Automobile Insurance Companies Near Me

Welcome to a comprehensive guide on finding the best automobile insurance companies near you. In today's fast-paced world, having reliable car insurance is crucial, and with so many options available, it's essential to make an informed decision. This article will delve into the world of automotive insurance, providing you with valuable insights, expert tips, and a step-by-step process to find the ideal insurance provider that suits your specific needs.

The Importance of Automobile Insurance

Automobile insurance is more than just a legal requirement; it’s a financial safety net that provides peace of mind and protection against unforeseen circumstances. Whether you’re navigating city streets or embarking on long-distance journeys, having comprehensive coverage can make all the difference. Let’s explore the key reasons why automobile insurance is an indispensable aspect of modern life.

Financial Protection

One of the primary functions of car insurance is to safeguard your finances in the event of an accident or vehicle damage. Repair costs, medical expenses, and legal fees can quickly add up, leaving you with significant financial burdens. A good insurance policy acts as a shield, ensuring that you’re not left footing the entire bill.

For instance, let's consider a hypothetical scenario where you're involved in a collision that results in extensive damage to your vehicle and injuries to yourself and the other driver. Without insurance, you'd be responsible for covering the repair costs, which could run into thousands of dollars, not to mention the medical bills and potential legal expenses. However, with comprehensive insurance coverage, you can rest assured that your insurer will handle these expenses, providing you with financial relief during a challenging time.

Legal Compliance

In most regions, it’s mandatory to have valid automobile insurance to drive legally. Failure to comply with these regulations can result in hefty fines, license suspension, or even legal repercussions. By obtaining insurance, you not only protect yourself but also demonstrate your commitment to responsible driving and community safety.

Imagine being pulled over by a law enforcement officer for a routine traffic stop. If you're unable to produce valid insurance documentation, you may face immediate consequences. In some cases, your vehicle could be impounded, and you might be issued a citation with substantial fines. On the other hand, presenting proof of insurance can smoothen the process and allow you to continue your journey with minimal disruption.

Peace of Mind

Knowing that you’re adequately insured provides a sense of security and peace of mind. Whether you’re a cautious driver or an adventurous road trip enthusiast, accidents can happen, and having insurance coverage ensures that you’re prepared for the unexpected. It allows you to focus on your daily commute or travel plans without constantly worrying about potential financial disasters.

Consider the scenario where you're driving through a remote area and encounter unexpected weather conditions, causing your vehicle to skid off the road. In such situations, having insurance coverage can be a lifesaver. Your insurer can assist with towing services, temporary vehicle repairs, and even provide accommodation until your car is ready to hit the road again. This level of support can make a world of difference during challenging times.

Factors to Consider When Choosing an Insurance Company

With a vast array of automobile insurance companies vying for your attention, it’s crucial to approach the selection process with a critical eye. Each insurer offers unique features, coverage options, and pricing structures. To make an informed decision, here are some key factors to consider:

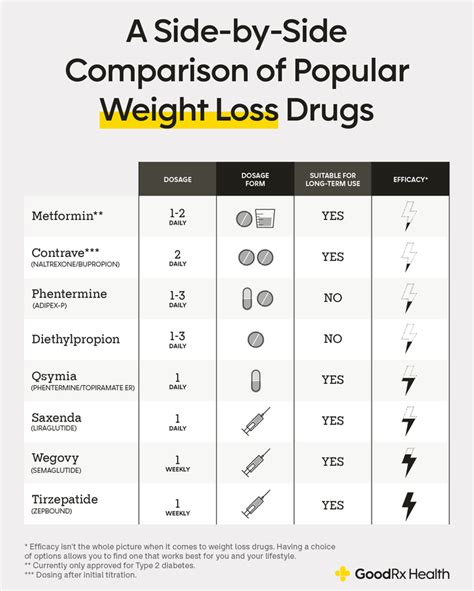

Coverage Options

Evaluate the range of coverage options offered by different insurance companies. Look for providers that offer comprehensive plans, including liability coverage, collision coverage, comprehensive coverage, personal injury protection, and uninsured/underinsured motorist coverage. Ensure that the policy aligns with your specific needs and provides adequate protection.

For example, if you frequently drive in urban areas with high traffic volumes, consider opting for higher liability limits to protect yourself against potential lawsuits. On the other hand, if you live in an area prone to natural disasters like hurricanes or hailstorms, comprehensive coverage becomes crucial to safeguard your vehicle against unexpected damage.

Reputation and Financial Stability

Research the reputation and financial stability of the insurance companies you’re considering. A reputable insurer with a strong financial standing is more likely to provide reliable service and honor claims promptly. Look for companies that have a history of satisfying customers and maintaining positive ratings from industry experts.

Review customer testimonials and online reviews to gauge the insurer's track record. Additionally, check financial ratings from reputable agencies like Standard & Poor's or Moody's to assess their long-term viability and ability to meet financial obligations.

Claims Process and Customer Service

The claims process can be a critical factor in your overall insurance experience. Look for insurance companies with a streamlined and efficient claims process. Assess their customer service reputation, response times, and availability of support channels, such as online portals, phone hotlines, and live chat options.

Imagine a scenario where you're involved in an accident, and you need to file a claim urgently. A responsive and empathetic customer service team can make a significant difference in your experience. They should guide you through the process, provide timely updates, and ensure that your claim is processed efficiently, allowing you to focus on your recovery or vehicle repairs.

Pricing and Discounts

While insurance is a necessary expense, it’s important to find a balance between coverage and affordability. Compare pricing structures and available discounts offered by different insurers. Look for providers that offer competitive rates without compromising on coverage quality.

Explore potential discounts based on your driving history, vehicle safety features, multi-policy bundles, or even your profession. Many insurance companies provide incentives for safe driving records, so be sure to inquire about these opportunities to potentially reduce your insurance premiums.

Policy Flexibility and Customization

Every driver has unique needs and preferences. Opt for insurance companies that offer flexible policies and customization options. This allows you to tailor your coverage to your specific circumstances, ensuring that you’re not paying for unnecessary features while still maintaining adequate protection.

For instance, if you own a classic car that's primarily used for occasional drives or exhibitions, you may require specialized coverage that caters to the unique needs of vintage vehicles. Look for insurers that offer such niche policies, ensuring that your beloved classic car receives the protection it deserves.

Steps to Find the Right Automobile Insurance Company

Now that we’ve covered the key factors to consider, let’s dive into a step-by-step process to help you find the perfect automobile insurance company near you:

Define Your Needs

Start by assessing your specific insurance needs. Consider factors such as your driving history, the make and model of your vehicle, the average distance you drive annually, and any unique circumstances that may impact your coverage requirements. Understanding your needs is crucial for making an informed choice.

Research Local Insurance Providers

Begin your search by researching insurance companies that operate in your area. Look for established providers with a local presence, as they may offer tailored policies and better understand the regional nuances that could impact your coverage.

Utilize online directories, insurance comparison websites, and local business listings to compile a list of potential insurance companies. Read reviews and testimonials to gain insights into the experiences of other customers, which can help you narrow down your options.

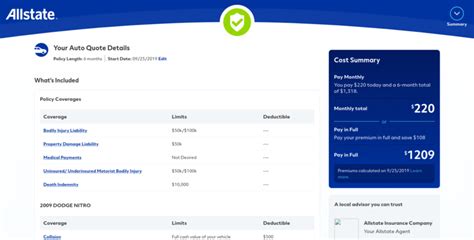

Compare Coverage and Pricing

Once you’ve identified a few potential insurers, it’s time to delve into the specifics of their coverage and pricing. Request quotes from each company, ensuring that you’re comparing apples to apples. Look for policies that offer similar coverage limits and deductibles to make an accurate comparison.

Analyze the fine print of each policy, paying close attention to the exclusions and limitations. Some insurers may offer lower premiums but have more restrictive coverage, so it's crucial to understand the full scope of what's included and excluded in each plan.

Evaluate Customer Service and Claims Handling

The quality of customer service and claims handling can significantly impact your overall insurance experience. Research the insurer’s reputation for customer satisfaction and response times during claims processes. Look for companies that prioritize prompt and empathetic support.

Consider reaching out to existing customers or seeking referrals from friends and family who have had firsthand experience with the insurance company. Their insights can provide valuable perspectives on the insurer's reliability and responsiveness during critical moments.

Assess Financial Stability

Financial stability is a critical aspect when choosing an insurance provider. Ensure that the company you’re considering has a solid financial foundation to guarantee that they’ll be able to honor your claims in the long run. Check financial ratings from reputable agencies to assess their overall financial health.

Look for insurers that have maintained consistent financial performance over the years. This indicates their ability to withstand market fluctuations and provide stable coverage for their policyholders. Financial stability ensures that your insurance provider will be a reliable partner for the duration of your policy.

Review Additional Benefits and Services

Apart from the core coverage, some insurance companies offer additional benefits and services that can enhance your overall experience. These may include roadside assistance, rental car coverage, accident forgiveness, or even loyalty rewards programs.

Evaluate which of these added perks align with your needs and preferences. For instance, if you frequently travel long distances, roadside assistance coverage could be a valuable addition to your policy, providing peace of mind during unexpected breakdowns.

Seek Professional Advice

If you’re still unsure about which insurance company to choose, consider seeking professional advice from an independent insurance broker or an experienced insurance agent. These experts can provide personalized recommendations based on your specific circumstances and guide you through the selection process.

Insurance brokers and agents have extensive knowledge of the industry and can offer valuable insights into the strengths and weaknesses of different providers. They can help you navigate complex insurance terminology and ensure that you make an informed decision that aligns with your best interests.

Conclusion: Your Peace of Mind is Priceless

Finding the right automobile insurance company near you is a crucial step towards ensuring your financial well-being and peace of mind on the road. By considering factors such as coverage options, reputation, claims process, pricing, and customization, you can make an informed choice that aligns with your unique needs.

Remember, automobile insurance is more than just a legal requirement; it's a vital investment in your safety and security. Take the time to research, compare, and seek professional advice to find the perfect insurance provider that offers the protection and support you deserve. With the right coverage, you can drive with confidence, knowing that you're prepared for whatever the road ahead may bring.

How do I know if an insurance company is reputable?

+Reputable insurance companies typically have a strong track record of satisfying customers and honoring claims. Look for companies with positive customer reviews and ratings, and check their financial stability through industry ratings. Additionally, seek recommendations from trusted sources or insurance experts who can provide insights into the company’s reputation.

What should I do if I’m unsure about my insurance needs?

+If you’re uncertain about your insurance needs, it’s advisable to consult with an insurance professional. An experienced agent or broker can assess your circumstances, provide guidance, and recommend suitable coverage options. They can help you understand the various policies available and ensure that you’re adequately protected without overspending.

Can I switch insurance companies if I’m dissatisfied with my current provider?

+Absolutely! You have the freedom to switch insurance companies if you’re not satisfied with your current provider. Research and compare different options, considering factors like coverage, pricing, and customer service. Ensure that you understand the cancellation process and any potential penalties before making the switch. Remember, finding the right insurance company is an ongoing process, and it’s essential to prioritize your needs and preferences.

Are there any hidden costs associated with automobile insurance policies?

+It’s important to thoroughly review the terms and conditions of any automobile insurance policy to identify potential hidden costs. Some policies may have additional fees, such as administrative charges or surcharges for specific coverage options. Always read the fine print and clarify any doubts with the insurance company before finalizing your policy to avoid unexpected expenses down the line.