Cost Small Business Insurance

In the world of small business ownership, navigating the complex landscape of insurance coverage is a crucial aspect of ensuring the longevity and success of your venture. The cost of small business insurance is a topic that often raises questions and concerns among entrepreneurs, as they strive to protect their hard-earned assets and mitigate potential risks. This article aims to delve into the intricacies of small business insurance costs, providing a comprehensive guide to help business owners make informed decisions.

Understanding the Landscape: Small Business Insurance Essentials

Small business insurance is an umbrella term encompassing various types of coverage designed to protect businesses from a wide range of potential liabilities and losses. From general liability insurance to property insurance and professional indemnity, the options can be overwhelming for newcomers. However, understanding the essentials is key to making cost-effective choices.

General Liability Insurance: A Fundamental Protection

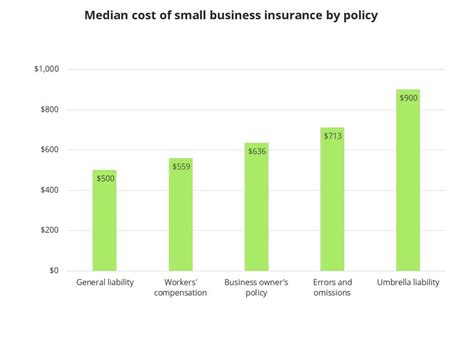

General liability insurance is often the bedrock of small business insurance policies. It provides coverage for bodily injury, property damage, and personal and advertising injury claims that may arise from your business operations. The cost of general liability insurance can vary based on factors such as your industry, the number of employees, and the level of risk associated with your business activities.

| Industry | Average Annual Cost |

|---|---|

| Retail | $600 - $1,200 |

| Professional Services | $400 - $800 |

| Manufacturing | $1,500 - $3,000 |

For instance, a retail store owner might expect to pay between $600 and $1,200 annually for general liability insurance, while a professional service provider could spend around $400 to $800. These costs can further vary based on the specific nature of your business and the insurer's assessment of risk.

Property Insurance: Safeguarding Your Assets

Property insurance is essential for protecting the physical assets of your business, including your office space, equipment, inventory, and any other tangible items crucial to your operations. The cost of property insurance depends on the value of your assets and the level of coverage you choose. Additionally, factors like the location of your business and the presence of any natural disaster risks can influence the premium.

| Business Type | Average Annual Cost |

|---|---|

| Office Space | $1,000 - $2,500 |

| Warehouse | $2,000 - $5,000 |

| Retail Store | $1,500 - $3,500 |

A small business operating out of an office space might expect to pay between $1,000 and $2,500 annually for property insurance, whereas a warehouse or a retail store might incur higher costs due to the increased value of assets and potential risks.

Professional Indemnity Insurance: Protecting Your Reputation

Professional indemnity insurance, also known as errors and omissions insurance, is crucial for businesses offering professional services. It provides coverage for legal costs and damages resulting from mistakes, negligence, or failures in service delivery. The cost of professional indemnity insurance is influenced by factors such as the nature of your business, the level of risk involved, and the amount of coverage you require.

| Professional Service | Average Annual Cost |

|---|---|

| Consulting | $500 - $1,500 |

| Legal Services | $1,000 - $3,000 |

| Medical Practice | $2,000 - $5,000 |

For example, a consulting firm might spend around $500 to $1,500 annually on professional indemnity insurance, while a legal practice or medical clinic could face higher costs due to the nature of their services and the potential for high-value claims.

Optimizing Costs: Strategies for Small Business Insurance

Navigating the complex world of small business insurance costs can be challenging, but there are strategies to optimize your coverage and keep expenses in check. Here are some expert tips to help you find the right balance between protection and affordability.

Assess Your Risks and Needs

Before diving into insurance policies, take the time to thoroughly assess the specific risks and needs of your small business. Identify the potential liabilities and areas where you might face financial loss. This self-assessment will guide you in selecting the most appropriate insurance coverage without overspending on unnecessary policies.

Compare Quotes and Insurers

Insurance premiums can vary significantly between providers, so it’s crucial to compare quotes from multiple insurers. Online comparison tools can be a valuable resource, allowing you to quickly gather quotes and understand the range of prices available. Remember, the cheapest option might not always offer the best coverage, so balance cost with the level of protection provided.

Bundle Your Policies

Many insurance providers offer bundled policies that combine multiple types of coverage, such as general liability and property insurance. Bundling your policies can often lead to significant cost savings, as insurers may offer discounts for multiple policies. However, ensure that the bundled policy meets all your business needs and doesn’t leave any crucial areas uncovered.

Consider Higher Deductibles

Opting for higher deductibles on your insurance policies can result in lower premiums. A deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in. While this strategy can reduce your insurance costs, it’s essential to ensure you have the financial means to cover the deductible in the event of a claim. Weigh the potential savings against your business’s financial stability.

Explore Risk Management Strategies

Implementing effective risk management strategies can not only reduce the likelihood of claims but also lead to lower insurance premiums. This could involve investing in safety measures, employee training, and improved security systems. By demonstrating a commitment to reducing risks, you may be eligible for discounts or preferred rates from insurers.

Review and Update Regularly

Small businesses evolve, and so do their insurance needs. Regularly review your insurance policies to ensure they remain aligned with your business’s current operations, assets, and risks. As your business grows or changes, you may need to adjust your coverage or add new policies. Staying proactive in this regard can prevent gaps in coverage and help you maintain cost-effectiveness.

The Future of Small Business Insurance: Trends and Innovations

The world of small business insurance is dynamic, with emerging trends and innovations shaping the industry. As technology advances and consumer expectations evolve, insurers are adapting to offer more tailored and efficient solutions. Here’s a glimpse into the future of small business insurance.

Digital Transformation and Online Insurance

The digital age has revolutionized the insurance industry, with online platforms and digital tools becoming increasingly prominent. Small business owners can now easily compare policies, purchase coverage, and manage their insurance needs entirely online. This digital transformation enhances convenience and accessibility, allowing business owners to make informed decisions quickly and efficiently.

Personalized Insurance Packages

Insurers are recognizing the unique needs of small businesses and are increasingly offering personalized insurance packages. These packages are tailored to the specific risks and operations of individual businesses, providing a more comprehensive and cost-effective solution. By leveraging data analytics and risk assessment tools, insurers can create customized policies that better protect small businesses.

Telematics and Usage-Based Insurance

Telematics, the technology that tracks vehicle usage and driving behavior, is making its way into small business insurance. Usage-based insurance policies offer real-time insights into driving habits, allowing insurers to assess risk more accurately. For small businesses with fleet vehicles, this technology can lead to more accurate premiums and encourage safer driving practices.

Insurtech: Disrupting the Industry

Insurtech, the fusion of insurance and technology, is disrupting traditional insurance models. Insurtech startups are leveraging innovative technologies like artificial intelligence, blockchain, and machine learning to streamline insurance processes, enhance risk assessment, and offer more efficient coverage. These disruptions are driving down costs and improving the overall customer experience for small business owners.

Cybersecurity Insurance: A Growing Concern

With the rise of cyber threats, cybersecurity insurance is becoming an essential component of small business insurance portfolios. As more businesses rely on digital operations and data storage, the risk of cyber attacks and data breaches has increased significantly. Cybersecurity insurance provides protection against these risks, covering costs associated with data recovery, business interruption, and legal expenses.

Conclusion: Navigating the Cost Landscape

The cost of small business insurance is a complex topic, influenced by various factors and evolving trends. By understanding the essentials, implementing cost-optimization strategies, and staying abreast of industry innovations, small business owners can navigate the insurance landscape with confidence. Remember, the right insurance coverage is not just about cost but also about protecting your business’s future and ensuring its longevity.

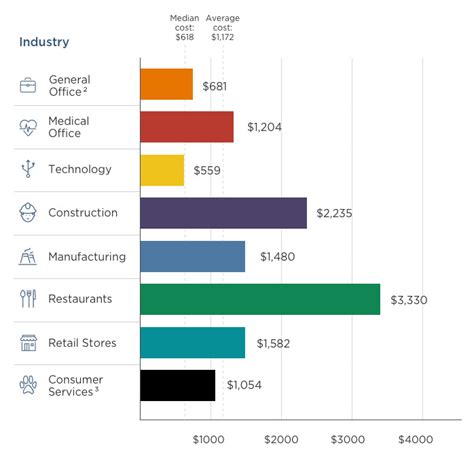

What is the average cost of small business insurance?

+The average cost of small business insurance varies widely depending on the type of business, industry, and coverage needed. However, as a rough estimate, small businesses can expect to pay anywhere from 500 to 2,000 annually for basic coverage, including general liability and property insurance. Professional services may require additional coverage, increasing the cost.

How can I reduce the cost of small business insurance?

+To reduce costs, consider bundling multiple insurance policies with the same provider, which often leads to discounts. Additionally, review your coverage annually to ensure you’re not overinsured, and opt for higher deductibles if possible. Implementing risk management strategies and maintaining a safe work environment can also lead to lower premiums.

What are the essential types of insurance for small businesses?

+Essential insurance types for small businesses include general liability insurance to protect against bodily injury and property damage claims, property insurance to cover physical assets, and professional indemnity insurance for businesses offering professional services. Depending on the nature of your business, you may also need workers’ compensation, commercial auto insurance, and cyber liability insurance.

How often should I review my small business insurance coverage?

+It’s recommended to review your small business insurance coverage annually or whenever significant changes occur in your business, such as expansion, relocation, or addition of new products or services. Regular reviews ensure that your coverage remains adequate and cost-effective, reflecting the current needs and risks of your business.