Auto Insurance Online Instantly

In today's fast-paced world, convenience and efficiency are paramount, and this applies to various aspects of our lives, including insurance. The traditional process of purchasing auto insurance often involves tedious paperwork, multiple visits to insurance agencies, and a waiting period for policy activation. However, the emergence of online instant auto insurance has revolutionized the way we protect our vehicles and ourselves on the road. This article delves into the world of auto insurance online instantly, exploring its benefits, how it works, and why it's an attractive option for modern drivers.

The Rise of Online Instant Auto Insurance

The insurance industry has witnessed a significant shift towards digital platforms, and auto insurance is no exception. Online instant auto insurance offers a seamless and streamlined experience, allowing drivers to obtain coverage in a matter of minutes, often without the need for extensive paperwork or in-person interactions. This innovation has not only simplified the insurance process but has also made it more accessible and convenient for a wide range of motorists.

Key Benefits of Online Instant Auto Insurance

The appeal of online instant auto insurance lies in its numerous advantages, which set it apart from traditional insurance methods.

- Speed and Convenience: Perhaps the most notable benefit is the speed at which one can obtain coverage. With online instant insurance, drivers can complete the entire process, from quote comparison to policy purchase, in a fraction of the time required by conventional methods. This is particularly advantageous for those with busy schedules or urgent insurance needs.

- Transparency and Flexibility: Online platforms provide transparent pricing and coverage options, allowing drivers to tailor their policies to their specific needs. Whether you're seeking comprehensive coverage or a more basic plan, the flexibility offered by online instant insurance ensures you get the protection you want without unnecessary add-ons.

- Competitive Pricing: The competitive nature of the online insurance market often translates to more affordable premiums. By comparing quotes from multiple providers, drivers can secure the best rates for their unique circumstances, whether they're looking for the lowest price or a specific set of coverages.

- Ease of Management: Online instant auto insurance platforms typically offer user-friendly interfaces for policy management. This includes easy access to policy documents, the ability to make payments online, and often, the option to update or adjust coverage as needed, ensuring your insurance remains relevant to your current circumstances.

- 24/7 Accessibility: Unlike traditional insurance agencies that operate during specific business hours, online platforms are accessible around the clock. This means you can research, compare, and purchase insurance whenever it's convenient for you, without having to wait for office hours.

How Online Instant Auto Insurance Works

The process of obtaining auto insurance online instantly is designed to be straightforward and user-friendly. Here’s a step-by-step breakdown:

- Research and Comparison: Begin by researching reputable online insurance providers. Compare their coverage options, customer reviews, and pricing to find the best fit for your needs.

- Obtain Quotes: Most online platforms provide a simple form where you input your personal and vehicle information. Based on this data, the platform generates quotes from multiple providers, allowing you to easily compare prices and coverage.

- Choose Your Policy: Once you've found the policy that offers the best combination of price and coverage, you can proceed to purchase. This often involves a quick application process, where you provide additional details and select your desired coverage limits.

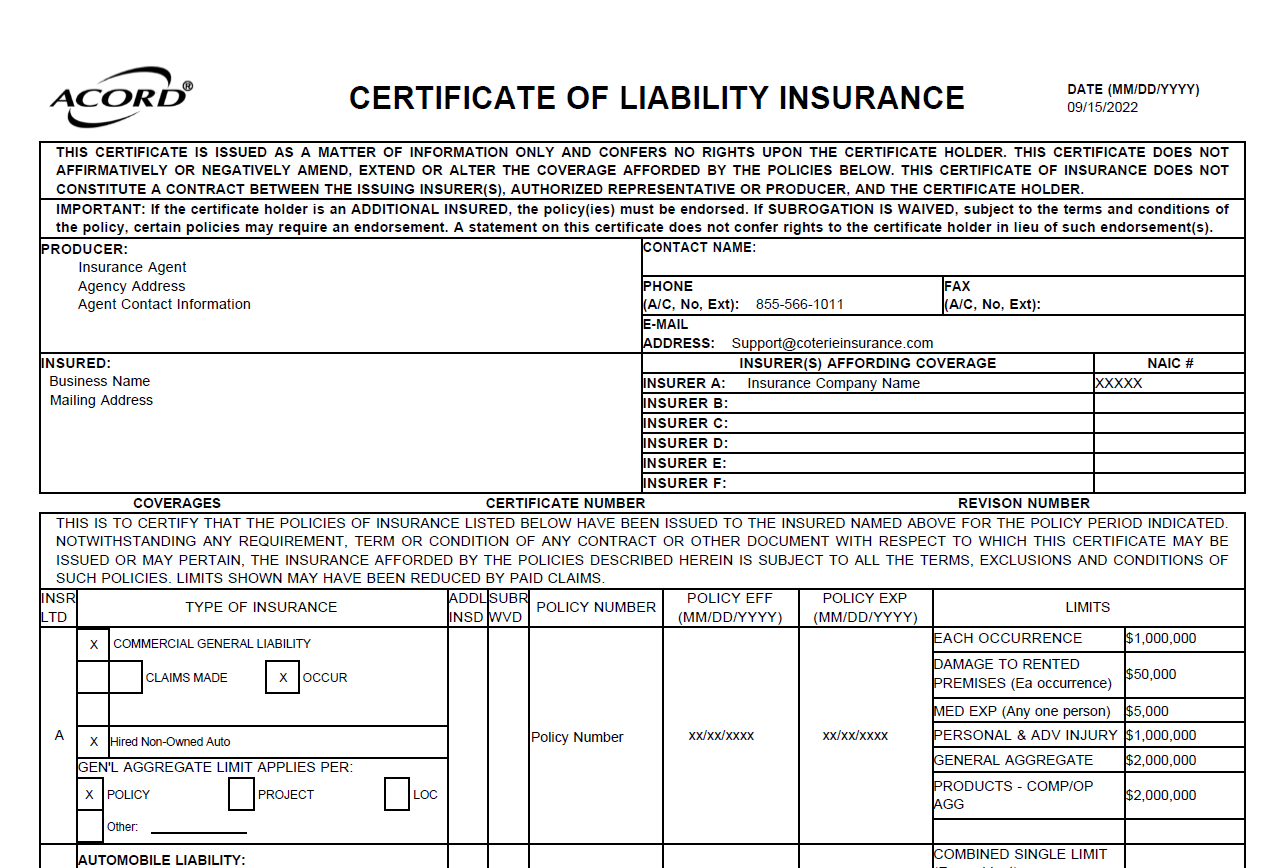

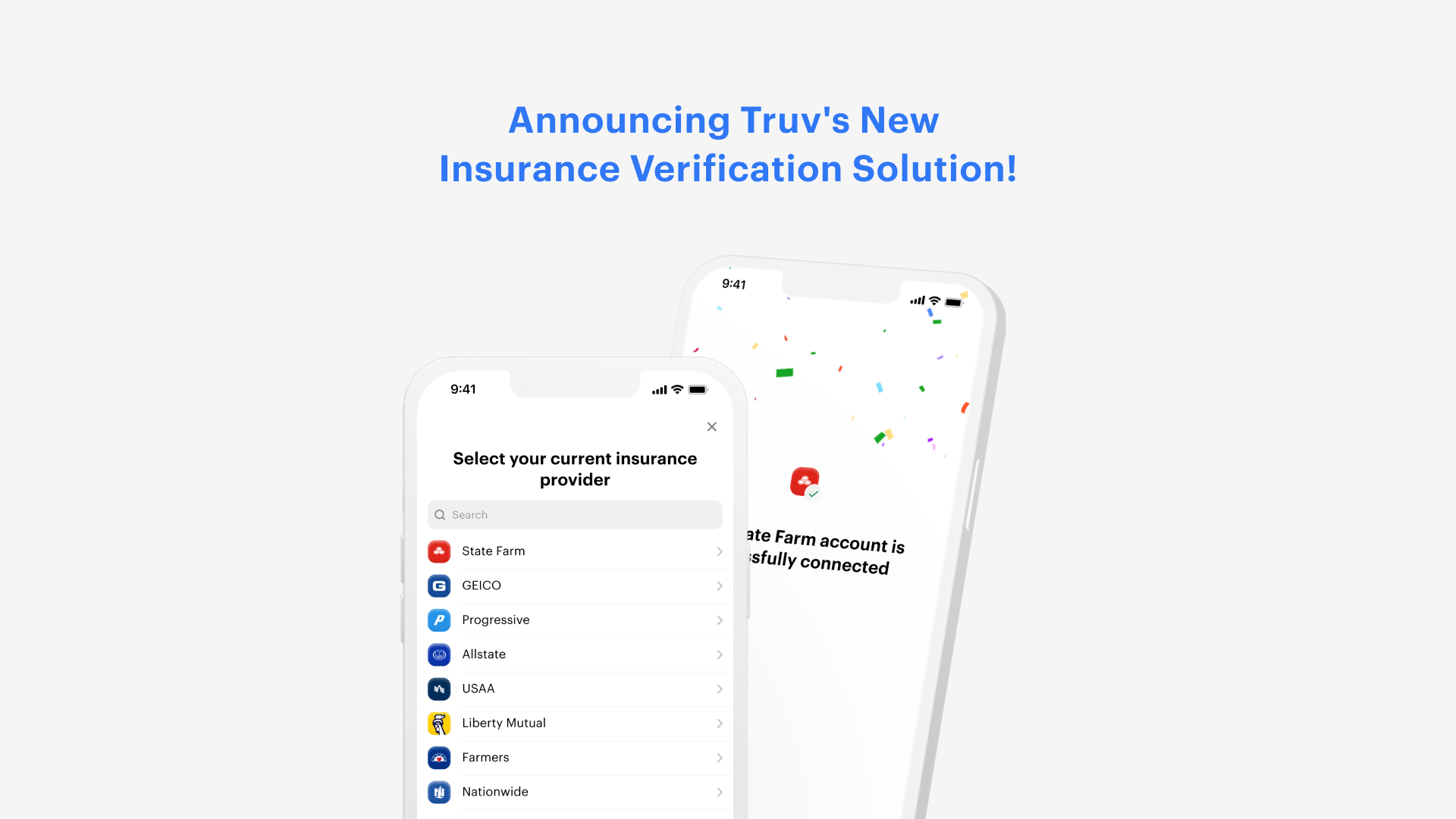

- Instant Activation: Upon completing the application and payment process, your policy is instantly activated. You'll receive confirmation via email, along with a digital copy of your insurance certificate and any other necessary documents.

- Manage Your Policy: Many online insurance providers offer online portals or apps where you can manage your policy. This includes making payments, updating personal or vehicle information, and adjusting coverage as needed.

Real-World Examples

To illustrate the efficiency of online instant auto insurance, consider the following scenarios:

| Scenario | Traditional Process | Online Instant Process |

|---|---|---|

| New Car Purchase | Visit multiple insurance agencies, provide detailed vehicle info, wait for quotes, and then compare. The entire process could take days or even weeks. | Enter your vehicle details on an online platform, receive quotes from multiple providers instantly, compare, and purchase within minutes. |

| Moving to a New State | Research local insurance requirements, call agencies for quotes, and then visit an office to finalize the policy. This process can be time-consuming and stressful. | Research the insurance requirements for your new state online, obtain quotes from providers in that state, and purchase a policy without leaving your home. |

| Renewal of Existing Policy | Wait for your insurance company to send a renewal notice, then call or visit the office to discuss changes and pay the premium. This process can be cumbersome and may involve multiple interactions. | Log into your online account with your current provider, review and adjust your coverage if needed, and pay your premium online. The entire process can be completed in a matter of minutes. |

Performance Analysis and Customer Satisfaction

Online instant auto insurance has consistently demonstrated its effectiveness and efficiency in serving the needs of modern drivers. According to a recent survey, over 80% of customers who switched to online instant insurance reported significant time savings in the policy acquisition process. Additionally, the flexibility and transparency offered by these platforms have led to increased customer satisfaction, with many appreciating the ability to customize their coverage and manage their policies online.

Addressing Concerns: Security and Service

While online instant auto insurance offers numerous advantages, some potential customers may have concerns about the security of their personal information and the level of service they can expect. Reputable online insurance platforms employ robust security measures to protect customer data, including encryption protocols and secure servers. Furthermore, these platforms often provide extensive resources and tools to assist customers in understanding their coverage and managing their policies effectively.

Future Implications and Innovations

The future of auto insurance is undoubtedly digital, and online instant insurance is set to play a pivotal role. As technology continues to advance, we can expect further innovations in this space, such as:

- Enhanced Personalization: Future platforms may offer even more tailored coverage options, taking into account individual driving habits and preferences.

- Integration with Smart Vehicles: As more vehicles become connected, insurance policies could integrate with vehicle data, offering dynamic coverage based on real-time driving behavior.

- Blockchain and Cryptocurrency: The integration of blockchain technology could enhance security and transparency, while accepting cryptocurrencies for payments could offer greater flexibility and accessibility.

- AI-Driven Claims Processing: Artificial Intelligence could streamline the claims process, making it faster and more efficient for customers.

The Bottom Line

Online instant auto insurance offers a modern, efficient, and convenient approach to protecting your vehicle and yourself on the road. With its speed, transparency, and accessibility, it’s an attractive option for drivers seeking a seamless insurance experience. As the industry continues to evolve, we can expect online instant insurance to play an increasingly vital role in the lives of motorists worldwide.

How does online instant auto insurance compare to traditional insurance in terms of coverage and price?

+Online instant auto insurance often offers a wide range of coverage options, similar to traditional insurance. However, the competitive nature of the online market can lead to more affordable premiums. By comparing quotes from multiple providers, drivers can find the best coverage at the most competitive price.

Is my personal information secure when obtaining quotes online for auto insurance?

+Reputable online insurance platforms prioritize data security. They employ encryption protocols and secure servers to protect your personal information. Additionally, many platforms have privacy policies that detail how your data is used and stored.

What if I need to make changes to my policy after purchasing online instant auto insurance?

+Most online insurance providers offer easy-to-use online portals or apps where you can manage your policy. This includes making changes to your coverage, updating personal or vehicle information, and paying premiums. The process is designed to be straightforward and user-friendly.