Bcbs Medical Insurance

Blue Cross Blue Shield (BCBS) is one of the most recognized and trusted names in the health insurance industry, offering a comprehensive range of medical coverage options to individuals and families across the United States. With a long-standing history and a reputation for quality healthcare services, BCBS has become a go-to choice for many seeking reliable and accessible medical insurance.

In this article, we will delve into the world of BCBS medical insurance, exploring its offerings, benefits, and impact on healthcare accessibility. By understanding the nuances of BCBS plans, we can make informed decisions about our healthcare coverage and navigate the complex landscape of medical insurance with confidence.

The Evolution of BCBS Medical Insurance

The origins of BCBS can be traced back to the early 20th century when the concept of prepaid medical care was gaining traction. In 1929, the first Blue Cross plan was established to provide hospital coverage, and a few years later, the Blue Shield plans emerged to offer medical coverage. These independent organizations eventually merged, forming the Blue Cross Blue Shield Association (BCBSA) in 1982.

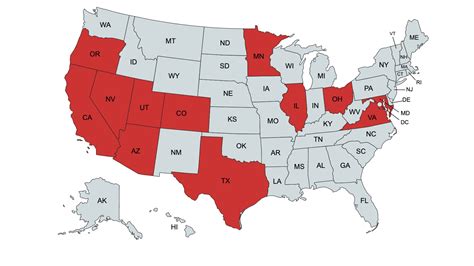

Since its inception, BCBS has grown to become a powerful force in the healthcare industry, with a network of 36 independent, community-based companies spread across the United States. This decentralized structure allows BCBS to offer tailored plans that cater to the unique needs of each region, while still providing a unified brand and a consistent level of quality.

Understanding BCBS Medical Insurance Plans

BCBS offers a diverse range of medical insurance plans to cater to the varied needs of its customers. These plans can be broadly categorized into four main types:

- Health Maintenance Organization (HMO) Plans: HMO plans typically have a lower premium and offer comprehensive coverage for services provided by in-network doctors and hospitals. Members are required to choose a primary care physician (PCP) who coordinates their healthcare and provides referrals for specialty care.

- Preferred Provider Organization (PPO) Plans: PPO plans offer more flexibility, allowing members to choose any healthcare provider, both in and out of network. While out-of-network services may be more costly, members have the freedom to access a wider range of providers.

- Exclusive Provider Organization (EPO) Plans: EPO plans provide coverage only for in-network providers, similar to HMO plans. However, unlike HMO plans, EPO plans do not require a primary care physician referral for specialty care.

- Point-of-Service (POS) Plans: POS plans combine elements of both HMO and PPO plans. Members can choose a primary care physician and receive in-network coverage, but they also have the option to access out-of-network providers with an increased cost.

Key Features of BCBS Medical Insurance

BCBS medical insurance plans offer a multitude of features and benefits, making them a popular choice among consumers. Some of the key advantages include:

- Comprehensive Coverage: BCBS plans provide coverage for a wide range of medical services, including doctor visits, hospital stays, prescription medications, preventive care, and specialty treatments. Depending on the plan, members may also have access to dental, vision, and mental health coverage.

- In-Network Benefits: BCBS has an extensive network of healthcare providers, ensuring that members have access to a broad range of in-network options. Utilizing in-network providers often results in lower out-of-pocket costs and streamlined claim processes.

- Preventive Care Focus: BCBS places a strong emphasis on preventive care, encouraging members to take proactive steps towards maintaining their health. Many plans offer free or low-cost preventive services such as annual check-ups, screenings, and immunizations, helping to detect and address health issues early on.

- Flexible Plan Options: With a variety of plan types and levels of coverage, BCBS caters to different budgets and healthcare needs. Members can choose from high-deductible health plans (HDHPs) for cost-conscious individuals, to more comprehensive plans with lower out-of-pocket expenses for those seeking extensive coverage.

- Digital Tools and Resources: BCBS understands the importance of convenience and accessibility in today's digital age. Their plans often come with user-friendly mobile apps and online portals, providing members with easy access to their health records, claim information, and a network of providers.

BCBS Medical Insurance: A Comparative Analysis

To truly appreciate the value of BCBS medical insurance, it’s essential to compare it with other leading health insurance providers in the market. While each provider offers unique benefits, BCBS stands out in several key areas:

Network Size and Accessibility

BCBS boasts one of the largest healthcare provider networks in the United States. With over 96% of all hospitals and more than 90% of physicians contracted with BCBS plans, members have an extensive array of options for their healthcare needs. This wide network ensures that members can easily find in-network providers, reducing the hassle and cost of out-of-network care.

Plan Customization and Flexibility

BCBS understands that every individual’s healthcare needs are unique. Their diverse range of plan options allows members to tailor their coverage to their specific requirements. Whether it’s prioritizing cost savings or seeking comprehensive coverage, BCBS provides the flexibility to choose a plan that aligns with personal preferences and budget constraints.

Focus on Preventive Care

Preventive care is a cornerstone of BCBS’s approach to healthcare. By encouraging members to prioritize regular check-ups and screenings, BCBS aims to prevent illnesses and detect health issues early on. This focus on prevention not only improves overall health outcomes but also helps to reduce long-term healthcare costs for both members and the insurance provider.

Digital Innovation and Convenience

In today’s fast-paced world, convenience and accessibility are paramount. BCBS recognizes this and has invested heavily in digital innovation. Their mobile apps and online portals provide members with real-time access to their health information, claim status, and a directory of in-network providers. This level of convenience enhances the overall member experience and streamlines the healthcare process.

The Impact of BCBS Medical Insurance on Healthcare Accessibility

BCBS medical insurance plays a vital role in increasing healthcare accessibility for millions of Americans. By offering a range of affordable plan options and an extensive network of providers, BCBS ensures that individuals and families can access the care they need without facing financial barriers.

Furthermore, BCBS's commitment to preventive care and health education empowers members to take control of their health. By providing resources and incentives for regular check-ups and screenings, BCBS helps individuals stay on top of their well-being, potentially catching health issues before they become more serious and costly to treat.

Additionally, BCBS's focus on digital innovation has made healthcare more accessible than ever. Members can easily schedule appointments, refill prescriptions, and access their health records from the comfort of their homes, eliminating the need for time-consuming and potentially daunting trips to healthcare facilities.

Real-Life Success Stories

BCBS medical insurance has made a tangible difference in the lives of countless individuals. Here are a few real-life success stories that highlight the impact of BCBS coverage:

- Sarah, a single mother, was able to access specialized care for her daughter's rare medical condition through her BCBS plan. The extensive provider network and comprehensive coverage allowed her to seek the best treatment options without worrying about financial constraints.

- John, a self-employed business owner, opted for a BCBS high-deductible health plan to save on premiums. When he was diagnosed with a serious illness, the plan's flexibility allowed him to access the necessary treatments and procedures, providing him with peace of mind during a challenging time.

- Emily, a young professional, valued the preventive care focus of her BCBS plan. By taking advantage of the free annual check-ups and screenings, she was able to detect and address potential health issues early on, ensuring her long-term well-being.

Future Implications and Innovations

As the healthcare landscape continues to evolve, BCBS remains at the forefront of innovation and adaptation. Here are some key areas where BCBS is expected to make significant strides in the coming years:

- Telehealth Integration: BCBS is actively exploring ways to incorporate telehealth services into its plans. By expanding access to remote medical consultations and treatments, BCBS aims to enhance convenience and improve healthcare outcomes, particularly for individuals in rural or underserved areas.

- Personalized Medicine: With advancements in genetic testing and precision medicine, BCBS is working towards integrating these technologies into its coverage. By offering personalized treatment plans based on an individual's genetic makeup, BCBS can further improve health outcomes and reduce unnecessary costs.

- Wellness Programs: BCBS recognizes the importance of holistic health and is developing innovative wellness programs to encourage healthy lifestyles. These programs may include incentives for regular exercise, healthy eating, and stress management, fostering a culture of well-being among its members.

- Data-Driven Decision Making: BCBS is leveraging the power of data analytics to optimize its plans and improve member experiences. By analyzing claim data and member feedback, BCBS can identify areas for improvement, streamline processes, and enhance the overall quality of its healthcare services.

Conclusion

BCBS medical insurance has established itself as a trusted and reliable provider, offering a comprehensive range of plans to meet the diverse needs of its members. With an extensive provider network, a focus on preventive care, and a commitment to digital innovation, BCBS continues to drive accessibility and improve healthcare outcomes.

As we navigate the complex world of medical insurance, understanding the offerings and benefits of BCBS can empower us to make informed decisions about our healthcare coverage. By choosing BCBS, individuals and families can rest assured that they have access to quality healthcare services, tailored to their unique circumstances.

FAQ

How do I choose the right BCBS medical insurance plan for my needs?

+

When selecting a BCBS plan, consider your healthcare needs, budget, and preferences. Assess whether you prioritize cost savings or comprehensive coverage. Evaluate the network of providers to ensure access to your preferred healthcare professionals. Additionally, consider the plan’s focus on preventive care and any additional benefits or incentives offered.

What is the difference between an HMO and a PPO plan?

+

HMO plans typically offer lower premiums and comprehensive coverage for in-network services, but require a primary care physician (PCP) referral for specialty care. PPO plans provide more flexibility, allowing members to choose any healthcare provider, both in and out of network, but may have higher out-of-pocket costs for out-of-network services.

How does BCBS ensure the quality of its healthcare providers?

+

BCBS maintains high standards for its network of healthcare providers. They undergo rigorous credentialing and quality assurance processes to ensure they meet the necessary criteria. BCBS also regularly monitors provider performance and collects member feedback to maintain the quality of its network.

Can I switch my BCBS medical insurance plan during the year?

+

Switching BCBS plans during the year is typically possible during the annual open enrollment period. However, there may be exceptions, such as experiencing a qualifying life event (e.g., marriage, birth of a child) that allows you to enroll outside of the open enrollment period. Check with your BCBS representative for specific details.