Average Home Insurance Cost California

California, the Golden State, is renowned for its diverse landscapes, vibrant cities, and a lifestyle that attracts people from all over the world. However, the dream of living in California comes with its own set of considerations, and one of the most important is understanding the cost of home insurance in this unique and varied state.

The average cost for a 500,000 home in California can vary based on location and other factors. It could range from 1,500 to 3,000 annually.">What is the average cost of home insurance in California for a 500,000 home? +

Home insurance is an essential investment for homeowners, providing financial protection against unforeseen events such as natural disasters, theft, or accidents. Given California's propensity for natural calamities like wildfires and earthquakes, along with its high property values, the cost of home insurance can be a significant factor for prospective and current homeowners.

In this comprehensive guide, we will delve into the factors that influence the average cost of home insurance in California, explore the range of rates across different regions, and provide valuable insights to help homeowners make informed decisions about their coverage.

Understanding the Average Home Insurance Cost in California

The average cost of home insurance in California can vary significantly depending on a multitude of factors. These factors include the location of the property, the age and condition of the home, the coverage limits chosen, and any additional features or endorsements added to the policy.

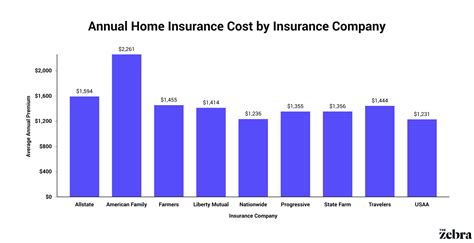

According to industry data, the average annual premium for home insurance in California is approximately $1,200, which is higher than the national average. However, this figure is just an average, and the actual cost can range from a few hundred dollars to several thousand dollars, depending on individual circumstances.

It's important to note that California's diverse geography and climate play a significant role in determining insurance rates. Coastal regions, for instance, may face higher premiums due to the risk of earthquakes and coastal storms, while inland areas might experience higher rates due to the threat of wildfires.

Factors Influencing Home Insurance Costs

Several key factors contribute to the variability of home insurance costs in California. Understanding these factors can help homeowners make more informed decisions when choosing their insurance coverage.

- Location: The specific region or city within California can significantly impact insurance rates. Areas with a higher risk of natural disasters or criminal activity may have higher premiums. For instance, regions prone to wildfires or earthquakes often command higher insurance costs.

- Home Value and Size: The value and size of the home are crucial factors. Generally, larger homes or those with higher replacement costs will have higher insurance premiums. The type of construction and the age of the home can also influence rates, as older homes may require more extensive coverage.

- Coverage Limits: Homeowners can choose different coverage limits for their policies. Higher coverage limits will naturally result in higher premiums. It's essential to find a balance between adequate coverage and affordability.

- Deductibles: The deductible, or the amount the homeowner pays out of pocket before the insurance kicks in, can affect the premium. Higher deductibles often lead to lower premiums, while lower deductibles can result in higher premiums.

- Claims History: Insurance companies consider a homeowner's claims history when setting rates. A history of frequent claims may lead to higher premiums, as it indicates a higher risk to the insurer.

- Discounts and Bundling: Many insurance companies offer discounts for various reasons, such as loyalty, safety features in the home, or bundling multiple policies (e.g., home and auto insurance) with the same provider.

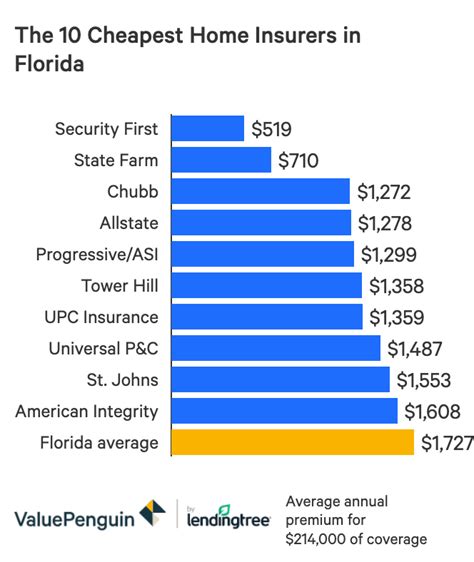

Regional Variations in Home Insurance Costs

California's vast size and diverse geography mean that home insurance costs can vary significantly from one region to another. Let's explore some of the key regions and their associated insurance costs.

Southern California

Southern California, encompassing major cities like Los Angeles, San Diego, and Orange County, is known for its beautiful beaches, diverse entertainment options, and, unfortunately, its susceptibility to natural disasters. The region's proximity to the coast increases the risk of earthquakes and coastal storms, which can drive up insurance premiums.

| Region | Average Annual Premium |

|---|---|

| Los Angeles County | $1,500 - $2,000 |

| San Diego County | $1,300 - $1,800 |

| Orange County | $1,200 - $1,600 |

Northern California

Northern California, home to cities like San Francisco, Sacramento, and the iconic Silicon Valley, offers a unique blend of urban life, natural beauty, and technological innovation. While this region is generally considered less risky in terms of natural disasters compared to Southern California, it still faces challenges, particularly with wildfires and earthquakes.

| Region | Average Annual Premium |

|---|---|

| San Francisco Bay Area | $1,000 - $1,500 |

| Sacramento and Surrounding Areas | $900 - $1,200 |

| Central Coast (e.g., Santa Cruz, Monterey) | $1,100 - $1,400 |

Central Valley and Inland Regions

The Central Valley and inland regions of California, including cities like Fresno, Bakersfield, and Stockton, offer a more affordable cost of living compared to coastal areas. However, these regions face their own set of challenges, primarily the threat of wildfires, which can impact insurance rates.

| Region | Average Annual Premium |

|---|---|

| Fresno and Surrounding Areas | $800 - $1,100 |

| Bakersfield and Kern County | $900 - $1,200 |

| Stockton and San Joaquin Valley | $850 - $1,050 |

Tips for Lowering Home Insurance Costs

While the average cost of home insurance in California can be higher than in other states, there are strategies homeowners can employ to potentially reduce their insurance premiums.

- Shop Around: Don't settle for the first insurance quote you receive. Compare rates from multiple providers to find the best value for your specific needs.

- Increase Deductibles: Opting for higher deductibles can lower your premium, but ensure you can afford the deductible amount if a claim arises.

- Bundle Policies: Many insurance companies offer discounts when you bundle your home and auto insurance policies with them.

- Safety Features: Installing safety features like smoke detectors, fire sprinklers, and security systems can qualify you for discounts.

- Review Coverage Regularly: Your insurance needs may change over time. Regularly review your coverage to ensure you're not over- or under-insured.

- Consider Renovations: Upgrading your home's plumbing, electrical systems, or roof can sometimes lower insurance costs by reducing potential risks.

The Future of Home Insurance in California

The home insurance landscape in California is continually evolving, driven by changing environmental conditions, technological advancements, and shifting regulatory environments. As the state grapples with the increasing frequency and severity of natural disasters, particularly wildfires and earthquakes, the insurance industry is adapting its strategies to manage risks and provide adequate coverage.

One of the key trends is the increased focus on risk assessment and mitigation. Insurance companies are utilizing advanced technologies, including satellite imagery and data analytics, to more accurately assess the risk profiles of individual properties. This allows for a more nuanced approach to pricing, ensuring that homeowners are paying premiums that reflect their specific risk factors.

Furthermore, there is a growing emphasis on promoting disaster resilience and preparedness among homeowners. Insurance providers are offering incentives and discounts for homes that meet certain resilience standards, such as wildfire-resistant roofing materials or earthquake-proof foundations. By encouraging homeowners to take proactive measures, the industry aims to reduce the severity of losses and create a more sustainable insurance market.

The regulatory environment in California also plays a significant role in shaping the future of home insurance. The state's Department of Insurance continually works to protect consumers and ensure a competitive market. Recent initiatives have focused on addressing the challenges posed by climate change, including measures to stabilize the insurance market and provide relief to homeowners in high-risk areas.

Key Takeaways

Understanding the average cost of home insurance in California is essential for homeowners to make informed decisions about their coverage. While the state's unique risks, such as wildfires and earthquakes, can drive up insurance premiums, there are strategies available to potentially lower costs. By shopping around, increasing deductibles, and implementing safety features, homeowners can find the right balance between coverage and affordability.

As California continues to navigate the challenges posed by its diverse and dynamic environment, the home insurance industry will play a crucial role in protecting homeowners and promoting resilience. By staying informed about the latest trends and advancements in the industry, homeowners can ensure they are adequately prepared for whatever the future may hold.

What is the average cost of home insurance in California for a 500,000 home?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>The average cost for a 500,000 home in California can vary based on location and other factors. It could range from 1,500 to 3,000 annually.

Are there any discounts available for home insurance in California?

+Yes, insurance companies often offer discounts for factors like loyalty, safety features, and bundling policies.

How do I find the best home insurance rate in California?

+Compare quotes from multiple insurers, consider higher deductibles, and take advantage of available discounts.