Automobile Insurance Texas

Automobile insurance, often referred to as car insurance or auto insurance, is a vital aspect of vehicle ownership, providing financial protection and peace of mind to drivers across the United States. In the state of Texas, which is known for its vast landscapes, bustling cities, and diverse driving conditions, having adequate car insurance is not just a legal requirement but also a smart decision to safeguard oneself and one's assets. This comprehensive guide will delve into the world of automobile insurance in Texas, covering everything from the unique challenges faced by Texan drivers to the best practices for securing optimal coverage.

Understanding the Landscape: Texas’ Unique Driving Challenges

Texas, with its sprawling geography and diverse climate, presents a range of driving conditions that are unique to the region. From the bustling highways of Houston and Dallas to the rural roads of West Texas, drivers encounter a variety of scenarios that can impact their insurance needs. Understanding these challenges is crucial for tailoring insurance policies to individual needs.

Weather Extremes

Texas is no stranger to extreme weather, from scorching summers to severe storms and occasional hurricanes. These weather events can lead to increased risk of accidents, property damage, and even natural disasters, all of which can impact insurance rates and claims.

Consider the case of Hurricane Harvey, which struck Texas in 2017. The catastrophic flooding that followed resulted in numerous vehicle damages, highlighting the importance of comprehensive insurance coverage for natural disasters.

Urban vs. Rural Driving

The state’s urban centers like Houston, Dallas, and Austin present their own set of challenges with high traffic volumes, congested roads, and an increased risk of accidents. On the other hand, rural areas have their own risks, such as wildlife collisions and long distances between service providers.

For instance, a driver navigating the highways of Houston during rush hour might face different risks compared to someone driving on a quiet country road in West Texas. Understanding these distinctions is key to tailoring insurance policies effectively.

Population Growth and Traffic

Texas has seen a steady increase in population over the years, leading to more vehicles on the road and a higher risk of accidents. This growth has put additional strain on infrastructure, often resulting in increased traffic congestion and longer commute times.

As the state’s population continues to rise, so does the importance of having adequate insurance coverage. With more vehicles on the road, the likelihood of accidents and claims increases, making comprehensive insurance coverage a necessity for Texan drivers.

The Legal Requirements: Understanding Texas’ Insurance Laws

In Texas, automobile insurance is not just a personal choice but a legal requirement. The state mandates that all drivers carry at least a minimum level of insurance coverage to protect themselves and others on the road. Understanding these legal requirements is crucial for drivers to stay compliant and avoid penalties.

Minimum Liability Coverage

Texas requires drivers to carry liability insurance, which covers the cost of damages and injuries caused to others in an accident for which the insured driver is at fault. The minimum liability limits in Texas are:

- Bodily Injury: 30,000 per person / 60,000 per accident

- Property Damage: $25,000 per accident

While these are the minimum requirements, it is often recommended to carry higher limits to provide adequate protection in the event of a serious accident.

Additional Coverages

Beyond the mandatory liability coverage, Texas drivers may choose to add additional coverages to their policies to protect their own vehicles and assets. These include:

- Collision Coverage: Pays for repairs or replacement of the insured vehicle in the event of a collision, regardless of fault.

- Comprehensive Coverage: Covers damage to the insured vehicle caused by non-collision events such as theft, vandalism, natural disasters, or hitting an animal.

- Personal Injury Protection (PIP): Provides medical coverage for the insured and their passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects the insured in case of an accident with a driver who has no insurance or insufficient insurance.

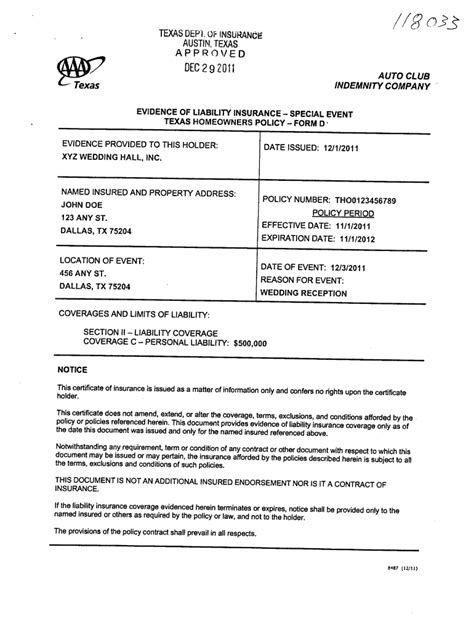

Proof of Insurance

Texas law requires drivers to provide proof of insurance when requested by a law enforcement officer. This can be done by presenting a valid insurance card or an electronic proof of insurance document. Failure to provide proof can result in fines and other penalties.

Shopping for Insurance: Finding the Best Coverage in Texas

With numerous insurance providers operating in Texas, finding the right coverage at the best price can be a daunting task. However, by understanding the key factors that influence insurance rates and having a strategic approach to shopping for insurance, drivers can make informed decisions to secure the best coverage for their needs.

Factors Affecting Insurance Rates

Insurance rates in Texas are influenced by a variety of factors, including the driver’s age, gender, driving history, and the type of vehicle insured. Additionally, the following factors play a significant role:

- Location: Insurance rates can vary significantly based on the driver’s residence. Urban areas often have higher rates due to increased traffic and accident risks.

- Credit Score: In Texas, insurance companies are allowed to use credit-based insurance scores to determine rates. Maintaining a good credit score can help drivers secure more favorable insurance rates.

- Vehicle Usage: How a vehicle is used can impact insurance rates. For instance, driving for work or pleasure can lead to different rates, as can the number of miles driven annually.

Comparing Quotes and Coverage

When shopping for automobile insurance in Texas, it’s crucial to compare quotes from multiple providers. This allows drivers to assess not only the cost but also the coverage offered by each insurer. Some key considerations when comparing quotes include:

- Coverage Limits: Ensure that the quotes provide adequate coverage limits for liability, collision, and comprehensive coverage.

- Deductibles: Compare deductibles, which are the amount the insured pays out of pocket before the insurance coverage kicks in. Lower deductibles often mean higher premiums.

- Additional Coverages: Look for policies that offer optional coverages like rental car reimbursement, roadside assistance, or glass coverage.

- Discounts: Inquire about available discounts, such as multi-policy discounts, safe driver discounts, or loyalty discounts. These can significantly reduce insurance costs.

Working with an Insurance Agent

For those who prefer personalized guidance, working with a local insurance agent can be beneficial. Agents can provide expert advice, help tailor policies to individual needs, and often have access to multiple insurance carriers, ensuring a comprehensive range of options.

Claims and Customer Service: Ensuring a Smooth Process

In the unfortunate event of an accident or vehicle damage, having a responsive and reliable insurance provider is crucial. The claims process and the insurer’s customer service can significantly impact the overall experience. Here’s what Texas drivers should consider when evaluating an insurer’s claims handling and customer service.

Claims Process and Response Time

When an accident occurs, the insurer’s claims process should be efficient and timely. Look for insurance providers that offer 24⁄7 claims reporting and a straightforward process for filing claims, either online or over the phone. A quick response time can help minimize the stress and inconvenience associated with an accident.

Consider an example where a driver is involved in an accident and needs to file a claim. A prompt response from the insurer, including immediate communication and guidance on the next steps, can make a significant difference in the driver’s experience.

Customer Service and Support

Excellent customer service is a hallmark of reputable insurance providers. Look for insurers that offer multiple channels of communication, including phone, email, and live chat, to ensure easy access to support when needed. Additionally, consider the insurer’s track record in resolving customer complaints and providing timely assistance.

For instance, if a policyholder has questions about their coverage or needs assistance understanding their policy, a responsive customer service team can provide the necessary clarity and reassurance.

Roadside Assistance and Additional Benefits

Many insurance providers offer roadside assistance as an added benefit, which can be invaluable in emergency situations. This service often includes towing, flat tire changes, jump-starts, and other assistance, providing peace of mind to drivers.

Additionally, some insurers offer unique benefits such as rental car coverage, accident forgiveness, or discounts on services like oil changes and tire rotations. These added perks can enhance the overall value of an insurance policy.

Special Considerations: Unique Situations in Texas

Texas, with its diverse landscape and unique driving conditions, presents a range of situations that may require specialized insurance considerations. From teen drivers to high-risk professions, understanding these unique scenarios can help drivers tailor their insurance coverage accordingly.

Teen Drivers and Young Adults

Insuring young drivers can be a significant expense due to their higher risk profile. However, there are strategies to mitigate costs, such as maintaining a clean driving record, taking driver education courses, and exploring insurance options that cater specifically to young drivers.

Additionally, parents can consider adding their teen drivers to their existing policies, which may provide more comprehensive coverage and potential discounts.

High-Risk Occupations

Certain professions, such as commercial truck drivers, delivery drivers, or those who frequently travel for work, may face increased insurance costs due to the higher risk associated with their jobs. Understanding the unique insurance needs of these professions is crucial for securing adequate coverage.

For instance, commercial truck drivers may require specialized insurance policies that cover their vehicles and cargo, while delivery drivers may benefit from policies that offer rental car coverage in the event of an accident.

Classic and Antique Cars

Texas is home to many car enthusiasts who own classic and antique vehicles. Insuring these vehicles requires a specialized approach, often involving agreed-value policies that ensure the vehicle’s unique value is properly insured.

Agreed-value policies are particularly important for classic car owners, as they ensure the vehicle is insured for its actual value rather than its depreciated market value. This provides peace of mind and ensures proper compensation in the event of a total loss.

Future Trends: The Evolving Landscape of Auto Insurance in Texas

The world of automobile insurance is constantly evolving, and Texas is no exception. With advancements in technology, changing regulations, and shifting consumer preferences, the insurance landscape is set to undergo significant transformations in the coming years. Here’s a glimpse into the future of auto insurance in Texas.

Technology and Digital Innovations

The insurance industry is embracing technology to enhance the customer experience and improve efficiency. From digital applications that streamline the claims process to the use of telematics for usage-based insurance, technology is set to play a pivotal role in the future of auto insurance.

Usage-based insurance, for instance, allows insurers to track driving behavior and offer personalized premiums based on individual driving habits. This could lead to more accurate pricing and potentially lower rates for safe drivers.

Regulatory Changes and New Laws

Texas, like many states, is subject to regulatory changes that can impact insurance requirements and practices. Keeping abreast of these changes is crucial for both insurers and policyholders to ensure compliance and take advantage of any new opportunities.

For example, if Texas were to implement new laws regarding autonomous vehicles, it could have a significant impact on insurance policies and coverage options for self-driving cars.

Consumer Expectations and Preferences

The modern consumer is increasingly tech-savvy and expects convenience, transparency, and personalized service. Insurers in Texas will need to adapt to these changing expectations, offering digital platforms, personalized coverage options, and a seamless customer experience.

Additionally, with the rise of electric vehicles and alternative fuel options, insurers may need to adapt their policies to accommodate the unique needs and risks associated with these new technologies.

Conclusion: Navigating the Complex World of Auto Insurance in Texas

Automobile insurance in Texas is a complex but essential aspect of vehicle ownership. From understanding the unique driving challenges of the state to navigating the legal requirements and shopping for the best coverage, there are numerous factors to consider. By staying informed, comparing options, and working with reputable insurers, Texan drivers can secure the coverage they need to protect themselves and their assets.

As the insurance landscape continues to evolve, staying up-to-date with the latest trends and innovations will be crucial for both insurers and policyholders. With the right knowledge and strategies, navigating the world of auto insurance in Texas can be a smooth and rewarding experience.

What are the average insurance rates in Texas for different age groups and gender?

+Insurance rates can vary significantly based on age and gender. On average, younger drivers (ages 16-24) tend to have the highest insurance rates due to their higher risk profile. As drivers age, rates generally decrease, with the lowest rates often seen for drivers in their 50s and 60s. Additionally, male drivers typically pay higher premiums than female drivers, particularly in younger age groups.

Are there any discounts available for safe drivers in Texas?

+Yes, many insurance providers offer discounts for safe drivers. These discounts can include accident-free and violation-free periods, as well as rewards for completing defensive driving courses. Additionally, some insurers offer discounts for installing approved safety devices in vehicles.

How does credit score impact insurance rates in Texas?

+In Texas, insurance companies are allowed to use credit-based insurance scores when determining rates. A good credit score can lead to more favorable insurance rates, as it is seen as an indicator of financial responsibility. Conversely, a poor credit score may result in higher premiums.