Auto Insurance Collision

In the complex landscape of automotive safety, the term "collision" holds a significant place. It refers to an event where two or more objects, often vehicles, come into contact with considerable force. This can result in varying degrees of damage, from minor scratches to total write-offs. Understanding the dynamics of collisions is crucial for both drivers and insurance providers, as it forms the basis for assessing risks, determining fault, and calculating insurance premiums.

This article aims to provide an in-depth analysis of collision events in the context of auto insurance, exploring the various aspects that influence coverage, claims, and premiums. By delving into real-world examples and industry insights, we aim to equip readers with a comprehensive understanding of how collisions impact their insurance journey.

The Dynamics of Collisions: Causes and Outcomes

Collisions can occur due to a myriad of reasons, ranging from human error to environmental factors. The most common causes include:

- Driver Distraction: With the increasing reliance on technology, distracted driving has become a leading cause of collisions. From texting while driving to adjusting navigation systems, these distractions can result in catastrophic outcomes.

- Speeding: Excessive speed reduces a driver's ability to react to sudden changes, making collisions more likely and often more severe.

- Weather Conditions: Adverse weather like rain, snow, or fog can significantly impact visibility and road conditions, increasing the risk of collisions.

- Vehicle Malfunction: Mechanical failures, such as brake or steering issues, can lead to unexpected collisions, particularly if not promptly addressed.

- Road Design and Maintenance: Poorly designed or inadequately maintained roads can contribute to collisions, especially in areas with sharp curves or hidden hazards.

The outcomes of collisions can vary greatly, depending on factors such as the speed of impact, the angle of collision, and the type of vehicles involved. These outcomes can range from minor property damage to severe injuries and even fatalities. Understanding these dynamics is crucial for both drivers and insurance providers, as it directly influences the cost and complexity of claims.

Real-World Examples of Collision Outcomes

Consider the case of a head-on collision between two sedans traveling at high speed. This type of collision often results in severe damage to the front-end structures of both vehicles, potentially affecting the engine, transmission, and other critical components. Additionally, the force of impact can lead to significant injuries for the occupants, ranging from whiplash to more severe traumatic brain injuries.

In contrast, a low-speed collision, such as a rear-end collision in heavy traffic, might result in minor damage to the bumpers and tail lights. While these collisions are often less severe, they can still lead to insurance claims, particularly if there are personal injury concerns or if the vehicles are newer models with advanced safety features.

Collision Coverage: Understanding Your Insurance Policy

Collision coverage is a critical component of auto insurance policies, providing financial protection in the event of a collision. This coverage typically pays for the repair or replacement of your vehicle, minus your deductible, regardless of who is at fault in the accident. However, the specifics of collision coverage can vary widely between insurance providers and policies.

Key Elements of Collision Coverage

- Deductibles: This is the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but it also means you’ll pay more if you file a claim.

- Policy Limits: These are the maximum amounts your insurer will pay for a covered loss. It’s important to ensure your policy limits are sufficient to cover the value of your vehicle and any potential liability claims.

- Additional Coverages: Some policies offer optional add-ons for collision coverage, such as rental car reimbursement or coverage for custom parts and equipment.

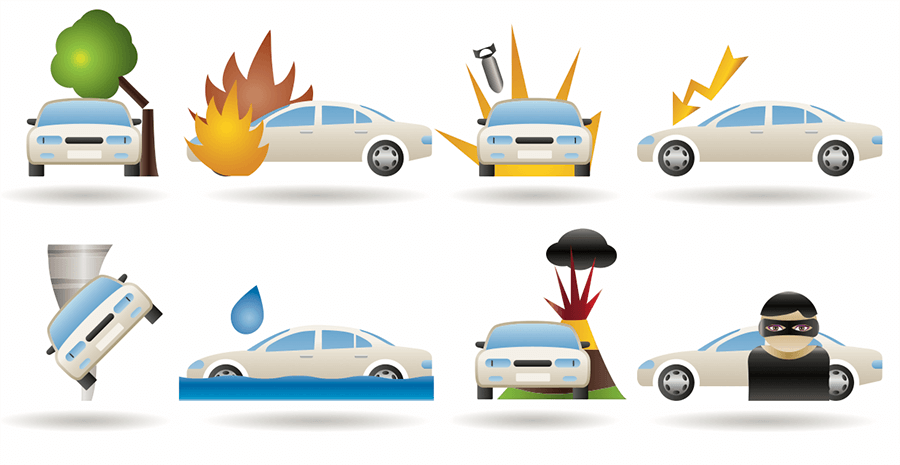

- Exclusions: Be aware of what your policy doesn’t cover. For instance, wear and tear, mechanical breakdowns, and damage caused by non-collision events like flooding or vandalism are typically excluded from collision coverage.

Understanding these elements is crucial for making informed decisions about your insurance coverage. It's important to carefully review your policy and discuss any questions or concerns with your insurance provider to ensure you have the right level of protection.

Filing a Collision Claim: The Process and Considerations

When a collision occurs, the process of filing an insurance claim can be daunting. However, understanding the steps involved and being prepared can help streamline the process and ensure a smoother resolution.

Step-by-Step Guide to Filing a Collision Claim

- Contact Your Insurance Provider: As soon as possible after the collision, contact your insurance company to report the incident. Most providers have 24-hour claims hotlines to assist you.

- Provide Details: Be prepared to provide detailed information about the collision, including the date, time, location, and a description of the events leading up to the collision. Also, provide any relevant photos or videos of the scene and the damage.

- Cooperate with the Investigation: Your insurance provider will conduct an investigation to determine fault and assess the damage. Cooperate fully with this process, providing any additional information or documentation as requested.

- Receive an Estimate: Once the investigation is complete, your insurer will provide an estimate for the repairs. If you disagree with the estimate, you have the right to seek a second opinion from an independent appraiser.

- Choose a Repair Shop: You can typically choose your preferred repair shop. However, some insurers have preferred provider networks that may offer discounts or other benefits.

- Get Your Vehicle Repaired: Once the repairs are completed, your insurance company will process the payment to the repair shop, minus your deductible.

It's important to keep thorough records throughout the claims process, including all communications with your insurance provider, estimates, and repair receipts. This documentation can be crucial if there are any disputes or complications during the claims process.

Considerations for High-Value Vehicles

For owners of high-value vehicles, such as luxury cars or classic cars, standard collision coverage may not be sufficient. These vehicles often require specialized repairs or parts that can significantly increase the cost of claims.

Consider adding an optional endorsement to your policy, such as an agreed value clause, which sets a specific value for your vehicle at the time you purchase the policy. This ensures that in the event of a total loss, your insurer will pay the agreed value, rather than the actual cash value, which may not reflect the true value of a high-end or classic car.

Collision Avoidance: Preventative Measures and Safety Features

While collision coverage provides financial protection, the best defense against costly collisions is to avoid them altogether. This involves a combination of safe driving practices and leveraging the latest advancements in automotive safety technology.

Safe Driving Practices

- Stay Focused: Avoid distractions like cell phones, eating, or adjusting the radio while driving. Keep your eyes on the road and your hands on the wheel.

- Obey Traffic Laws: Follow speed limits, yield signs, and traffic lights. Obeying traffic laws reduces the risk of collisions and helps maintain a safe driving environment for everyone.

- Maintain a Safe Following Distance: Leave enough space between your vehicle and the one in front of you to allow for a safe stop, especially in adverse weather conditions.

- Regularly Check Your Vehicle: Ensure your vehicle is in good working condition by performing regular maintenance checks. This includes checking tire pressure, brake function, and fluid levels.

Advanced Safety Features

Modern vehicles are equipped with a range of advanced safety features designed to prevent or mitigate the impact of collisions. These features include:

- Forward Collision Warning (FCW): This system uses sensors to detect potential collisions and alerts the driver to take action.

- Automatic Emergency Braking (AEB): In the event of an imminent collision, AEB systems can automatically apply the brakes to help reduce the severity of the impact.

- Lane Departure Warning (LDW): LDW systems use cameras to monitor lane markings and alert the driver if the vehicle is drifting out of its lane.

- Blind Spot Monitoring (BSM): BSM systems use sensors to monitor the areas surrounding the vehicle that are not visible to the driver, providing an alert when a vehicle enters the blind spot.

- Adaptive Cruise Control (ACC): ACC systems use radar or lasers to automatically adjust the vehicle's speed to maintain a safe distance from the vehicle in front.

These features, along with a commitment to safe driving practices, can significantly reduce the risk of collisions and the associated costs and complications.

The Impact of Collisions on Insurance Premiums

Collisions can have a significant impact on insurance premiums, both for the policyholder and other drivers on the road. Insurance companies use statistical models to assess the risk associated with each driver, and collisions are a key factor in this assessment.

How Premiums Are Calculated

Insurance companies use a variety of factors to calculate premiums, including the driver’s age, gender, driving record, and the type of vehicle insured. Collisions are a major consideration in this calculation, as they indicate a higher risk of future claims.

When a driver files a collision claim, their insurance company will typically increase their premiums for the next policy period. The amount of the increase depends on several factors, including the severity of the collision, the driver's history of claims, and the overall cost of the claim.

Impact on Other Drivers

Collisions can also indirectly impact the premiums of other drivers, even if they weren’t involved in the accident. This is because insurance companies use statistical models to calculate premiums based on the overall risk associated with a particular group of drivers. If a large number of drivers in a particular area or demographic group are involved in collisions, premiums for that group may increase across the board.

Furthermore, if a driver causes a collision and is found to be at fault, their insurance company may choose to non-renew their policy. In this case, the driver will need to find a new insurance provider, often at a higher premium due to their increased risk profile.

Managing Premium Increases

If you’ve been involved in a collision and are facing premium increases, there are several strategies you can consider to manage these costs. These include:

- Shop Around: Compare quotes from multiple insurance providers to find the best rate for your needs. Remember, each insurer has its own unique rating system, so rates can vary significantly.

- Increase Your Deductible: Choosing a higher deductible can lower your premium, as you'll be paying more out of pocket if you need to file a claim.

- Take Advantage of Discounts: Many insurers offer discounts for safe driving records, vehicle safety features, and loyalty. Be sure to ask your insurer about any applicable discounts.

- Consider Bundle Discounts: If you have multiple policies with the same insurer, such as auto and home insurance, you may be eligible for bundle discounts.

Conclusion: Navigating the Collision Landscape

Collisions are an unfortunate reality of driving, but understanding their impact on insurance coverage, claims, and premiums can help drivers navigate this complex landscape more effectively. By combining safe driving practices with a thorough understanding of collision coverage and the claims process, drivers can minimize the financial and personal impact of collisions.

Furthermore, by staying informed about the latest advancements in automotive safety technology and leveraging these features in their vehicles, drivers can significantly reduce their risk of being involved in a collision. This not only benefits the individual driver but also contributes to a safer driving environment for everyone on the road.

How often do insurance companies increase premiums after a collision claim?

+

Insurance companies typically increase premiums after a collision claim, but the frequency and amount of the increase can vary based on several factors. These factors include the severity of the collision, the driver’s history of claims, and the overall cost of the claim. Generally, the more severe the collision and the higher the cost of the claim, the more significant the premium increase is likely to be.

Are there any ways to avoid premium increases after a collision?

+

While premium increases after a collision are standard practice, there are some strategies that can help minimize the impact. These include maintaining a safe driving record, increasing your deductible, and taking advantage of any applicable discounts, such as safe driver discounts or vehicle safety discounts. Additionally, shopping around for insurance quotes after a collision can help you find the best rate for your new risk profile.

What should I do if I’m involved in a collision with an uninsured driver?

+

If you’re involved in a collision with an uninsured driver, the first step is to ensure your safety and the safety of any passengers. Then, call the police to report the incident. Depending on your insurance policy, you may have uninsured/underinsured motorist coverage, which can help cover the costs of the collision. However, it’s important to review your policy to understand your specific coverage and any applicable deductibles.