Fdic Insured High Yield Savings Accounts

In today's economic landscape, finding secure and profitable investment options is a top priority for many individuals and businesses. Among the plethora of financial instruments available, FDIC-insured high-yield savings accounts stand out as a reliable choice for those seeking a balance between security and profitability. These accounts offer an attractive combination of safety, liquidity, and competitive interest rates, making them an appealing option for investors who wish to grow their savings without assuming excessive risks.

Understanding FDIC-Insured High-Yield Savings Accounts

FDIC-insured high-yield savings accounts are a type of savings account offered by banks and credit unions in the United States. The Federal Deposit Insurance Corporation (FDIC) is a government agency that insures deposits in member banks, protecting customers' money up to specific limits. This insurance provides a safety net for account holders, ensuring that even if the bank fails, their deposits are safe.

High-yield savings accounts, as the name suggests, offer higher interest rates compared to traditional savings accounts. This higher yield is achieved through various strategies employed by financial institutions, such as offering online-only accounts with lower overhead costs or providing specialized savings accounts with specific terms and conditions.

The Benefits of FDIC Insurance

FDIC insurance is a significant advantage for savers. The coverage ensures that, in the unlikely event of a bank failure, depositors' funds are protected up to $250,000 per depositor, per insured bank, per ownership category. This means that even if the bank goes bankrupt, customers can rest assured that their money is safe and accessible.

Additionally, FDIC insurance promotes confidence in the banking system. It encourages individuals and businesses to save and invest, knowing that their funds are secure. This stability is crucial for a healthy economy, as it fosters trust and encourages long-term financial planning.

| Ownership Category | Coverage Limit |

|---|---|

| Single Account | $250,000 |

| Joint Account | $250,000 per co-owner |

| Trust Accounts | Varies based on beneficiary relationships |

| Business Accounts | $250,000 per ownership category |

Features of High-Yield Savings Accounts

High-yield savings accounts offer several features that make them an attractive option for savers. Firstly, these accounts typically provide higher interest rates compared to standard savings accounts, allowing your money to grow at a faster pace. For example, while a traditional savings account might offer an annual percentage yield (APY) of 0.01% to 0.05%, high-yield accounts can provide APYs of 0.5% or higher, depending on market conditions and the financial institution.

Secondly, high-yield savings accounts often come with convenient online features. Many banks and credit unions now offer digital banking platforms, allowing customers to manage their accounts remotely. This includes mobile check deposits, online transfers, and real-time account monitoring, providing savers with flexibility and control over their finances.

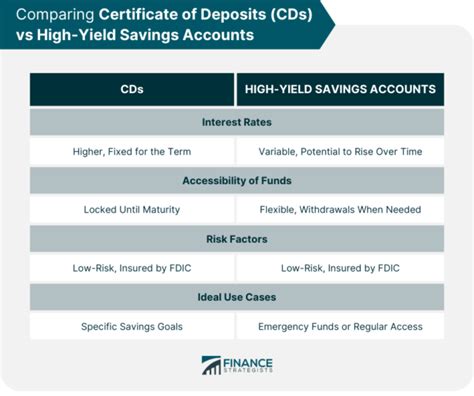

Lastly, high-yield savings accounts are known for their liquidity. Unlike fixed-term investments like certificates of deposit (CDs), high-yield savings accounts allow for easy access to funds without penalty. This means that savers can withdraw their money at any time without incurring additional fees, making these accounts a convenient and flexible savings option.

Maximizing Returns with High-Yield Savings Accounts

While high-yield savings accounts offer competitive interest rates, it's important to understand how to maximize your returns. Here are some strategies to consider:

Shop Around for the Best Rates

Interest rates can vary significantly between financial institutions. It's crucial to compare rates and terms from multiple banks and credit unions to find the best deal. Online comparison tools and financial websites can make this process easier, providing a quick overview of the current market rates.

Additionally, consider the potential for rate increases. Some high-yield savings accounts offer introductory rates that are significantly higher than the standard APY. While these rates might not last forever, they can provide a substantial boost to your savings during the promotional period.

Take Advantage of Compound Interest

Compound interest is a powerful tool for growing your savings. It's the interest earned on both the initial deposit and the accumulated interest from previous periods. High-yield savings accounts often compound interest daily or monthly, which means your balance grows faster over time.

To maximize the benefits of compound interest, consider making regular contributions to your savings account. The more frequently you contribute, the more opportunities your savings have to earn interest on interest, accelerating the growth of your balance.

Explore Additional Benefits

Beyond interest rates, some high-yield savings accounts offer additional perks. These can include cash bonuses for opening an account, rewards programs, or special discounts on other financial products. While these benefits might not directly impact your savings, they can provide extra value and incentives for choosing a particular financial institution.

Choosing the Right High-Yield Savings Account

With a plethora of options available, selecting the right high-yield savings account can be a daunting task. Here are some key factors to consider when making your decision:

Interest Rates and APY

The most obvious consideration is the interest rate and APY offered by the financial institution. While higher rates are generally more appealing, it's important to understand the terms and conditions attached to these rates. Some banks might offer promotional rates for a limited time, while others might require a certain balance to qualify for the advertised APY.

Fees and Minimum Balances

High-yield savings accounts should generally have low or no fees. However, it's important to review the fine print to ensure there aren't hidden costs. Some accounts might charge fees for certain transactions, account maintenance, or for falling below a minimum balance requirement. Be sure to understand these fees and how they might impact your savings strategy.

Convenience and Accessibility

Consider the convenience and accessibility of the savings account. Do you prefer a brick-and-mortar bank with physical branches, or are you comfortable with an online-only institution? Online banks often offer higher rates due to their lower overhead costs, but they might not provide the same level of personal service as traditional banks.

Additionally, think about the account's accessibility. Can you easily transfer funds to and from the account? Are there any limitations on the number of transactions or withdrawals you can make in a given period? These factors can impact your ability to manage your finances effectively.

FDIC Insurance Coverage

While all FDIC-insured high-yield savings accounts provide a level of protection, it's important to understand the specifics of this coverage. Ensure that the financial institution is a member of the FDIC and that your deposits are within the insured limits. If you have multiple accounts at the same bank, consider how these accounts are categorized to maximize your insurance coverage.

Performance Analysis and Future Outlook

High-yield savings accounts have become increasingly popular in recent years, offering a stable and secure alternative to riskier investment options. The market for these accounts is highly competitive, with financial institutions continually striving to offer the best rates and terms to attract savers.

Historical Performance

Over the past decade, high-yield savings accounts have provided steady returns, with APYs typically ranging from 0.5% to 2.5%. While these rates might not seem significant, they offer a reliable and consistent growth opportunity for savers. For example, a savings account with an APY of 1.5% would grow your balance by approximately 1.5% per year, tax-deferred.

It's important to note that interest rates are influenced by various economic factors, including the federal funds rate and market competition. As a result, the APY on high-yield savings accounts can fluctuate over time. During periods of economic growth and low inflation, rates tend to be higher, while economic downturns or periods of high inflation can lead to lower rates.

Future Projections

Looking ahead, the future of high-yield savings accounts appears promising. With the ongoing digital transformation of the banking industry, online-only banks are expected to continue gaining popularity, offering even more competitive rates and innovative features. Additionally, the recent trend of increasing interest rates set by the Federal Reserve suggests that savers might see higher returns in the coming years.

However, it's essential to remain cautious and vigilant. Economic conditions can change rapidly, and unexpected events, such as global pandemics or financial crises, can impact interest rates and the overall financial landscape. Savers should stay informed and regularly review their savings strategies to ensure they are maximizing their returns while maintaining a balanced approach to risk.

FAQs

How do I open a high-yield savings account?

+Opening a high-yield savings account typically involves a simple online application process. You'll need to provide personal information, such as your name, address, and social security number. Some institutions might require a minimum deposit to open the account, but these amounts are often low and easily attainable.

Are there any limitations on withdrawals from high-yield savings accounts?

+Generally, high-yield savings accounts offer unlimited withdrawals and transfers. However, it's important to review the account terms and conditions, as some institutions might impose limitations or fees for excessive transactions.

Can I have multiple high-yield savings accounts at different banks?

+Yes, you can have multiple high-yield savings accounts at different financial institutions. This can be a strategic approach to maximize your savings and take advantage of different interest rates and account features. However, be mindful of FDIC insurance limits to ensure your deposits are fully covered.

Are there any tax implications for high-yield savings accounts?

+Yes, the interest earned on high-yield savings accounts is subject to federal and state income taxes. The financial institution will typically send you a 1099-INT form at the end of the year, which you'll need to include in your tax filings. It's important to consult with a tax professional to understand the specific implications for your situation.

In conclusion, FDIC-insured high-yield savings accounts offer a compelling balance of security and profitability. With competitive interest rates, convenient online features, and FDIC insurance, these accounts provide a reliable option for individuals and businesses seeking to grow their savings. By understanding the market, comparing rates, and making informed decisions, savers can maximize their returns and achieve their financial goals.