Average Cost For Homeowners Insurance

Homeowners insurance is an essential aspect of homeownership, providing financial protection against various risks and liabilities. The average cost of homeowners insurance is a topic of interest for many prospective and current homeowners, as it directly impacts their monthly expenses and overall financial planning. This comprehensive guide aims to delve into the intricacies of homeowners insurance costs, exploring the factors that influence them and offering insights into how homeowners can secure the best coverage at a reasonable price.

The cost of homeowners insurance for a 200,000 home can vary widely, depending on factors such as location, the home’s age and construction, and the coverage limits selected. On average, it could range from a few hundred dollars to over $1,000 annually.">How much does homeowners insurance cost for a 200,000 home? +

Understanding the Average Cost of Homeowners Insurance

The average cost of homeowners insurance varies significantly depending on numerous factors, including location, the type and value of the property, and the level of coverage desired. According to recent industry data, the average annual premium for homeowners insurance in the United States is approximately $1,312, with costs ranging from a few hundred dollars to several thousand dollars annually. However, it’s crucial to note that this average cost is just a starting point, and the actual premium can deviate significantly based on individual circumstances.

Factors Influencing Homeowners Insurance Costs

Several key factors play a role in determining the cost of homeowners insurance. These include:

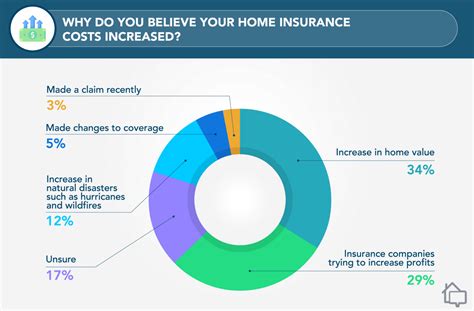

- Location: Insurance rates are heavily influenced by the geographic location of the property. Areas prone to natural disasters like hurricanes, earthquakes, or floods typically have higher insurance premiums. Additionally, crime rates and the local fire department’s response rating can also impact insurance costs.

- Property Type and Value: The type of home and its replacement cost are significant factors. Larger homes, custom-built properties, or those with unique architectural features often require more coverage and thus cost more to insure. The age of the home and its construction materials can also affect insurance rates.

- Coverage Amount and Deductibles: The amount of coverage selected by the homeowner directly impacts the premium. Higher coverage limits generally result in higher premiums. Additionally, the choice of deductibles plays a role; a higher deductible usually leads to a lower premium, and vice versa.

- Claims History: Insurance companies consider a homeowner’s claims history when determining rates. Frequent claims can lead to higher premiums or even non-renewal of the policy.

- Discounts and Bundling: Many insurance companies offer discounts for various reasons, such as having multiple policies with the same insurer (e.g., bundling home and auto insurance), installing safety features like smoke detectors or security systems, or being a long-term customer.

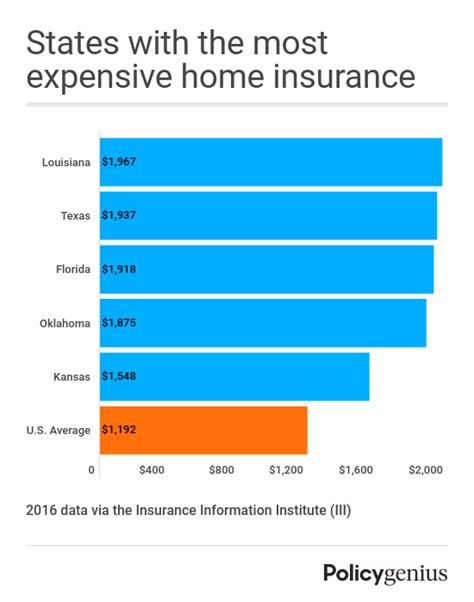

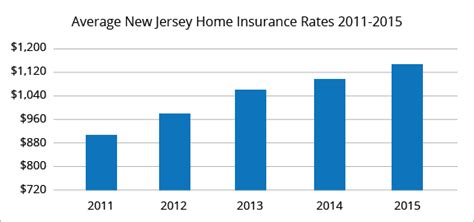

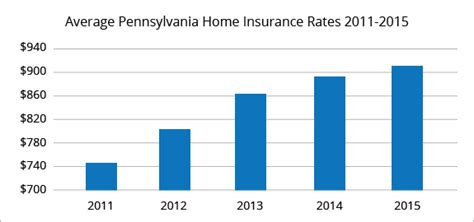

Regional Variations in Homeowners Insurance Costs

The cost of homeowners insurance can vary greatly from one state to another and even within different regions of the same state. For instance, states like Florida, Louisiana, and Texas, which are prone to hurricanes, tend to have higher average insurance costs. On the other hand, states like Ohio, Indiana, and Pennsylvania typically have lower average premiums.

| State | Average Annual Premium |

|---|---|

| Florida | $2,600 |

| Louisiana | $2,100 |

| Texas | $2,000 |

| Ohio | $900 |

| Indiana | $850 |

| Pennsylvania | $1,200 |

Tips for Lowering Homeowners Insurance Costs

While the average cost of homeowners insurance is a useful reference point, it’s not a fixed or unchangeable figure. Homeowners can take several proactive steps to potentially reduce their insurance premiums. Here are some strategies to consider:

Increase Your Deductible

Opting for a higher deductible can lead to significant savings on your insurance premium. For example, raising your deductible from 500 to 1,000 could reduce your premium by 20% or more. However, it’s essential to ensure that you can afford the higher deductible in the event of a claim.

Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies with them. For instance, if you have auto insurance with a particular provider, you might receive a discount on your homeowners insurance when you bundle the two.

Maintain a Good Credit Score

Insurance companies often use credit scores as a factor in determining insurance rates. A good credit score can lead to lower premiums, so it’s essential to maintain a healthy credit profile.

Install Safety and Security Features

Installing certain safety features like smoke detectors, fire sprinklers, burglar alarms, and deadbolt locks can make your home less risky to insure and lead to premium discounts. Additionally, investing in a home security system monitored by a central station can provide further savings.

Review Your Policy Regularly

Insurance needs and costs can change over time. It’s important to review your policy annually to ensure that your coverage is still adequate and that you’re not paying for coverage you no longer need. Regular reviews can also help you identify potential discounts or changes in your circumstances that could affect your premium.

Shop Around and Compare Quotes

Different insurance companies have different rates and discounts. Shopping around and comparing quotes from multiple providers can help you find the best coverage at the most competitive price. Online insurance marketplaces or insurance agents can be useful resources for obtaining multiple quotes.

Conclusion: Finding the Right Balance

The average cost of homeowners insurance is a starting point for understanding the financial commitment of protecting your home. However, it’s just one piece of the puzzle. The actual cost of your homeowners insurance will depend on your unique circumstances and the level of coverage you choose. By understanding the factors that influence insurance costs and taking proactive steps to manage them, you can find the right balance between adequate coverage and affordable premiums.

What is the average cost of homeowners insurance per month?

+On average, homeowners insurance costs around 109 per month, or 1,312 annually. However, this average can vary significantly based on factors like location, property type, and coverage amounts.

How much does homeowners insurance cost for a 200,000 home?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>The cost of homeowners insurance for a 200,000 home can vary widely, depending on factors such as location, the home’s age and construction, and the coverage limits selected. On average, it could range from a few hundred dollars to over $1,000 annually.

What is the cheapest homeowners insurance option?

+The cheapest homeowners insurance option will depend on your specific circumstances and location. Generally, shopping around for quotes from multiple insurers and comparing rates can help you find the most cost-effective coverage for your needs.