Small Businesses Health Insurance

Small businesses play a crucial role in the economy, and providing comprehensive health insurance to their employees is a significant aspect of their operations. In today's competitive landscape, offering attractive benefits, such as health coverage, can be a powerful tool for attracting and retaining top talent. However, the process of selecting and managing health insurance plans can be complex and challenging for small business owners. This article aims to provide an in-depth guide to understanding the intricacies of small business health insurance, covering key considerations, plan options, and strategies to ensure a successful implementation.

Navigating the Landscape of Small Business Health Insurance

Small business owners often face unique challenges when it comes to providing health insurance. The cost of coverage, plan selection, and compliance with regulations are just a few of the many factors that require careful consideration. Additionally, the dynamic nature of the healthcare industry means that staying updated with the latest trends and options is essential.

Understanding the Cost Structure

One of the primary concerns for small businesses is the financial feasibility of offering health insurance. The cost of coverage can vary significantly depending on several factors, including the type of plan, the number of employees, and the location of the business. To gain a comprehensive understanding, it’s crucial to explore the various cost components involved.

The cost of health insurance for small businesses typically includes employer premiums, which are the contributions made by the business to cover the plan's expenses. These premiums can be influenced by the chosen plan's benefits, the age and health status of employees, and the business's industry. Additionally, employee contributions, which are the out-of-pocket expenses paid by employees, are another critical aspect of the cost structure. These contributions can take the form of deductibles, copayments, and coinsurance, and they can significantly impact the affordability of coverage for employees.

To illustrate, consider a small business with 10 employees located in a metropolitan area. The business chooses a PPO (Preferred Provider Organization) plan, which offers flexibility in provider choice but comes with higher premiums. The employer premiums for this plan might average around $600 per employee per month, while employee contributions could range from $100 to $300 per month, depending on their chosen coverage level and out-of-pocket maximums.

| Plan Type | Average Monthly Premium (Employer) | Average Monthly Premium (Employee) |

|---|---|---|

| PPO | $600 | $200 |

| HMO | $550 | $150 |

| EPO | $500 | $125 |

Plan Options: Choosing the Right Fit

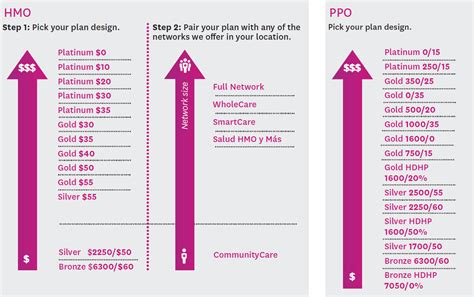

Small businesses have a range of health insurance plan options to choose from, each with its own set of benefits and considerations. The most common types of plans include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). Understanding the nuances of these plans is crucial for selecting the most suitable option for your business.

HMOs are known for their comprehensive coverage and lower out-of-pocket costs. However, they typically require members to choose a primary care physician (PCP) and obtain referrals for specialist care. PPOs, on the other hand, offer more flexibility in provider choice, allowing members to visit any in-network provider without referrals. While PPOs may have higher premiums, they can be a good fit for businesses with employees who value convenience and a wider network of providers.

EPOs represent a middle ground between HMOs and PPOs. They typically have a more limited network of providers than PPOs but offer more flexibility than HMOs. EPOs often require members to choose an in-network primary care physician but do not require referrals for specialist care. This balance between cost and flexibility can make EPOs an attractive option for small businesses seeking a compromise between the benefits of HMOs and PPOs.

When selecting a plan, it's essential to consider the specific needs of your business and its employees. Factors such as the prevalence of chronic conditions, the age distribution of employees, and the geographical location of the business can all influence the most suitable plan option. Consulting with insurance experts and conducting thorough market research can help small business owners make informed decisions about their health insurance offerings.

Implementing and Managing Small Business Health Insurance

Once a small business has selected an appropriate health insurance plan, the process of implementation and ongoing management begins. This phase involves a series of critical steps to ensure that the chosen plan aligns with the business’s goals and the needs of its employees.

Enrollment and Communication Strategies

Effective communication is key during the enrollment process. Small business owners should clearly communicate the benefits and features of the chosen plan to their employees. This includes providing detailed explanations of coverage, out-of-pocket costs, and any unique aspects of the plan, such as telehealth services or wellness programs.

To facilitate enrollment, businesses can utilize digital tools and platforms specifically designed for small business health insurance. These platforms often provide streamlined processes for employees to review and select their coverage options, making the experience more user-friendly and efficient. Additionally, offering open enrollment periods and providing ample time for employees to make informed decisions can contribute to a successful enrollment process.

Monitoring and Adjusting Coverage

Health insurance is not a static offering; it requires ongoing monitoring and adjustments to ensure its continued effectiveness. Small business owners should regularly review their chosen plan’s performance, taking into account factors such as employee satisfaction, utilization rates, and claims experience.

One key aspect of monitoring coverage is staying updated with any changes in the healthcare landscape. This includes keeping abreast of evolving regulations, such as the Affordable Care Act (ACA) and its potential impacts on small business health insurance. Understanding these changes and their implications can help businesses make informed decisions about their coverage strategies.

Furthermore, small businesses should consider conducting periodic employee surveys or focus groups to gather feedback on their health insurance offerings. This direct input can provide valuable insights into areas where the plan may need adjustments or improvements. For example, if employees consistently express dissatisfaction with the available provider network, the business may need to explore alternative plans with a broader network or negotiate with existing providers to expand their coverage.

By actively monitoring and adjusting their health insurance coverage, small businesses can ensure that their offerings remain competitive and aligned with the needs of their workforce. This proactive approach not only demonstrates a commitment to employee well-being but also helps to attract and retain top talent in a dynamic job market.

Future Trends and Considerations for Small Business Health Insurance

As the healthcare landscape continues to evolve, small businesses must stay informed about emerging trends and potential disruptions. This section explores some of the key future considerations for small business health insurance, offering insights into how these trends may impact coverage strategies and decision-making.

Telehealth and Digital Health Solutions

The rapid advancement of digital health technologies, including telehealth services, is revolutionizing the way healthcare is delivered and accessed. Small businesses should consider the potential benefits of incorporating telehealth into their health insurance plans. Telehealth can provide employees with convenient access to medical care, particularly for minor illnesses or routine check-ups, reducing the need for in-person visits and associated costs.

When evaluating telehealth options, small businesses should assess the availability and quality of telehealth services within their chosen plan. Some plans may offer robust telehealth benefits, including virtual primary care and specialist consultations, while others may have more limited offerings. By incorporating telehealth into their coverage, businesses can enhance the overall convenience and accessibility of healthcare for their employees.

Wellness Programs and Employee Engagement

Promoting employee wellness has become a key focus for many small businesses, as it can lead to improved productivity, reduced absenteeism, and lower healthcare costs. Wellness programs, which encourage healthy lifestyle choices and provide resources for managing chronic conditions, can be a valuable addition to health insurance plans.

Small businesses should explore the availability of wellness programs within their chosen plans. These programs may include incentives for participating in fitness challenges, accessing nutritional counseling, or managing stress. By actively engaging employees in wellness initiatives, businesses can foster a culture of health and well-being, leading to improved overall health outcomes for their workforce.

The Impact of Technology on Coverage Options

Advancements in technology are not only transforming the delivery of healthcare but also shaping the insurance industry itself. Small businesses should stay informed about emerging technologies that may impact their health insurance options. For example, the increasing use of data analytics and artificial intelligence in the insurance sector can lead to more personalized and targeted coverage options.

Additionally, the rise of direct-to-consumer insurance platforms and digital brokers is providing small businesses with more choices and flexibility when selecting health insurance plans. These platforms often offer streamlined enrollment processes, real-time plan comparisons, and personalized recommendations based on the specific needs of the business and its employees. By leveraging these technological advancements, small businesses can navigate the complex insurance landscape more efficiently and make more informed decisions about their coverage.

Conclusion: Navigating the Future of Small Business Health Insurance

In a rapidly changing healthcare environment, small businesses must remain agile and proactive in their approach to health insurance. By staying informed about emerging trends, such as telehealth, wellness programs, and technological advancements, small businesses can adapt their coverage strategies to meet the evolving needs of their employees.

The key to successful small business health insurance lies in a comprehensive understanding of the cost structure, careful plan selection, and effective communication and management. By following the insights and strategies outlined in this article, small business owners can navigate the complexities of health insurance, ultimately providing their employees with the comprehensive coverage they deserve.

What are the key factors that influence the cost of small business health insurance?

+The cost of small business health insurance is influenced by several factors, including the type of plan (HMO, PPO, EPO), the number of employees, their age and health status, and the business’s industry. Additionally, regional factors and the specific needs of the business and its employees can impact the overall cost structure.

How can small businesses effectively communicate health insurance options to their employees during enrollment?

+Small businesses should utilize clear and concise communication strategies, providing detailed explanations of coverage, out-of-pocket costs, and unique plan features. Digital tools and platforms designed for small business health insurance can streamline the enrollment process and make it more user-friendly for employees.

What steps can small businesses take to monitor and adjust their health insurance coverage over time?

+Small businesses should regularly review their chosen plan’s performance, considering factors such as employee satisfaction, utilization rates, and claims experience. Conducting employee surveys or focus groups can provide valuable feedback for making informed adjustments to the coverage.

How can small businesses leverage telehealth and digital health solutions to enhance their health insurance offerings?

+Small businesses can incorporate telehealth into their health insurance plans to provide employees with convenient access to medical care. This can reduce the need for in-person visits and associated costs, making healthcare more accessible and efficient.

What role do wellness programs play in small business health insurance, and how can they be effectively implemented?

+Wellness programs encourage healthy lifestyle choices and manage chronic conditions, leading to improved health outcomes and reduced healthcare costs. Small businesses can explore the availability of wellness programs within their chosen plans and actively engage employees in these initiatives to foster a culture of well-being.