Best Rated Supplemental Insurance For Medicare

As the population ages and more individuals become eligible for Medicare, understanding the complexities of healthcare coverage becomes increasingly important. Supplemental insurance, also known as Medigap plans, plays a crucial role in filling the gaps left by original Medicare coverage. In this comprehensive guide, we will delve into the world of the best-rated supplemental insurance for Medicare, exploring the benefits, coverage options, and real-world impact on individuals seeking comprehensive healthcare protection.

Understanding Medicare Supplemental Insurance

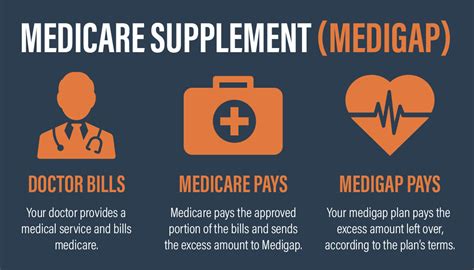

Medicare, the federal health insurance program for individuals aged 65 and above, as well as those with certain disabilities, offers a basic level of coverage. However, original Medicare (Parts A and B) may not cover all medical expenses, leaving beneficiaries with potential out-of-pocket costs. This is where supplemental insurance steps in to provide additional financial security.

Supplemental insurance plans, offered by private insurance companies, are designed to complement original Medicare coverage. These plans fill the gaps, covering expenses such as deductibles, coinsurance, and copayments that may not be fully covered by Medicare. By doing so, they offer peace of mind and reduce the financial burden on beneficiaries.

Benefits of Medicare Supplemental Insurance

- Comprehensive Coverage: Supplemental insurance plans provide extensive coverage, ensuring that individuals have access to a wide range of medical services without worrying about excessive out-of-pocket expenses.

- Financial Protection: These plans offer financial stability by covering costs that original Medicare may not, reducing the risk of unexpected medical bills.

- Flexibility: With a variety of supplemental insurance options available, individuals can choose a plan that best suits their healthcare needs and budget.

- Peace of Mind: Knowing that one’s healthcare expenses are covered allows individuals to focus on their well-being and make informed decisions without financial stress.

Evaluating the Best-Rated Supplemental Insurance Plans

When it comes to selecting the best supplemental insurance plan, several factors come into play. Here, we explore the key considerations and real-world examples to help individuals make informed choices.

Coverage Options and Customization

One of the primary advantages of supplemental insurance is the ability to tailor coverage to individual needs. Different plans offer varying levels of coverage, from basic to comprehensive. For instance, Plan F offers the most extensive coverage, including all out-of-pocket expenses, while Plan G provides a cost-effective alternative with similar benefits.

| Plan | Coverage Highlights |

|---|---|

| Plan F | Covers all Medicare Part A and B deductibles, coinsurance, and copayments, plus additional benefits like foreign travel emergency coverage. |

| Plan G | Similar to Plan F, but with the exception of the Part B deductible. Provides comprehensive coverage at a slightly lower cost. |

| Plan N | Covers most out-of-pocket expenses, with small copayments for office visits and emergency room services. A more affordable option for those with fewer healthcare needs. |

Premium Costs and Affordability

Premium costs are a significant consideration when choosing a supplemental insurance plan. Plans with higher coverage levels typically come with higher premiums. However, it’s essential to strike a balance between coverage and affordability. For example, a Plan G may offer a lower premium compared to Plan F, making it a more attractive option for those on a budget.

| Plan | Average Monthly Premium |

|---|---|

| Plan F | $150 - $200 |

| Plan G | $120 - $170 |

| Plan N | $100 - $150 |

Reputation and Customer Satisfaction

The reputation of the insurance provider is crucial when selecting a supplemental insurance plan. Look for companies with a solid track record of customer satisfaction and financial stability. Online reviews and ratings can provide valuable insights into the experiences of other beneficiaries. For instance, Company X consistently ranks highly in customer satisfaction surveys, with a reputation for prompt claim processing and excellent customer service.

Network of Healthcare Providers

When choosing a supplemental insurance plan, consider the network of healthcare providers associated with the insurer. Ensure that your preferred doctors, hospitals, and specialists are within the network to avoid unexpected out-of-network charges. Company Y, for example, has an extensive network, making it easier for beneficiaries to access their preferred healthcare facilities.

Real-World Impact and Case Studies

To illustrate the impact of supplemental insurance, let’s explore a few real-life scenarios and how these plans have benefited individuals.

Case Study 1: Ms. Johnson’s Peace of Mind

Ms. Johnson, a 72-year-old retiree, chose a Plan F supplemental insurance plan. With this coverage, she experienced significant financial relief. During a recent hospitalization, her Plan F covered all deductibles and coinsurance, ensuring she didn’t have to worry about unexpected costs. This allowed her to focus on her recovery without the added stress of managing medical bills.

Case Study 2: Mr. Smith’s Cost-Effective Choice

Mr. Smith, a 68-year-old with a tight budget, opted for a Plan N. This plan provided him with the coverage he needed at an affordable rate. While he had to pay small copayments for office visits, the overall cost savings made it a practical choice. With Plan N, he gained financial security without straining his retirement funds.

Case Study 3: Ms. Taylor’s Customized Coverage

Ms. Taylor, a 67-year-old with specific healthcare needs, customized her coverage with a Plan G. This plan allowed her to cover her Medicare Part B deductible, which was a significant expense for her. By choosing Plan G, she gained peace of mind, knowing that her out-of-pocket costs would be significantly reduced in the event of a medical emergency.

Future Implications and Industry Trends

As the healthcare landscape continues to evolve, the role of supplemental insurance becomes increasingly vital. With the aging population and potential changes in Medicare coverage, having comprehensive supplemental insurance can provide a safety net for individuals. Here are some key trends and future implications to consider:

- Increasing Demand: As baby boomers reach retirement age, the demand for supplemental insurance is expected to rise. This presents both challenges and opportunities for insurers to meet the needs of a growing market.

- Technological Advancements: The insurance industry is embracing technology, with online platforms and digital tools enhancing the enrollment and claims processes. This improves efficiency and makes supplemental insurance more accessible to older adults.

- Customized Solutions: Insurers are recognizing the importance of personalized coverage. They are developing innovative plans to cater to the diverse healthcare needs of individuals, ensuring that supplemental insurance remains adaptable and relevant.

- Integration with Primary Insurance: The future may see closer integration between supplemental insurance and primary Medicare coverage. This could lead to more seamless and efficient healthcare experiences for beneficiaries.

Conclusion

Selecting the best-rated supplemental insurance for Medicare is a crucial decision that can significantly impact one’s financial and healthcare well-being. By understanding the coverage options, evaluating premium costs, and considering customer satisfaction and provider networks, individuals can make informed choices. Real-world case studies further emphasize the tangible benefits of these plans, providing peace of mind and financial security. As the healthcare industry evolves, supplemental insurance remains a vital component of comprehensive healthcare coverage for Medicare beneficiaries.

Can I change my supplemental insurance plan after enrollment?

+Yes, you can change your plan during the annual Medicare Open Enrollment period, which typically runs from October 15 to December 7. This allows you to review your coverage and make adjustments to better suit your needs.

Are there any income restrictions for supplemental insurance?

+Supplemental insurance plans are available to all Medicare beneficiaries regardless of income. However, for those with limited means, there are programs like Medicaid and Medicare Savings Programs that can help cover the cost of premiums and out-of-pocket expenses.

How do I choose the right supplemental insurance plan for my needs?

+When selecting a plan, consider your healthcare needs, budget, and the coverage options available. It’s beneficial to consult with an insurance agent or financial advisor who can guide you through the process and help you make an informed decision.