Average Cost For Renters Insurance

Renters insurance, often overlooked by many tenants, is an essential aspect of financial planning and risk management for individuals residing in rental properties. It provides a crucial safety net, protecting renters from potential financial burdens that can arise from various unforeseen events. Understanding the average cost of renters insurance is vital for individuals looking to secure their possessions and future without breaking the bank. This article aims to delve into the intricacies of renters insurance costs, providing a comprehensive analysis to help renters make informed decisions about their insurance coverage.

The Importance of Renters Insurance

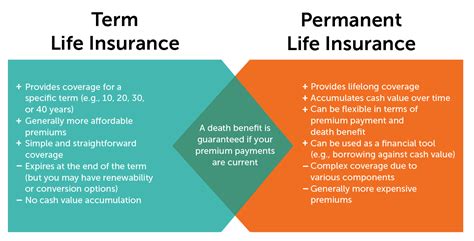

Before delving into the specifics of costs, it’s imperative to grasp the significance of renters insurance. Unlike homeowners insurance, which is often mandated by mortgage lenders, renters insurance is an optional coverage. However, its value cannot be overstated, as it safeguards renters against a range of perils that could otherwise result in substantial financial losses.

Renters insurance typically offers coverage for personal property, liability, and additional living expenses. In the event of a covered loss, such as a fire, theft, or vandalism, renters insurance can provide financial relief, covering the cost of damaged or lost belongings and, in some cases, even providing temporary housing expenses.

Furthermore, renters insurance provides an added layer of protection against liability claims. Should a guest suffer an injury while on the rental property, renters insurance can provide coverage for any resulting legal expenses and settlements. This coverage is particularly crucial for renters who host guests frequently or have young children or pets.

Factors Influencing Renters Insurance Costs

The cost of renters insurance is influenced by a multitude of factors, each playing a significant role in determining the premium. Understanding these factors can help renters anticipate and manage their insurance expenses effectively.

Coverage Amount and Deductibles

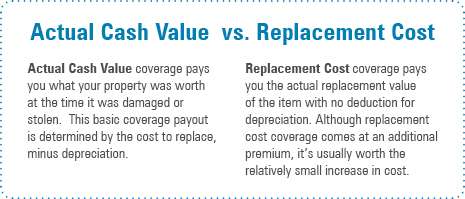

The amount of coverage an individual chooses is a primary determinant of the insurance premium. Renters insurance policies typically offer coverage limits ranging from 10,000 to 50,000 for personal property, with higher limits available for an additional cost. It’s crucial for renters to assess the value of their possessions accurately to ensure they have adequate coverage without overpaying.

Deductibles, the amount renters must pay out of pocket before their insurance coverage kicks in, also impact the premium. Opting for a higher deductible can result in a lower premium, as it reduces the insurer's potential liability. However, it's essential to choose a deductible that is manageable financially, ensuring that the renter can afford to pay it in the event of a claim.

Location and Risk Factors

The geographical location of the rental property is a significant factor in determining renters insurance costs. Areas with higher crime rates, a history of natural disasters, or a higher incidence of claims may see increased insurance premiums. Insurance companies assess the risk associated with a particular location and adjust premiums accordingly.

Additionally, the type of dwelling and its construction can influence insurance costs. For instance, apartments in high-rise buildings may have lower premiums due to the presence of security systems and fire safety measures. In contrast, older buildings or those constructed with combustible materials may face higher insurance costs due to the increased risk of fire or structural damage.

Renter’s Claims History and Credit Score

An individual’s claims history and credit score are also considered when determining renters insurance premiums. Renters with a history of frequent claims or those with a low credit score may face higher premiums. Insurance companies use these factors to assess the potential risk associated with insuring a particular individual, adjusting premiums to reflect the perceived level of risk.

Discounts and Bundling Options

Renters can often take advantage of discounts and bundling options to reduce their insurance costs. Many insurance companies offer discounts for policyholders who maintain multiple policies with the same insurer, such as combining renters and auto insurance. Additionally, renters may qualify for discounts if they have certain safety features in their rental unit, such as smoke detectors or security systems.

Average Cost of Renters Insurance

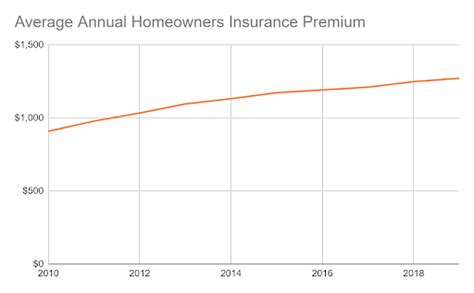

The average cost of renters insurance varies significantly depending on the factors mentioned above. According to recent data, the average annual premium for renters insurance in the United States ranges from 150 to 300. However, it’s essential to note that this is just an average, and actual premiums can vary widely based on individual circumstances.

For instance, renters in high-risk areas or those requiring higher coverage limits may pay significantly more than the average. On the other hand, renters who qualify for discounts or opt for higher deductibles may pay considerably less.

| Coverage Amount | Average Annual Premium |

|---|---|

| $10,000 | $120 |

| $20,000 | $150 |

| $30,000 | $180 |

| $40,000 | $210 |

| $50,000 | $240 |

It's worth noting that the table above provides a general guideline, and actual premiums may differ based on individual circumstances and the insurance company chosen. Renters should obtain quotes from multiple insurers to compare costs and coverage options.

Regional Variations in Renters Insurance Costs

Renters insurance costs can vary significantly from one region to another. For instance, states with a higher cost of living or a history of natural disasters may have higher average premiums. According to a recent study, the states with the highest average renters insurance premiums include California, Florida, and New York, with premiums often exceeding the national average.

On the other hand, states with lower populations, fewer natural disasters, and a lower cost of living tend to have lower average premiums. For example, states like North Dakota, Iowa, and Nebraska often have average premiums well below the national average.

| State | Average Annual Premium |

|---|---|

| California | $350 |

| Florida | $320 |

| New York | $280 |

| North Dakota | $180 |

| Iowa | $160 |

| Nebraska | $140 |

Tips for Reducing Renters Insurance Costs

While the cost of renters insurance is largely determined by external factors, there are several strategies renters can employ to potentially reduce their premiums:

- Shop around and compare quotes from multiple insurers to find the best rates.

- Increase your deductible to lower your premium, but ensure you can afford the deductible in the event of a claim.

- Bundle your renters insurance with other policies, such as auto insurance, to qualify for multi-policy discounts.

- Maintain a good credit score, as this can positively impact your insurance premiums.

- Install security features in your rental unit, such as smoke detectors, security systems, or fire sprinklers, as these can qualify you for discounts.

- Review your policy annually and adjust your coverage as your needs change.

Choosing the Right Renters Insurance Policy

Selecting the right renters insurance policy involves more than just finding the lowest premium. Renters should carefully consider their specific needs and circumstances to ensure they have adequate coverage. Here are some key considerations when choosing a renters insurance policy:

Coverage Limits

Assess the value of your personal possessions and choose a coverage limit that adequately reflects their worth. Underestimating the value of your belongings can leave you underinsured, while overestimating can result in unnecessary expenses.

Additional Coverages

Renters insurance policies often offer additional coverages, such as personal liability, medical payments to others, and coverage for valuable items like jewelry or electronics. Consider your specific needs and the potential risks you face to determine if these additional coverages are necessary.

Policy Exclusions

Carefully review the policy exclusions to understand what is not covered. Common exclusions in renters insurance policies include damage caused by floods, earthquakes, or pests. If you live in an area prone to these risks, you may need to purchase separate coverage or consider alternative insurance options.

Reputation and Financial Stability of the Insurer

Choose an insurance company with a strong reputation and financial stability. This ensures that the insurer will be able to pay out claims promptly and fairly. You can research insurance companies through ratings agencies and consumer reviews to assess their reliability.

Future of Renters Insurance

The renters insurance market is evolving, with new technologies and trends shaping the industry. Insurtech, the intersection of insurance and technology, is bringing innovative solutions to the market, making it easier for renters to access insurance and manage their policies.

One notable trend is the increasing availability of usage-based insurance policies. These policies use sensors or other technology to assess the risk associated with a particular rental unit, allowing insurers to offer more tailored and potentially more affordable coverage. Additionally, the use of big data and advanced analytics is enabling insurers to more accurately assess risk and price policies, which could lead to more competitive premiums for renters.

As the rental market continues to grow and evolve, the demand for renters insurance is likely to increase. This, coupled with the advancements in technology, suggests that renters insurance will become more accessible and tailored to individual needs. Renters can expect to see more personalized coverage options and potentially more affordable premiums in the future.

Conclusion

Renters insurance is an essential component of financial security for individuals residing in rental properties. By understanding the factors that influence insurance costs and the average premiums, renters can make informed decisions about their coverage. With the right policy, renters can protect their possessions and future without incurring excessive expenses.

As the renters insurance market evolves, renters can look forward to more innovative and tailored coverage options. By staying informed and proactive, renters can ensure they have the protection they need without straining their finances.

What is the difference between renters insurance and homeowners insurance?

+Renters insurance and homeowners insurance serve different purposes. Renters insurance is designed to protect renters’ personal property and provide liability coverage for individuals residing in rental properties. On the other hand, homeowners insurance is tailored for homeowners and covers the structure of the home as well as personal belongings. Homeowners insurance often includes additional coverages not typically found in renters insurance policies, such as coverage for damage to the dwelling.

Do I need renters insurance if my landlord has insurance?

+While your landlord may have insurance for the rental property, it typically only covers the structure and the landlord’s liability. It does not cover your personal belongings or provide liability coverage for you. Renters insurance is essential to protect your possessions and provide you with liability coverage in case of accidents or injuries on your rental property.

Can I get renters insurance even if I have a low credit score?

+Yes, it is possible to obtain renters insurance even with a low credit score. While your credit score may impact the premium you pay, it is not the sole determining factor. Other factors such as your claims history, the location of your rental property, and the coverage limits you choose also play a significant role in determining your premium. It’s advisable to shop around and obtain quotes from multiple insurers to find the best coverage at a competitive price.