Finding Car Insurance Quotes

In the realm of personal finance and vehicle ownership, the quest for affordable and comprehensive car insurance is a perennial concern. With a myriad of insurance providers and policies, securing the right coverage at the best price can be a daunting task. This comprehensive guide aims to demystify the process of obtaining car insurance quotes, offering an expert's insight into navigating the complex landscape of automotive insurance.

Understanding Car Insurance Quotes: An Overview

Car insurance quotes are tailored estimates provided by insurance companies, detailing the cost and coverage of a potential policy. These quotes are based on various factors, including the driver’s profile, the vehicle, and the desired level of coverage. Obtaining multiple quotes is crucial, as it allows for a comprehensive comparison, ensuring the best value and coverage.

The insurance landscape is diverse, with numerous providers offering a wide array of policies. Each provider uses unique algorithms and considerations when calculating quotes, resulting in varying prices and coverage options. Therefore, understanding the key elements that influence these quotes is vital for making an informed decision.

Factors Influencing Car Insurance Quotes

Numerous factors contribute to the complexity of car insurance quotes. These include the driver’s age, gender, driving history, and location. The type and value of the vehicle, its usage, and the desired coverage level are also significant. Additionally, external factors such as local crime rates, weather conditions, and even the time of year can influence insurance quotes.

| Factor | Impact |

|---|---|

| Driver's Age | Younger drivers are often considered higher risk, leading to higher premiums. |

| Driving History | A clean driving record with no accidents or violations can result in lower premiums. |

| Vehicle Type | Sports cars or luxury vehicles may attract higher premiums due to their higher repair costs. |

| Coverage Level | Comprehensive coverage will typically cost more than basic liability coverage. |

The Process of Obtaining Car Insurance Quotes

Securing car insurance quotes involves a systematic process, often requiring a thorough understanding of one’s insurance needs and a detailed exploration of various providers. Here’s a step-by-step guide to navigating this process effectively.

Step 1: Define Your Insurance Needs

Before requesting quotes, it’s crucial to understand your specific insurance needs. Consider factors such as the primary use of your vehicle (e.g., daily commute, occasional leisure trips), the value of your vehicle, and the level of coverage you desire. Do you require comprehensive coverage for damages and theft, or are you more interested in basic liability coverage to protect against accidents you cause?

Step 2: Research Insurance Providers

The insurance market is vast, with numerous providers offering unique policies and coverage options. Researching these providers is essential to ensure you receive quotes from companies that align with your needs. Look for reputable providers with a solid financial background and a history of fair claims processing. Online reviews and ratings can be a helpful guide, but it’s important to verify the information and consider multiple sources.

Step 3: Gather Required Information

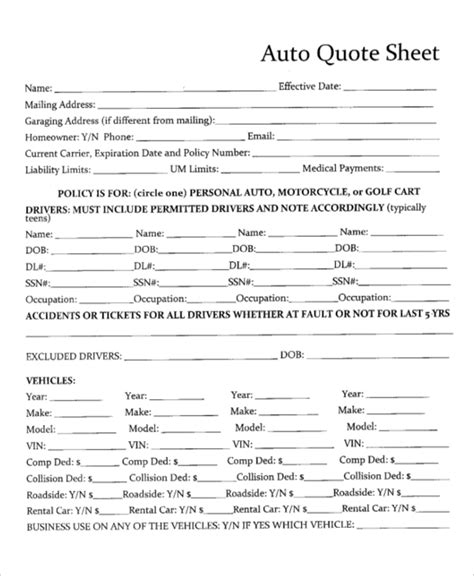

To obtain accurate quotes, you’ll need to provide specific information to insurance providers. This typically includes personal details like your name, date of birth, and driver’s license number. Additionally, you’ll need to provide information about your vehicle, such as the make, model, year, and VIN (Vehicle Identification Number). Some providers may also require details about your driving history, including any accidents or violations.

Step 4: Request Quotes

There are several ways to request car insurance quotes. You can visit insurance provider websites and fill out online quote forms, call providers directly, or even visit their physical offices. Many providers offer instant online quotes, while others may require a more detailed process, especially if you’re seeking comprehensive coverage.

When requesting quotes, be sure to provide accurate and detailed information. Inconsistencies or errors can lead to incorrect quotes, which may cause issues when you decide to purchase a policy.

Step 5: Compare Quotes

Once you’ve gathered several quotes, it’s time to compare them. Look beyond the price and consider the coverage details. Ensure that the quotes you’re comparing are for similar coverage levels. Compare the deductibles, policy limits, and any additional benefits or perks offered by the providers.

It's also essential to consider the reputation and financial stability of the insurance providers. A low-cost policy may not be the best value if the provider has a history of slow claims processing or financial instability.

Tips for Securing the Best Car Insurance Quotes

Obtaining car insurance quotes is just the first step. To ensure you secure the best coverage at the most competitive price, consider these expert tips and strategies.

Bundle Your Policies

Many insurance providers offer discounts when you bundle multiple policies with them. If you have other insurance needs, such as home or renters insurance, consider obtaining these policies from the same provider as your car insurance. This can result in significant savings.

Explore Discounts

Insurance providers offer a variety of discounts to attract customers. These can include discounts for safe driving, good grades (for young drivers), multiple vehicles on one policy, and even certain professions or affiliations. Be sure to ask about all available discounts when requesting quotes.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is a newer concept that calculates premiums based on your actual driving habits. This can be a great option for safe drivers who don’t drive frequently. These policies often require the installation of a tracking device in your vehicle or the use of an app that monitors your driving.

Maintain a Good Driving Record

Your driving record is a significant factor in determining your insurance premiums. Maintaining a clean record, free of accidents and violations, can lead to lower quotes. If you have a less-than-perfect record, consider taking a defensive driving course. Many insurance providers offer discounts for completing these courses, and it can also help improve your driving skills.

Shop Around Regularly

Insurance rates and policies can change frequently. It’s a good idea to shop around for new quotes at least once a year, especially if you’ve made significant changes to your vehicle or driving habits. You may find that your current provider is no longer offering the best value, and switching providers can save you money.

Understand Your Coverage Needs

Don’t settle for the first quote you receive, especially if it’s significantly lower than others. Low quotes often come with low coverage limits, which may not provide adequate protection in the event of an accident. Understand your specific coverage needs and ensure that any quote you’re considering meets or exceeds those needs.

Conclusion: Navigating the Car Insurance Landscape

Obtaining car insurance quotes is a crucial step in securing the right coverage for your vehicle. By understanding the factors that influence quotes, following a systematic process, and employing strategic tips, you can navigate the complex insurance landscape with confidence. Remember, the best quote is not always the cheapest, but the one that offers the most comprehensive coverage at a competitive price.

Stay informed, compare quotes regularly, and don't hesitate to seek expert advice when needed. With the right approach, you can find car insurance that suits your needs and your budget.

FAQ

How often should I compare car insurance quotes?

+It’s recommended to compare quotes at least once a year, or whenever you make significant changes to your vehicle or driving habits. Regular comparison ensures you’re always getting the best value for your insurance needs.

What information do I need to provide when requesting car insurance quotes?

+You’ll typically need to provide personal details like your name, date of birth, and driver’s license number. Information about your vehicle, such as the make, model, year, and VIN, is also required. Some providers may also ask about your driving history.

How do I know if I’m getting a good car insurance quote?

+A good quote offers comprehensive coverage at a competitive price. Compare quotes from multiple providers, ensuring they offer similar coverage levels. Also, consider the reputation and financial stability of the insurance provider.

What is usage-based insurance, and is it a good option for me?

+Usage-based insurance calculates premiums based on your actual driving habits. It’s a good option for safe drivers who don’t drive frequently. However, it may not be suitable for those who drive regularly or have a less-than-perfect driving record.