Travel Insurance Medical Coverage

In an era where global travel is more accessible than ever, understanding the intricacies of travel insurance, particularly medical coverage, is paramount. This comprehensive guide aims to shed light on the essential aspects of travel insurance medical coverage, offering insights and advice to ensure you're fully prepared for your journeys.

Unraveling Travel Insurance Medical Coverage

Travel insurance is a vital component of any trip, especially when it comes to safeguarding your health and well-being while abroad. Medical coverage within travel insurance policies provides a safety net, ensuring you receive the necessary medical care should an unexpected illness or injury occur during your travels. This section aims to delve into the key components of travel insurance medical coverage, providing a thorough understanding of its benefits and limitations.

The Importance of Medical Coverage

When traveling, unforeseen medical emergencies can occur, ranging from minor ailments to more serious health issues. Without adequate medical coverage, the financial burden of such emergencies can be significant, often resulting in costly medical bills and potential repatriation expenses. Medical coverage in travel insurance policies is designed to cover these expenses, providing financial protection and peace of mind.

Moreover, medical coverage can also offer access to a network of medical providers, ensuring you receive quality healthcare regardless of your location. This aspect is particularly crucial when traveling to destinations with varying healthcare standards.

Understanding Policy Terms and Conditions

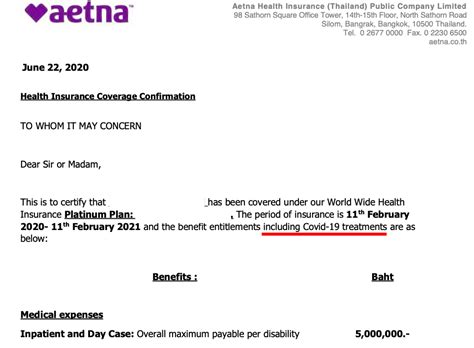

Every travel insurance policy with medical coverage comes with its own set of terms and conditions. These conditions outline the scope of coverage, including the types of medical expenses covered, any pre-existing condition exclusions, and the geographical limits of the policy.

It's crucial to thoroughly review these terms before purchasing a policy. Key aspects to consider include the coverage limits for different types of medical expenses, such as hospital stays, emergency treatments, prescription medications, and even dental care. Additionally, understanding any waiting periods or exclusions related to pre-existing conditions is essential to ensure you're fully protected.

| Policy Aspect | Details |

|---|---|

| Coverage Limits | Specifies the maximum amount the insurance provider will pay for various medical expenses. |

| Pre-existing Condition Exclusions | Outlines any conditions or illnesses that existed prior to the policy start date, which may not be covered. |

| Geographical Limits | Defines the regions where the policy is valid, often excluding certain high-risk areas or specific countries. |

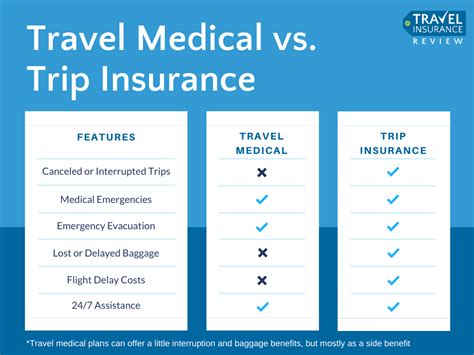

Comparing Policies for Optimal Coverage

Given the variety of travel insurance policies available, it's essential to compare different options to find the one that best suits your needs. Consider factors such as the overall coverage limits, the range of covered medical expenses, and any additional benefits like emergency medical evacuation or repatriation.

Look for policies that provide comprehensive coverage, ensuring you're protected for a wide range of medical scenarios. This includes not only acute illnesses and injuries but also chronic conditions and mental health issues that may require specialized care.

Real-Life Scenarios and Case Studies

To illustrate the importance and value of travel insurance medical coverage, let's explore a few real-life scenarios:

Scenario 1: Emergency Appendicitis

Imagine you're on a backpacking trip through Europe when you suddenly develop acute appendicitis. Without travel insurance, the cost of surgery and hospitalization could easily exceed $10,000. However, with a robust travel insurance policy, these expenses are covered, ensuring you receive the necessary treatment without financial strain.

Scenario 2: Ski Accident

During a skiing holiday in the Alps, you suffer a severe injury to your knee. Without insurance, the cost of emergency medical treatment, transportation to a specialized facility, and potential surgery could be prohibitive. However, with medical coverage, these expenses are covered, providing access to the best possible care.

Scenario 3: Mental Health Support

Travel can be emotionally and mentally challenging, and sometimes travelers may require mental health support. A comprehensive travel insurance policy can cover the cost of therapy sessions, medication, and even repatriation if necessary, ensuring travelers receive the care they need.

Maximizing Your Travel Insurance Benefits

To ensure you fully utilize the benefits of your travel insurance medical coverage, consider the following strategies:

1. Keep Your Policy Information Handy

Ensure you have easy access to your policy documents and emergency contact numbers. Keep digital copies on your phone and consider printing a physical copy for your travel bag. This ensures you can quickly access the necessary information in case of an emergency.

2. Understand Your Coverage Limits

Familiarize yourself with the coverage limits of your policy, especially for major medical expenses like hospital stays and emergency treatments. This awareness can help you make informed decisions about seeking medical care and managing your finances while traveling.

3. Know Your Rights and Responsibilities

Understand your rights and responsibilities as a policyholder. This includes knowing when and how to make a claim, the documentation required, and any time limits for claiming. Being well-informed can streamline the claims process and ensure you receive the full benefits of your policy.

Future Implications and Industry Trends

As the travel industry continues to evolve, so too does the landscape of travel insurance. Here are some key trends and future implications to consider:

1. Growing Focus on Digitalization

The travel insurance industry is increasingly embracing digitalization, with more insurers offering online policy management and claims processes. This trend is expected to continue, providing travelers with greater convenience and accessibility.

2. Expansion of Coverage Options

Travel insurance providers are expanding their coverage options to cater to a wider range of travelers and travel scenarios. This includes offering more comprehensive medical coverage, as well as specialized policies for adventure sports, study abroad programs, and other niche travel experiences.

3. Emphasis on Preventative Care

There's a growing recognition of the importance of preventative care in travel insurance. This includes coverage for vaccinations, pre-travel medical consultations, and access to telemedicine services while abroad. Such initiatives aim to reduce the risk of medical emergencies and promote traveler health and well-being.

Frequently Asked Questions

What happens if I need medical treatment while abroad and my insurance policy doesn't cover it?

+If your travel insurance policy doesn't cover a particular medical treatment or expense, you may have to pay out of pocket. It's important to carefully review your policy's terms and conditions before traveling to understand what's covered and what isn't. Additionally, consider seeking alternative sources of funding, such as personal savings or loans, to cover any unexpected costs.

How do I know if my travel insurance policy covers pre-existing medical conditions?

+Pre-existing condition coverage in travel insurance policies can vary widely. Some policies may offer full coverage for pre-existing conditions, while others may have exclusions or require additional premiums for coverage. It's crucial to review your policy's terms and conditions, especially the section on pre-existing conditions, to understand what's covered and any potential limitations or exclusions. If you have specific concerns or questions, contact your insurance provider directly for clarification.

Can I purchase travel insurance if I'm already abroad and need medical coverage for an extended trip?

+Yes, it's possible to purchase travel insurance while you're already abroad. Many insurance providers offer policies that can be purchased during your trip, although the availability and terms may vary. It's important to research and compare different providers to find the best coverage for your needs. Keep in mind that some policies may have restrictions or exclusions for certain situations or locations, so be sure to review the terms carefully before purchasing.

Travel insurance, particularly its medical coverage aspect, is a critical component of any travel plan. By understanding the intricacies of medical coverage, comparing policies, and staying informed about industry trends, travelers can ensure they’re fully prepared for any medical emergencies that may arise during their journeys.