Become An Insurance Adjuster

The insurance industry is vast and multifaceted, offering a wide range of career opportunities. Among these, the role of an insurance adjuster stands out as a pivotal position, playing a crucial role in the claims process. This article will delve into the world of insurance adjusters, exploring what they do, the skills required, the education and training needed, and how to get started in this rewarding career path.

What Does an Insurance Adjuster Do?

Insurance adjusters, also known as claims adjusters or examiners, are the professionals responsible for evaluating and settling insurance claims. They act as a bridge between insurance companies and policyholders, ensuring that claims are handled fairly and efficiently. Their primary role is to investigate and assess the validity and extent of a claim, determine the appropriate coverage, and negotiate settlements with claimants.

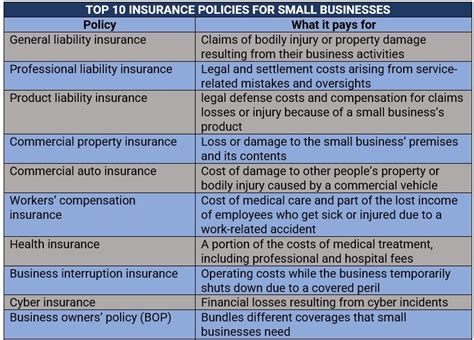

Adjusters work with various types of insurance, including property, casualty, and liability claims. They may be employed by insurance companies, independent adjusting firms, or even work on a freelance basis. Their work involves a combination of desk-based research, site visits, and face-to-face interactions with claimants and other stakeholders.

In the claims process, adjusters play a critical role in:

- Investigating Claims: They thoroughly examine the circumstances surrounding a claim, gathering evidence, and assessing the extent of damage or loss.

- Evaluating Coverage: Adjusters have an in-depth understanding of insurance policies and use this knowledge to determine the applicable coverage for a specific claim.

- Negotiating Settlements: A key aspect of their role is negotiating with claimants to reach a fair and mutually acceptable settlement, ensuring both parties' interests are considered.

- Managing Claim Files: They maintain detailed records of each claim, ensuring all relevant documentation is accurate and up-to-date.

- Communicating with Stakeholders: Effective communication is vital as adjusters interact with a range of individuals, including claimants, insurance agents, legal representatives, and experts in various fields.

Skills and Qualities of a Successful Insurance Adjuster

The insurance adjuster role demands a unique set of skills and qualities. Here are some of the key attributes that contribute to success in this field:

- Attention to Detail: Adjusters must possess an acute eye for detail, as even the smallest oversight can impact a claim's outcome.

- Analytical Thinking: Strong analytical skills are essential for evaluating claims, interpreting policies, and making informed decisions.

- Communication Proficiency: Excellent written and verbal communication skills are vital for interacting with a diverse range of individuals and conveying complex information clearly.

- Negotiation Expertise: The ability to negotiate effectively is crucial for reaching mutually beneficial settlements.

- Organization and Time Management: Managing multiple claims simultaneously requires excellent organizational skills and the ability to prioritize tasks efficiently.

- Empathy and Interpersonal Skills: Adjusters often deal with individuals who are facing challenging situations, so empathy and the ability to build rapport are essential.

- Adaptability: The insurance industry is constantly evolving, and adjusters must be adaptable to changes in regulations, technologies, and insurance products.

- Integrity and Ethics: Maintaining high ethical standards is crucial in this role, as adjusters handle sensitive information and must make unbiased decisions.

Education and Training Requirements

While specific requirements may vary by state or country, a solid educational foundation is beneficial for aspiring insurance adjusters. Here’s an overview of the typical path to becoming an insurance adjuster:

Education

Most insurance adjusters hold at least a high school diploma or equivalent. However, a growing number of employers prefer candidates with a bachelor’s degree, particularly in fields such as business, finance, or insurance.

While not always mandatory, a degree can provide a strong foundation in relevant areas like risk management, insurance law, and financial analysis. Additionally, some universities offer specialized programs or concentrations in insurance, which can be advantageous for those seeking a career in this field.

Licensing and Certification

Licensing requirements for insurance adjusters vary by jurisdiction. In the United States, for example, adjusters typically need to obtain a license from their state’s insurance department. The licensing process often involves passing an exam that tests knowledge of insurance principles, laws, and regulations.

Beyond licensing, several certifications can enhance an adjuster's credentials and demonstrate a higher level of expertise. Some of the prominent certifications in the field include:

- Certified Insurance Adjuster (CIA): This certification is offered by the American Institute for Chartered Property Casualty Underwriters (CPCU Society) and validates an adjuster's knowledge and skills.

- Certified Claims Adjuster (CCA): The National Alliance for Insurance Education & Research provides this certification, which focuses on claims adjustment and management.

- Certified Claims Specialist (CCS): Offered by the Insurance Institute of America, this certification covers various aspects of the claims process, including investigation, evaluation, and settlement.

Getting Started in the Field

Breaking into the insurance adjuster field can be exciting but may also present challenges. Here are some steps to help aspiring adjusters get started:

Gaining Experience

Entry-level positions in insurance often provide a solid foundation for aspiring adjusters. These roles, such as customer service representatives or underwriters, can offer valuable insights into the industry and its operations. They also provide an opportunity to network with experienced professionals who can offer mentorship and guidance.

Internships and Entry-Level Positions

Internships with insurance companies or adjusting firms can be an excellent way to gain hands-on experience and build a professional network. These opportunities often lead to full-time positions, providing a smooth transition into the field.

Continuing Education

The insurance industry is dynamic, with frequent changes in regulations and products. Continuous learning is essential for adjusters to stay updated and maintain their expertise. Many states require adjusters to complete a certain number of continuing education hours annually to renew their licenses.

Building a Professional Network

Networking is a powerful tool for career advancement. Joining professional organizations, attending industry events, and engaging with colleagues can provide valuable insights, mentorship, and potential job opportunities.

Career Growth and Advancement

The insurance adjuster career path offers ample opportunities for growth and advancement. With experience and a solid track record, adjusters can progress into senior roles with increased responsibilities and higher earnings. Some potential career trajectories include:

- Senior Claims Adjuster: This role involves managing a team of adjusters, overseeing complex claims, and providing mentorship to junior staff.

- Claims Supervisor or Manager: Supervisors and managers are responsible for the overall claims department, ensuring efficient operations and quality control.

- Independent Adjuster: Experienced adjusters may choose to work independently, offering their services to multiple insurance companies or adjusting firms.

- Specialized Adjuster: Adjusters can specialize in specific areas, such as auto, property, or liability claims, becoming experts in their chosen field.

- Underwriting or Risk Management: With their deep understanding of insurance, adjusters may transition into underwriting roles, assessing and pricing risks.

Additionally, many insurance companies and adjusting firms offer internal training programs and mentorship initiatives to support career growth and development.

Conclusion

Becoming an insurance adjuster offers a rewarding career path with opportunities for growth, variety, and impact. By combining strong analytical skills, excellent communication, and a commitment to ethical practices, adjusters play a vital role in ensuring fair and efficient claims handling. With the right education, training, and experience, aspiring adjusters can embark on a fulfilling journey in the insurance industry.

What is the typical salary range for insurance adjusters?

+Salaries for insurance adjusters can vary based on factors such as experience, location, and specialization. Entry-level adjusters may start around 40,000 to 50,000 annually, while experienced adjusters can earn upwards of 80,000 to 100,000. Senior roles and specialized positions often command higher salaries.

How long does it typically take to become an insurance adjuster?

+The timeline can vary, but many individuals pursue a bachelor’s degree, which typically takes 4 years. After graduation, it often takes a few months to obtain the necessary licenses and certifications. So, on average, it can take around 4 to 5 years to become an insurance adjuster.

Are there opportunities for remote work as an insurance adjuster?

+Yes, with advancements in technology, many insurance companies and adjusting firms offer remote work opportunities. Adjusters can work from home or other locations, especially for roles that involve desk-based tasks and claim evaluations. However, site visits and face-to-face interactions may still be required in certain situations.