Auto Insurance Family

Navigating the world of auto insurance can be a complex task, especially when it comes to securing coverage for your entire family. As a family, your insurance needs may vary depending on factors such as the number of drivers, age differences, and vehicle preferences. This article aims to provide an in-depth analysis of auto insurance for families, offering expert insights and practical tips to help you make informed decisions.

Understanding Family Auto Insurance Policies

A family auto insurance policy is designed to cover multiple drivers and vehicles under a single policy. It offers convenience and potential cost savings, as insurance companies often provide discounts for bundling multiple vehicles and drivers together. However, the structure and benefits of family policies can vary significantly between insurance providers.

Key considerations when evaluating family auto insurance policies include:

- Number of Drivers: Ensure the policy can accommodate all family members who require coverage, including teenagers and elderly relatives.

- Vehicle Usage: Consider the purpose and frequency of vehicle usage for each driver. Some policies may offer discounts for low-mileage drivers or provide options for occasional or leisure use.

- Discounts and Bundling: Look for insurance providers that offer substantial discounts for bundling multiple vehicles and drivers. Additionally, inquire about other potential discounts, such as safe driver incentives or good student discounts.

- Coverage Options: Understand the different coverage types available, including liability, collision, comprehensive, and personal injury protection (PIP). Tailor your coverage to meet your family's specific needs and ensure adequate protection.

Choosing the Right Insurance Provider

Selecting the right insurance provider is crucial to ensure you receive the best coverage and value for your family's needs. Here are some key factors to consider when evaluating insurance companies:

- Financial Stability: Opt for insurance providers with a strong financial rating, ensuring they can fulfill their obligations even in challenging economic times.

- Customer Satisfaction: Research customer reviews and ratings to gauge the provider's reputation for customer service and claim handling.

- Coverage Customization: Choose an insurer that offers flexible coverage options and allows you to tailor your policy to your family's unique circumstances.

- Claims Process: Understand the insurer's claims process, including the steps involved, response times, and any potential roadblocks that may impact your claim experience.

Some reputable insurance providers known for their family-oriented policies include:

- State Farm: Offers a range of coverage options and discounts, including a good student discount and a defensive driving course discount.

- GEICO: Provides comprehensive coverage and discounts for good drivers, military members, and federal employees.

- Progressive: Known for its flexible policies and customizable coverage options, allowing families to tailor their insurance to their specific needs.

Managing Teen Drivers and Young Adults

Insuring teen drivers and young adults can significantly impact your family's auto insurance costs. However, there are strategies to mitigate these costs and ensure your young drivers receive the necessary coverage.

Consider the following tips when managing auto insurance for your teenage or young adult drivers:

- Inquire about Good Student Discounts: Many insurance providers offer discounts for students with good academic standing. Encourage your child to maintain good grades to take advantage of these discounts.

- Enroll in a Driver Training Program: Some insurance companies provide discounts for young drivers who complete approved driver training courses. These courses can improve driving skills and potentially lower insurance costs.

- Evaluate Separate Policies: In some cases, it may be more cost-effective to have a separate policy for your young driver. Compare the costs and benefits of adding them to your family policy versus a standalone policy.

- Discuss Safe Driving Habits: Educate your young drivers about the importance of safe driving practices. This can not only reduce the risk of accidents but also lead to lower insurance premiums over time.

Maximizing Savings on Family Auto Insurance

Securing auto insurance for your family doesn't have to break the bank. By exploring different coverage options and taking advantage of available discounts, you can significantly reduce your insurance costs.

Discounts and Savings Opportunities

Insurance providers offer a range of discounts to help families save on their auto insurance premiums. Some common discounts include:

- Multi-Vehicle Discounts: Save by insuring multiple vehicles under one policy. Most insurance companies offer discounts for bundling two or more vehicles together.

- Multi-Policy Discounts: If you have other insurance policies, such as home or life insurance, inquire about potential discounts for bundling these policies with your auto insurance.

- Safe Driver Discounts: Many insurance companies reward drivers with clean driving records. If you or your family members have a history of safe driving, you may be eligible for significant discounts.

- Loyalty Discounts: Some insurance providers offer discounts for long-term customers. Check if your insurer provides loyalty benefits or rewards for continuous policy renewals.

- Usage-Based Insurance (UBI) Programs: These programs use telematics devices or smartphone apps to track driving behavior. If your driving habits meet certain criteria, you may be eligible for discounts.

To maximize savings, compare quotes from multiple insurance providers and negotiate discounts. Don't hesitate to ask your insurer about potential savings opportunities tailored to your family's unique circumstances.

Evaluating Coverage and Deductibles

When selecting auto insurance coverage, it’s important to strike a balance between adequate protection and cost-effectiveness. Consider the following tips when evaluating your coverage options:

- Assess Your Risk Profile: Evaluate your family’s driving habits and risk factors. If you have a history of accidents or claims, consider higher liability limits to protect your assets.

- Understand Coverage Limits: Review your policy’s coverage limits, ensuring they align with your family’s needs. Consider increasing coverage limits for comprehensive and collision coverage if you own newer or more valuable vehicles.

- Evaluate Deductibles: Higher deductibles can lower your insurance premiums. Assess your financial ability to cover higher deductibles in the event of a claim and choose a deductible that balances cost savings and financial comfort.

- Consider Alternative Coverage Options: Explore alternative coverage options, such as usage-based insurance or pay-as-you-drive policies. These policies may offer cost savings for low-mileage drivers or those with a proven record of safe driving.

Future Implications and Trends in Family Auto Insurance

The auto insurance landscape is continually evolving, driven by technological advancements and changing consumer needs. As a family, staying informed about these trends can help you make more informed insurance decisions.

Emerging Technologies and Their Impact

Technological innovations are transforming the auto insurance industry, offering new opportunities for personalized coverage and cost savings. Some key trends to watch include:

- Telematics and Usage-Based Insurance: Telematics devices and smartphone apps are becoming increasingly common, allowing insurance companies to track driving behavior and offer personalized premiums based on real-time data.

- Artificial Intelligence and Machine Learning: AI and machine learning technologies are being used to analyze vast amounts of data, improving risk assessment and claim handling processes.

- Connected Car Technology: With the rise of connected cars, insurance providers are exploring ways to leverage vehicle data to offer more accurate and personalized coverage.

These emerging technologies have the potential to revolutionize auto insurance, offering more precise risk assessment and personalized coverage options for families.

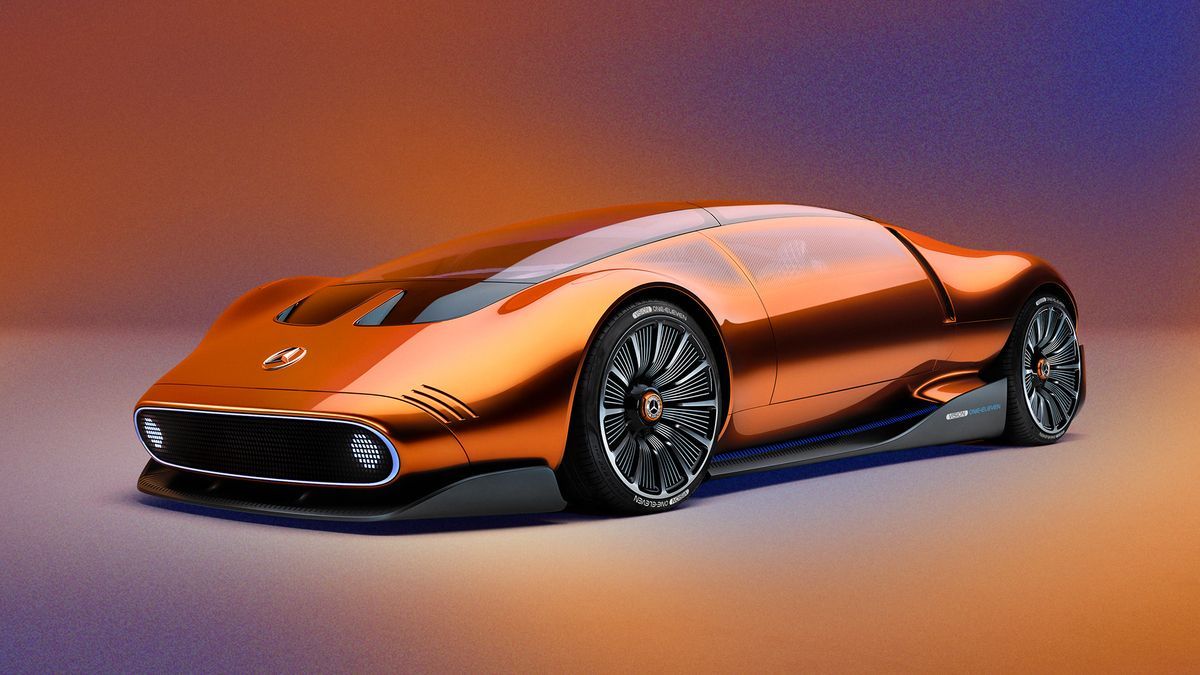

The Rise of Electric Vehicles and Their Insurance Implications

The growing popularity of electric vehicles (EVs) is also having an impact on auto insurance. EVs often come with unique features and requirements, which can influence insurance costs and coverage needs.

Consider the following when evaluating auto insurance for your family's EV:

- Battery Coverage: EVs rely on advanced battery technology, and battery replacement can be costly. Ensure your insurance policy provides adequate coverage for battery-related issues.

- Charging Station Coverage: If you install a charging station at your home, consider adding this to your insurance policy to protect against potential damage or liability risks.

- Lower Insurance Costs: EVs often have lower insurance costs due to their advanced safety features and reduced risk of certain types of accidents. However, the cost of repairing or replacing an EV can be higher, so ensure your coverage reflects these potential expenses.

The Future of Family Auto Insurance

As technology continues to advance and consumer needs evolve, the future of family auto insurance is likely to become even more personalized and data-driven. Insurance providers will increasingly rely on real-time data and analytics to offer tailored coverage options and more accurate pricing.

Additionally, the rise of autonomous vehicles and shared mobility services may further transform the auto insurance industry. Families may need to adapt their insurance coverage to accommodate these new transportation options, ensuring they have the necessary protection for a changing mobility landscape.

How often should I review and update my family’s auto insurance policy?

+It’s recommended to review your auto insurance policy annually or whenever there are significant changes in your family’s circumstances. This includes adding or removing drivers, purchasing new vehicles, or moving to a new location. Regular reviews ensure your coverage remains adequate and up-to-date.

What are some common exclusions or limitations in family auto insurance policies?

+Common exclusions or limitations may include damage caused by natural disasters, intentional damage, or mechanical breakdowns. It’s important to carefully review your policy’s terms and conditions to understand any specific exclusions that may apply to your coverage.

Can I switch insurance providers if I’m not satisfied with my current coverage or rates?

+Absolutely! You have the freedom to switch insurance providers at any time. Shopping around for quotes and comparing coverage options can help you find the best value and coverage for your family’s needs. Don’t hesitate to explore different providers to find the right fit.