Average Amount For Car Insurance

Car insurance is an essential aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. The cost of car insurance can vary significantly depending on numerous factors, and understanding these factors is crucial for individuals seeking to obtain adequate coverage without overspending. In this comprehensive article, we delve into the average amounts associated with car insurance, exploring the key determinants that influence premiums and offering insights into how individuals can secure the best rates tailored to their unique circumstances.

Factors Influencing Car Insurance Premiums

The average cost of car insurance is influenced by a multitude of factors, each playing a distinct role in determining the overall premium. These factors include:

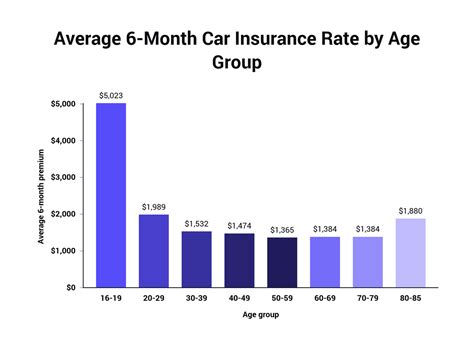

- Driver Profile: Age, gender, driving experience, and the driver's history of accidents and traffic violations significantly impact insurance rates. Younger drivers, especially males, often face higher premiums due to their perceived risk profile.

- Vehicle Type: The make, model, and year of the vehicle can affect insurance costs. High-performance cars and luxury vehicles typically have higher premiums due to their higher repair and replacement costs.

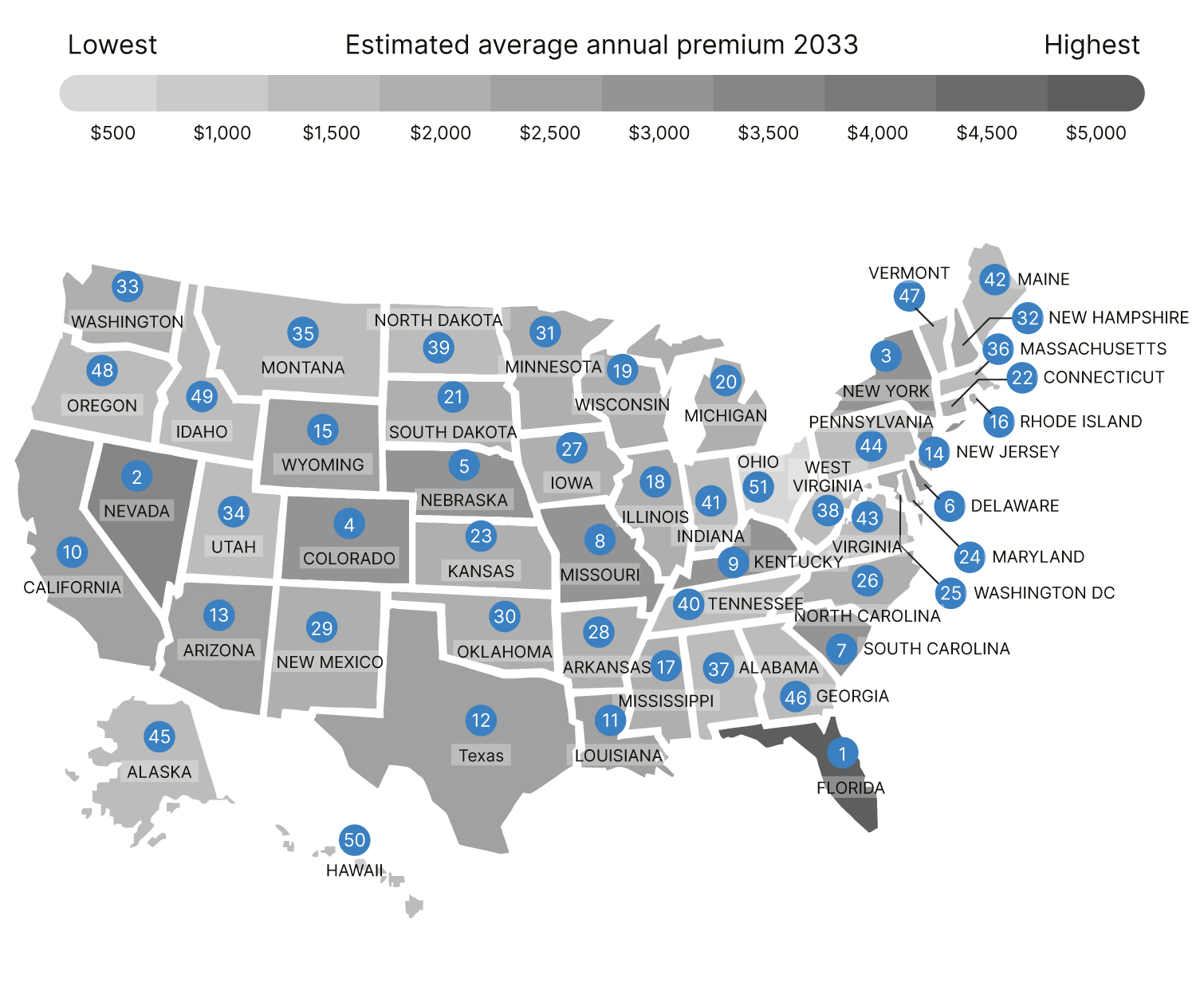

- Location: Insurance rates can vary based on the geographical location. Areas with higher populations, increased traffic, and a higher incidence of accidents and thefts often command higher premiums.

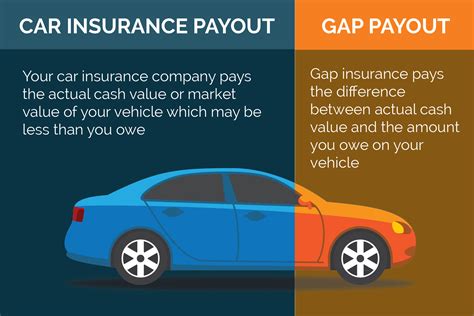

- Coverage Type and Limits: The type of coverage chosen, such as liability-only, collision, comprehensive, or personal injury protection (PIP), and the limits of each coverage, directly impact the premium. Higher coverage limits generally result in higher premiums.

- Usage and Mileage: The frequency and distance of vehicle usage can affect insurance rates. Drivers who use their vehicles for business or commute long distances may pay more.

- Credit Score: In many states, insurance companies use credit-based insurance scores to assess risk. Individuals with higher credit scores may be eligible for lower premiums.

- Claims History: A history of frequent claims can lead to higher premiums or even non-renewal of policies. Insurance companies consider past claims when determining future rates.

- Discounts and Bundles: Insurance companies often offer discounts for various reasons, such as good driving records, safe vehicle features, or bundling multiple policies (e.g., auto and home insurance) with the same provider.

Average Car Insurance Premiums by Coverage Type

The average cost of car insurance varies depending on the type of coverage chosen. Here’s a breakdown of average premiums for different coverage types based on industry data:

| Coverage Type | Average Annual Premium (USD) |

|---|---|

| Liability-Only Coverage | $500 - $1,500 |

| Collision Coverage | $300 - $800 (in addition to liability) |

| Comprehensive Coverage | $150 - $400 (in addition to liability) |

| Personal Injury Protection (PIP) | $300 - $1,000 (varies by state and coverage limits) |

It's important to note that these averages can vary significantly based on the factors mentioned earlier, and they are intended as a general guide rather than precise estimates.

Understanding Coverage Limits and Deductibles

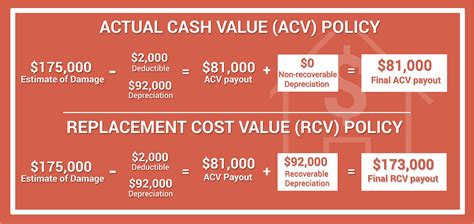

When choosing car insurance, understanding coverage limits and deductibles is crucial. Coverage limits refer to the maximum amount an insurance company will pay for a covered loss, while deductibles are the amount you pay out of pocket before your insurance coverage kicks in.

Higher coverage limits typically result in higher premiums, as they provide more extensive protection. On the other hand, choosing a higher deductible can lower your premium, as you're assuming more financial responsibility in the event of a claim. It's a delicate balance between cost and coverage, and individuals should carefully consider their financial situation and risk tolerance when making these choices.

Tips for Securing the Best Car Insurance Rates

Here are some practical tips to help you find the best car insurance rates:

- Shop Around: Compare quotes from multiple insurance providers. Online quote tools can be a convenient way to quickly gather estimates.

- Consider Bundling: Bundling multiple policies (e.g., auto and home insurance) with the same provider can often lead to significant discounts.

- Improve Your Driving Record: Maintaining a clean driving record with no accidents or violations can lead to lower premiums over time.

- Explore Discounts: Insurance companies offer various discounts for safe driving, good student status, vehicle safety features, and more. Inquire about available discounts and see if you qualify.

- Review Coverage Annually: Regularly review your insurance policy to ensure it still meets your needs. Coverage requirements may change over time, and you might be able to save by adjusting your policy.

- Consider Usage-Based Insurance: Some insurance providers offer usage-based insurance programs that monitor driving behavior and offer discounts for safe driving habits.

- Pay Annually or Semi-Annually: Many insurance companies offer discounts for paying your premium in full annually or semi-annually rather than monthly.

Future Trends in Car Insurance

The car insurance industry is evolving, and several trends are shaping the future of automotive coverage. Here are some key developments to watch:

- Telematics and Usage-Based Insurance: Telematics devices and smartphone apps are becoming more prevalent, allowing insurance companies to track driving behavior and offer more personalized premiums based on actual driving habits.

- Artificial Intelligence and Data Analytics

- Autonomous Vehicles: As self-driving cars become a reality, the insurance landscape will need to adapt. Liability for accidents may shift from drivers to vehicle manufacturers, and new coverage types may emerge.

- Blockchain Technology: Blockchain has the potential to streamline insurance processes, improve data security, and enhance the efficiency of claims handling.

- Increased Competition: The entry of new insurance providers, including tech-driven startups, is likely to increase competition and drive innovation, potentially leading to better rates and services for consumers.

Advanced data analytics and AI are being used to improve risk assessment and fraud detection, potentially leading to more accurate pricing and better claim management.

Conclusion

Car insurance is a critical financial safeguard for vehicle owners, and understanding the average costs and factors influencing premiums is essential for making informed decisions. By considering their unique circumstances, shopping around, and taking advantage of available discounts, individuals can secure the best car insurance rates that offer the right balance of coverage and affordability.

As the car insurance industry continues to evolve with technological advancements and changing risk profiles, staying informed about the latest trends and coverage options will empower consumers to make the most suitable choices for their needs.

How can I reduce my car insurance premium if I’m a young driver?

+As a young driver, you can explore options such as maintaining a clean driving record, enrolling in a defensive driving course, or considering a usage-based insurance program that rewards safe driving habits. Additionally, you may qualify for student discounts if you’re a full-time student.

What is the difference between liability and comprehensive coverage?

+Liability coverage is mandatory in most states and covers the cost of damages and injuries you cause to others in an accident. Comprehensive coverage, on the other hand, covers damages to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

Can I get car insurance if I have a poor credit score?

+Yes, you can still obtain car insurance with a poor credit score. However, it’s important to shop around as insurance companies have different underwriting criteria. Additionally, working on improving your credit score over time can lead to more favorable insurance rates.