Aarp Insurance For Seniors

As we navigate the complexities of aging, it becomes increasingly crucial to secure our financial well-being and protect our health. One of the essential aspects of this process is understanding the options available for insurance coverage, especially as we transition into our golden years. AARP, a renowned organization dedicated to enhancing the quality of life for older adults, offers a comprehensive suite of insurance products tailored to meet the unique needs of seniors. In this article, we will delve into the world of AARP insurance, exploring its various offerings, benefits, and how it can provide peace of mind during this pivotal stage of life.

Understanding AARP Insurance: A Comprehensive Overview

AARP, the American Association of Retired Persons, is a nonprofit organization with a rich history spanning over six decades. Founded in 1958, AARP has grown into a powerful advocate for the rights and interests of older Americans, offering a wide range of services and resources to its members. One of the key areas where AARP has made a significant impact is in the realm of insurance.

AARP Insurance is a partnership between the organization and leading insurance providers, aimed at providing seniors with affordable and comprehensive coverage options. The insurance portfolio covers a broad spectrum, including health insurance, life insurance, auto insurance, home insurance, and travel insurance, among others. This diverse range of offerings ensures that seniors can find tailored solutions to protect their health, assets, and overall well-being.

Health Insurance: Prioritizing Senior Wellness

Health insurance is undoubtedly one of the most critical aspects of financial planning for seniors. AARP recognizes this and offers a variety of health insurance plans through its partnership with UnitedHealthcare. These plans are designed to cater to the unique healthcare needs of older adults, providing access to quality medical care and prescription drug coverage.

One of the standout features of AARP's health insurance plans is their focus on preventative care. Many plans include annual wellness visits, health screenings, and immunizations at no additional cost, encouraging seniors to take a proactive approach to their health. Additionally, AARP offers Medigap (Medicare Supplement) plans, which can help cover the gaps in original Medicare coverage, ensuring seniors have the financial protection they need when facing unexpected medical expenses.

| Health Insurance Plans | Key Features |

|---|---|

| Medicare Advantage Plans | Includes prescription drug coverage, dental, vision, and hearing benefits |

| Medigap Plans | Fills gaps in original Medicare, offering coverage for co-pays, deductibles, and other expenses |

| Prescription Drug Plans | Provides coverage for prescription medications, often at discounted rates |

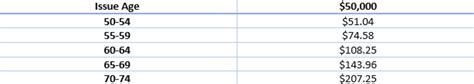

Life Insurance: Securing Your Legacy

AARP understands that life insurance is not just about financial protection; it's about ensuring your loved ones are taken care of and your legacy is secured. That's why they offer a range of life insurance options, including term life insurance and permanent life insurance, through their partnership with New York Life Insurance Company.

Term life insurance provides coverage for a specified period, typically 10-30 years, and is often more affordable than permanent life insurance. It's an excellent option for seniors who want to cover final expenses, such as funeral costs, or provide financial support for their family during a transitional period.

On the other hand, permanent life insurance, such as whole life or universal life insurance, offers lifelong coverage and builds cash value over time. This type of insurance can be particularly beneficial for seniors who want to leave an inheritance, pay for long-term care, or ensure their family's financial stability.

| Life Insurance Options | Key Benefits |

|---|---|

| Term Life Insurance | Affordable coverage for a specified period, ideal for covering final expenses |

| Whole Life Insurance | Provides lifelong coverage and builds cash value, suitable for long-term financial planning |

| Universal Life Insurance | Flexible coverage with adjustable premiums and death benefits, offering customization |

Auto and Home Insurance: Protecting Your Assets

As seniors, it's essential to have adequate insurance coverage for our homes and vehicles. AARP offers competitive rates on auto and home insurance through its partnership with Hartford Financial Services Group, Inc. These policies are designed with the unique needs of older adults in mind, providing comprehensive protection at an affordable cost.

AARP's auto insurance policies offer discounts for safe driving, mature drivers, and multi-car policies. Additionally, the home insurance policies cover a wide range of potential risks, including natural disasters, theft, and liability claims, ensuring your home and personal belongings are protected.

| Auto Insurance Discounts | Eligibility |

|---|---|

| Safe Driving Discount | For members with a clean driving record |

| Mature Driver Discount | Available to drivers aged 50 and above |

| Multi-Car Discount | For members with multiple vehicles insured under the same policy |

Travel Insurance: Exploring the World with Confidence

Travel is an essential part of retirement for many seniors, and AARP offers travel insurance through its partnership with Allianz Global Assistance. This insurance provides coverage for trip cancellations, interruptions, and delays, as well as medical emergencies while traveling.

AARP's travel insurance plans are tailored to meet the needs of older travelers, offering higher age limits and medical coverage for pre-existing conditions. This ensures that seniors can explore the world with peace of mind, knowing they are protected in case of unexpected events.

The Benefits of Choosing AARP Insurance

When considering insurance options as a senior, choosing AARP insurance comes with a multitude of advantages. Here are some key benefits to highlight:

- Competitive Rates: AARP negotiates with insurance providers to secure the best rates for its members, ensuring affordable coverage without compromising on quality.

- Tailored Coverage: AARP offers a wide range of insurance products designed specifically for seniors, taking into account their unique needs and financial situations.

- Expert Guidance: AARP provides access to knowledgeable insurance advisors who can help members navigate the complex world of insurance, ensuring they make informed decisions.

- Discounts and Rewards: AARP members can often take advantage of exclusive discounts and rewards programs, making insurance more affordable and providing additional benefits.

- Convenience and Accessibility: AARP's insurance products are easily accessible online, and members can manage their policies and make claims with ease, ensuring a seamless experience.

AARP's Commitment to Senior Well-being

Beyond just insurance, AARP is dedicated to enhancing the overall well-being of seniors. The organization offers a wealth of resources and services to its members, including:

- Health and Wellness Programs: AARP provides access to fitness programs, healthy living initiatives, and educational resources to promote physical and mental well-being.

- Financial Planning Tools: Members can access financial planning guides, budget calculators, and investment advice to ensure they are making sound financial decisions.

- Social Engagement Opportunities: AARP fosters a sense of community among its members, offering social events, volunteer opportunities, and online communities to combat social isolation.

- Advocacy and Legislative Updates: AARP is a powerful voice for seniors, advocating for their rights and keeping members informed about legislative changes that impact their lives.

FAQs: Your Questions, Answered

Can I purchase AARP insurance if I'm not a member of the organization?

+No, AARP insurance products are exclusively available to members of the organization. However, becoming a member is straightforward and offers a wide range of benefits beyond insurance.

How much does AARP membership cost, and what are the benefits?

+AARP membership costs $16 per year, and it provides access to a variety of discounts, resources, and insurance products. Members also receive AARP The Magazine and have opportunities to engage in community events.

Are there any age restrictions for AARP insurance?

+While there are no strict age restrictions, AARP insurance products are primarily designed for older adults. However, some plans, like life insurance, may have specific age limits or eligibility criteria.

Can I bundle my AARP insurance policies to save money?

+Yes, AARP offers bundling options for its insurance policies, allowing members to save money by combining multiple policies. This can include auto and home insurance, or health and life insurance.

How do I make a claim with AARP insurance?

+The process for making a claim depends on the type of insurance and the specific provider. Generally, members can start the claims process online or by calling the insurance provider's customer service hotline.

As we embark on this journey into our senior years, having the right insurance coverage can provide a sense of security and peace of mind. AARP insurance offers a comprehensive suite of products tailored to meet the unique needs of older adults, ensuring that we can focus on enjoying our golden years to the fullest. With AARP’s commitment to senior well-being and its partnership with leading insurance providers, we can trust that our financial and health interests are in good hands.