Day Car Insurance

For many drivers, the concept of day insurance, also known as short-term or temporary car insurance, is an appealing option. Whether you're borrowing a friend's car for a road trip, renting a vehicle for a business trip, or even just needing coverage for a day while your regular insurance is being sorted out, day car insurance provides a flexible and convenient solution. In this comprehensive guide, we'll delve into the world of day car insurance, exploring its benefits, how it works, and why it's a valuable tool for modern drivers.

Understanding Day Car Insurance

Day car insurance is a specialized type of coverage designed to provide temporary protection for a vehicle, typically for a period ranging from one day to a few weeks. Unlike traditional annual car insurance policies, which are often lengthy and fixed-term, day insurance offers flexibility and customization. This makes it an ideal choice for situations where you need coverage for a specific, limited timeframe.

Key Benefits of Day Car Insurance

- Flexibility: One of the most significant advantages of day car insurance is its adaptability. You can tailor the coverage period to your exact needs, whether it’s for a single day, a weekend, or a couple of weeks. This flexibility is especially beneficial for those with unique driving circumstances, such as occasional drivers, car renters, or individuals who only need coverage for specific events.

- Cost-Effectiveness: Day insurance is often more cost-efficient than traditional policies for short-term needs. By only paying for the coverage you require, you can save money compared to purchasing a full annual policy, especially if you don’t drive frequently. This makes it an attractive option for occasional drivers or those who only need temporary coverage.

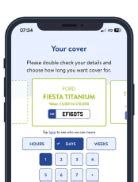

- Convenience: Obtaining day car insurance is typically a straightforward process. Many insurers offer online applications, allowing you to secure coverage quickly and easily. This convenience is particularly beneficial in urgent situations where you need insurance immediately, such as when borrowing a friend’s car for an unexpected trip.

- Wide Availability: Day car insurance is widely available, with many insurers offering this service. This means you have options and can compare providers to find the best coverage and rates for your needs. Whether you’re looking for comprehensive coverage or something more basic, there are likely options available to suit your preferences.

How Does Day Car Insurance Work?

The process of obtaining day car insurance is generally simple and straightforward. Here’s a step-by-step breakdown of how it typically works:

- Assess Your Needs: Begin by evaluating your specific requirements. Consider the duration of coverage you need, whether it’s for a single day, a week, or a longer period. Determine the type of coverage you’re seeking, such as comprehensive, third-party, fire, and theft, or other options offered by insurers.

- Compare Providers: Research and compare different insurers that offer day car insurance. Look for reputable companies with a good track record and competitive rates. Consider factors such as the level of coverage, any additional benefits or perks, and the overall customer experience.

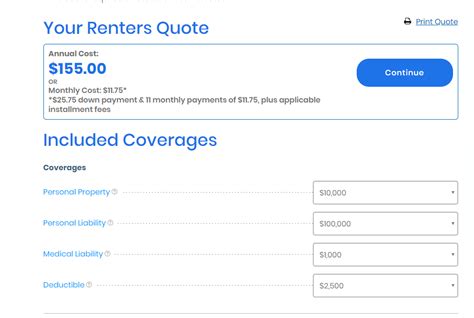

- Obtain a Quote: Once you’ve chosen a provider, obtain a quote based on your requirements. Many insurers provide online quoting tools, allowing you to input your details and receive an instant estimate. Ensure you understand the coverage limits, any excess amounts, and any additional fees or charges.

- Purchase Coverage: If you’re satisfied with the quote, proceed to purchase the day car insurance. This can often be done online, with immediate coverage starting from the moment you complete the transaction. You’ll typically receive confirmation and any necessary documentation via email or post.

- Manage Your Policy: Throughout the coverage period, ensure you understand the terms and conditions of your policy. Keep track of any important dates, such as the end of the coverage period, and make sure to renew or cancel the policy accordingly. If you have any questions or need assistance, reach out to the insurer’s customer support.

Real-World Applications and Scenarios

Day car insurance has a wide range of practical applications, making it a versatile tool for drivers facing various situations. Here are some common scenarios where day insurance can be invaluable:

- Borrowing a Friend’s Car: If you’re planning a road trip or need to borrow a friend’s car for a few days, day car insurance provides a simple solution. You can obtain coverage specifically for the duration of your trip, ensuring you’re protected while driving someone else’s vehicle.

- Renting a Vehicle: When renting a car, day insurance can be a more cost-effective alternative to the often expensive rental company coverage. By purchasing your own day insurance, you can save money while still enjoying the peace of mind of comprehensive protection.

- Occasional Driving: For individuals who only drive occasionally, such as retirees or those with secondary vehicles, day car insurance is an excellent option. You can pay for coverage only when you need it, avoiding the cost of a full annual policy for limited use.

- Emergency Coverage: In unexpected situations where you suddenly need to drive but don’t have insurance, day car insurance can be a lifesaver. Whether it’s a last-minute trip or an emergency situation, you can quickly secure coverage and get on the road without delay.

- Short-Term Vehicle Ownership: If you’re purchasing a new car and need coverage while waiting for your regular insurance to be processed, day insurance can bridge the gap. This ensures you’re protected during the transition period, providing peace of mind while you sort out your long-term insurance needs.

Technical Specifications and Performance

Day car insurance policies can vary in their technical specifications and coverage limits. While the exact details may differ between insurers, here’s an overview of some common features and what you can typically expect:

| Coverage Type | Description |

|---|---|

| Comprehensive | Provides protection for a wide range of scenarios, including damage to your vehicle, theft, fire, and third-party liability. This is the most extensive coverage option. |

| Third-Party Only | Covers you for damage or injury caused to other people’s property or vehicles. It does not provide protection for your own vehicle, focusing solely on third-party claims. |

| Fire and Theft | As the name suggests, this coverage protects against fire damage and theft of your vehicle. It may also include third-party liability coverage. |

| Excess Amounts | Most day insurance policies have an excess amount, which is the initial cost you must pay towards a claim. This can vary depending on the insurer and the type of coverage. |

| Policy Limits | Day insurance policies typically have specific limits on the amount they will pay out for different types of claims. Ensure you understand these limits to avoid any surprises. |

Future Implications and Considerations

As the demand for flexible and customizable insurance options continues to grow, day car insurance is likely to become an even more popular choice for drivers. Here are some future implications and considerations to keep in mind:

- Digital Innovation: With the rise of digital technologies, we can expect day car insurance providers to further streamline their processes. This could include even more convenient online applications, instant policy issuance, and digital documentation, making the entire process faster and more efficient.

- Personalized Coverage: As insurers gather more data and utilize advanced analytics, they may be able to offer more personalized day insurance policies. This could involve tailoring coverage based on individual driving habits, vehicle usage, and other factors, providing even more cost-effective and tailored solutions.

- Integration with Connected Cars: As more vehicles become connected and data-rich, there’s potential for day insurance policies to be integrated with vehicle systems. This could lead to more dynamic and real-time pricing, with coverage automatically adjusting based on driving behavior and conditions.

- Environmental Considerations: With increasing focus on sustainability and eco-friendly practices, we may see day insurance policies offer incentives for drivers who choose environmentally friendly vehicles or adopt eco-conscious driving habits.

FAQ

Can I purchase day car insurance for a single day only?

+Absolutely! Day car insurance is designed to be flexible, allowing you to choose coverage for as little as a single day. This makes it ideal for short-term needs, such as borrowing a friend’s car for a day trip.

Is day car insurance more expensive than traditional policies?

+Not necessarily. Day insurance can be more cost-effective for short-term needs, as you only pay for the coverage you require. However, the exact cost will depend on various factors, including the duration of coverage, the level of protection, and your personal circumstances.

Can I obtain day car insurance if I have a full annual policy?

+Yes, you can. Day insurance is designed to supplement your existing coverage, providing temporary protection for specific situations. It’s a useful option when you need additional coverage, such as when renting a car or borrowing a vehicle.

What happens if I need to extend my day car insurance coverage?

+If you find that you need to extend your coverage beyond the initial period, most insurers allow you to do so. You can typically extend your policy by contacting the insurer and paying any additional fees. However, it’s important to note that extending coverage may not always be possible, especially if your circumstances have changed.

Are there any restrictions on the types of vehicles covered by day insurance?

+Yes, there may be some restrictions. Day insurance policies often have specific criteria for the types of vehicles they cover. This can include restrictions on the age, value, and condition of the vehicle. It’s important to check the terms and conditions of your chosen policy to ensure your vehicle meets the requirements.