Best Company Insurance

In today's fast-paced and ever-evolving business landscape, having a reliable insurance partner is crucial for companies of all sizes. The right insurance coverage can provide peace of mind, protect assets, and ensure the long-term viability of a business. This comprehensive guide aims to delve into the world of Best Company Insurance, exploring the key factors that contribute to an exceptional insurance experience and the benefits it brings to businesses.

The Significance of Best Company Insurance

Best Company Insurance is more than just a policy; it’s a strategic partnership that can make or break a business’s success. In an unpredictable world, where risks lurk around every corner, having comprehensive insurance coverage is not just an option but a necessity. It safeguards businesses against unforeseen events, be it natural disasters, lawsuits, or operational disruptions, and ensures they can continue to operate smoothly.

For businesses, especially small and medium-sized enterprises (SMEs), the impact of an unexpected event can be devastating. It can disrupt operations, lead to financial strain, and even force closures. This is where Best Company Insurance steps in, offering a safety net that protects businesses and their assets, allowing them to focus on what they do best – running their businesses.

Key Factors of Best Company Insurance

When it comes to choosing the right insurance provider, several factors come into play. These factors differentiate a good insurance provider from the Best Company Insurance partner. Here’s a breakdown of the key aspects to consider:

Comprehensive Coverage

The cornerstone of any good insurance policy is its coverage. Best Company Insurance should offer a comprehensive range of coverage options tailored to the specific needs of the business. This includes not just standard policies like property, liability, and business interruption insurance, but also specialized coverages relevant to the industry and the unique risks it faces.

For instance, a technology startup might require cyber liability insurance to protect against data breaches and cyber attacks, while a manufacturing company might need product liability insurance to cover potential product defects. The best insurance providers understand these nuances and offer tailored coverage solutions.

Competitive Pricing

While comprehensive coverage is essential, it’s equally important to find an insurance provider that offers competitive pricing. Best Company Insurance understands that businesses operate on tight budgets and aims to provide cost-effective solutions without compromising on coverage quality. They offer flexible payment plans and work with businesses to find the right balance between coverage and cost.

Excellent Customer Service

When businesses face a crisis, they need an insurance provider that is responsive, empathetic, and efficient. Best Company Insurance prides itself on its customer service, offering 24⁄7 support, dedicated account managers, and a seamless claims process. They understand that businesses need timely assistance during difficult times and work tirelessly to provide it.

Additionally, the best insurance providers offer educational resources and risk management tools to help businesses mitigate potential risks and understand their coverage better. This proactive approach to customer service sets them apart from the competition.

Financial Stability

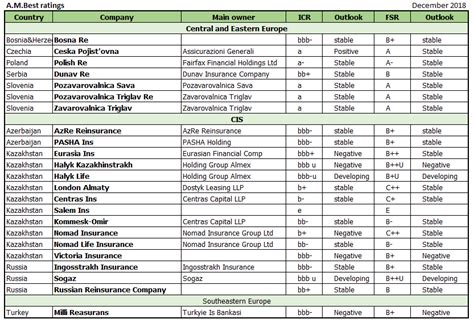

One of the most critical aspects of choosing an insurance provider is their financial stability. Best Company Insurance is backed by strong financial ratings, ensuring that they have the resources to pay out claims even in the face of large-scale disasters or multiple claims. This financial strength provides businesses with the assurance that their insurance partner is here for the long haul.

Customized Solutions

Every business is unique, and its insurance needs are equally distinct. Best Company Insurance recognizes this and offers customized solutions that cater to the specific requirements of each business. Whether it’s a small business looking for basic coverage or a large enterprise needing complex risk management strategies, the best insurance providers tailor their services to meet these needs.

| Insurance Type | Coverage Details |

|---|---|

| Property Insurance | Covers physical assets, including buildings, equipment, and inventory, against damages from fire, theft, or natural disasters. |

| Liability Insurance | Protects against legal liabilities arising from bodily injury, property damage, or advertising claims. |

| Business Interruption Insurance | Provides financial support during business disruptions, covering lost income and ongoing expenses. |

| Cyber Liability Insurance | Offers coverage for data breaches, cyber attacks, and online security risks. |

| Product Liability Insurance | Covers legal costs and damages in case of product defects or injuries caused by a company's products. |

The Benefits of Partnering with Best Company Insurance

Choosing the right insurance provider can bring a multitude of benefits to businesses. Here’s a look at some of the key advantages:

Peace of Mind

Knowing that your business is protected against potential risks provides an invaluable sense of peace. Best Company Insurance takes the stress out of running a business, allowing owners and employees to focus on their core competencies without worrying about unforeseen events.

Financial Security

With comprehensive coverage, businesses can rest assured that they have the financial resources to recover from unexpected events. Whether it’s a fire, a lawsuit, or a cyber attack, Best Company Insurance steps in to provide the necessary financial support, ensuring businesses can get back on their feet quickly.

Improved Risk Management

Best Company Insurance partners often provide risk management tools and resources that help businesses identify and mitigate potential risks. This proactive approach to risk management not only reduces the likelihood of incidents but also helps businesses operate more efficiently and safely.

Enhanced Reputation

Having Best Company Insurance can enhance a business’s reputation, particularly among clients, investors, and partners. It demonstrates a commitment to safety, responsibility, and long-term sustainability, which can be a significant advantage in competitive markets.

Access to Expertise

Partnering with Best Company Insurance means gaining access to a team of experts in the insurance field. These professionals can provide valuable insights, advice, and guidance on risk management, coverage options, and industry trends. Their expertise can be a powerful asset for businesses looking to navigate the complex world of insurance.

FAQs

What makes an insurance provider the ‘Best Company Insurance’ partner for my business?

+The ‘Best Company Insurance’ partner for your business is one that offers a combination of comprehensive coverage, competitive pricing, excellent customer service, and financial stability. They should understand your industry-specific risks and provide tailored solutions accordingly. Additionally, their expertise, responsiveness, and commitment to your business’s success are key indicators of a great insurance partner.

How can I ensure I’m getting the best insurance coverage for my business?

+To ensure you’re getting the best insurance coverage, start by understanding your business’s unique risks and needs. Then, compare quotes and coverage options from multiple providers. Look for providers who offer customized solutions and have a strong track record of handling claims efficiently. Reading reviews and seeking recommendations from other businesses can also provide valuable insights.

What should I do if I’m unsure about the coverage I need for my business?

+If you’re unsure about the coverage you need, it’s best to consult with an insurance professional. They can assess your business operations, identify potential risks, and recommend appropriate coverage options. Many insurance providers offer free consultations or risk assessments to help businesses understand their insurance needs better.

How often should I review my business insurance policies?

+It’s recommended to review your business insurance policies annually or whenever there are significant changes to your business operations, such as expansion, relocation, or addition of new products or services. Regular reviews ensure that your coverage remains up-to-date and aligned with your business’s evolving needs.

What are some common challenges businesses face when choosing insurance providers, and how can they be overcome?

+Common challenges include finding the right balance between coverage and cost, understanding complex insurance jargon, and ensuring the chosen provider is financially stable. To overcome these challenges, businesses can seek professional advice, compare multiple providers, and research their financial stability and customer satisfaction records. Additionally, understanding your business’s specific needs and risks can help you make more informed insurance decisions.