How To Get Dental Insurance

Dental insurance is an essential aspect of maintaining good oral health and can provide significant benefits for individuals and families. While it may seem daunting to navigate the world of dental coverage, this comprehensive guide will walk you through the steps to help you secure the best dental insurance plan for your needs.

Understanding Dental Insurance

Dental insurance is a type of health insurance specifically designed to cover the costs associated with dental care. It helps individuals manage the financial burden of various dental procedures, from routine check-ups and cleanings to more complex treatments. By understanding the fundamentals of dental insurance, you can make informed decisions when choosing a plan.

Key Components of Dental Insurance Plans

Dental insurance plans typically include the following components:

- Premiums: The regular payments you make to maintain your dental coverage. These are usually paid monthly or annually.

- Deductibles: The amount you must pay out of pocket before your insurance coverage kicks in. Some plans have no deductibles, while others have higher or lower deductibles based on the plan's design.

- Copayments (Copays): A fixed amount you pay for covered services. For example, you might have a $20 copay for a dental cleaning.

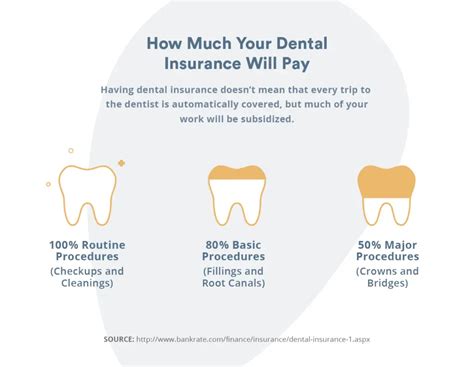

- Coinsurance: This is the percentage of the cost you pay for covered services after meeting your deductible. For instance, you might pay 20% of the cost for a root canal, while your insurance covers the remaining 80%.

- Annual Maximum: The maximum amount your insurance plan will pay toward your dental care in a year. Once you reach this limit, you're responsible for any additional costs.

- Network: A group of dental providers who have contracted with your insurance company to offer services at discounted rates. Staying in-network usually results in lower out-of-pocket costs.

Types of Dental Insurance Plans

There are several types of dental insurance plans available, each with its own set of features and coverage options. Understanding these types can help you choose the plan that aligns with your dental needs and preferences.

- Indemnity Plans: Also known as fee-for-service plans, these allow you to choose any dentist you prefer. You pay for the services upfront and then submit a claim to your insurance company for reimbursement.

- Preferred Provider Organization (PPO) Plans: PPO plans offer a network of preferred dentists and specialists. You can visit any dentist, but you'll save more by staying within the network. PPOs often provide more flexibility than other plan types.

- Health Maintenance Organization (HMO) Plans: HMO plans require you to choose a primary dentist within their network. You must visit this dentist for all your dental care needs, unless you obtain a referral for specialized treatment. HMOs typically have lower premiums but may have more restrictions.

- Dental Health Maintenance Organization (DHMO) Plans: Similar to HMOs, DHMOs require you to select a primary dentist within their network. These plans often cover preventive care at 100%, making them a popular choice for those prioritizing preventive dental health.

- Discount Dental Plans: Instead of providing insurance coverage, discount dental plans offer reduced rates on dental services. You pay a membership fee to access these discounts, which can be a cost-effective option for those with minimal dental needs.

Assessing Your Dental Needs

Before diving into the world of dental insurance, it's crucial to assess your specific dental needs. This step will help you narrow down the type of plan and coverage that best suits your circumstances.

Consider Your Dental History

Look at your recent and past dental records. Have you been to the dentist regularly for check-ups and cleanings? Or do you have a history of more complex dental issues that require specialized care? Understanding your dental history can help you anticipate future needs and choose a plan that covers these potential expenses.

Evaluate Your Current Dental Condition

Are you currently dealing with any dental issues? Do you have any pending treatments or procedures that you know you'll need in the near future? Consider the cost of these treatments and whether you'll require immediate or ongoing care. This assessment will guide you toward plans that offer the necessary coverage.

Determine Your Dental Priorities

Think about what aspects of dental care are most important to you. Do you prioritize preventive care to maintain good oral health? Or are you more concerned about having coverage for major procedures and treatments? Your priorities will influence the type of plan and the level of coverage you seek.

Researching Dental Insurance Options

Now that you have a clearer understanding of your dental needs, it's time to explore the available dental insurance options. Researching different plans and providers will ensure you make an informed decision and find the best fit for your circumstances.

Online Resources

The internet is a valuable tool for researching dental insurance. Start by visiting reputable websites that provide comprehensive information about various dental plans. These sites often offer comparative analyses, allowing you to easily assess the features and benefits of different plans.

Some popular online resources for researching dental insurance include:

Employer-Provided Plans

If you're employed, check with your human resources department to see if your employer offers dental insurance as part of their benefits package. Many employers provide dental coverage, which can be a convenient and often more affordable option.

Individual Market Plans

If you're not covered through an employer, you can explore individual market plans. These plans are available directly from insurance companies or through online marketplaces like Healthcare.gov (for U.S. residents). Compare different plans based on their coverage, network, and cost to find the one that suits your needs.

Comparing Dental Insurance Plans

Once you've identified a few potential dental insurance plans, it's time to compare them side by side. This step ensures you can make an apples-to-apples comparison and select the plan that offers the best value for your money.

Coverage and Benefits

Examine the coverage and benefits of each plan. Pay close attention to the procedures and treatments covered, as well as the level of coverage (e.g., preventive, basic, major, and orthodontic care). Ensure that the plan covers the specific services you anticipate needing.

Network and Provider Options

Check the network of dentists and specialists available under each plan. Verify that your preferred dental providers are included in the network, or explore the options for out-of-network coverage if needed. Consider the convenience of having in-network providers nearby.

Cost and Value

Compare the costs of each plan, including premiums, deductibles, copays, and coinsurance. Calculate the overall value by considering the coverage and benefits provided in relation to the costs. Remember that the cheapest plan may not always offer the best value if it has limited coverage.

Additional Plan Features

Look for additional features that may enhance the plan's value. These could include:

- Discounts on dental services

- Vision care coverage

- Wellness programs or incentives

- Flexible spending accounts (FSAs) or health savings accounts (HSAs)

Choosing the Right Dental Insurance Plan

With your research and comparisons complete, it's time to select the dental insurance plan that best meets your needs. Consider your budget, your dental priorities, and the coverage you require to make an informed decision.

Assess Your Budget

While dental insurance is an investment in your oral health, it's essential to choose a plan that fits within your financial means. Evaluate your budget and select a plan with premiums and out-of-pocket costs that you can comfortably afford.

Prioritize Your Dental Needs

Recall your assessment of your dental needs and priorities. Choose a plan that covers the procedures and treatments you anticipate needing. If you have specific dental concerns, ensure the plan offers adequate coverage for those issues.

Read the Fine Print

Before finalizing your decision, carefully review the plan's summary of benefits and coverage. Pay attention to any exclusions or limitations, as well as the waiting periods for certain procedures. Understanding these details will help you avoid any surprises down the line.

Enrolling in Your Chosen Dental Insurance Plan

Once you've selected the dental insurance plan that aligns with your needs and budget, it's time to enroll. Follow these steps to ensure a smooth enrollment process.

Review Enrollment Requirements

Check the enrollment requirements for your chosen plan. Some plans may have specific eligibility criteria or enrollment periods. Ensure you meet these requirements and understand any deadlines for enrollment.

Gather Necessary Information

Collect the information you'll need to complete the enrollment process. This may include personal details, employment information (if applicable), and payment details for your premiums.

Complete the Enrollment Form

Fill out the enrollment form accurately and completely. Provide all the required information and double-check your entries to avoid delays or errors in processing.

Submit Your Enrollment

Submit your enrollment form and any supporting documentation according to the plan's instructions. This may involve mailing or uploading the form online. Ensure you receive confirmation of your enrollment.

Activate Your Coverage

Once your enrollment is processed and accepted, activate your dental insurance coverage. This may involve setting up your online account, selecting a primary dentist (if applicable), and familiarizing yourself with the plan's procedures for accessing care.

Maximizing Your Dental Insurance Benefits

Now that you have your dental insurance in place, it's important to make the most of your benefits. Here are some tips to help you get the most value from your coverage.

Schedule Regular Check-Ups

Preventive dental care is often covered at 100% by dental insurance plans. Take advantage of this by scheduling regular check-ups and cleanings. These visits can help identify potential issues early on and prevent more complex (and costly) treatments down the line.

Understand Your Coverage

Familiarize yourself with your plan's coverage details. Know what procedures are covered, the levels of coverage (e.g., preventive, basic, major), and any exclusions or limitations. This knowledge will help you make informed decisions about your dental care and avoid unexpected out-of-pocket expenses.

Choose In-Network Providers

Whenever possible, choose dental providers who are in your insurance plan's network. This will typically result in lower out-of-pocket costs and smoother claim processes. Check with your insurance company or their website to find a list of in-network providers in your area.

Review Your Benefits Annually

Dental insurance plans can change from year to year. Take the time to review your benefits annually to ensure they still meet your needs. This review can help you identify any changes in coverage, premiums, or network providers, allowing you to make adjustments if necessary.

Frequently Asked Questions

What if I already have a dentist I prefer outside the network?

+

If you have a preferred dentist who is not in your insurance plan’s network, you have a few options. You can choose to continue seeing your preferred dentist and pay for their services out-of-pocket. Alternatively, some plans offer out-of-network benefits, which provide partial coverage for out-of-network providers. However, you may incur higher out-of-pocket costs compared to in-network providers.

Are there any additional costs beyond premiums and deductibles?

+

Yes, there may be additional costs associated with dental insurance. These can include copayments for covered services, coinsurance for more complex procedures, and any out-of-pocket expenses for treatments not covered by your plan. It’s important to review your plan’s summary of benefits to understand these potential costs.

Can I change my dental insurance plan during the year?

+

In most cases, you can only change your dental insurance plan during specific enrollment periods, such as during open enrollment or if you experience a qualifying life event (e.g., marriage, birth of a child, loss of other coverage). Check with your insurance provider or employer to understand your options for changing plans.

How do I submit a claim for reimbursement if I see an out-of-network provider?

+

To submit a claim for reimbursement, you’ll typically need to fill out a claim form provided by your insurance company. This form will require details about the services received, the dates of service, and the costs incurred. You may also need to include supporting documentation, such as receipts or itemized bills. Follow the instructions provided by your insurance company to ensure a smooth claims process.