Auto Liability Insurance Covers

In the intricate world of insurance, understanding the nuances of coverage is paramount. This article delves into the realm of auto liability insurance, unraveling its intricacies and shedding light on the essential protection it provides.

Understanding Auto Liability Insurance

Auto liability insurance, a cornerstone of vehicle ownership, is a safeguard against financial losses arising from accidents and incidents on the road. It is designed to protect individuals and businesses from the legal and financial repercussions of causing harm to others or their property while operating a vehicle.

This type of insurance is a mandatory requirement in most jurisdictions, serving as a critical component of responsible driving and a fundamental aspect of road safety. By understanding its scope and implications, drivers can navigate the roads with a sense of security and confidence.

What Does Auto Liability Insurance Cover?

Auto liability insurance provides a comprehensive safety net, offering coverage for a range of scenarios that may arise during the course of driving. Here’s a detailed breakdown of its key coverage areas:

Bodily Injury Liability

Bodily injury liability coverage is a cornerstone of auto insurance policies. It steps in to provide financial protection in the event that a policyholder causes an accident resulting in bodily harm to others. This coverage extends to medical expenses, lost wages, and pain and suffering incurred by the injured parties.

For instance, imagine a scenario where an insured driver accidentally collides with a pedestrian, causing serious injuries. Bodily injury liability coverage would step in to cover the medical bills and any other related costs, offering a vital layer of protection against potential lawsuits and financial burdens.

| Coverage | Description |

|---|---|

| Medical Expenses | Covers the injured party's medical bills, including hospitalization, surgery, and rehabilitation. |

| Lost Wages | Compensates for the income lost by the injured individual due to their inability to work during recovery. |

| Pain and Suffering | Provides financial support for the physical and emotional distress experienced by the injured individual. |

Property Damage Liability

Property damage liability coverage is another crucial aspect of auto insurance. It steps in to cover the costs associated with damage to other people’s property, including vehicles, homes, or any other tangible assets, caused by the policyholder’s vehicle.

Consider a situation where an insured driver inadvertently backs into a parked car, causing significant damage. Property damage liability coverage would be activated to cover the cost of repairing or replacing the damaged vehicle, ensuring that the policyholder is not financially burdened by the accident.

| Coverage | Description |

|---|---|

| Vehicle Repair/Replacement | Covers the cost of repairing the damaged vehicle or, if it's a total loss, provides funds for its replacement. |

| Home/Building Damage | Provides coverage for damage caused to homes, buildings, or other structures as a result of the accident. |

| Other Property Damage | Extends to any other tangible property damaged in the accident, such as fences, street signs, or personal belongings. |

Legal Defense and Settlement

Auto liability insurance not only covers the costs associated with accidents but also provides a crucial layer of legal protection. In the event that an accident leads to a lawsuit, the policyholder’s insurance carrier will step in to provide a legal defense and negotiate settlements on their behalf.

This aspect of coverage is particularly valuable, as it ensures that policyholders have access to expert legal representation and are not left to navigate the complex legal system alone. The insurance company's legal team will work to minimize the financial impact of the lawsuit and protect the policyholder's interests.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is an optional addition to auto liability insurance policies, but it can provide invaluable protection in certain situations. This coverage kicks in when an insured individual is involved in an accident with a driver who either has no insurance or insufficient insurance to cover the damages.

By opting for this coverage, policyholders can rest assured that they will have financial support in the event of an accident caused by an uninsured or underinsured driver. This coverage can help cover medical expenses, vehicle repairs, and other related costs, ensuring that the insured individual is not left to bear the burden alone.

The Importance of Adequate Coverage

Ensuring that auto liability insurance coverage is adequate is a critical aspect of responsible vehicle ownership. It is essential to carefully review policy limits and consider the potential financial risks associated with driving.

Policyholders should aim to strike a balance between comprehensive coverage and affordability. Higher policy limits offer greater protection but may come at a higher premium. It is crucial to consult with insurance professionals to determine the optimal coverage level based on individual needs and circumstances.

Additionally, it is worth noting that some states have mandatory minimum coverage requirements. Policyholders should familiarize themselves with these requirements to ensure compliance and avoid any legal repercussions.

Real-World Scenarios and Implications

To illustrate the significance of auto liability insurance, let’s explore a few real-world scenarios and their potential implications:

Scenario 1: Hit-and-Run Accident

Imagine a driver, let’s call them Alice, who is involved in a hit-and-run accident. In this scenario, Alice’s vehicle collides with another car, causing significant damage and injuries to the other driver. However, the other driver flees the scene, making it challenging to identify them and pursue legal action.

In such a situation, Alice's auto liability insurance coverage, including bodily injury and property damage liability, would step in to cover the costs associated with the accident. This coverage would provide financial support for the injured driver's medical expenses and help repair or replace their vehicle, ensuring that Alice is not left to bear the full financial burden.

Scenario 2: Multi-Vehicle Pileup

Now, let’s consider a more complex scenario involving a multi-vehicle pileup on a busy highway. In this case, multiple drivers are involved in a chain-reaction accident, resulting in numerous injuries and extensive property damage.

Here, the role of auto liability insurance becomes even more crucial. Each driver's policy would need to be assessed to determine the extent of their coverage and liability. Bodily injury and property damage liability coverage would be activated to provide financial support for medical expenses, vehicle repairs, and any other related costs.

In such a scenario, having adequate insurance coverage is vital, as it can help alleviate the financial strain on all parties involved and ensure that victims receive the necessary support for their recovery.

Scenario 3: Lawsuit and Legal Defense

In some cases, accidents may lead to lawsuits, especially when there are severe injuries or significant property damage involved. In this scenario, auto liability insurance provides a crucial layer of protection by offering legal defense and settlement support.

Imagine a situation where a driver, Bob, is involved in an accident that results in serious injuries to a pedestrian. The pedestrian decides to file a lawsuit, seeking compensation for their medical expenses, lost wages, and pain and suffering. Bob's auto liability insurance policy would step in to provide him with legal representation and negotiate a settlement on his behalf.

Having this coverage ensures that Bob is not financially devastated by the lawsuit and that he has expert legal guidance to navigate the complex legal process. It underscores the importance of auto liability insurance as a safeguard against potential legal liabilities.

The Future of Auto Liability Insurance

As technology advances and the automotive industry evolves, the landscape of auto liability insurance is also undergoing transformations. The rise of autonomous vehicles and connected car technologies presents both challenges and opportunities for insurers.

One key trend is the shift towards usage-based insurance, where premiums are determined based on an individual's actual driving behavior and mileage. This approach offers a more personalized and data-driven insurance experience, allowing policyholders to potentially save on premiums by demonstrating safe driving habits.

Additionally, the integration of advanced driver assistance systems (ADAS) and telematics technologies is shaping the future of auto insurance. These technologies can provide real-time data on driving behavior, vehicle performance, and accident scenarios, enabling insurers to offer more accurate and tailored coverage options.

Furthermore, the concept of shared mobility, including ride-sharing and car-sharing services, is gaining traction. Insurers are adapting to this trend by developing specialized insurance products that cater to the unique needs of shared mobility platforms and their users. These policies often include coverage for multiple drivers and offer flexibility in terms of coverage periods.

Frequently Asked Questions

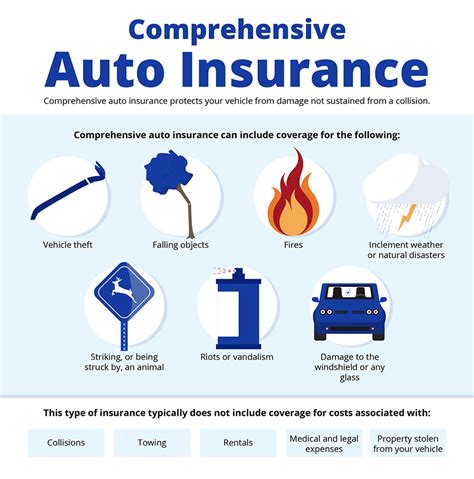

What is the difference between liability insurance and comprehensive insurance for my car?

+Liability insurance covers the costs associated with damages caused to others or their property, while comprehensive insurance provides broader coverage, including protection against theft, vandalism, natural disasters, and other non-accident-related incidents.

How much auto liability insurance coverage do I need?

+The amount of auto liability insurance coverage you need depends on various factors, including your state’s requirements, your personal assets, and your financial risk tolerance. It’s recommended to consult with an insurance professional to determine the appropriate coverage limits for your specific circumstances.

Does auto liability insurance cover my own injuries or damages to my vehicle?

+No, auto liability insurance primarily covers the costs associated with damages caused to others. To cover your own injuries and damages to your vehicle, you would need to consider additional coverage options such as medical payments coverage, personal injury protection (PIP), or collision coverage.

What happens if I cause an accident but don’t have enough liability insurance coverage?

+If you cause an accident and your liability insurance coverage is insufficient to cover the damages, you may be held personally liable for the remaining amount. This can result in significant financial hardship, so it’s crucial to ensure you have adequate coverage to protect yourself and your assets.

Can I customize my auto liability insurance policy to meet my specific needs?

+Yes, auto liability insurance policies can often be customized to meet your specific needs. You can choose different coverage limits, add optional coverages like uninsured/underinsured motorist coverage, and even opt for additional endorsements to tailor your policy to your unique circumstances.