage: Protects the physical structure of your home against covered perils.

- Personal Property Coverage: Covers your belongings against theft, fire, or other specified events.

- Liability Coverage: Provides financial protection if someone gets injured on your property.

- Additional Living Expenses: Covers the cost of temporary housing if your home becomes uninhabitable due to a covered event.

Allstate: Nationwide Provider with Customizable Plans

Allstate is a well-known national provider offering a range of customizable plans to meet the diverse needs of homeowners. With an A rating from AM Best, Allstate provides comprehensive coverage with a focus on innovation and customer service. Their customizable approach ensures that you can build a policy that suits your specific requirements.

Allstate’s home insurance coverage includes:

- Dwelling Coverage: Protects the physical structure of your home against covered perils.

- Personal Property Coverage: Covers your belongings against theft, fire, or other specified events.

- Liability Coverage: Provides financial protection if someone gets injured on your property.

- Additional Coverages: Options like identity protection, home business coverage, and more can be added to your policy.

Choosing the Right Coverage: A Guide to Tailoring Your Policy

When selecting a home insurance policy, it’s crucial to consider your specific needs and the unique risks associated with your location. California residents, for instance, may need to consider additional coverage for earthquakes or wildfires. Here’s a step-by-step guide to help you choose the right coverage for your home.

Assess Your Risks

Start by evaluating the potential risks your home faces. Consider factors like:

- Location: Is your home in an area prone to natural disasters like earthquakes, wildfires, or floods?

- Structure: What is the age and condition of your home? Older homes may require more extensive coverage.

- Personal Belongings: Do you have valuable possessions like jewelry, art, or electronics that may need additional coverage?

- Liability: Are there any specific liability risks associated with your property, such as a swimming pool or trampoline?

Compare Coverage Options

Once you’ve assessed your risks, it’s time to compare coverage options. Look for providers that offer:

- Comprehensive Coverage: Ensure your policy covers a wide range of perils, including fire, theft, and natural disasters.

- Customizable Options: Choose a provider that allows you to tailor your policy to your specific needs.

- Additional Coverages: Consider adding optional coverages like earthquake, flood, or identity theft protection.

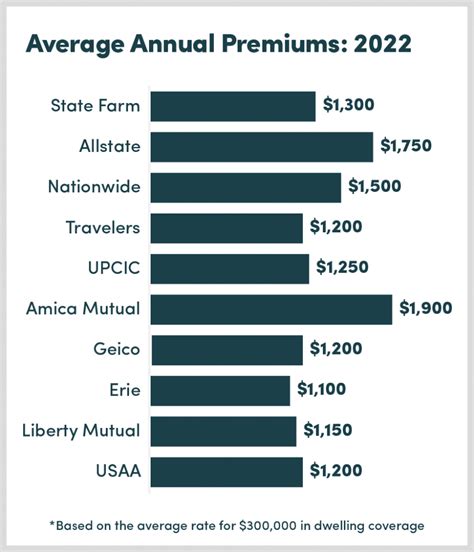

Evaluate Cost and Value

While cost is an important factor, it’s crucial to balance it with the value and coverage provided. Consider:

- Premium Costs: Compare the annual premiums offered by different providers for similar coverage.

- Deductibles: Higher deductibles can lower your premium, but ensure you can afford the out-of-pocket expense in the event of a claim.

- Discounts: Look for providers that offer discounts for things like home safety features, multi-policy bundles, or loyalty.

Read Reviews and Ratings

Researching reviews and ratings can provide valuable insights into a provider’s reputation and customer service. Look for:

- AM Best Ratings: This independent agency assesses the financial strength of insurance companies.

- J.D. Power Ratings: J.D. Power evaluates customer satisfaction and claim handling processes.

- Online Reviews: Read reviews from current and former customers to gauge satisfaction levels.

The Bottom Line: Making an Informed Decision

Choosing the right home insurance provider is a critical decision that can provide peace of mind and financial protection. In California, where the risks can be diverse and unique, selecting a provider that understands the local landscape is essential. Whether you opt for a provider like USAA, State Farm, Farmers, Mercury, or Allstate, ensure your policy is tailored to your specific needs and provides comprehensive coverage.

Remember, home insurance is not a one-size-fits-all solution. Take the time to understand your risks, compare coverage options, and choose a provider that offers the best value and protection for your home. With the right policy in place, you can rest easy knowing your biggest investment is secure.

How do I know if my home insurance covers earthquakes in California?

+Earthquake coverage is typically not included in standard home insurance policies in California. You may need to purchase a separate earthquake policy or add an endorsement to your existing policy to ensure coverage for this specific peril. It’s essential to review your policy documents or consult with your insurance provider to understand your coverage.

What factors determine the cost of home insurance in California?

+The cost of home insurance in California can vary based on several factors, including the location and value of your home, the level of coverage you choose, the deductible amount, and any additional endorsements or coverages you add. Other factors may include the age and condition of your home, the presence of certain safety features, and your claims history.

Can I get home insurance if I own a historic home in California?

+Yes, you can obtain home insurance for a historic home in California. However, due to the unique risks and potential challenges associated with older homes, you may need to work with a specialized insurer who understands the specific needs of historic properties. These insurers may offer customized coverage to address issues like outdated electrical systems, aging plumbing, or potential damage from natural disasters.