Car Insurance For A Rental

When you're planning a trip and considering renting a car, one crucial aspect that often arises is the need for car insurance. Ensuring adequate coverage for your rental vehicle is essential to protect yourself financially and legally in the event of an accident or unforeseen circumstances. This comprehensive guide will delve into the world of car insurance for rentals, providing you with expert insights and practical tips to navigate this often complex landscape.

Understanding the Basics: Car Insurance for Rentals

Renting a car is an exciting prospect, offering freedom and flexibility during your travels. However, it also comes with responsibilities, particularly regarding insurance. Car insurance for rentals is a specialized form of coverage designed to protect both the renter and the rental company in the event of an accident or damage to the vehicle. It’s important to note that the insurance landscape can vary significantly between different rental companies and even between different locations within the same company.

The primary purpose of rental car insurance is to provide financial protection. It covers a range of potential issues, including damage to the rental vehicle, liability for injuries or property damage caused to others in an accident, and, in some cases, personal belongings lost or damaged during the rental period. Understanding the different types of coverage and their implications is key to making informed decisions when renting a car.

Key Coverage Types for Rental Car Insurance

- Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW): This is the most fundamental type of coverage, protecting you from the costs of damage to the rental car. It typically waives your liability for any collision-related damage, provided the accident was not caused by gross negligence or intentional damage.

- Liability Insurance: Liability coverage is essential to protect you in the event you cause damage to a third party’s property or injure someone in an accident. It covers medical expenses, property damage, and legal fees that may arise from such incidents.

- Personal Accident Insurance (PAI): PAI provides coverage for the driver and passengers in the event of an accident, offering compensation for medical expenses, loss of income, and even death or permanent disability.

- Personal Effects Coverage: This type of insurance covers personal belongings left in the rental car in the event of theft or damage. It’s particularly useful for travelers carrying valuable items such as laptops or jewelry.

- Supplemental Liability Insurance (SLI): SLI provides additional liability coverage, increasing the limits of your standard liability insurance. This is beneficial for travelers concerned about the potential costs of severe accidents or lawsuits.

It's important to carefully review the terms and conditions of each coverage type to ensure you fully understand the benefits and limitations. Different rental companies may offer these coverages under different names or with varying levels of coverage, so it's crucial to compare policies and choose the one that best suits your needs and provides adequate protection.

Navigating the Insurance Landscape: Tips and Strategies

Renting a car and navigating the insurance options can be a daunting task. Here are some expert tips and strategies to help you make informed decisions and ensure you’re adequately covered:

1. Check Your Existing Insurance Policies

Before renting a car, it’s essential to review your existing insurance policies. Many auto insurance policies include some level of coverage for rental cars. Check with your insurance provider to understand the extent of this coverage. It may cover collision damage, liability, or both, providing a solid foundation for your rental insurance needs.

Additionally, review your credit card benefits. Many credit cards offer rental car insurance as a cardholder benefit, often providing collision and liability coverage. However, it's crucial to note that these benefits usually come with conditions and limitations, such as rental duration limits or specific rental company requirements. Make sure to read the fine print to understand the exact coverage and any exclusions.

2. Understand the Rental Company’s Insurance Options

Each rental company offers its own set of insurance options, often with varying levels of coverage and prices. When renting a car, take the time to carefully review the insurance options provided by the rental company. Compare the different packages and their coverage limits to ensure you’re getting the right level of protection for your needs.

Some rental companies may offer packages that bundle different types of coverage, providing a more comprehensive solution. Others may offer basic coverage with the option to add additional protection for a fee. It's essential to understand the specifics of each package to make an informed decision.

3. Consider Your Risk Profile and Needs

Everyone’s insurance needs are unique. Consider your personal risk profile and the specific needs of your trip when choosing insurance coverage. Factors such as your driving experience, the duration of your rental, the destination, and the type of car you’re renting can all influence the level of coverage you require.

For example, if you're renting a car for a short period in a low-risk area and you already have comprehensive insurance coverage through your auto policy or credit card, you may only need basic liability insurance. On the other hand, if you're renting an expensive car for an extended period in a high-risk area, you may want to consider more comprehensive coverage to protect yourself financially.

4. Compare Prices and Shop Around

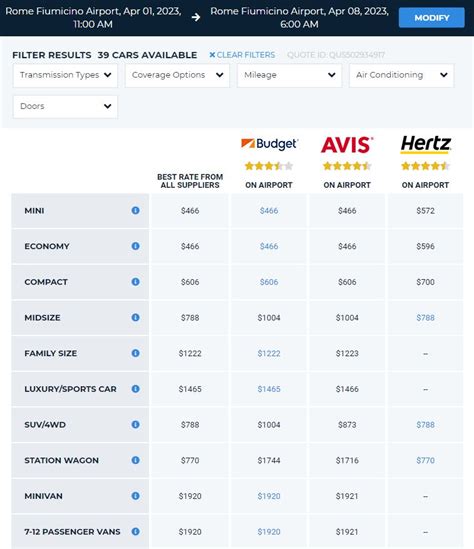

Insurance prices can vary significantly between rental companies and even between different locations of the same company. Take the time to shop around and compare prices to find the best deal. Online comparison tools and travel websites can be useful for this purpose, allowing you to quickly compare insurance options and prices across different rental companies.

Additionally, consider the overall cost of the rental, including insurance. Some rental companies may offer more competitive rates but have higher insurance costs, while others may have higher base rental rates but more affordable insurance options. Balancing these factors can help you find the most cost-effective solution.

5. Review and Understand the Policy Terms

When choosing an insurance policy, it’s crucial to thoroughly review and understand the policy terms and conditions. Pay close attention to the coverage limits, deductibles, exclusions, and any specific conditions or requirements. Understanding these details will help you make informed decisions and avoid unpleasant surprises in the event of a claim.

Some policies may have specific conditions, such as requiring you to use certain repair shops or limiting coverage if the accident involves alcohol or drugs. Others may have exclusions for certain types of damage, such as tire or windshield damage. Being aware of these details ensures you're fully protected and helps you make any necessary adjustments to your rental plans.

Real-World Scenarios: Case Studies

To further illustrate the importance of car insurance for rentals, let’s explore some real-world scenarios and how different insurance coverage options would play out:

Case Study 1: Collision Damage

Imagine you’re on a road trip and unfortunately get into a minor collision with another vehicle. The damage to your rental car is estimated at $3,000. If you have a Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW) in place, the rental company will waive your liability for this damage, and you won’t have to pay out of pocket. However, without this coverage, you would be responsible for the full repair cost.

Additionally, if you have comprehensive insurance coverage through your auto policy or credit card, this may also cover the damage, providing an additional layer of protection.

Case Study 2: Liability for Third-Party Injuries

In a different scenario, you’re involved in an accident where you cause injuries to another person. The medical expenses and legal fees associated with this incident amount to $50,000. If you have adequate liability insurance in place, this policy will cover these costs, protecting your financial well-being.

Without liability insurance, you would be personally responsible for these expenses, which could be financially devastating. It's crucial to have sufficient liability coverage to protect yourself in such situations.

Case Study 3: Personal Belongings Coverage

During your travels, you decide to take a scenic hike and leave your rental car parked at a trailhead. Unfortunately, when you return, you find that your rental car has been broken into, and your laptop, worth $2,000, has been stolen. If you have personal effects coverage in place, this policy will compensate you for the loss of your laptop, providing some peace of mind.

Without this coverage, you would have to bear the cost of replacing your laptop, which could be a significant financial burden, especially if you're on a tight budget.

The Future of Car Insurance for Rentals

The world of car insurance for rentals is constantly evolving, with new trends and innovations shaping the industry. Here are some key trends and future implications to consider:

1. Digital Transformation and Automation

The rental car industry is increasingly embracing digital technologies and automation to streamline the rental process and enhance the customer experience. This includes online booking platforms, self-service kiosks, and mobile apps for rental car management. These digital innovations also extend to insurance, with rental companies offering online platforms for customers to easily select and purchase insurance coverage.

The trend towards digital transformation and automation is expected to continue, making the rental car insurance process more efficient and user-friendly. Customers can expect faster and more convenient access to insurance options and policies, with real-time updates and easy management through digital channels.

2. Personalized Insurance Packages

As the rental car industry becomes more customer-centric, there is a growing trend towards personalized insurance packages. Rental companies are recognizing the unique needs and preferences of different customer segments and offering tailored insurance solutions to meet these specific requirements.

For example, business travelers may require higher liability limits and more comprehensive coverage for their rental cars, while leisure travelers may prioritize cost-effectiveness and basic protection. By offering personalized insurance packages, rental companies can better meet the diverse needs of their customers, providing a more satisfying rental experience.

3. Integration with Mobility Services

The rental car industry is increasingly integrating with other mobility services, such as ride-sharing platforms and public transportation systems. This integration allows for a more seamless travel experience, with rental cars becoming just one part of a comprehensive mobility solution.

From an insurance perspective, this integration can lead to the development of new insurance products that cover multiple modes of transportation. For instance, a single insurance policy could cover both a rental car and a ride-sharing service, providing continuous coverage throughout a customer's journey. This integration of insurance with mobility services is expected to become more prevalent in the future, offering customers greater convenience and flexibility.

4. Enhanced Data Analytics and Risk Assessment

With the increasing availability of data and advanced analytics tools, rental car companies are better equipped to assess risk and price insurance policies more accurately. By analyzing data on customer behavior, driving patterns, and accident histories, rental companies can more effectively identify high-risk customers and tailor insurance coverage and pricing accordingly.

This enhanced risk assessment capability allows rental companies to offer more competitive insurance rates to low-risk customers, while also ensuring that high-risk customers are appropriately covered. By leveraging data analytics, the insurance landscape for rentals can become more fair and efficient, benefiting both customers and rental companies.

Conclusion: A Well-Informed Decision

Renting a car and navigating the insurance landscape can be complex, but with the right knowledge and preparation, you can make well-informed decisions to protect yourself and your finances. By understanding the different types of coverage, reviewing your existing policies, and comparing options from rental companies, you can find the insurance solution that best suits your needs and provides peace of mind during your travels.

As the rental car industry continues to evolve, embracing digital technologies, personalized packages, and integrated mobility services, the future of car insurance for rentals looks promising. With ongoing innovations, customers can expect a more seamless and tailored insurance experience, further enhancing the overall rental car journey.

Can I rely solely on my credit card’s rental car insurance benefits?

+While credit card rental car insurance benefits can provide valuable coverage, it’s important to carefully review the terms and conditions. These benefits often come with limitations, such as rental duration limits or specific rental company requirements. Additionally, credit card insurance may not cover all potential risks, such as personal belongings or specific types of damage. It’s advisable to assess your coverage needs and consider purchasing additional insurance from the rental company if necessary.

What happens if I decline insurance from the rental company?

+If you decline insurance from the rental company, you’ll be responsible for any damage or liability that arises during your rental period. This means that you’ll have to pay for any repairs or compensation out of pocket, which can be financially burdensome. It’s important to carefully consider your existing insurance coverage and the potential risks before declining insurance from the rental company.

Are there any alternative insurance options for rental cars?

+Yes, there are alternative insurance options available for rental cars. These include third-party insurance providers that specialize in rental car insurance, as well as peer-to-peer rental platforms that often include insurance coverage in their rental packages. Exploring these alternatives can provide you with additional choices and potentially more tailored coverage options.